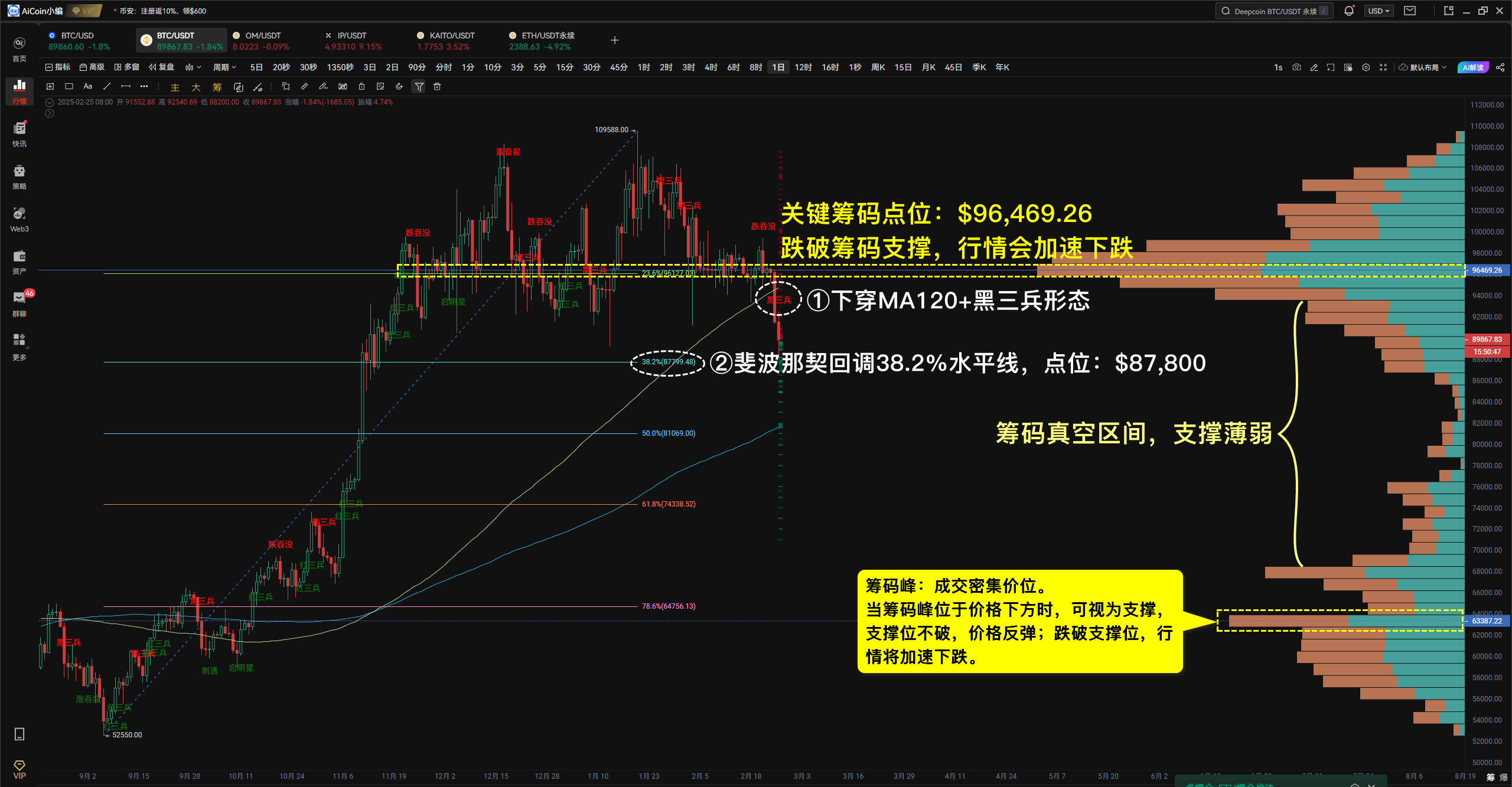

BTC跌破关键筹码峰 $96,469.26 后加速回落,当前进入筹码密集区下沿,下方筹码真空区间支撑薄弱。且币安大户持续出货,若价格无法迅速回升,大概率将进一步加剧下行趋势。 特别注意,BTC日线级别已跌破MA120均线,并形成黑三兵形态,空头情绪占据主导,38.2%斐波那契回调位将成为关键支撑,主要区间为$88,000~$87,800。 筹码峰解读:筹码峰代表成交密集区,当筹码峰位于价格下方时,可视为支撑,支撑位不破,价格反弹;跌破支撑位,行情将加速下跌。 数据源于PRO会员,仅供参考,不构成任何投资建议!

