Surfing Academy Live: Finger pointing high, ready to take off, where is the opportunity to draw low?

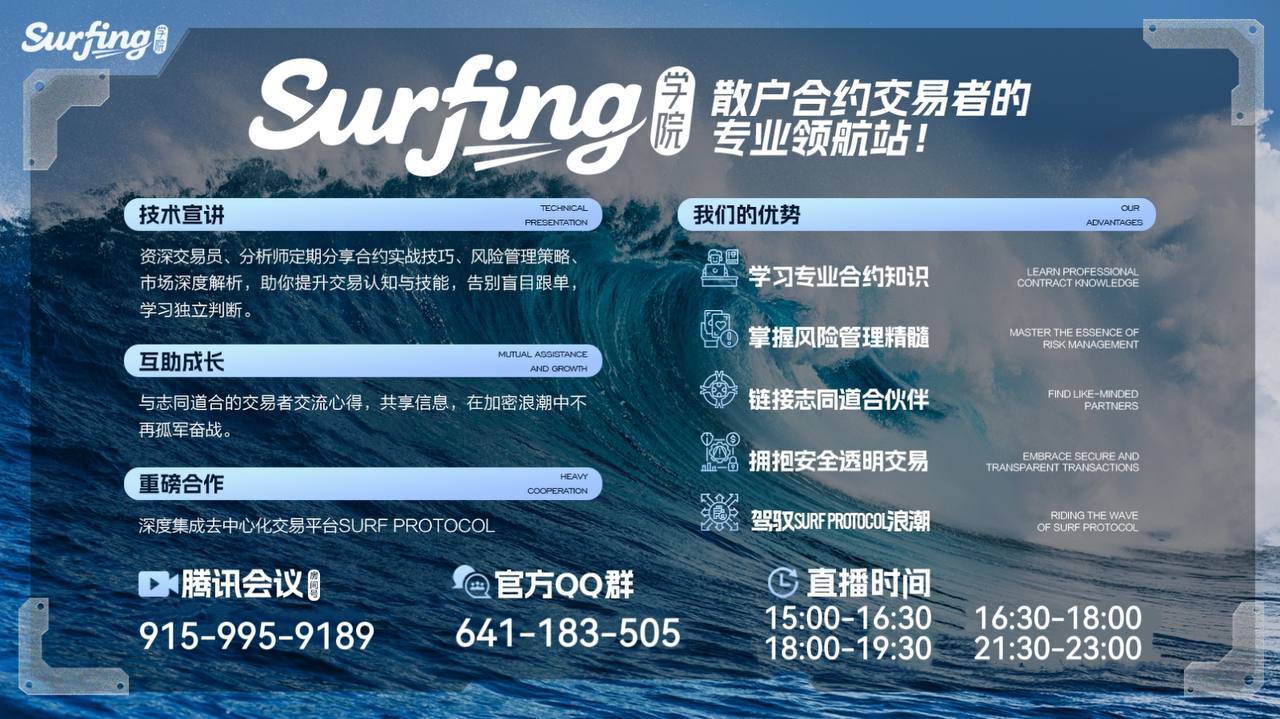

Click on the link to enter Tencent Meeting: https://meeting.tencent.com/p/9159959189 BTC: The Big Dipper continued to fluctuate at a high level yesterday. Although it encountered resistance at the key integer level again, the retracement amplitude is controllable, and the daily chart remains within the high range. The key point is that the daily level support platform of 114000 has remained strong, and the long-term structure has not been disrupted. The previous pullback can still be seen as a "consolidation wash" on the high road before the breakthrough. As the sorting time continues, the amount of energy accumulates, and the short-term breakthrough momentum is gradually increasing. The current operation needs to closely monitor the opportunity for a pullback: if the price falls back into the strong support range of 114000-113500 again, it can be seen as a good entry point for a low suction. The primary pressure above is still at 116000. Once the large market can stabilize above the 116000 mark with increased volume, it will declare the end of consolidation, and the market that hits historical highs or even higher targets will officially begin. ETH: Ethereum has been consistently outperforming the market in recent times and showed resilience during yesterday's follow-up correction. Although there was a pullback during trading, it quickly rebounded and successfully stabilized above the important hourly level upward channel lower track (around 3580-3600), and re established its position in the middle track of the channel in the latter half of the US session. In terms of technical form, the hourly level has formed a convergence triangle or a small-scale flag shaped organization, indicating that a turnaround is imminent. The intraday strategy is mainly focused on a pullback and a bullish trend: the ideal entry level is to move up to around 3900 on the lower track of the channel (supported by the previous breakthrough point), or wait for the price to increase and break through the triangular/flag shaped upper edge (around the 3680-3700 area) to follow suit. Standing above 4000 will be the first important confirmation signal. From a long-term perspective, ETH is approaching the critical breakthrough window period. If we can successfully stabilize at 4000 and further break through the previous high, it will open up vast upward space; On the contrary, if the key level cannot be broken through for a long time and ultimately falls below the lower track of the channel (such as 3580), it is necessary to be alert to the risk of deep retracement, and bulls should control the risk in a timely manner. Tencent Meeting: 915-995-9189 QQ group: 641183505 Join the Surfing Academy group and enjoy a variety of service offerings 1. Daily free in-depth market analysis and tailor-made account troubleshooting solutions. 2. Lock in the college seat and receive: live streaming of live sales in the evening; Exclusive weekly technical research course updates. 3. High frequency intraday trading signal prompts, seize multiple profitable opportunities during the day. 4. Teach exclusive secrets: "Decryption of Institutional Order Flow", "Tai Chi Tactics", "Time Space Tunnel Trading" 5. Insight into market opportunities by combining "Golden Ratio Expansion", "Long Short Energy Wave (OBV)", and "Application of Fractal Theory". Disclaimer: The above content only represents the author's personal opinion and is for communication and sharing purposes only. It does not represent the position or viewpoint of AiCoin and does not constitute any investment advice. Based on this investment, there may be external contacts, which have nothing to do with AiCoin, and the consequences shall be borne by oneself.