Author: OKX Ventures

The content of this article does not represent the views of ChainCatcher and does not constitute any investment advice.

Perp DEX (Decentralized Perpetual Contract Exchange) has become one of the most explosive and competitive sectors in current on-chain applications. OKX Ventures aims to systematically outline the complete evolution of Perp DEX from its inception, explosion, to differentiation through this research, and to deeply analyze its representative projects at different stages, presenting how this core sector continuously reshapes itself amid the alternation of bull and bear markets and technological iterations.

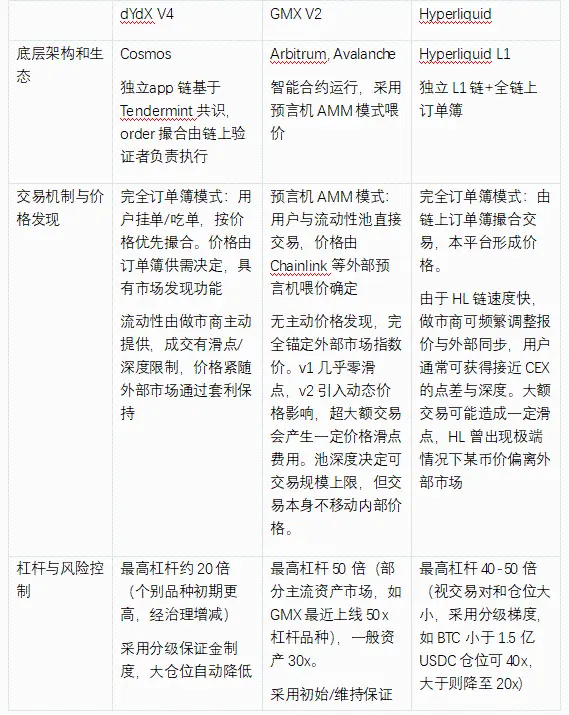

Based on an in-depth review, we will focus on dissecting the two early dominators, dYdX and GMX, exploring why they transitioned from prominence to decline, and further discussing how new forces like Hyperliquid and Aster have managed to break through in fierce competition: is it due to innovative architectural design? A reconstruction of trading philosophy? Or the evolution of community economic models?

Through a systematic comparison of successes and failures, this research aims to reveal the most critical, challenging yet enlightening "trade-off moments" in the construction of Perp DEX, providing reusable experiences and deep insights for the new generation of entrepreneurs in product, technology, and market strategies.

1. Market Background

1.1 History of Perp DEX Market Development

The core of the first stage is the validation of concepts and the dawn of Layer 2 (2017–2021). The theory of Perpetual DEX/Perpetual Swap can be traced back to the release of the dYdX white paper "dYdX: A Standard for Decentralized Margin Trading and Derivatives" in 2017 and Hart Lambur's white paper "BitDEX: A decentralized BitMEX using Priceless Financial Contract" in 2019. In 2020, dYdX launched the first BTC perpetual contract on the Ethereum mainnet, putting theory into practice, and that same year, Perpetual Protocol launched its v1 version on the xDai chain, with its innovative virtual AMM mechanism allowing users to trade without order book matching. However, these early explorations were invariably constrained by the performance shackles of the Ethereum mainnet. High gas fees and slow transaction confirmations made user experience unable to compete with centralized exchanges (CEX), with daily trading volumes hovering only in the range of millions to billions of dollars, insignificant compared to the hundreds of billions on CEX at that time.

The real turning point came in 2021, with the maturation of Ethereum Layer 2 technology, marking the first rapid growth for Perp DEX. dYdX seized the opportunity to migrate its product to StarkWare's Layer 2 solution, significantly enhancing speed and reducing costs. On this basis, dYdX issued governance tokens and launched trading mining in August of the same year, which instantly ignited the market. On September 28, 2021, dYdX's daily trading volume surged to approximately $9 billion, surpassing the total of all other DEXs and even exceeding the data from mainstream CEXs like Coinbase during the same period. This milestone event first demonstrated the potential of Perp DEX to challenge CEX on a scale and pointed the entire industry in a direction: embracing Layer 2 is the only way to achieve growth.

The narrative of the second stage is dominated by innovations in the AMM model and the rise of GMX (2021–2023). After dYdX validated the feasibility of L2 order books, the market began to explore more diverse protocol models. GMX, which launched on the Arbitrum mainnet in September 2021, became the flagbearer of this new wave. GMX innovatively combined multi-asset liquidity pools (GLP) with oracle price feeds, using the GLP pool as the counterparty for all traders, achieving unique advantages of zero slippage trading and LP impermanent loss. GMX's success was attributed to its precise market positioning (capturing the early explosion of the Arbitrum ecosystem), LP-friendly incentive mechanisms, and the market trust shift brought about by the collapse of centralized giants like FTX in 2022. As a result, GMX rapidly grew to become the dominant Perp DEX in this cycle.

During the same period, projects like Synthetix's synthetic asset perpetual contracts and Gains Network's oracle trading further expanded the landscape of Perp DEX. This stage is characterized by model diversification and intensified competition. Although the market entered a bear phase, the trading volume of Perp DEX remained resilient, steadily increasing its share of the crypto derivatives market. A key trend is that dYdX's market share plummeted from 73% in January 2023 to 7% by the end of 2024, marking the end of its era of dominance. The intensifying competition also spurred a route dispute over underlying infrastructure: dYdX announced a shift to an independent Cosmos application chain (v4), while high-performance DEXs like Mango and Drift emerged on Solana, and dedicated application chains like Sei began to rise, laying the groundwork for the arrival of the third wave.

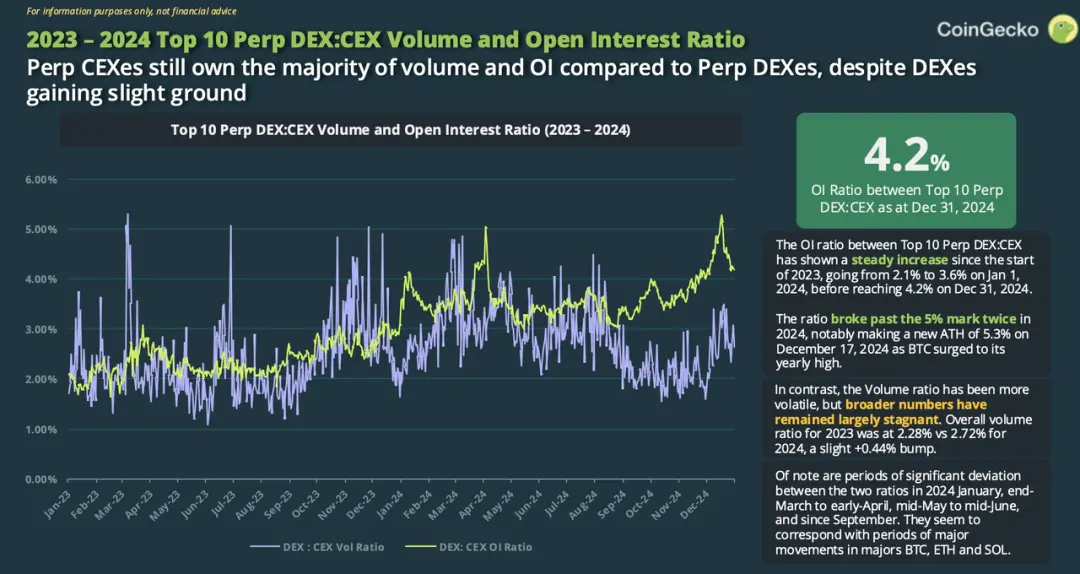

Figure: The trading volume and open interests of Perp DEX as a percentage of Perp CEX show a slow upward trend from 2023 to 2024.

The third stage is the high-performance revolution led by Hyperliquid (2023 to present). The core feature of this wave is the pursuit of extreme on-chain performance and a professional trading experience, aiming to truly match CEX in speed and depth. Hyperliquid launched in early 2023, achieving exponential growth with its "dedicated high-performance chain + CLOB order book" technical architecture and aggressive market incentives. Its ignition point was the HYPE token airdrop on November 29, 2024, which allocated 31% of the total supply to early users, greatly stimulating community enthusiasm. Its growth momentum continued unabated after the airdrop, reaching a monthly trading volume of $160 billion by December 2024, with a market share climbing to about 66%, and setting a single-day historical high of $21 billion on January 19, 2025.

