Loading...

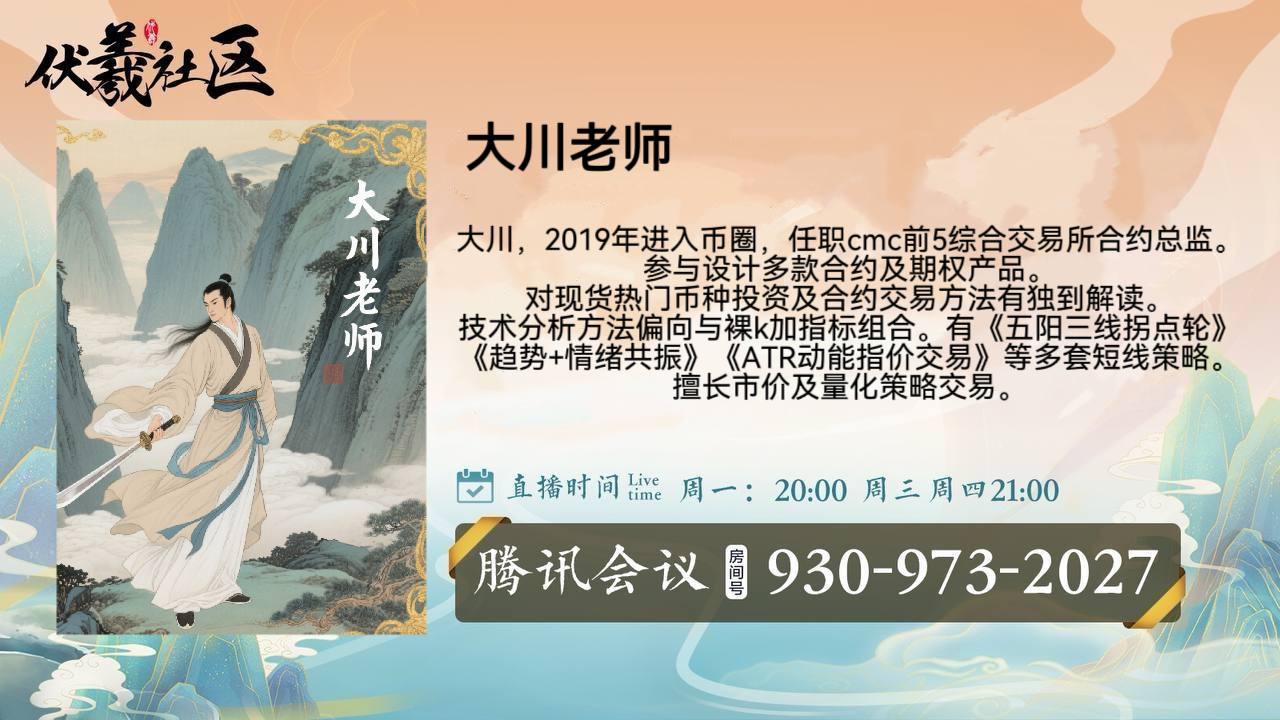

Click on the link to enter Tencent Meeting: https://meeting.tencent.com/p/9309732027 The digital currency market is constantly changing, and Ethereum (ETH) has once again become the focus of attention. Behind the price fluctuations is a fierce game of multiple technical factors and market sentiment. Ethereum experienced a significant decline on August 28, 2025, with the price falling below $4500 and a intraday drop of over 3%. This decline occurred against the backdrop of an overall adjustment in the global cryptocurrency market, with investor sentiment tending towards caution. Despite short-term pressure, the market shows that Ethereum has successfully broken through the downtrend line, reigniting bulls' hopes for a future impact of $6000 or even $10000. Today's Market Performance: Ethereum in Decline As of August 28, 2025, the trading price of Ethereum is approximately 4543.81, with a market value maintained at around 547.7 billion US dollars. Although the price dropped by 1.24% within 24 hours, it still maintained a 7.61% increase this week, with a monthly increase of up to 19.88%. The price fluctuations of Ethereum are not isolated events. On the same day, Bitcoin also fell below $111000 for a short period of time, but then rebounded to around $111600. This linkage once again confirms the high degree of correlation in the cryptocurrency market. The lack of significant positive news in recent times, coupled with the impact of macroeconomic environment, has put pressure on the prices of mainstream cryptocurrencies such as Ethereum. Investors tend to operate cautiously in uncertainty, reducing their holdings of high-risk assets. Technical Analysis: Key Positions and Long Short Game From a technical analysis perspective, Ethereum is currently at a critical crossroads. According to technical analysis, the Ethereum market has shown obvious horizontal fluctuations, and neither the technical nor external environment has provided clear trend guidance. The bullish alignment and swallowing pattern of the moving average released a bullish signal, but the extreme decrease in trading volume resulted in a volume price divergence, indicating that the current upward momentum may not be healthy. The price is around the BOLL mid track, and the RSI indicator shows a balanced market sentiment. In terms of key support and resistance levels, the $4500- $4525 range forms immediate support, while the upper resistance is seen in the $4750- $4800 range. Only by breaking the resistance of 4582 above the B center and stabilizing, can there be a certain rebound momentum in the short term. Market dynamics: Whale's increase in holdings and capital flow The on chain data shows remarkable signs of institutional interest reigniting. On August 27th, Ethereum recorded a net inflow of over $93 million, reversing the trend of capital outflows throughout the summer. The exchange balance also shows a macro trend of ETH continuously withdrawing from centralized platforms, which is usually a precursor to long-term holdings. Most notably, Whale tracking data shows that Bitmine spent a whopping $427 million on ETH in a single day, setting one of the largest increase events of the year. Such large-scale