The millennium brilliance of gold, along with the decade-long sharp rise of Bitcoin, is jointly reshaping the future landscape of global asset reserves.

Since the beginning of this year, gold prices have soared, especially since September 2025, reaching new highs repeatedly. This surge has stirred significant waves in the market, with many self-media outlets using Soros's "reflexivity theory" to explain this phenomenon—the so-called reflexivity means that the expectations of market participants can influence market fundamentals, and the changing fundamentals can, in turn, alter expectations, forming a self-reinforcing cycle.

Within this explanatory framework, the explosive rise of gold is understood as a financial market version of the "prisoner's dilemma": central banks around the world are worried about the scarcity of gold and are competing to purchase it, driving up prices, while the rising prices further intensify the impulse to buy.

Traditional analysis suggests that the primary driver of gold's rise over the years has been the continuous purchases by central banks. The strategic stockpiling by major powers is particularly noteworthy.

Major powers' regular investments exacerbate scarcity, leading to price increases; smaller countries, seeing this, become anxious and rush to buy; the competition drives prices up dramatically, forming a perfect closed loop.

Gold's Surge: Reflexivity Effect and Market Reality

Gold reached its peak moment in 2025. Driven by multiple factors such as trade frictions, fluctuations in U.S. Treasury bonds, and geopolitical tensions, gold outperformed Bitcoin, the Nasdaq, and all mainstream asset classes, with an annual increase of over 50%, truly achieving a "return of the king."

● At the same time, Bitcoin also broke through the $100,000 mark in 2025, but in comparison, its approximately 15% increase is far lower than that of gold. This clear differentiation in strength has sparked heated discussions in the market: Is Bitcoin's safe-haven property real? Is gold still the undisputed king of safe havens?

● Goldman Sachs strategist Tony Pasquariello maintains a core investment strategy that favors U.S. tech stocks, traditional and digital "value storage" like Bitcoin, moderate dollar shorts, and despite recent market volatility, still supports a steepening global yield curve.

The core of his recommended investment stance is "long-term holding of value storage (gold/silver/BTC)." These asset components serve as a hedge in his broader "long-term holding with hedging" strategy applicable for the second half of 2025.

Limitations of Traditional Interpretations: The Pitfall of a Static Perspective

● Attributing the rise of gold simply to purchases by central banks, while somewhat reasonable, overlooks a more complex picture.

This interpretation adopts a static view of the issue, ignoring the decisive variables in historical development. This decisive variable is Bitcoin.

● Deutsche Bank analysts Marion Laboure and Camilla Siazon wrote in a recent report: "By 2030, both gold and Bitcoin may appear on central bank balance sheets." This judgment breaks the traditional view that positions gold and Bitcoin in opposition, pointing to a more diverse future.

Before the birth of Bitcoin, when sovereign nations or individuals sensed instability in the existing order, allocating gold was almost the only safe-haven choice, easily falling into the reflexive cycle of the prisoner's dilemma.

The Rise of Bitcoin as Value Storage: From Niche to Mainstream

● Bitcoin is no longer just a speculative asset but is gradually becoming an important component of national strategic reserves.

According to the latest report from the Bitcoin Policy Institute, 32 countries worldwide are actively promoting Bitcoin arrangements, with 27 countries already holding Bitcoin and 13 countries formulating relevant legislation.

Countries like the United States, Argentina, and the UAE are accelerating the adoption of Bitcoin through national reserves, energy-driven mining, and investments in payments and ETFs.

● At the corporate level, Bitcoin's status is also rising. Currently, over 190 publicly listed companies globally have included Bitcoin on their balance sheets, collectively holding over 1.5 million Bitcoins, worth hundreds of billions of dollars.

These companies generally view Bitcoin as a tool to hedge against inflation and currency devaluation, similar to the historical logic of central banks accumulating gold, but Bitcoin possesses the advantages of a supply cap and global transferability.

Gold's Fatal Flaw: The Vulnerability of Physical Assets

● As a physical asset, gold has significant flaws that are difficult to overcome—it requires sufficient strength to truly ensure its safety.

● For smaller countries, if they wish to be independent, they cannot store their gold in the vaults of major powers. Conversely, if smaller countries do not seek independence but rather depend on major powers, purchasing the bonds of the major power they depend on would be a better choice than gold.