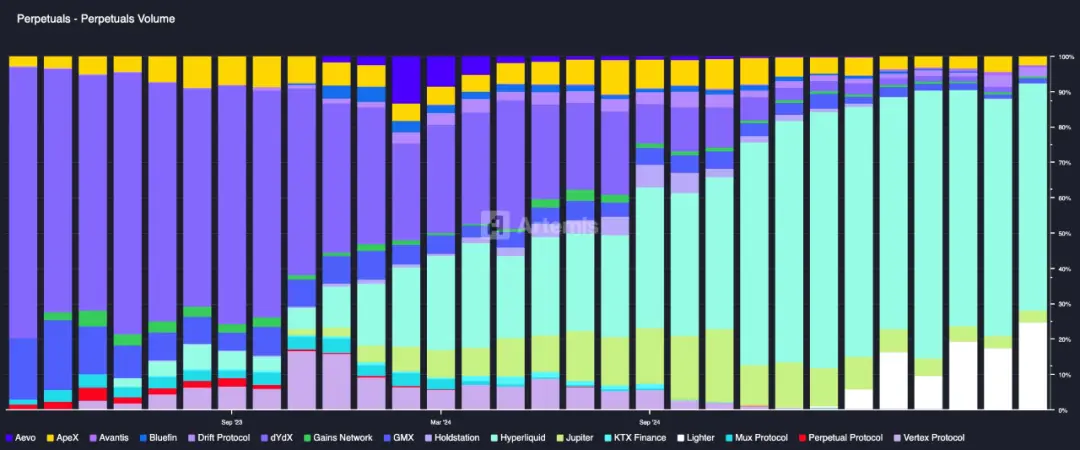

The rise of Hyperliquid has completely reshaped the market landscape. In 2024, the total trading volume of perpetual DEXs in the industry reached $1.5 trillion, a year-on-year increase of 138%, with Hyperliquid alone contributing over half in the fourth quarter. By mid-2025, Hyperliquid monopolized over 75% of the market share, while former kings dYdX and GMX both fell to single-digit percentages. In response to the impact, established projects are also actively adapting: dYdX officially launched its technologically advanced independent Cosmos chain (v4) in November 2023, achieving decentralization of the matching engine but failing to reverse the decline in market share; GMX, through gradual improvements, also could not stop the loss of users. Meanwhile, Jupiter in the Solana ecosystem rapidly climbed to the second position in the market, demonstrating the attraction of a strong ecosystem.

The third wave has clarified future technological trends: high-performance on-chain order books have become the focus. The success of Hyperliquid proves that decentralization and high performance can be unified through dedicated chains. However, this also raises new trade-offs, namely the performance advantages of dedicated chains versus their shortcomings in ecological composability. As noted by Multicoin Capital, dedicated chains face issues such as insufficient cross-chain asset support and reliance on bridges. To address this, projects like dYdX and Hyperliquid are also working to bridge these gaps, such as by integrating native USDC or launching EVM-compatible sub-chains. It is foreseeable that the future Perp DEX sector will continue to explore the trade-offs between "performance" and "ecology," seeking the best combination of speed, depth, and DeFi composability.

1.2 Market Data

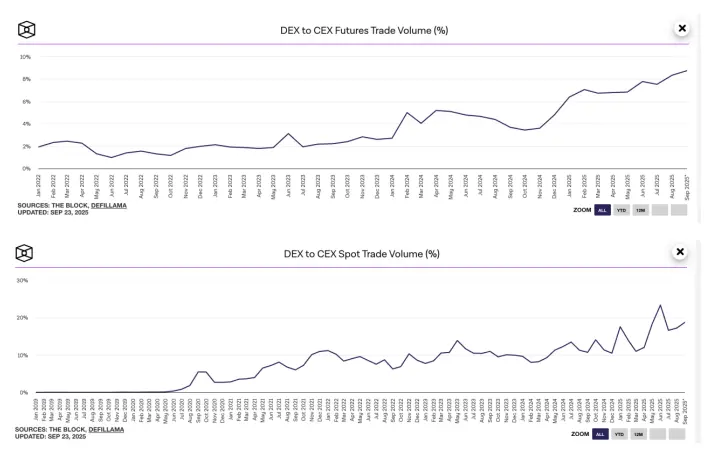

Figure: DEX trading volume divided by CEX Volume indicator: Spot DEX is 20%, Perp DEX is 8%; this indicator for Perp DEX has seen rapid growth after mid-2024.

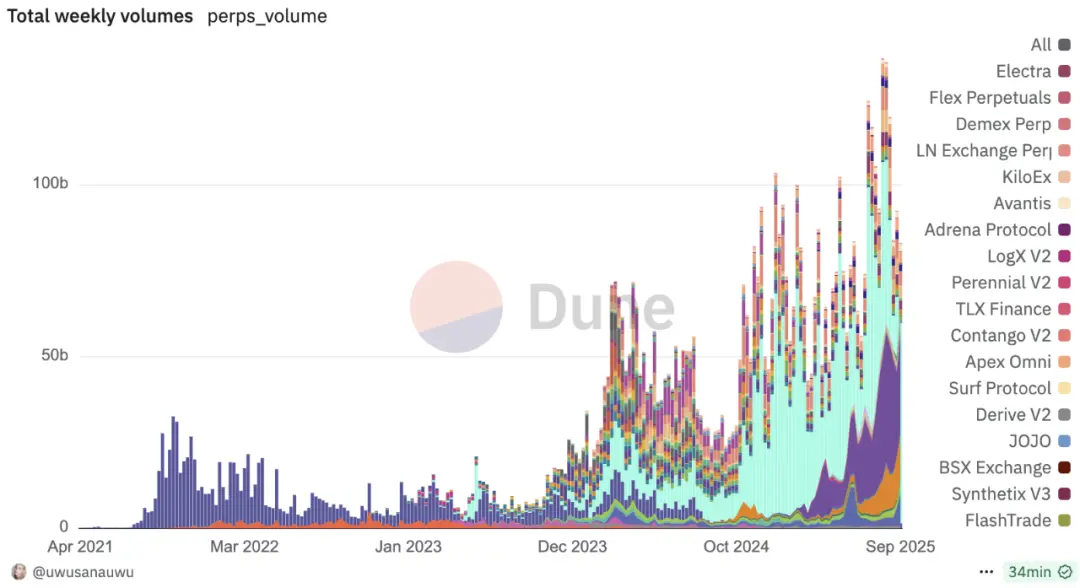

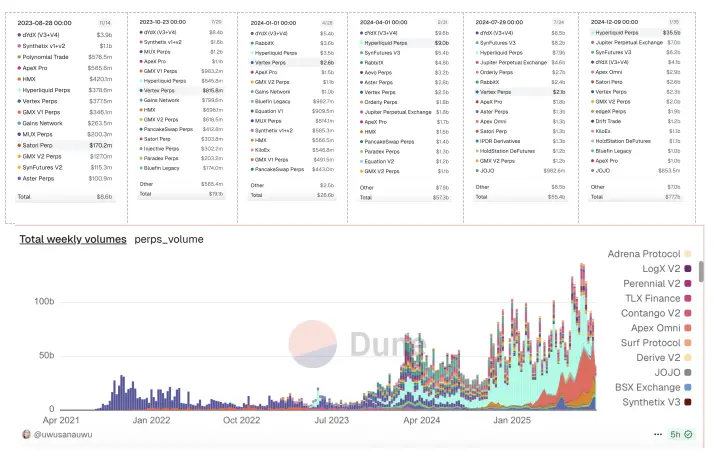

Figure: From 2021 to 2023, the market was essentially monopolized by dYdX and GMX; after dYdX completed a large-scale token airdrop in August 2021, its weekly volume basically maintained around $10 billion, while GMX's weekly volume remained around $2 billion. Hyperliquid emerged around May 2023, and by the end of 2023, its weekly volume maintained between $2 billion and $3 billion, flipping GMX, and by around August 2024, it grew to about $10 billion, flipping dYdX v4.

Figure: In terms of market share, Hyperliquid has maintained a market share of 50%-70% of Perp DEX since November 2024.

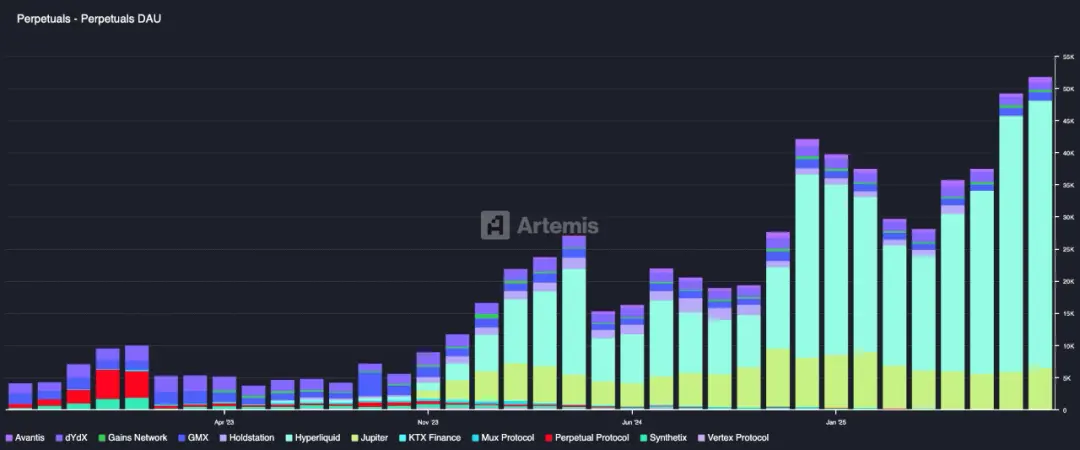

Figure: In terms of DAU, after Hyperliquid completed its airdrop at the end of November 2024, DAU has consistently maintained above 25k and has grown to 40k in recent months.

