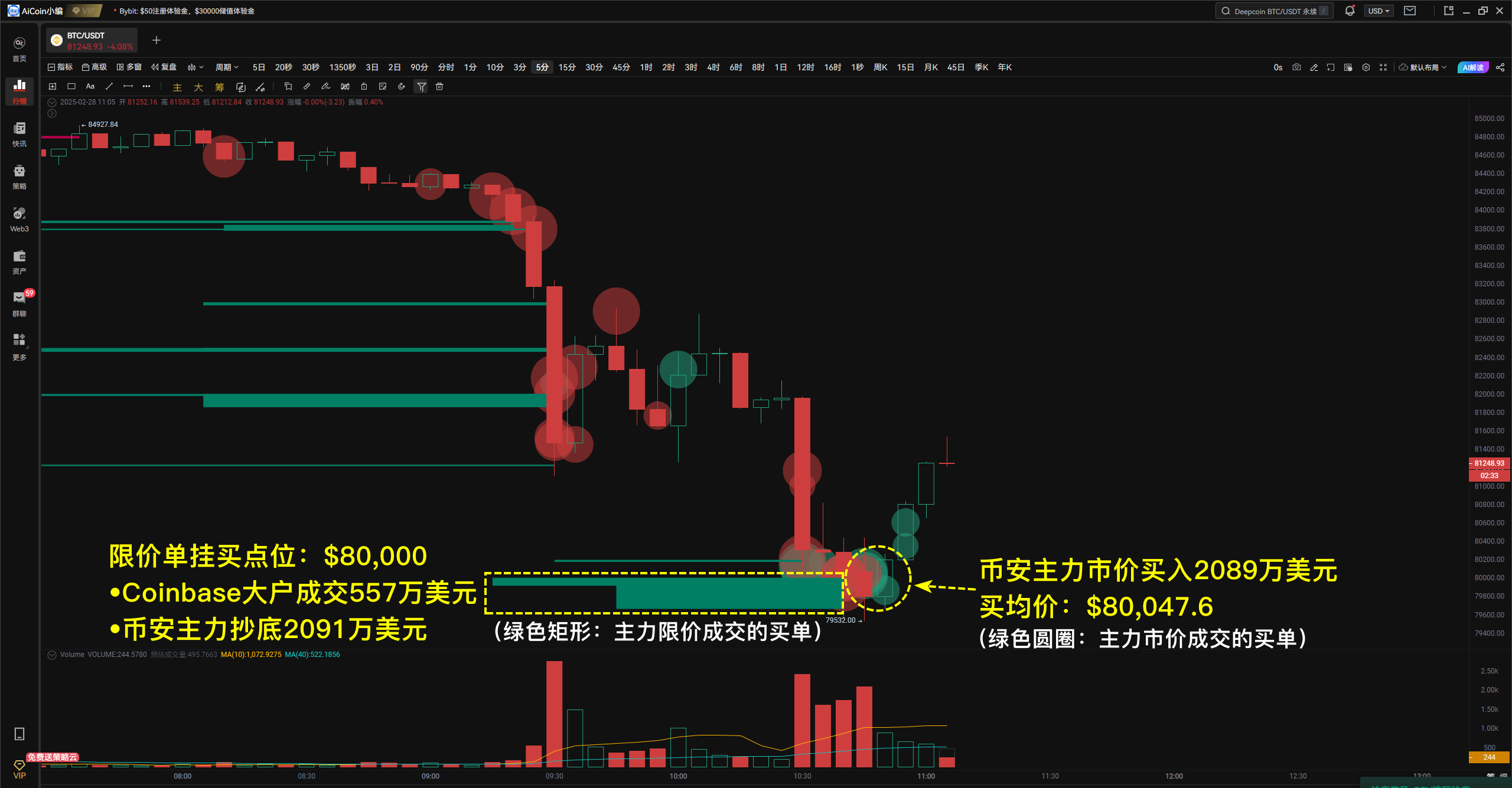

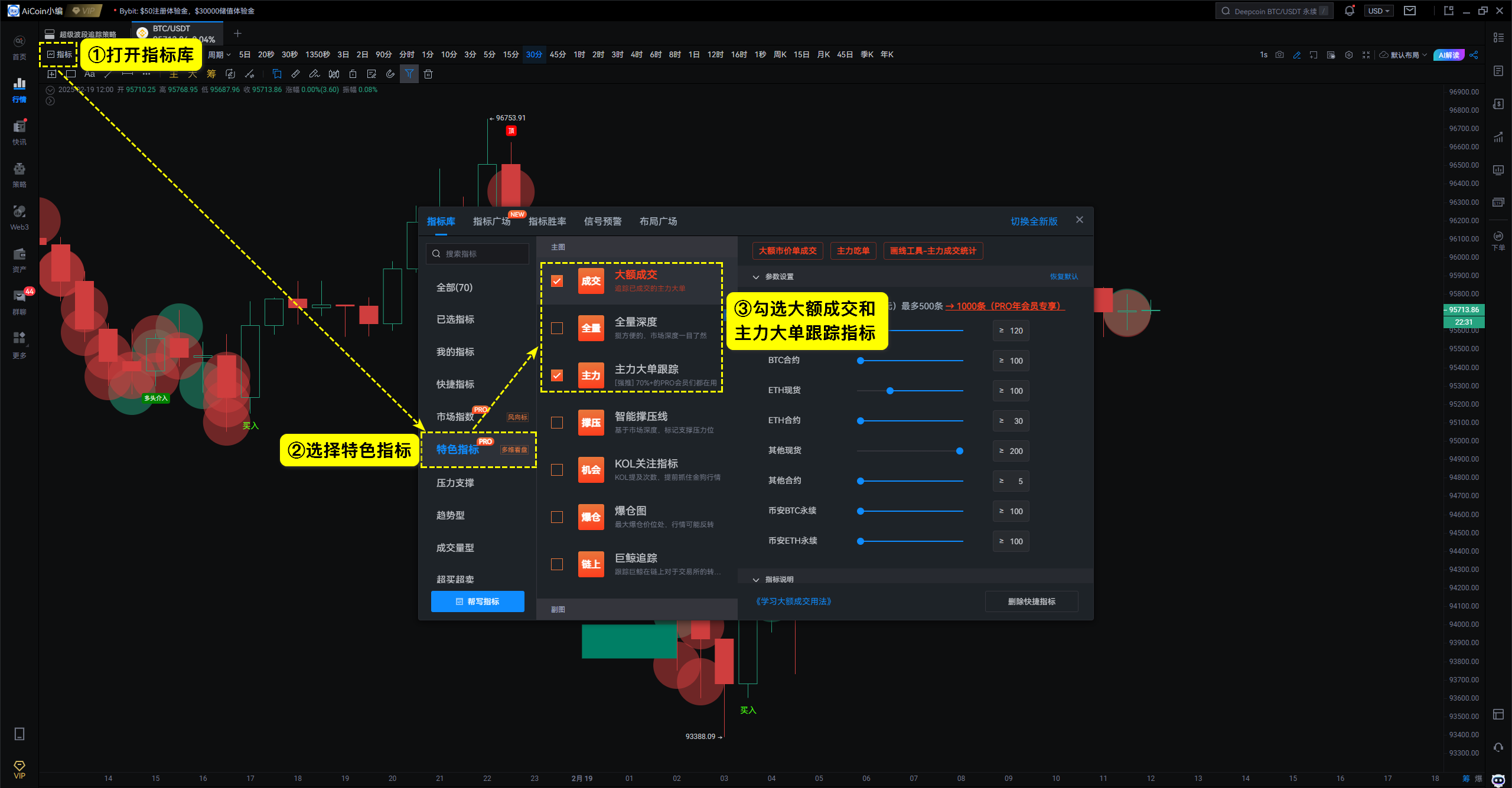

BTC主力资金在$80,000关键支撑位精准布单,体现出强烈的防守意图: Coinbase大户:限价买入557万美元 Binance主力:限价抄底2091万美元+市价买入2089万美元 数据源于PRO主力成交指标(开PRO送策略云会员!!!): •大额成交:实时跟踪主力市价成交情况,识别主力护盘/砸盘意图。 •主力大单:实时监控大户布局方向、点位及金额,精准跟随主力买卖。 特别提醒:BTC短线放量下跌,回调危机尚未结束,请务必做好风控! 数据仅供参考,不构成任何投资建议

