The Bitcoin market, once dominated by retail investors, is being reshaped by institutional whales rewriting the rules. A fundamental shift is occurring in the Bitcoin market landscape. According to the quarterly market report released by Bitwise, the Bitcoin market is undergoing a "wealth transfer" from early retail investors to institutional investors.

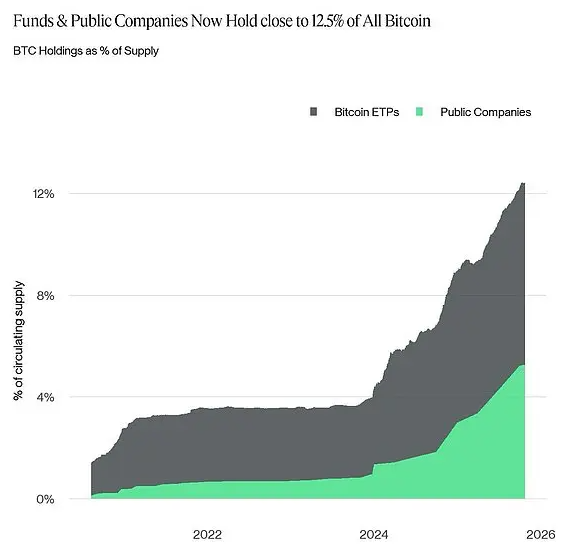

Currently, institutional investors control approximately 12.5% of the Bitcoin supply, and this proportion is rapidly increasing. This silent ownership revolution is not only changing the holding structure of Bitcoin but also reshaping its market characteristics and future direction.

Wealth Distribution: Oligopoly Remains, Dolphin Addresses Rise

The wealth distribution of Bitcoin shows a clear concentration, but holders of different scales are playing different roles in the market.

● Wealth is Highly Concentrated: Approximately 106 million people globally hold Bitcoin, but wealth is concentrated in the hands of a few. Only 19,142 addresses hold over ten million dollars in Bitcoin, while the top 100 addresses control the vast majority of Bitcoin supply.

● Expansion of Small and Medium Investor Base: Data shows that 24.1 million addresses have a balance exceeding 100 dollars, and 12.6 million addresses hold more than 1,000 dollars, reflecting a deepening participation of retail investors.

● Influence of Dolphin Addresses: Addresses holding 100-1,000 Bitcoins, known as "dolphin addresses" (including exchange-traded funds, companies, and large holders), currently collectively hold about 26% of the circulating Bitcoin supply.

In the market cycle of 2025, the dolphin group has cumulatively increased their holdings by 686,000 Bitcoins, becoming the cornerstone of the bullish structure in the current market cycle.

Institutional Holdings: From Marginal to Mainstream Strategic Allocation

The acceptance of Bitcoin by institutional investors significantly increased in 2025, forming a diversified institutional holding pattern.

1. Significant Growth in Corporate Reserves

In the third quarter of 2025, corporate Bitcoin reserves surged by 40%, reaching a value of 117 billion dollars. The number of publicly traded companies holding Bitcoin expanded to 172, with total holdings exceeding 1 million BTC. MicroStrategy leads corporate holdings with 640,000 Bitcoins, continuing its aggressive asset allocation strategy.

2. Bitcoin ETFs Become Important Channels

As of October 2025, U.S. spot Bitcoin ETFs manage $169.48 billion in assets, accounting for 6.79% of Bitcoin's market value. In the third quarter of 2025, net inflows into Bitcoin spot ETFs reached $7.8 billion, with 3.2 billion recorded in the first week of October alone, setting a new weekly inflow record for 2025.

3. Government Participation

Various governments have also joined the ranks of Bitcoin holders, currently holding about 463,000 BTC, accounting for 2.3% of the supply. This phenomenon further validates Bitcoin's legitimacy as a store of value.

Driving Factors: Diverse Forces Propel Bitcoin Adoption

The driving factors for Bitcoin adoption have shifted from early technology enthusiasts to a more diversified mechanism.

● Generational Preference Shift: Up to 65% of millennials and Generation Z continue to prefer cryptocurrencies over traditional equity assets. The younger generation's natural acceptance of digital assets is providing a sustained demand base for Bitcoin.

● Institutional Allocation Demand: Institutional investors view Bitcoin as a store of value and a hedge against inflation. Global macroeconomic uncertainties, such as changes in Federal Reserve policy and tensions in U.S.-China trade relations, further drive institutional allocation to Bitcoin.

