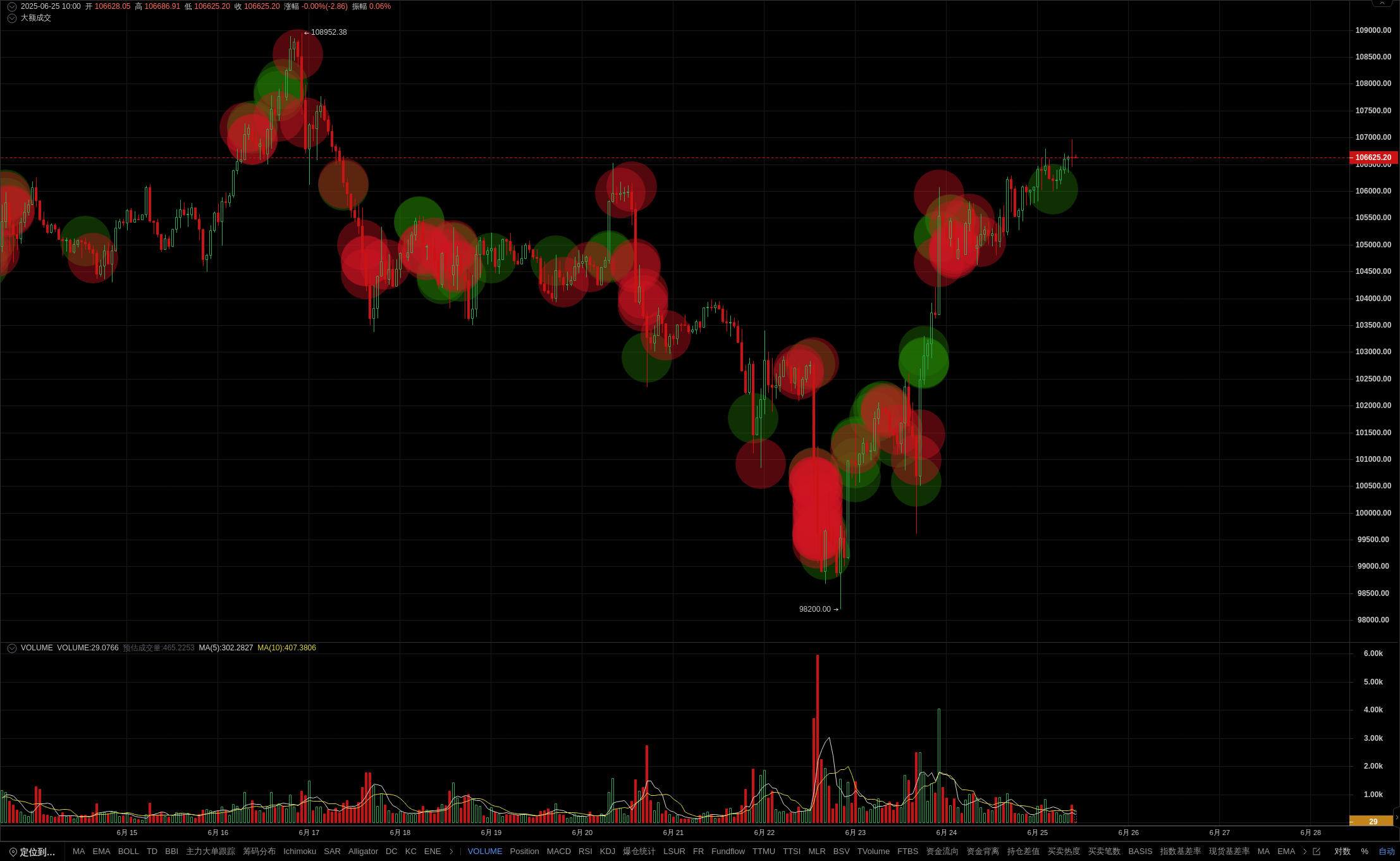

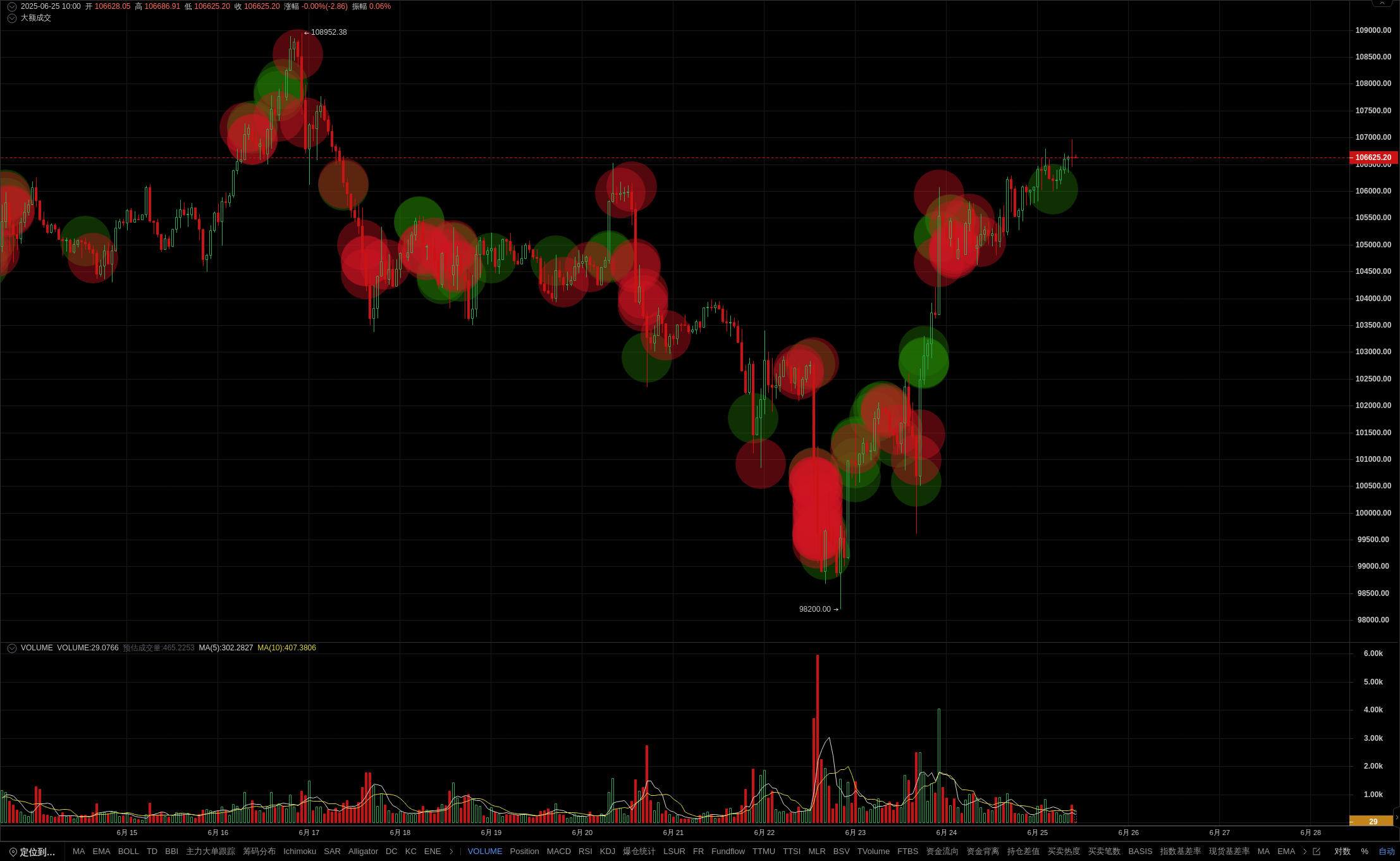

BTC大额成交揭示主力动向,短期方向或有变数

过去12小时,大额市价卖单总额达$1513万,超过买单$1238万,净流出$275万,呈现明显做空趋势。尤其在最新1小时周期,连续出现多笔超百万美元的大额市价卖单,进一步压制价格上行空间。结合当前K线形态,顶分型与十字星的出现暗示市场犹豫不决,KDJ死叉更强化了短期回调的可能性。 指标推荐语:大额成交指标精准捕捉主力异动,提前预判行情转折点,助你快人一步! 数据源于PRO会员 [BTC/USDT 币安 1小时] K线,仅供参考,不构成任何投资建议。

过去12小时,大额市价卖单总额达$1513万,超过买单$1238万,净流出$275万,呈现明显做空趋势。尤其在最新1小时周期,连续出现多笔超百万美元的大额市价卖单,进一步压制价格上行空间。结合当前K线形态,顶分型与十字星的出现暗示市场犹豫不决,KDJ死叉更强化了短期回调的可能性。 指标推荐语:大额成交指标精准捕捉主力异动,提前预判行情转折点,助你快人一步! 数据源于PRO会员 [BTC/USDT 币安 1小时] K线,仅供参考,不构成任何投资建议。

According to BlockBeats, on July 29th, Nick Timiraos, the voice of the Federal Reserve, published an article stating that Fed officials expect they will eventually need to continue cutting interest rates, but they are not yet ready to do so on Wednesday. Their disagreement lies in what evidence they need to see first and whether waiting for everything to become clear is a mistake. Officials are now divided into three camps on whether to resume interest rate cuts. The focus will be on whether Powell will provide any hints of a September rate cut at the press conference, and whether his colleagues will begin laying the groundwork for the next meeting's rate cut in the coming days and weeks. (Golden Ten)

According to a report by Golden Finance, the North Texas District Attorney's Office of the US Department of Justice has filed a civil lawsuit with the North Texas District Court on July 24th, requesting the confiscation of previously seized cryptocurrency assets. It is reported that the FBI Dallas branch seized approximately 20.29 BTC from an encrypted address on April 15th, with a current market value exceeding $2.4 million. The related assets are accused of being related to a member of the ransomware organization Chaos, Hors, and are involved in illegal activities such as money laundering and computer ransomware. This gang has carried out multiple cyber attacks in the North Texas region and other areas.

According to Farside monitoring, yesterday FBTC had a net inflow of $30.9 million and FETH had a net outflow of $49.2 million, as reported by Golden Finance.

According to the website of the US Department of Justice, Arizona man Vincent Anthony Mazzotta Jr. (also known as Vincent Midnight, Delta Prime, Director Vinchenzo) recently admitted to involvement in money laundering and obstruction of justice crimes. He and his accomplices used artificial intelligence automated trading robots to obtain high returns in the cryptocurrency market through false promises, luring investors to invest in companies such as Mind Capital and Cloud9 Capital, with a total amount involved exceeding $13 million. In addition, they also fabricated the Federal Crypto Reserve (FCR) government agency to further defraud victims of funds. Mazzotta also attempted to destroy evidence and falsify company records to cover up the crime. He may face up to 15 years in prison.

According to Bloomberg, US banking technology service provider FIS (Fidelity National Information Services Inc.) announced a partnership with Circle Internet Group Inc. to provide financial institutions with trading services based on Circle stablecoin USDC. Both parties aim to assist Bank of America in providing customers with the option to use USDC for domestic and cross-border payments. FIS plans to integrate USDC into its cash flow platform, and it is expected that the service will be launched before the end of the year.