Click on this link to enter the live stream: https://meeting.tencent.com/p/5658778060 I feel a bit awkward when writing this article. We must once again clarify that Lao Guan had already mentioned this market trend at the weekly level two weeks ago. If the decision at the weekly level is valid, then the overall direction must be bearish. But for the weekly level, it belongs to a relatively large cycle, with each candlestick filling in the volatility of 7 trading days. We have been analyzing the market in detail for the past three weeks, and during this period, we have also provided short-term ideas for the market. Honestly, when we analyzed the market yesterday, we did believe that the price would have a first upward momentum and then a downward movement, because we see that the current position of the market is not enough to show a deep downward trend. But the fact is that the market has just taken a downward trend. This wave of decline met some people's expectations, and of course, it also broke some people's expectations, but I objectively looked at the current dual currency market from an outsider's perspective. I have this idea. First of all, at the current position on the big cake, it has basically touched the lower edge of the oscillation downward channel line we drew before. I will show you this on the wheat tonight. In this situation, the market may still have rebound behavior after touching the oscillation resistance. So at the daily level on the ether, the several key resistance lines we previously drew have also been successfully touched, and currently belong to the last key resistance line below. So on this basis, Ethereum also has a certain expectation of rebound. At this point, we are not trying to guide you to engage in bottom hitting, rebound, and bottom buying operations. Instead, we would like to warn you that based on the objective fluctuations of the current market, we are indeed at a critical juncture. It seems that Duojun has been pushed to a dead end, but there may still be a glimmer of hope. Of course, this hope is limited, or only limited to this trading day. So tonight, our focus is more on discussing with everyone whether the key resistance level below the current dual currency can be broken, and what direction the market should take if it breaks or not. QQ group number: 701829134 Aicoin group: https://aicoin.com/link/chat?cid=2ARLLeaoM Tencent Meeting Number: 5658778060 Disclaimer: The above content only represents the author's personal opinion and is for communication and sharing purposes only. It does not represent AICoin's position or viewpoint and does not constitute any investment advice. Based on this investment, there may be external contacts, which have nothing to do with AICoin, and the consequences shall be borne by oneself.

BTC has accelerated its decline after falling below the key chip peak of $96469.26, and is currently entering the lower edge of the chip intensive zone, with weak support in the chip vacuum zone below. And if Binance's major players continue to ship, and the price cannot quickly recover, it is likely to further exacerbate the downward trend. Please note that the BTC daily level has fallen below the MA120 moving average and formed a black three soldier pattern, with bearish sentiment dominating. The 38.2% Fibonacci retracement level will become the key support, with the main range being $88000~$87800. Interpretation of Chip Peak: Chip peak represents a densely traded area. When the chip peak is below the price, it can be considered as support. If the support level does not break, the price will rebound; If it falls below the support level, the market will accelerate its decline. The data is sourced from PRO members, for reference only, and does not constitute any investment advice!

Odaily Planet Daily News: Juan Pellicer, Senior Research Analyst at IntoTheBlock, said that the current downturn may indicate that the market is about to surrender. He pointed out that the recent market adjustment, especially with a large amount of liquidation (especially for assets like Solana), indicates that as excessively leveraged positions are cleared, the market may surrender. In financial markets, surrender style selling refers to investors selling their positions in panic, causing a significant drop in prices and indicating that the market is about to bottom out before the next upward trend begins. (Cointelegraph)

Odaily Planet Daily News: Binance executives stated in a recent interview that the regulatory framework for virtual assets in Hong Kong is relatively cautious and moving in the right direction. They suggest further relaxing restrictions and allowing more virtual assets products and services to enter the local market while protecting investor rights. However, there is no direct response to market concerns about whether Binance intends to return to the US market or enter the Hong Kong market. They only emphasize that the Asia Pacific region is a global economic growth engine and the local cryptocurrency usage rate is high. They hope to participate in and support the development of virtual asset markets in relevant places in different ways. (Sing Tao Daily)

Odaily Planet Daily News: CryptoQuant has disclosed data showing that whales are buying during market downturns, with 26430 BTC flowing into whale accumulation addresses, typically related to over-the-counter trading and long-term custody.