2. Core Modules and Fundamental Challenges in Building Perp DEX

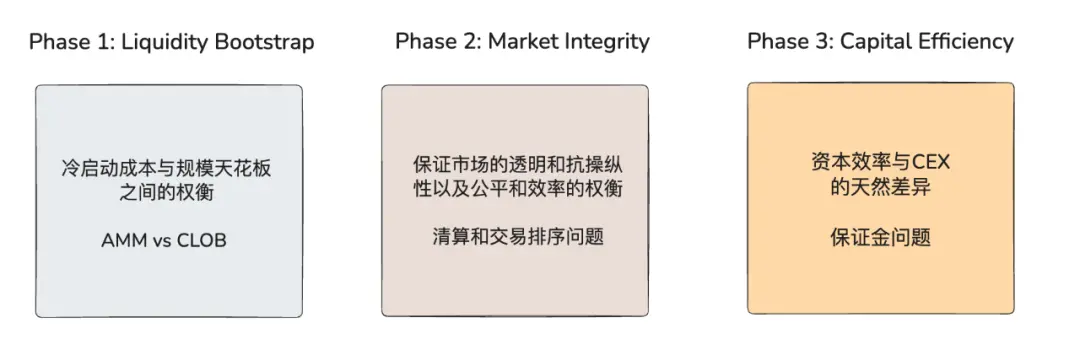

2.1 Trade-offs Between Liquidity Cold Start Costs and Scalability Ceilings (AMM vs. CLOB)

The primary issue faced by Perp DEX in its early stages is liquidity cold start, which revolves around the trade-off between "cold start costs" and "scalability ceilings." This trade-off is mainly reflected in two mainstream underlying architecture choices: Automated Market Maker (AMM) and Central Limit Order Book (CLOB).

1) About the AMM Model: Low Barrier to Entry Advantages and Inherent Scalability Bottlenecks

AMM-based liquidity pools (typically Oracle-based AMM, such as the architecture used by GMX) have a core advantage in significantly lowering the barrier to liquidity provision through the design of the LP Pool. Any user can deposit assets into the pool to become a liquidity provider, allowing the protocol to quickly and cost-effectively gather initial liquidity in the early stages, effectively addressing the cold start problem. However, this architecture also brings two interrelated inherent bottlenecks that limit its scalability ceiling:

Bottleneck 1: Passive Risk Exposure of LPs and Difficulty in Attracting Professional Market Making Capital.

The essence of AMM liquidity pools is to act as a collective counterparty for all traders. This model is characterized by "passive management," where LPs cannot actively manage their quotes and risks like order book market makers. This leads LPs to face directional risk: when traders' positions collectively lean in one direction (e.g., a large number of long positions in a bull market), the LP pool must take on a net short position opposite to that. If the market continues to move in one direction and traders collectively profit, the LP pool will incur corresponding systemic losses. Although GMX v2 introduced a dynamic funding rate mechanism to balance the holding costs of both long and short positions to some extent, it is still limited to risk mitigation rather than risk elimination. For large-scale professional market-making capital seeking precise risk control and active strategy execution, this passive, collective risk exposure is less attractive, making it more challenging for pure AMM pool models to attract top-tier market makers compared to order book models.

Bottleneck 2: The Ceiling of TVL Scale on Open Interest (OI) Scale.

The aforementioned risk model directly leads to the necessity for AMM protocols to set a hard ceiling on the total amount of open interest they can support. The size of this ceiling is directly related to the protocol's TVL. To protect the solvency of the LP pool and prevent bad debts due to extreme market fluctuations or excessive position imbalances, the protocol must limit its risk exposure, meaning total OI cannot grow indefinitely. This upper limit is typically set as a multiple of the TVL (with the total OI ceiling being about 5 times the TVL, depending on asset volatility and the protocol's risk control parameters). For example, a liquidity pool with $100 million TVL may set the total OI limit for both long and short positions at $500 million to control risk. Once OI approaches this threshold, the protocol's risk control mechanisms (such as sharply rising funding rates) will activate, significantly increasing holding costs to suppress users from continuing to open positions in the imbalanced direction. This design is particularly critical during periods of high volatility or consensus market sentiment; while it ensures the safety of the protocol, it also clearly limits the market's growth potential.

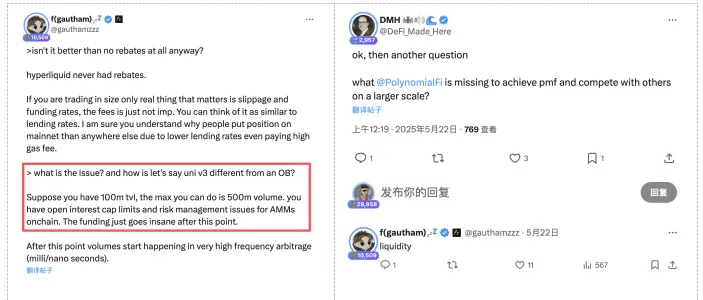

Figure: Polynomial founder Gautham expressed similar thoughts in a post discussing order book vs AMM in Perp DEX applications: the scale of AMM pools also limits trading scale; the team entered the decentralized derivatives market in 2021.

2) About the Order Book Model: High Ceiling Advantages and Severe Cold Start Challenges

The CLOB (Central Limit Order Book) model is a mature paradigm in traditional financial markets such as stock and futures exchanges, and it is also adopted by many high-performance Perp DEXs like Hyperliquid. Its core mechanism facilitates transactions by directly matching buy and sell limit orders submitted by both parties in a peer-to-peer manner.

The order book model fundamentally avoids the scalability limitations faced by AMM pool models in its underlying design.

Decoupled Liquidity and Risk: Unlike relying on a single liquidity pool as a collective counterparty, the liquidity of the order book is provided by numerous independent market makers and order users. Transactions are directly matched between buyers and sellers, with risk transferred among individuals rather than concentrated in a single pool.

Unlimited OI Scale Ceiling: Since it does not rely on a fixed liquidity pool TVL size, the Open Interest scale of the order book model is theoretically unlimited. Its ceiling depends solely on the total liquidity and risk-bearing capacity that all participants in the market are willing to provide. As long as there are enough market makers and traders participating, the market size can continue to grow.

Excellent Trade Execution Quality: This competitive quoting environment can lead to better price discovery mechanisms. For large trades and high-frequency arbitrage strategies, the order book can provide extremely low slippage and tighter bid-ask spreads, deeper liquidity, and more accurate pricing.

Overall, the order book model is an ideal choice for accommodating large-scale, specialized market-making liquidity, with a theoretically high scalability ceiling, widely regarded as the ultimate form for the maturity of Perp DEX.

However, the significant advantages of the order book model come with a severe challenge—high cold start costs. A healthy, active order book market requires multiple professional market makers to continuously provide deep, tightly priced two-sided quotes from day one. However, market makers can only profit when there is sufficient trading volume (Taker Flow), and traders are only willing to enter the market when there is enough liquidity. This creates a classic "chicken or egg" dilemma. To break this deadlock, new platforms must invest substantial capital and resources in the early stages of operation, using market maker incentive programs (such as providing token rewards, fee rebates, etc.) to attract and coordinate the first batch of market makers.

Figure: A recent article on Twitter titled "Deadly Perp DEX Traps (and the Paths Out)" revealed that if a team charges a 0.035% fee, after distributing to market makers and rebates, they may only have 0.015% left. Assuming the team's monthly operating cost is $500,000, they need at least $111.1 million in taker volume daily to break even.

2.2 Establishing Fair Market Game Rules

After addressing the initial liquidity issues of Perp DEX, the core challenge shifts to issues related to market integrity, including transparency, resistance to manipulation, and the trade-off between fairness and efficiency, which are primarily reflected in transaction ordering and liquidation mechanisms.

1) About Transaction Ordering: The Game of Fairness vs. Efficiency

In a blockchain environment, the final packaging order of transactions directly determines the transaction results, giving rise to MEV (Miner Extractable Value). This issue is particularly prominent in Perp DEX, as the nature of leveraged trading amplifies price sensitivity, with MEV strategies such as front-running and sandwich attacks exponentially increasing user losses in a leveraged environment, hindering participation from ordinary retail traders and making it easy for market makers' orders to be exploited by high-frequency traders (HFT), leading to continuous losses and exposure to so-called "toxic flow."

This forces protocol designers to confront a fundamental trade-off: should they prioritize fairness, protecting ordinary users and small to medium market makers from MEV exploitation, or should they prioritize efficiency, allowing fierce competition among HFTs to drive deeper liquidity and faster price discovery? This is a philosophical choice without a perfect answer, with different protocols providing starkly different responses.

Hyperliquid's design clearly leans towards a "fairness-first" protectionist path. To achieve this goal, the protocol introduces a key mechanism known as "Speed Bumps," which includes: memory pool buffering (providing about three blocks of processing buffer time for transactions) and prioritizing the processing of cancel orders (in the matching engine, cancel order instructions have higher execution priority than new orders). The direct effect of this design is to provide a strong protective layer for makers, especially small to medium market makers. When they detect a taker order that would cause losses to their orders entering the memory pool, they have sufficient time and authority advantage to preemptively cancel or modify their orders, thus avoiding being "sniped" by HFT strategies.

In contrast, opponents like GTE lean towards an "efficiency-first" Darwinian path, arguing that while Hyperliquid's "Speed Bumps" mechanism protects some participants, it sacrifices overall market efficiency and may limit the upper ceiling of liquidity depth. Their argument is that true market efficiency and price discovery stem from unrestricted fierce competition among the top and most sophisticated market makers, as neither leading exchanges in the crypto industry nor traditional financial markets like Nasdaq/CME impose similar protective "Speed Bumps" for market makers. In leading exchanges, most trading volume does not come from "market makers vs. retail," but rather from "market makers vs. market makers." Protecting weaker market makers allows them to easily avoid losses, which may actually weaken the profitability of top market makers with true alpha (excess returns) capabilities, potentially pushing them out of the market and ultimately harming overall liquidity.

2) About Liquidation Mechanisms: Balancing Transparency and Resistance to Manipulation

The liquidation mechanism is the "lifeline" of any leveraged trading protocol, with its core mission being to prevent the accumulation of systemic risk through forced liquidation when traders' positions incur losses beyond their margin coverage, thereby maintaining the protocol's solvency and overall user trust. However, this seemingly simple safety valve is exceptionally complex in design, as it must seek a fragile balance within a polygon composed of multiple conflicting goals, including transparency, fairness, resistance to manipulation, sensitivity, and stability.

