Loading...

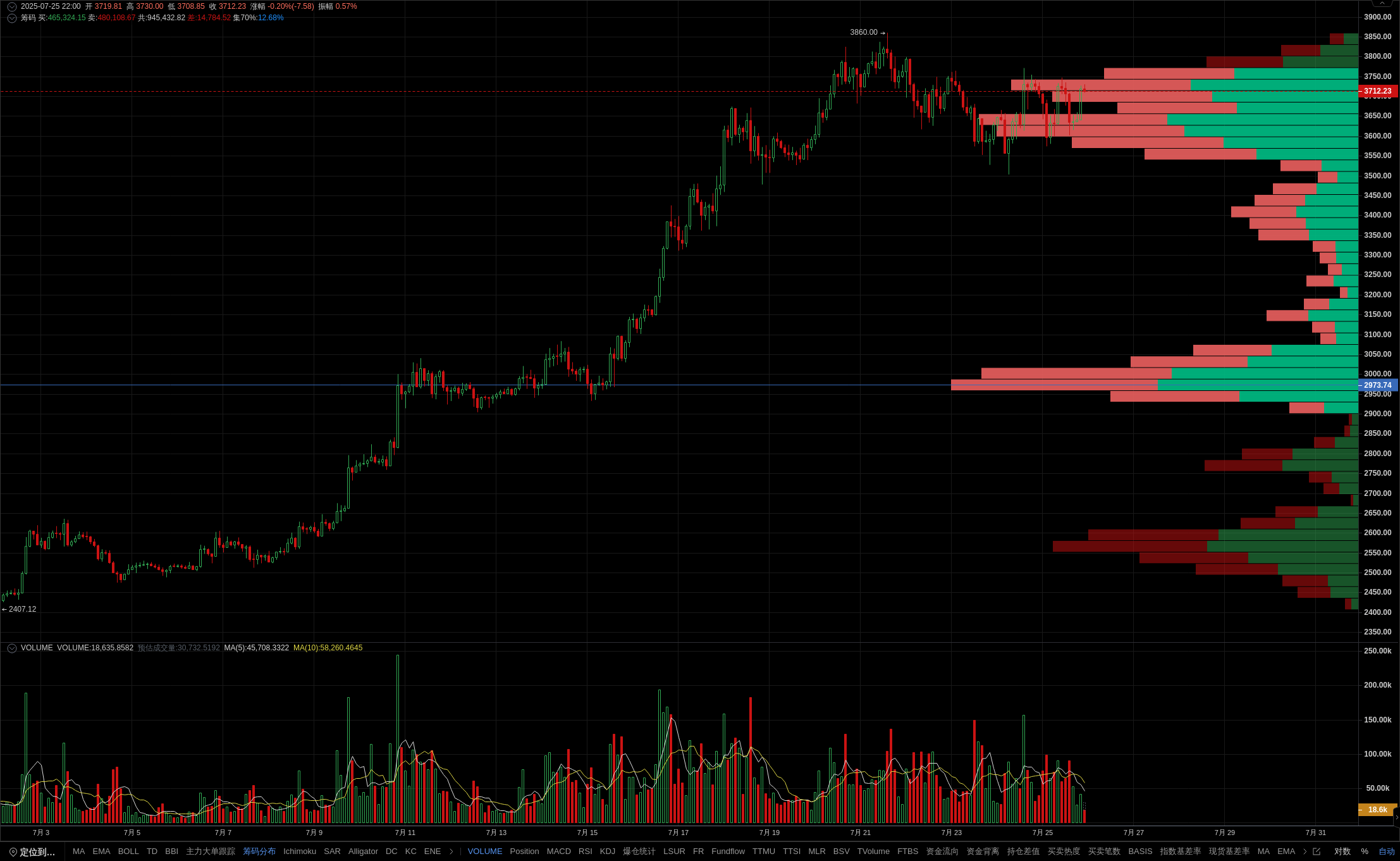

当前ETH价格位于3646强支撑位附近,此区域成交量占比达6.15%,多空比1.027,显示市场认可度较高。结合会员指标,价格正测试EMA24/52均线支撑,且KDJ金叉信号初现,上涨动能逐步增强。若价格有效站稳3646支撑,或向上挑战3741阻力位。 MACD零轴上方金叉确认中期看涨信号,但交易量萎缩需警惕假突破风险。关注3646-3741区间突破方向。 立即开通会员,获取精准支撑阻力分析与实时买卖点提示! 数据源于PRO会员 [ETH/USDT 币安 2小时] K线,仅供参考,不构成任何投资建议。