History provides many lessons: In the 1960s, French President de Gaulle repatriated gold from the U.S., forcing the U.S. to unilaterally tear up the Bretton Woods system; in 2012, Argentina's gold reserves stored in the Bank of England were intervened by the British government, which ordered their release to be prohibited.

● For the vast majority of small countries, regardless of whether they hide gold in their own vaults, it is difficult to protect their lifeline under the military pressure or strategic threats from major powers.

Just as U.S. President Roosevelt signed Executive Order 6102 on April 5, 1933, requiring all Americans to surrender their gold, ordinary citizens are almost powerless against the might of the state.

Bitcoin's Advantages: Value Storage in the Digital Age

● The security of Bitcoin does not rely on physical strength but is based on mathematical algorithms and distributed networks.

Destructive aircraft carriers, planes, missiles, submarines, tanks, and unmanned weapons are of no use in breaking hash algorithms. Satoshi Nakamoto had a clear understanding of this; he viewed the invention of Bitcoin as a means to win an important battle in the arms race and confidently believed that this invention would be invincible.

● Bitcoin is gradually integrating into daily life through rewards and payments, driving broader demand for self-custody of coins.

Fold Holdings has launched a Bitcoin credit card based on the Visa network, supported by Stripe, allowing users to earn up to 3.5% Bitcoin cashback on every purchase.

Long Tail Market: The Future Landscape of Value Storage

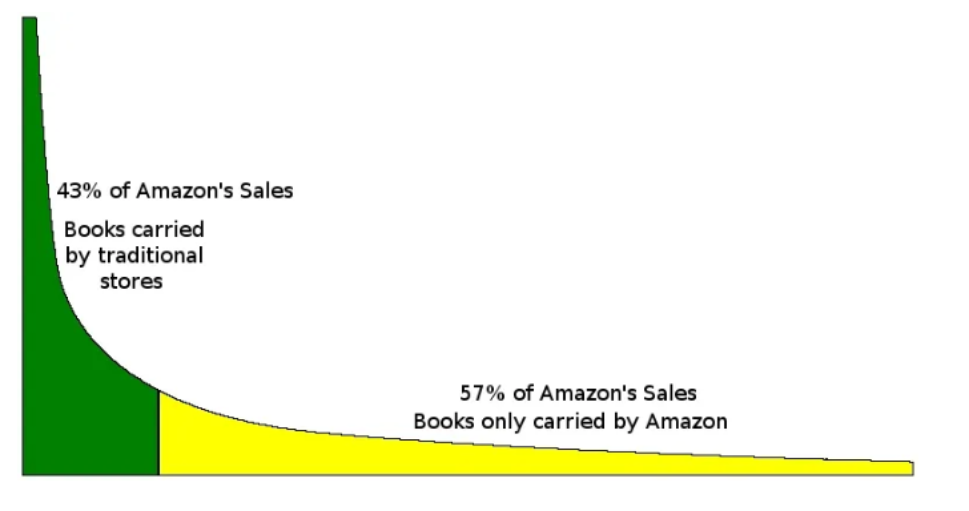

● According to strength classification, there is also a clear "long tail" phenomenon in the value storage and strategic reserve market.

This long tail market consists of a large number of small and medium-sized countries beyond the five permanent members, numerous enterprises, and an even larger number of individuals with some idle funds.

● According to long tail theory, when distribution costs, inventory costs, and search costs approach zero, demand spreads from "head blockbuster" to countless "tail niche" products. The future of commerce and culture lies not in the head representing "best-selling products" on the traditional demand curve, but in the long tail representing "niche products" that are often forgotten.

In the value storage market, gold will retreat from the long tail market, primarily concentrating on the head market. The long tail market will gradually belong to BTC. According to long tail theory, the scale ratio between the head market and the long tail market may be evenly split—this is the so-called "fat tail" distribution.

Goldman's latest research estimates that gold currently accounts for about 6% of global investment portfolios, while Bitcoin accounts for only about 0.6%, which is roughly one-tenth of gold. Behind this data lies the application of long tail theory—the head market dominated by gold and the long tail market dominated by Bitcoin are jointly forming a complete picture of value storage.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.