● Expansion of Application Scenarios: In 2025, the usage rate of crypto payments increased by about 45%, with half of small and medium enterprises accepting Bitcoin or stablecoin payments. Among the Fortune 500 companies, 60% are exploring the application of blockchain technology.

● Global Liquidity Environment: The global broad money supply (M2) has surpassed $96 trillion, reaching a historic high. The Federal Reserve's interest rate cut policy has further facilitated the flow of capital into assets like Bitcoin.

Regulatory Framework: From Hostile Opposition to Structured Management

The clarification of the global regulatory environment has cleared obstacles for institutional funds to flow into Bitcoin.

1. Increased Regulatory Clarity

In 2025, 64 jurisdictions worldwide advanced digital asset legislation, achieving a 43% year-on-year increase in regulatory clarity. The U.S. Securities and Exchange Commission (SEC) established a dedicated cryptocurrency task force focused on creating a clearer regulatory framework for cryptocurrencies rather than relying solely on enforcement actions.

2. Key Legislative Breakthroughs

The GENIUS Act (July 2025) established the first federal stablecoin framework in the U.S., mandating 100% reserves and monthly audits. The CLARITY Act clarified the regulatory responsibilities of the SEC and CFTC regarding digital assets, ending long-standing jurisdictional disputes.

3. Enhanced Policy Efficiency

The SEC's new regulations (September 2025) compressed the ETF approval cycle from 270 days to 75 days, improving approval efficiency by 72% and stimulating accelerated inflows of institutional funds. These policy changes have had a direct impact on Bitcoin prices—multiple U.S. policies have driven Bitcoin up by 35% since their announcement.

Market Outlook: Cycle Evolution and Price Expectations

Market observers present diverse views on Bitcoin's future development, but there is consensus on key trends.

1. Evolution of Cycle Patterns

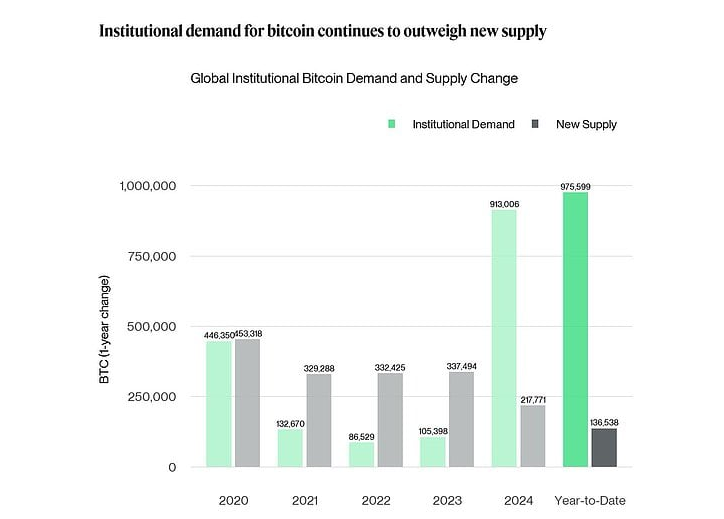

The Bitwise report indicates that over 80% of Bitcoin price fluctuations are driven by macro factors rather than the early halving events. Data from 2025 shows that institutional demand has reached approximately 7 times the supply gap caused by halving.

This indicates that Bitcoin has transformed from a narrative-driven asset to a true "macro asset."

2. Price Expectations Raised

In a report released in October 2025, Tiger Research set the target price for Bitcoin in the fourth quarter of 2025 at $200,000. This target price is based on its TVM method analysis: the neutral benchmark price is $154,000, up 14% from $135,000 in the second quarter.

ARK Invest has raised its target price for Bitcoin's bull market scenario in 2030 from $1.5 million to $2.4 million, indicating a high level of optimism about Bitcoin's long-term value.

3. Future Outlook on Holding Structure

By 2030, Bitcoin's total market capitalization could exceed $15 trillion, with retail holdings potentially decreasing from 85% in 2024 to 60% in 2030. With the expansion of ETFs and increased corporate holdings, the proportion of institutional holdings is expected to surpass 20% by 2030.

The Bitcoin market is undergoing a fundamental shift from retail dominance to institutional dominance. As the regulatory framework becomes increasingly clear and institutional allocations continue to grow, the market structure, price drivers, and cycle patterns of Bitcoin have all undergone profound changes. This shift not only drives Bitcoin prices to new highs but also reshapes its status as a compliant asset class.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.