The difficulty of the liquidation mechanism centers on determining the price at which a position should be liquidated. If the platform uses the Last Price directly, large single transactions or small transactions during liquidity droughts can cause prices to fluctuate sharply, leading to "spike" events that trigger a significant number of "unfair liquidations" that should not occur. To address this issue, the industry commonly adopts a Mark Price mechanism. The Mark Price is not a single transaction price but a synthetic price aimed at reflecting the asset's "fair value." It is typically derived by aggregating the spot prices from multiple mainstream, high-liquidity markets (such as the median or weighted average from Coinbase) and smoothing it with factors like funding rates. The Mark Price is used solely for calculating unrealized profits and losses and determining liquidations, while the Last Price is used for settling realized profits and losses. This design greatly enhances the fairness and resistance to manipulation of liquidations: due to the diverse and decentralized sources of price, it is difficult for a single entity to manipulate multiple markets simultaneously, effectively filtering out isolated abnormal fluctuations and ensuring the objectivity of the liquidation basis.

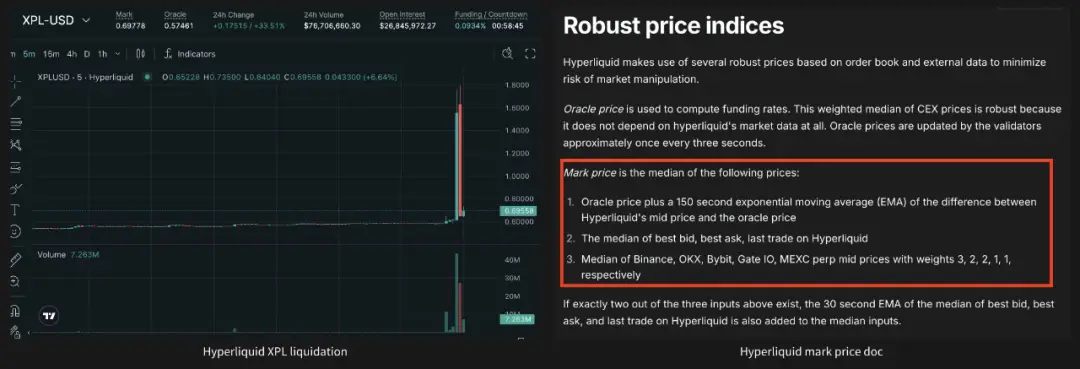

Figure: Hyperliquid's XPL event: On August 26, 2025, a whale raised the price of XPL tokens from $0.6 to $1.8 within minutes, leading to the liquidation of a $25 million short position, while prices on centralized exchanges remained stable. This occurred because, in a "pre-market" scenario lacking reliable external price sources, internal prices are easily manipulated.

However, in the pursuit of a perfect Mark Price, protocol designers also face the dilemma of "Sensitivity vs. Stability." This issue is well summarized in Yaoqi's recent article "Oracle, Oracle, Oracle: How Price Feed Design Turned $60 Million Into a $19 Billion Catastrophe": a highly sensitive oracle that closely tracks real-time markets can reflect price changes promptly but is also more susceptible to short-term manipulation. For instance, the recent $60 million USDe sell-off was fully absorbed by its sensitive oracle, ultimately triggering a chain liquidation worth $19.3 billion. Conversely, an oracle designed to filter out noise by being overly stable (e.g., using a TWAP with an excessively long time window) can resist short-term manipulation but may respond sluggishly during genuine, sustained market declines. This "sluggishness" can cause the protocol to miss the optimal window for timely liquidation of losing positions, leading to the accumulation of bad debt risk, which could ultimately result in more severe systemic shortfalls.

2.3 Margin Capital Efficiency Issues

Margin capital efficiency is another challenge faced by Perp DEXs in competing with centralized exchanges (CEXs) and is an area that designers continuously seek to improve. For example, Kyle Samani mentioned in 2020 in "DeFi’s Invisible Asymptotes" and "On Forking DeFi Protocols" that this direction would be a focus for future development. The fundamental reason for the differences in margin efficiency between Perp DEXs and CEXs lies in the differences in their underlying architectures:

1) The high efficiency of CEXs is rooted in their core of "centralized trust." Users completely entrust the custody of their assets and the execution of trades to a single entity. This entity thus possesses a global perspective, allowing it to act like a central brain, gaining real-time insights and calculating the total risk exposure of all users on the platform. This omniscient capability enables it to easily implement complex risk hedging. For example, when a user holds both long and short positions simultaneously, the CEX can identify that their net risk is nearly zero, significantly reducing margin requirements. More importantly, since CEXs actually control users' assets, they can re-trade or lend out funds that are temporarily idle and used as margin, creating additional returns for users, which is essentially a re-utilization of idle capital.

2) The design philosophy of Perp DEXs is precisely the opposite. Its first principle is "code is law," meaning that the system's security does not rely on any intermediaries but is guaranteed by publicly transparent smart contracts. This principle grants users absolute asset sovereignty but also brings profound constraints. For assets to be used as margin, they must be authorized through private keys and "locked" in specific smart contracts. This locking process is rigid and isolated. Once capital enters a contract's vault, it is isolated, with its sole mission being to support that one independent position, unable to flow to other areas where it might be needed, nor can it be used to earn interest as in CEXs. This leads to severe "fragmentation" of capital, where each transaction acts like an independent risk island, requiring its own dedicated margin to maintain security.

This characteristic of asset isolation and risk atomization leads to two consequences: first, the protocol struggles to identify hedged positions. Since smart contracts cannot see a user's actions in other contracts, they can only mechanically require users to provide sufficient collateral for every opposite position, forcing users into excessive over-collateralization. Second, the modular nature of functions in the DeFi world means that lending protocols and trading protocols operate independently, making their liquidation logic and risk parameters difficult to reconcile, and capital cannot flow seamlessly between the two systems, further exacerbating capital fragmentation.

To address these challenges, various solutions have emerged in the industry: Marginfi's unified collateral pool and Drift Protocol's multi-subaccount mechanism can be seen as a "simulation" of centralized efficiency within a decentralized framework. They attempt to re-integrate users' fragmented capital through more complex contract designs, creating a shared margin environment similar to that of CEXs within the protocol, thereby enhancing flexibility. GMX's GLP pool takes a different approach by concentrating risk in a single liquidity pool, simplifying the counterparty model.

Recently, Tarun Chitra and the Bain Capital team published a paper titled "Perpetual Demand Lending Pools," addressing the integration of perp DEX and lending models. Their proposed "Perpetual Demand Lending Pool (PDLP)" research represents a "reconstruction" from first principles. It no longer attempts to mimic the functions of CEXs but instead returns to the essence of financial risk, viewing perpetual contract trading and lending as two sides of the same coin. The model posits that the risk of a long position is essentially equivalent to borrowing the underlying asset, while a short position is equivalent to borrowing stablecoins. Based on this insight, PDLP unifies both into a cohesive framework, creating a unified asset pool where capital serves as both trading margin and lending liquidity.

3. Comparison of Perp DEX Operational Data

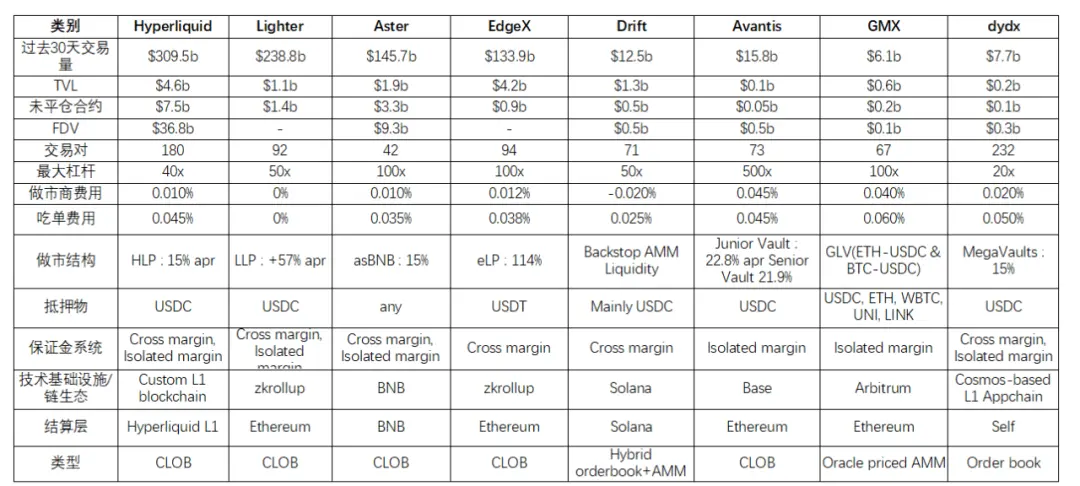

Data Source: defillama, perpetualpulse.xyz (October 20, 2025)

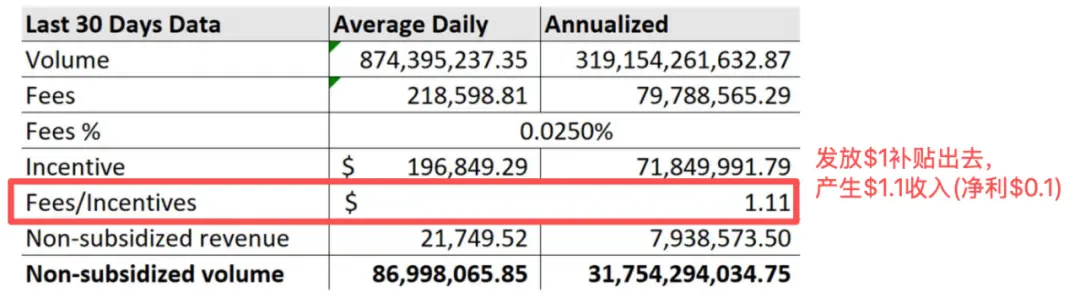

The core of liquidity is "how quickly and at what minimal cost a trader can complete a transaction." This cost includes the bid-ask spread, slippage, and transaction fees. Many platforms, in order to quickly attract users in the early stages, stimulate trading through token incentives, which can lead to a direct negative impact resulting in a significant amount of "Wash Trading"—users frequently engaging in self-executing fake trades to earn rewards. Although this trading inflates the platform's "trading volume" data, it does not bring real liquidity. When incentives decrease, this false prosperity will disappear (the most typical example being dYdX).