According to the popularity ranking, SHELL's popularity and attention remain the same as yesterday, ranking third. The popularity ranking is as follows: ① SHELL ($0.5255,-15.26%) ② ETH ($2144.82,-8.97%) ③ SOL ($132.69,-5.56%) ④ LTC ($119.99,-7.31%) ⑤ S ($0.6452,-10.80%) AiCoin Contract Transaction Ranking Report: The Bitget 24H contract has a transaction volume of $33.213 billion, ranking third globally

BTC selling pressure has increased significantly! According to the statistics of large transactions, since 0:00 today, Binance's main players have sold $238 million, with an average selling price of $81687; Coinbase's major player shipped 78.567 million US dollars, with an average price of approximately $80685.47. Data shows that although BTC attempted to rebound in the afternoon, it failed to effectively break through the $81550 pressure level, and the main force increased their efforts to smash the market. As of now, Binance's major players have completed three large orders worth over 4 million US dollars, totaling 13.95 million US dollars; The main force of Coinbase made 4 transactions with a total amount of 22.92 million US dollars. The main force continues to ship, and there is a high risk of BTC's short-term decline. Please take good risk control measures. The data is sourced from the PRO large transaction indicator, for reference only, and does not constitute any investment advice!

According to Foresight News, Zhao Changpeng wrote in an article, "The market correction is part of the free market, not financial advice. If you feel pressure about it, you may need to reduce your investment scale (if you see cryptocurrency as an investment). For me, this is a change in worldview. I exited the old world 11 years ago

According to BlockBeats, on February 28th, Matrixport released a daily analysis report stating that the Bitcoin ETF has achieved tremendous success, attracting $39 billion in inflows within fourteen months. However, as Wall Street fully embraced Bitcoin, it was increasingly influenced by global liquidity, macroeconomic conditions, central bank policies, and institutional capital flows. The strengthening of the US dollar has led to a decline in this liquidity indicator, indicating that the price of Bitcoin may be under downward pressure. Global liquidity reached its peak at the end of December 2024, and the significant strengthening of the US dollar provided a clear explanation for the continued pullback of Bitcoin. Looking ahead, the forward-looking nature of this time series suggests that once this correction ends (which may continue until March or April), Bitcoin may attempt to rebound to its previous highs. Analyzing macroeconomic trends and central bank policies gives us a clear advantage in predicting Bitcoin price trends. Especially as Wall Street investors begin to pay daily attention to these macro factors and actively participate in Bitcoin trading, this analysis has become particularly important. Wall Street investors entering the Bitcoin market are divided into two categories. One type is wealth and asset managers who view Bitcoin as digital gold and long-term investments. These investors are likely to represent the wallet group holding 100-1000 bitcoins, who have become the largest bitcoin holders, surpassing the once dominant whale wallet. The second type of Wall Street investors entering the Bitcoin market are hedge funds, who focus on non directional returns through arbitrage strategies rather than betting on long-term price increases in Bitcoin. When cryptocurrency traders are bullish, they typically use futures positions to push up funding rates. This provides arbitrage opportunities for hedge funds, who buy Bitcoin spot or Bitcoin ETF while short selling Bitcoin futures, thereby earning profits through fund rate differentials. These hedge funds hold a total of $10 billion in Bitcoin ETFs, and the total inflow of funds has reached $39 billion, indicating that at least 25% of Bitcoin ETF funds are related to arbitrage trading. According to calculations, 55% or more of ETF fund inflows may come from hedge funds focused on arbitrage, rather than investors who truly believe in Bitcoin's long-term upward potential. Since the FOMC meeting in December, there has been a significant decline in yield opportunities, followed by a decrease in trading volume, so it is not surprising that hedge funds have begun to unwind their arbitrage positions. This trend is reflected in the record breaking outflow of funds from Bitcoin ETFs, which have exited trades that are no longer profitable.

BTC has fallen, with a trading volume of 126 billion US dollars in the past 24 hours and a circulating market value of 1.57 trillion US dollars, a market value ratio decrease of 0.42%. Data for reference only