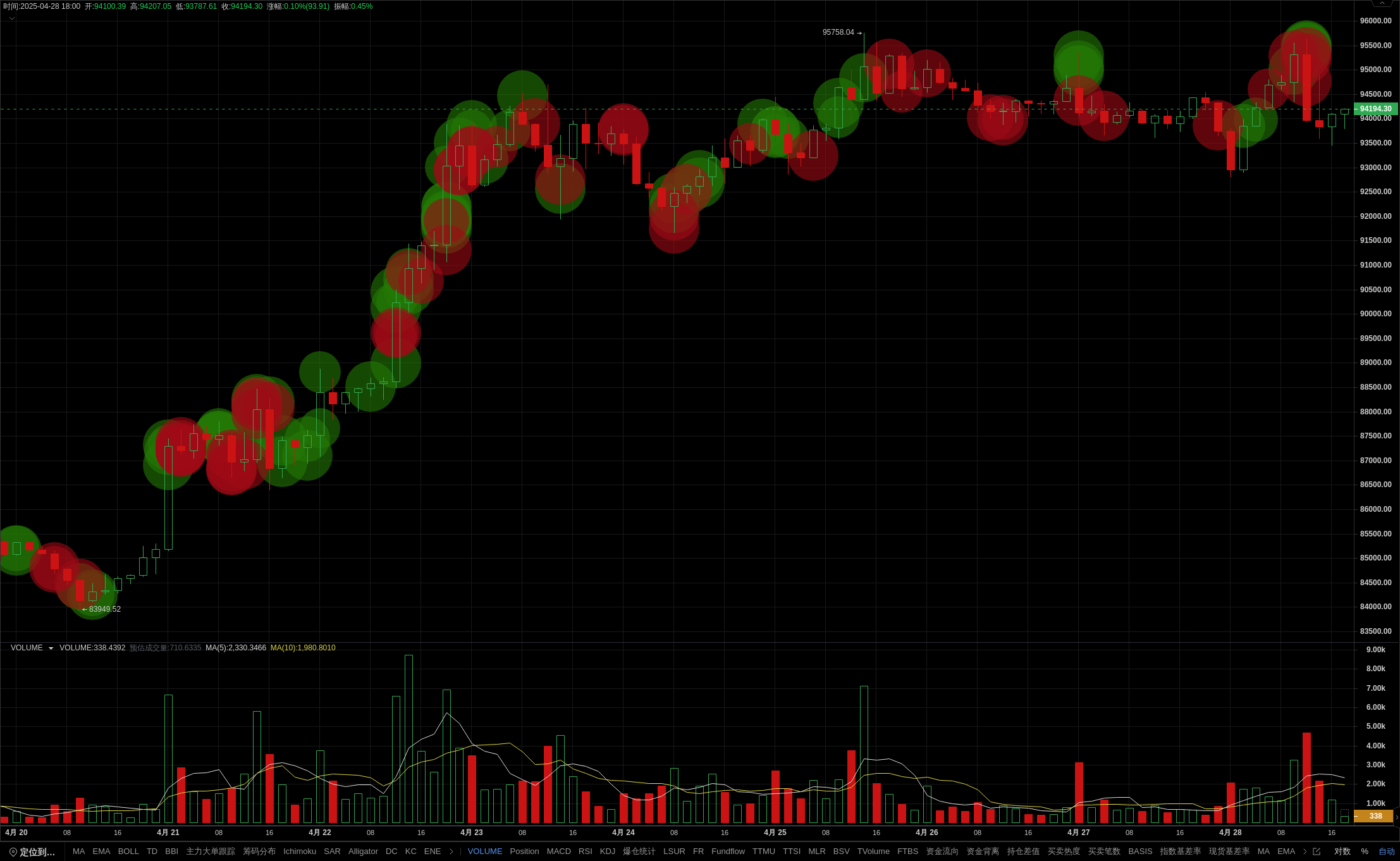

BTC 2-hour cycle large transactions exposed main intention: alert to short-term pullback risk

The large transaction indicator shows that the main net inflow in the past 12 hours was $41.53 million, but in the latest period, there were three consecutive large market sell orders of $9.3 million, indicating that short-term selling pressure is increasing. Based on the current candlestick pattern, although the price is above the EMA24/52 moving average, the upper hanging line pattern and the weakened momentum of the MACD bar chart form a double bearish signal. Although the medium-term trend still leans upwards, trading volume has shrunk to 32.92% of the average level, and market activity has significantly decreased, further confirming the risk of a pullback. The large transaction indicator accurately captures the main force's fluctuations, helping you quickly identify trend turning points. Open membership, unlock key capital trends, and stay ahead of the market! The data is sourced from the PRO member's [BTC/USDT Binance 2-hour] candlestick, for reference only, and does not constitute any investment advice.