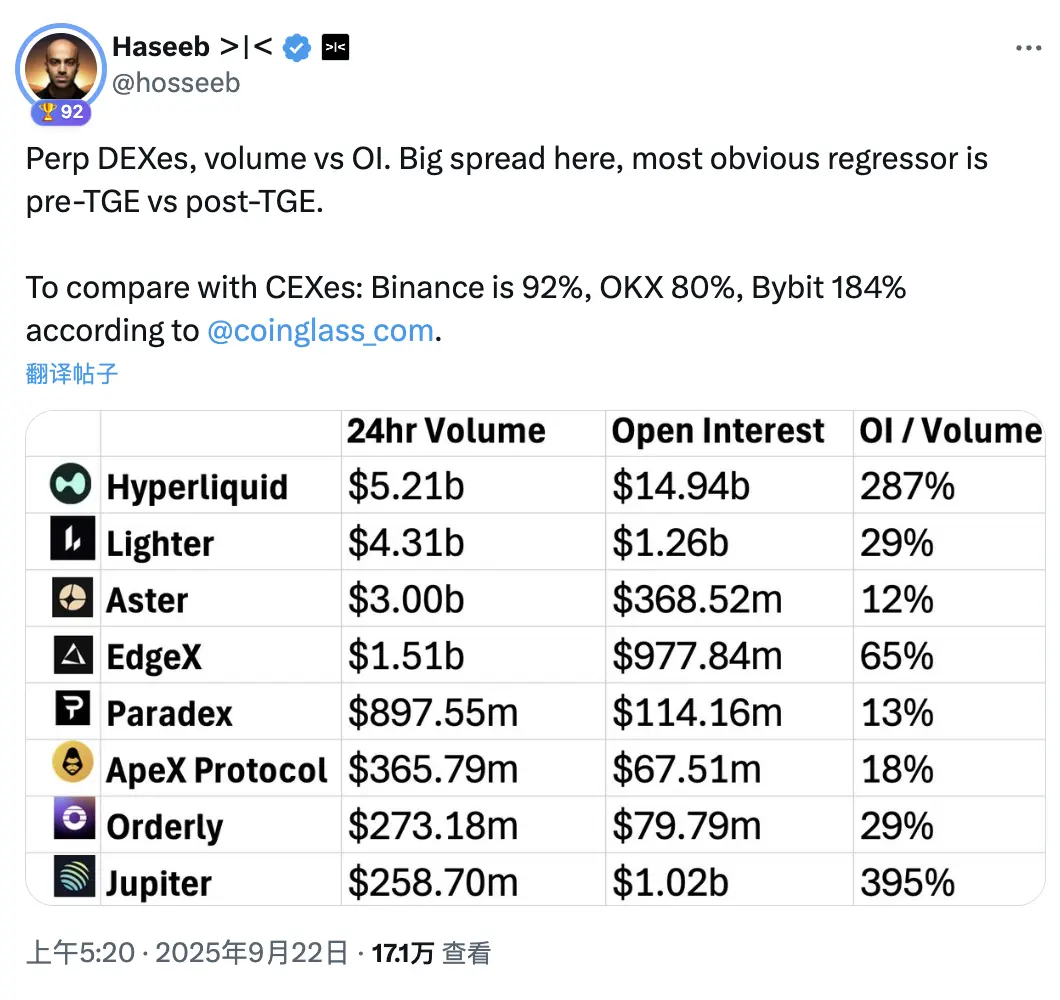

A major dimension for measuring healthy liquidity is the ratio of open interest to trading volume (Open Interest vs. Volume). According to OI/Volume data provided by Coinglass, Binance has 92%, OKX has 80%, and Bybit has 184%. In contrast, many Perp DEXs relying on token incentives have a much lower ratio, indicating that their trading activities are more about volume manipulation rather than real positions. However, this should not be the only reference standard; it is essential to extend the time period and specifically observe the behavior of major active addresses (recently, the OI to volume ratio has become a narrative for many project communities to attack each other, such as Hyperliquid and Lighter).

Data Source: perpetualpulse.xyz (October 20, 2025)

4. Comparison of Four Major Perp DEX Projects: Hyperliquid, Aster, Lighter, edgeX

4.1 Hyperliquid

4.1.1 Founder Jeff's Trading System Design Philosophy — Transparent Market, Non-toxic Flow

In June of this year, Hyperliquid founder Jeff publicly debated on Twitter and podcasts (Tweet 1, Tweet 2, Podcast) about his controversial "Transparent Market" trading system construction philosophy, which challenges traditional market structures and has garnered widespread attention in the industry. It is necessary to delve into his thesis to understand why Hyperliquid's development is disruptive, breaking it down into two parts (clarifying user goals and risks, establishing basic principles).

I. Core Motivations and Risk Analysis of Market Participants

The goals of market participants: In a trading market, participants' goals can be clearly divided into two categories. The core goal of liquidity demanders (Takers) is to achieve "Best Execution," meaning completing trades at the best price, with the fastest speed and minimal market impact. On the other hand, the core goal of liquidity providers (Makers or market makers) is to earn the spread by continuously providing buy and sell quotes, but they face the primary risk of trading losses due to information asymmetry.

Core Risk Identification: "Toxic Flow": The core risk faced by market makers is specifically manifested as "Toxic Flow." This type of trading refers to arbitrage activities that exploit asymmetric technological advantages, causing market makers' quotes to become instantly invalid, resulting in immediate losses upon execution. In contrast, "Non-toxic Flow" refers to trades that do not rely on instantaneous information advantages, such as buying and selling to establish long-term positions, which pose much lower risks to market makers. Based on this, the rational strategy for market makers is to avoid trading with "Toxic Flow" while actively providing services for "Non-toxic Flow."

Impact of Market Transparency on Market Maker Behavior: Market transparency directly determines the behavior patterns of market makers. In opaque markets, where it is impossible to distinguish between "Toxic Flow" and "Non-toxic Flow," market makers can only adopt defensive strategies, such as widening bid-ask spreads and reducing order book depth to protect themselves. However, this increases transaction costs for all liquidity demanders, including "Non-toxic" traders. Conversely, in a fully transparent market like Hyperliquid, publicly available on-chain addresses and historical behaviors enable market makers to identify and assess the intentions of counterparties. When they can recognize lower-risk "Non-toxic Flow," their perceived risk significantly decreases, making them more willing to offer narrower spreads and better liquidity depth, ultimately allowing "Non-toxic" demanders to achieve their trading goals at lower costs.

II. Ideal Market Design Principles Based on the Above Analysis

Counterparty Principle: The core of this principle is that the quality of a trade fundamentally depends on the identity and intentions of the counterparty. The traditional view holds that dark pools or OTC platforms can provide better execution due to their "privacy." Jeff argues that this is a misunderstanding. Their true advantage lies in filtering counterparties through an access system, excluding "Toxic Flow." "Filtering" is the fundamental reason, while "privacy" is merely a means to achieve filtering. Hyperliquid's solution is more thorough; it allows all participants' behaviors to be public through completely transparent on-chain addresses, enabling the market itself to perform the filtering. Market makers will proactively collaborate with reputable "Non-toxic" traders based on public trading histories and avoid "Toxic" addresses with arbitrage intentions, forming a more efficient and decentralized filtering mechanism.

Competition Principle: This principle follows a fundamental economic principle: optimal prices arise from maximized competition. Jeff believes that in traditional OTC trading, a large trader may only be able to solicit quotes from a few market makers, resulting in very limited competition. In a transparent on-chain market like Hyperliquid, their trading intentions can be broadcast to all market makers on the platform. This stimulates hundreds or thousands of market makers to engage in fierce bidding for this predictable "Non-toxic" order, continuously lowering their quotes. Maximizing the scope of competition inevitably leads to optimizing execution quality, as any attempt to capture excess profits with a quote will be instantly replaced by a more competitive counterparty.

Repeated Games Principle: This principle emphasizes the fundamental differences in participant behavior patterns between one-time trades and long-term relationships. In an anonymous market environment, trades are one-off games, and participants' optimal strategies may involve harming their opponents to maximize their own benefits, leading to widespread distrust. Hyperliquid transforms the market into a repeated games scenario through immutable on-chain addresses. Each address's every action builds its own reputation record. If an address frequently engages in "Toxic" trading, it will quickly be identified and avoided by the market maker community. To maintain a reputation that allows for ongoing trading, all participants are more motivated to engage in honest and predictable behavior, thereby pushing the market toward a healthier equilibrium.