purchases often indicate that prices will quickly rise, as the whale is laying out ahead of expected demand. This divergence from Bitcoin's trend is particularly significant - BTC is still under pressure from ETF related fund outflows. Institutional funds seem to be shifting towards favoring Ethereum, which could lay the foundation for relatively strong performance in the coming months. [Future outlook: prospects intertwined with multiple factors] The short-term direction of Ethereum depends on whether the bulls can recover and stabilize at the $4800 mark. A strong breakthrough may push ETH up to $5200 or even $6000, and if it falls, it may withdraw support of $4400. According to Polymarket's forecast market data, the current probability of ETH reaching $5000 by the end of the year is 76%, but there is a clear lack of confidence in hitting $10000. Fundamental factors are also supporting the long-term value of Ethereum. The verification node rewards attract institutional funds to flood in, keeping the pledge scale strong. At the same time, the transaction volume of Layer 2 ecosystems such as Arbitrarum, Optimism, and zkSync has significantly increased, driving the overall network activity of Ethereum. The continuous increase in total lock up volume (TVL) of Layer2 indicates that expansion plans are becoming an important component of ETH's long-term adoption narrative. The improvement of these infrastructures provides solid support for the long-term value of the Ethereum network. Investment Strategy: Coexistence of Risk and Opportunity In the current market environment, it is recommended to adopt a cautious and optimistic strategy. Investors can consider going long around 4410, with a defensive level set at 4360, a target around 4520-4550, and a break around 4580-4600. Another strategy suggestion is to set the long position at 4550, the replenishment position at 4500, take profit at 30 points, and target 4650; Short selling point 4700, replenishment point 4750, stop at 30 points, target 4550. It is important for investors to pay attention to the high volatility characteristics of the cryptocurrency market. The scariest thing in the market is not the lack of market trends or opportunities, but the confusion and lack of direction. As long as you work hard, the iron pestle can be ground into a needle! In the new century, as long as you are willing to work hard, who says you can't have your cake and eat your cake! "Several analysts emphasized the importance of risk management and long-term perspective in cryptocurrency investment. The significant increase in holdings by Whale and the rise in Layer 2 activity have provided strong fundamental support for Ethereum. Technically speaking, as long as Ethereum maintains channel support and effectively breaks through $4800, the $6000 target is completely reasonable. Meeting: 9309732027 QQ group: 123116768 Disclaimer: The above content only represents the author's personal opinion and is for communication and sharing purposes only. It does not represent the position or viewpoint of AiCoin and does not constitute any investment advice. Based on this investment, there may be external contacts, which have nothing to do with AiCoin, and the consequences shall be borne by oneself.