Bitget ALGO/USDT's perpetual trading volume surged 14 times within 10 minutes, with a turnover of 6.27 million US dollars in the past 24 hours, an increase of 4.11% A surge in trading volume generally indicates an increase in market trading activity or large-scale fund buying and selling operations, which may be caused by certain important market changes or news announcements. According to AiCoin data, the comprehensive ranking of Bitget contracts ranks fourth globally

This week, driven by favorable factors such as the US Japan trade agreement and the US AI plan, the S&P 500 index and Nasdaq index continued to hit historic highs. In terms of expected interest rate cuts, the White House continues to pressure Federal Reserve Chairman Powell, with Trump urging Powell to cut interest rates in person, marking the first visit by a US president to the Federal Reserve headquarters in nearly 20 years; US Treasury Secretary Besson plans to confirm the new chairman of the Federal Reserve in advance by the end of the year. Looking ahead to next week, the US stock market will usher in a heavyweight macro+earnings week, and the Federal Reserve will announce its interest rate decision next Thursday; In terms of tariffs, the deadline for Trump's tariffs is approaching on August 1st, and China and the United States will begin a new round of 4-day economic and trade negotiations on Sunday. 1. Monday (July 28): China and the United States held economic and trade talks in Sweden (27-30), and the Dallas Fed Manufacturing Activity Index for July. 2. Tuesday (July 29th): Initial wholesale inventory monthly rate for June in the United States, Consumer Confidence Index from the US Conference Board for July, JOLTs job vacancies for June, and the start of the Federal Reserve's two-day monetary policy meeting. 3. Wednesday (July 30th): US Q2 GDP series data, Federal Reserve interest rate decision, and Powell press conference. 4. Thursday (July 31st): China's official manufacturing PMI for July, Bank of Japan interest rate decision, number of layoffs by challenger companies in the United States in July, annual PCE price index for June, and initial jobless claims for the week ending July 26th. 5. Friday (August 1st): The originally set July 9th deadline for Trump's tariffs has been extended to August 1st, Hong Kong's stablecoin regulations have been implemented, the US July non farm payroll report, Eurozone July CPI data, and US July ISM manufacturing PMI.

According to BlockBeats, the important macro data to be released next week on July 26th are as follows: On Wednesday at 20:15, the ADP employment figures for July in the United States (in 10000 people) were expected to be 7.5, with a previous value of -3.5; On Wednesday at 00:00, He Lifeng, member of the Political Bureau of the Communist Party of China Central Committee and Vice Premier of the State Council, went to Sweden to hold economic and trade talks with the United States from July 27th to 30th; At 02:00 on Thursday, the Federal Reserve FOMC announced its interest rate decision; On Thursday at 02:30, Federal Reserve Chairman Powell held a monetary policy press conference; At 20:30 on Thursday, the number of initial jobless claims for the week ending July 26th in the United States (in 10000 people) was 21.7; At 20:30 on Thursday, the annual core PCE price index for June in the United States is expected to be 2.70%, up from the previous value of 2.70%; On Friday, the Hong Kong Stablecoins Ordinance came into effect; At 20:30 on Friday, the seasonally adjusted non farm payroll for July in the United States (10000 people) is expected to be 10.2, up from 14.7 previously; On Friday at 22:00, the US July ISM Manufacturing PMI is expected to be 49.6, up from 49 previously; On Friday at 22:00, the final value of the University of Michigan Consumer Confidence Index for July in the United States was 61.8.

According to a report by Golden Finance, Bitdeer, a Bitcoin mining company listed on NASDAQ, released the latest data on its Bitcoin holdings on the X platform. As of July 25th, its total Bitcoin holdings have increased to 1637.8 (note: this quantity is pure holdings, excluding Bitcoin deposited by customers). In addition, its Bitcoin mining output this week was 63.1 BTC, but it sold 26.8 BTC.

BlockBeats news, on July 26th, according to @ EmberCN monitoring, after Ethena announced on July 21st that StablecoinX would be reserved for ENA, an Ethena project affiliated address began transferring ENA. A total of 150 million ENAs (worth 77.35 million US dollars) have entered Binance and Bybit in the five days since the announcement. The last transaction transferred to the trading platform was 2 hours ago.