Full Transparency Principle: In information processing, information asymmetry is the most dangerous state. The worst-case scenario is when information is known only to a few, such as when an insider at a centralized platform knows the location of a user's stop-loss order, allowing them to "hunt" that order without external competition. The optimal state is complete information symmetry, where everyone is aware. When everyone knows the location of stop-loss orders, any attempt to trigger liquidations by crashing prices will be anticipated by other rational participants in the market. These participants will become "anti-hunters," placing buy orders near the stop-loss price to acquire cheap tokens, making the cost of hunting extremely high or even unprofitable, thus forming a self-defense mechanism for the market.

4.1.2 Hyperliquid Product and Technical Implementation

Hyperliquid's excellence lies in its not only proposing a disruptive "Transparent Market" theory but also perfectly translating this philosophy into a high-performance, fully vertically integrated trading system through powerful full-stack engineering capabilities. Every technical decision precisely serves the four principles mentioned in Jeff's design philosophy (Counterparty, Competition, Repeated Games, Full Transparency).

I. Building a Dedicated L1 Public Chain HyperCore for "Best Execution"

In response to the common question of "which public chain should be built on," Hyperliquid's answer is "to become that chain," which is an uncompromising choice in its product vision (some believe that Hyperliquid may have had professional market-making support from the beginning, as professional market makers can only accept order books, so "ultra-high performance" and "the ability to comfortably place and cancel orders before the taker" naturally became Hyperliquid's core design points).

Jeff's "Competition Principle" requires the system to handle massive, high-frequency order updates and bidding from global market makers. Hyperliquid's L1 is "specifically designed to support high-frequency order book trading and near-instant trade finality." In practice, it has supported processing capabilities of up to 100,000 orders per second, physically compressing the space for "Toxic Flow" to exploit delays for arbitrage.

II. Speed Bump and Cancel Order First Mechanism Protecting Market Makers

Hyperliquid's speed bump mechanism, also known as the cancel order first system, is a core design feature of its L1 blockchain. This mechanism prioritizes the processing of cancel orders during block execution, placing other orders for immediate execution afterward. This essentially provides a brief "buffer period" for market makers, allowing them to adjust or cancel quotes before taker orders are executed, while taker orders must buffer in the memory pool for about three blocks. This design reduces the risk of makers being quickly "sniped" by taker orders.

Why This Design: The core purpose of this mechanism is to protect market makers from the harm of toxic flow, allowing them to provide liquidity more comfortably without worrying about being quickly picked off by HFT takers. This aligns closely with founder Jeff's thesis: he believes that traditional order books often lead to a "loser's curse" between HFT takers and makers, where makers are hit by takers before canceling orders, leading to liquidity degradation, wider spreads, and ultimately harming the execution quality for end users (such as retail traders). By prioritizing cancellations, Hyperliquid optimizes the end-user experience, encouraging makers to provide tighter quotes and deeper liquidity rather than maximizing trading volume or fees. This design also emphasizes decentralization: the dedicated L1 chain ensures the platform maintains solvency during extreme volatility and allows community liquidity pools like HLP (Hyperliquidity Provider) to intervene profitably when makers withdraw, thus providing liquidity. Overall, this is an improvement over traditional CLOBs, prioritizing retail and makers over toxic takers, thereby building a fairer and more efficient ecosystem.

Community Feedback: Although this mechanism operates effectively (currently, Hyperliquid's retail user proportion is high, with good trading experience and depth), it has also sparked controversy: critics like the GTE team argue that it restricts trading among HFT market makers, potentially limiting overall trading volume growth and making it difficult for Hyperliquid to flip Binance; others, like Dan Robinson, hold a positive view of this mechanism.

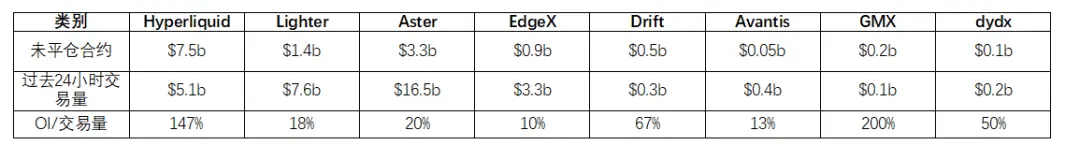

Figure: BTC Trading Pair Depth Comparison (Hyperliquid, Lighter, EdgeX) @andyandhii compared one hour of data from Lighter, EdgeX, and Hyperliquid in a test. The results showed that Hyperliquid maintained depth while processing large orders exceeding $16 million, and its performance at a $6 million order scale was comparable to EdgeX, indicating that Hyperliquid is indeed the best venue for large trades.

III. Redefining "Decentralization" — Fully On-Chain Central Limit Order Book (CLOB)

To understand the technical core of Hyperliquid, one must first grasp its redefinition of the term "decentralization." In a recent collaborative article by EdgeX, GTE, and others analyzing the development dilemmas of Perp DEXs titled "Deadly Perp DEX Traps," there is a statement: decentralization is often misused in the realm of Perp DEXs — most Perp DEXs merely shift centralized risks from the "custodial layer" to the less visible "execution and liquidation layer."

Hyperliquid's solution is to ensure that all core components — order book, matching, liquidation — operate entirely on a transparent chain, preventing the protocol from unilaterally intervening or liquidating user funds. This means that any changes in funds (whether through execution or liquidation) must strictly adhere to publicly verifiable rules written on-chain. No "administrator" or "centralized server" can override these rules. The ultimate technical form to achieve this goal is a fully on-chain CLOB.

IV. Liquidity Engine HLP — Two Roles: Market Making + Backstop Liquidations

After establishing a fair and transparent CLOB framework, Hyperliquid faces the challenge of "how to inject initial and sustained liquidity." Its solution is not a one-time complete decentralization but a phased evolution centered around HLP (Hyperliquidity Provider): initially, the protocol's built-in "Market Making Vault" assumes the "backstop" responsibilities for market making and liquidation, gradually delegating liquidity provision to open community Maker Vaults.

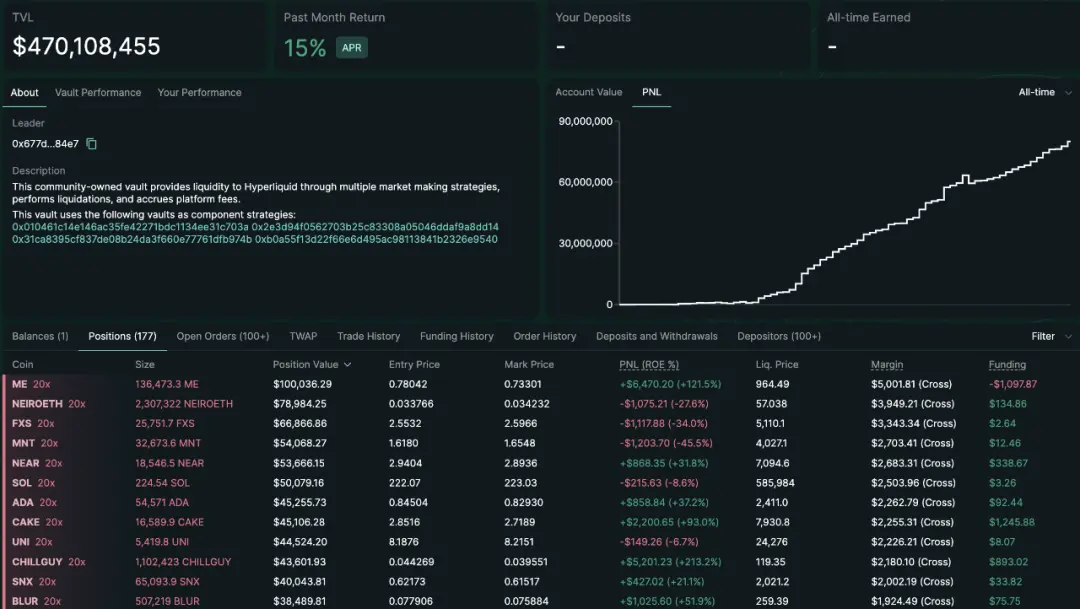

Bootstrapping Trading Liquidity with HLP: Hyperliquid first established a framework called "Market Making Vaults," operated by the team leading the flagship market making vault HLP. The founding team personally guides early liquidity, with the vision of "Democratizing Market Making": HLP does not charge any management fees, and P&L is shared proportionally based on depositors' shares (currently, P&L is at $80 million). The strategy currently operates off-chain, but positions, orders, trading history, deposits, and withdrawals are all visible on-chain in real-time for anyone to audit.

Founder's Background and Strategy: Jeff Yan, with market-making experience at top quantitative firm Hudson River Trading, actively and professionally manages HLP to "synthesize" a core experience similar to AMM for early users — a counterparty that is always online and permissionless. However, HLP's market-making strategy is passive, accounting for less than 2% of the platform's total trading volume, with the vast majority of trading volume occurring between non-HLP users.

Differences Between HLP and GLP (GMX's LP Pool):

Improving Decentralized Autonomy with HIPs (Hyperliquid Improvement Proposals): After HLP completed its historical mission of cold start in the first phase, Hyperliquid gradually returns the power of liquidity provision to the market through community governance proposals, HIPs.

HIP-1: Native Token Standard — A Transparent Mechanism for New Asset Listings. The premise of liquidity is "assets to be liquid." HIP-1 is the first step toward decentralization, establishing a transparent, market-driven new asset issuance mechanism. Through USDC auctions, any project can compete for listing qualifications (Dutch auction, where a new "listing right" is publicly auctioned every 31 hours, starting at twice the price of the last "listing right" transaction, but the price gradually decreases over time until someone purchases it), solving the past problem of listings relying on centralized team reviews and opaque processes, thus introducing a continuous stream of fresh blood into the order book.

HIP-2: Hyperliquidity — Ensuring Basic Liquidity for Newly Listed Long-Tail Assets. HIP-1 brings new assets, but the initial liquidity for these long-tail assets becomes a new challenge. To address this, Hyperliquid launched HIP-2: an automated market maker strategy that combines passive liquidity provision ideas with CLOB. We can think of Hyperliquidity as an automated robot liquidity provider that lives within the order book. When a new HIP-1 token is launched, the deployer can use some USDC to initialize the Hyperliquidity strategy, defining a price range, and the protocol will automatically place buy and sell orders within the symmetric range, updating every block (approximately every 3 seconds). Thus, it essentially acts as a grid market maker, ensuring that even newly listed tokens have basic liquidity from day one.

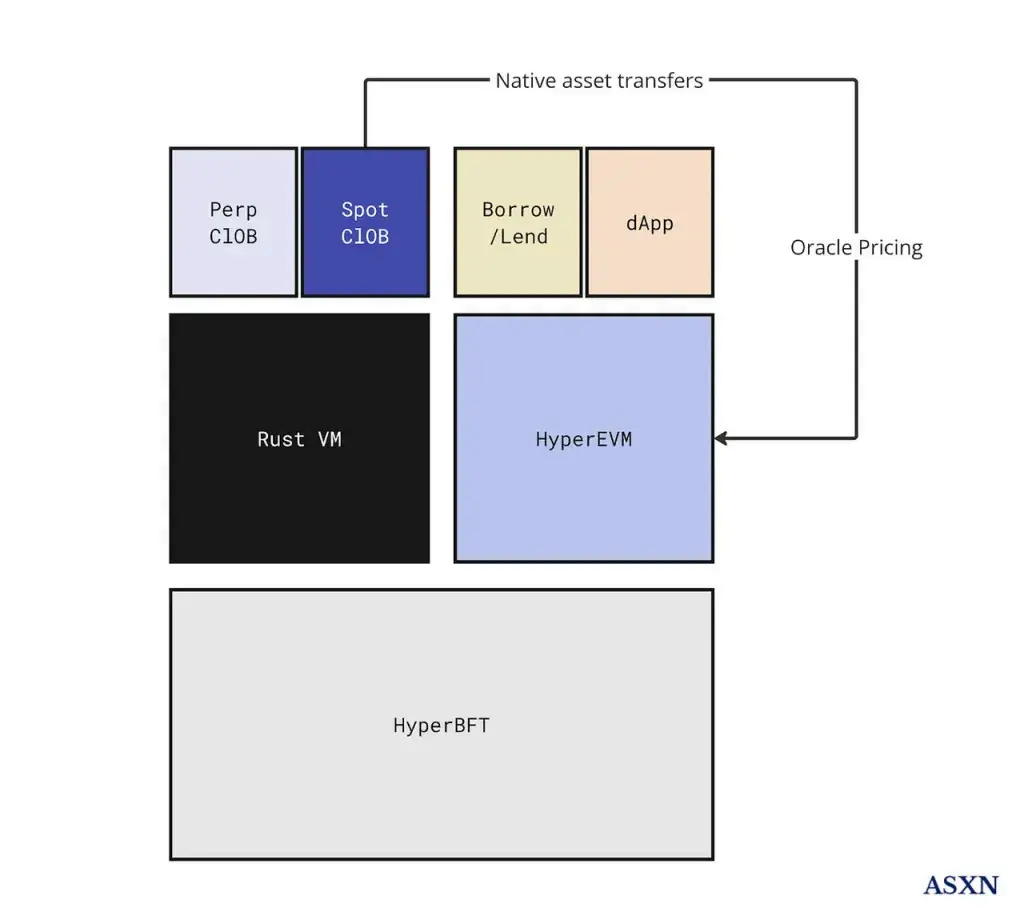

V. HyperEVM — The Smart Contract Layer on Hyperliquid L1

Overview: HyperEVM and HyperCore constitute the two main engines on Hyperliquid L1, one focusing on exchange operations and the other supporting generic smart contract development, with both engines sharing a Unified State.

Figure: Hyperliquid Chain: HyperCore (Rust VM) + HyperEVM Architecture Diagram

Comparing the Entire Hyperliquid to a High-Performance Computer:

Unified State: All data, whether order book status, user margin, or EVM smart contract code and storage, is stored here.

HyperBFT Consensus: The operating system kernel. Its sole responsibility is to receive all incoming instructions (transactions), sort them, and package them into an immutable instruction set (block), telling the computer what to do next.

HyperCore (RustVM) and HyperEVM: HyperCore is a dedicated processor born for trading, handling order book matching, liquidation, and other specific tasks with extreme efficiency; HyperEVM, as a general-purpose processor, can execute any Ethereum-standard smart contract instructions.

When a new block is generated, HyperBFT distributes the instruction set to the corresponding processors. Transaction instructions are executed by HyperCore, while smart contract instructions are executed by HyperEVM, both reading from and writing to the same unified state.

Specific Use Case: A Seamless Process from Idea to On-Chain Market:

Project Issuance: Tokens issued by projects on HyperEVM can be directly listed for trading on HyperCore.

Deploying Contracts: A project can use standard EVM tools (like Hardhat) to deploy its ERC20 token contract (e.g., XYZ) on HyperEVM.

Listing for Trading: The project can directly participate in the HIP-1 spot auction on HyperCore without any permission, creating a native order book market for its XYZ token.

State Linking: The protocol links the contract address on HyperEVM with the spot asset on HyperCore.

Seamless Experience: From then on, users holding XYZ tokens can use them in DeFi applications on HyperEVM and trade them on the high-performance order book on HyperCore.

4.1.3 Hyperliquid Business and Ecosystem Operation Strategy

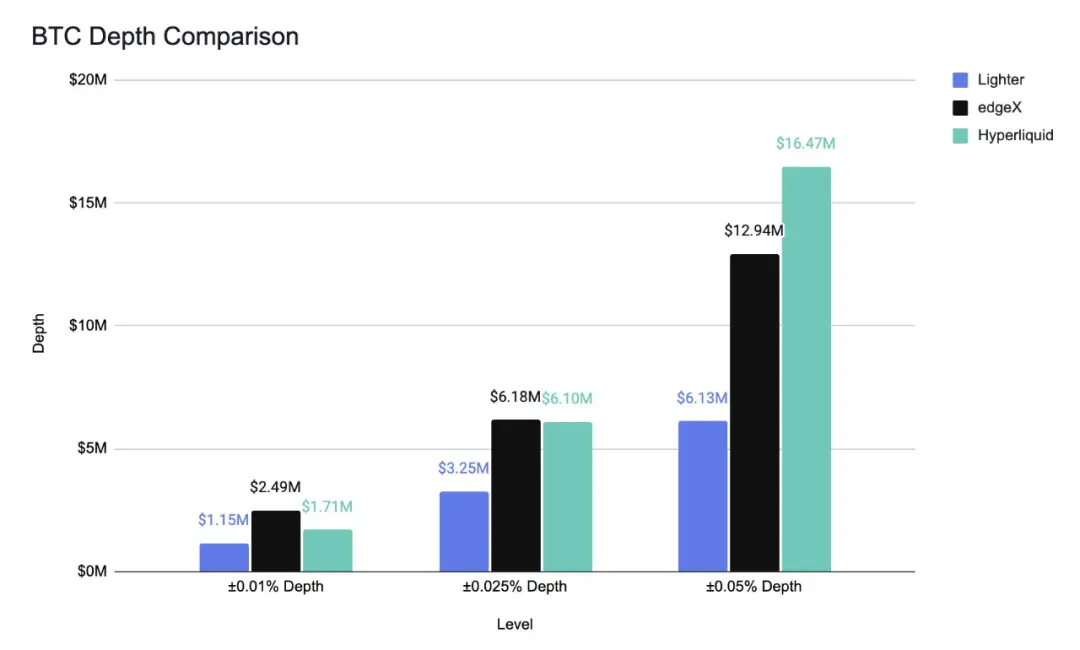

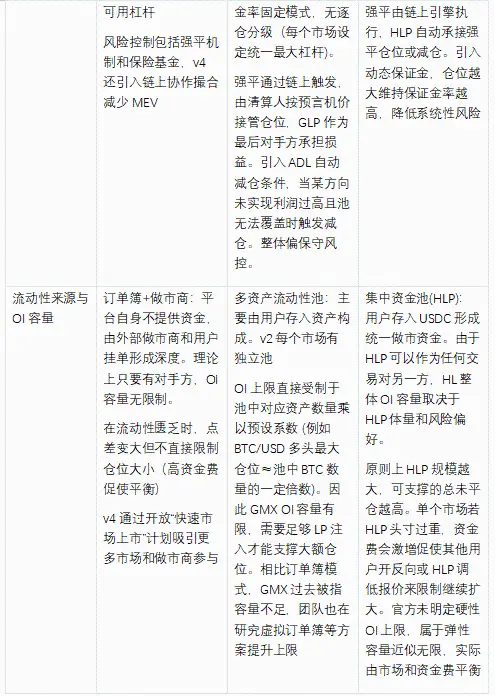

I. Protocol Revenue Distribution and Token Buyback

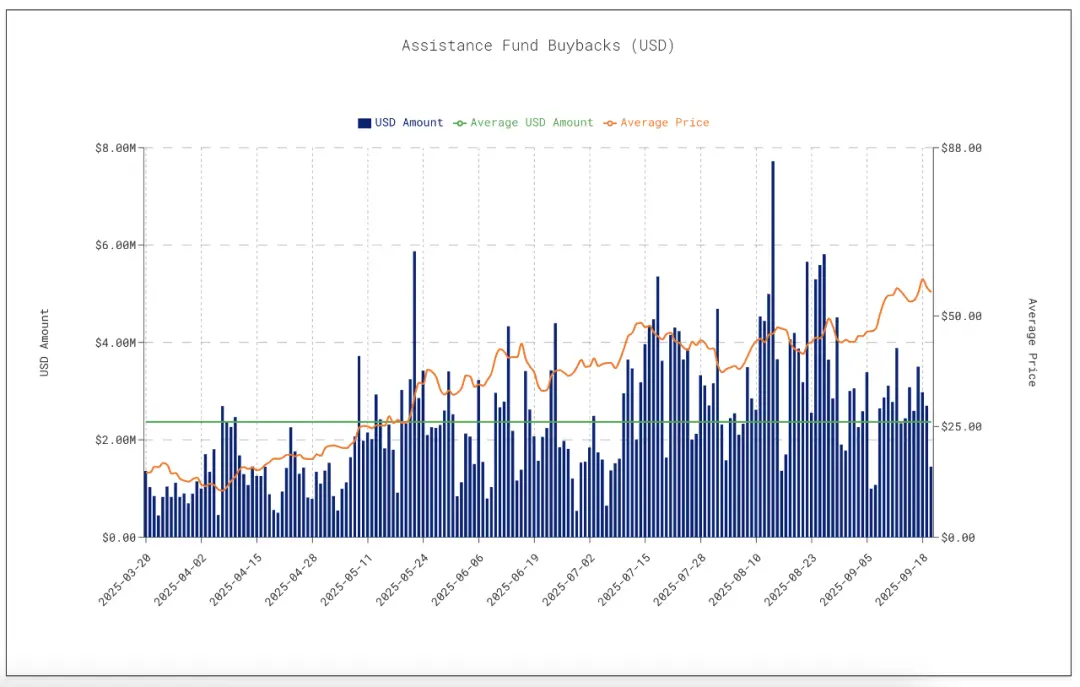

Hyperliquid's main source of revenue is trading fees, which have reached tens of millions of dollars in monthly revenue by 2025 — its annualized revenue runway is close to $1 billion (approximately $83 million per month), reflecting the protocol's massive trading scale.

In terms of revenue distribution, Hyperliquid adopts a highly transparent and community-oriented strategy, almost returning all protocol revenue to token holders and the ecosystem to avoid the common "team sell-off" phenomenon seen in traditional projects. 97% of trading fee revenue is used for HYPE token buybacks and ecosystem funds: this portion of funds flows into the "Assistance Fund," continuously buying back HYPE through the secondary market, implementing a permanent deflationary destruction plan. Only 3% of fee revenue is allocated to the HLP market making vault to incentivize liquidity providers.

Figure: 97% of trading fee revenue flows into the Assistance Fund for continuous buybacks of HYPE through the secondary market.

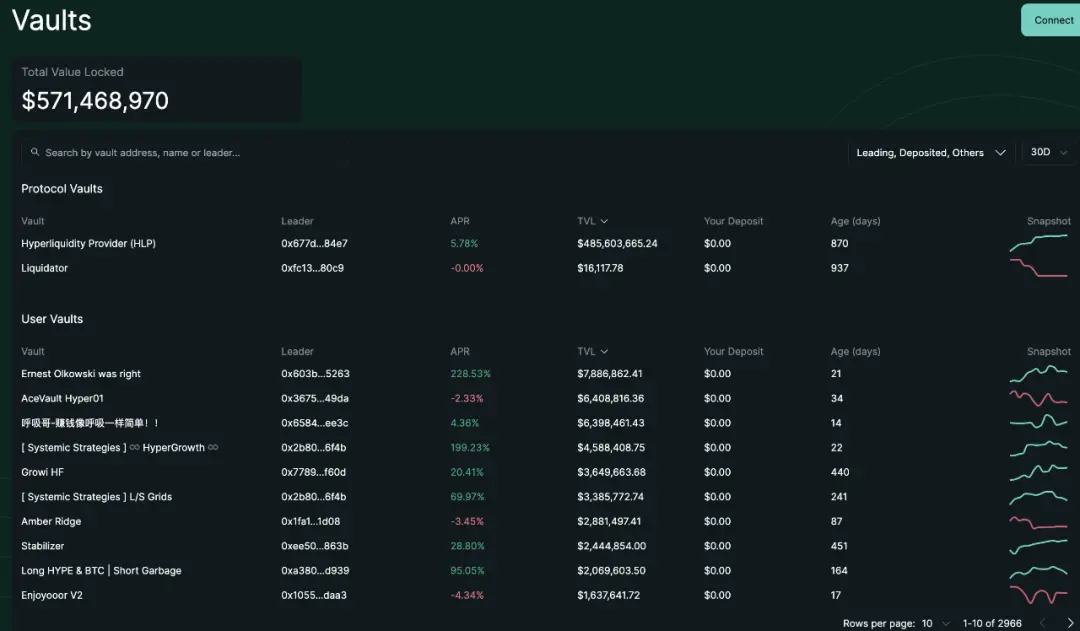

II. Market Making Fund

The HLP vault is the core market making and liquidation mechanism of the Hyperliquid protocol, acting as the platform's passive market maker and last liquidator, similar to a combination of an exchange's "insurance fund" and "market making pool." Any user can deposit USDC into the HLP vault, participating in sharing the profits and losses of the market making strategy, thus democratizing the profit opportunities traditionally limited to professional market makers.

The HLP strategy runs automatically in the background (currently, some strategies are executed off-chain, but positions and fund changes are publicly verifiable on-chain), assuming the responsibilities of providing counterparty liquidity in the order book and taking over forced liquidation positions. In return, the HLP vault enjoys a portion of the protocol's fees (approximately 3% as mentioned above) and liquidation profits to enhance the vault's yield.

Since its launch in mid-2023, the scale and performance of the HLP vault have grown significantly: TVL has quickly climbed to the $500 million level. The annualized yield between 2023 and 2024 reached the range of 8-15%. More importantly, its returns have low or even negative correlation with the trends in the crypto market, achieving considerable risk-adjusted returns under relatively low volatility (for example, from mid-2023 to 2024, the correlation of HLP returns with BTC was -9.6%, and the Sharpe ratio was significantly higher than that of BTC). This makes HLP particularly attractive to users: it provides a robust source of returns different from merely holding tokens and hedges against single market trend risks to some extent.

In terms of risk management, the HLP vault adopts a loss isolation principle, ensuring that even if the vault incurs losses, it does not affect other parts of the protocol: each trading market and account is on a per-position margin basis, meaning that losses incurred by one asset do not spill over to other asset markets. When a leveraged position is liquidated, the HLP's liquidation module (also known as the liquidator vault) first attempts to close the position through order book matching; if market liquidity is insufficient for liquidation and potential bad debts may arise, the protocol will initiate an automatic deleveraging (ADL) mechanism, using unrealized gains from profitable positions of the underlying asset to hedge against losses. This mechanism is triggered only in extreme cases and is rarely used under normal circumstances.

III. Token Airdrop

Hyperliquid adopts an aggressive community decentralization strategy for token issuance: a combination of large-scale airdrops and trading incentives rapidly gathers popularity and converts users into shareholders. In the HYPE token TGE at the end of November 2024, the official airdropped 31% of the total supply directly to early users, covering over 100,000 active trading participants of Hyperliquid.

IV. HIP-3 Decentralized Market Deployment Mechanism — Building Hyperliquid into "AWS of Liquidity"

HIP-3: Builder-Deployed Perpetuals is a significant upgrade launched by Hyperliquid in 2025. It decentralizes the creation rights of perpetual contract markets from validator governance to the community and third-party developers, achieving a fully on-chain permissionless deployment mechanism. Previously, the launch of new markets relied on centralized processes, which were inefficient; HIP-3 opens market creation through auctions and staking models, stimulating external innovation. Currently, the pre-IPO market's perp project Ventuals is an example of a HIP-3 ecosystem project.

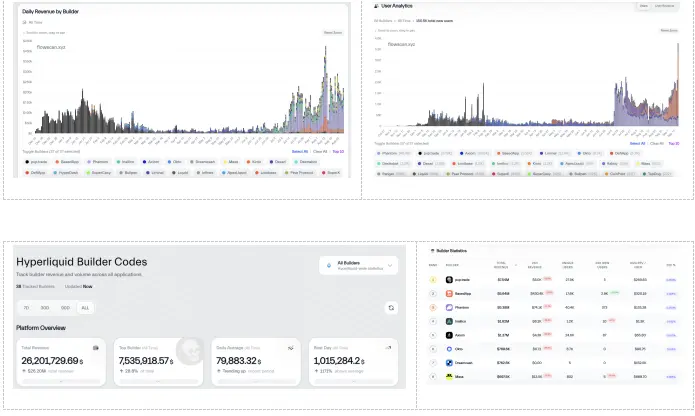

V. Builder Code — Finding More Growth Engines from the Front-End Traffic Entry

Builder Codes is an innovative product launched by Hyperliquid, providing third-party developers (such as wallets and other front-end trading applications like prediction markets and trading bots) with a set of protocol-native, programmable business models. Its core logic abandons simple API calls in favor of a rigorous on-chain workflow.

For example, in July this year, Phantom integrated Hyperliquid Builder Codes: the Builder Code mechanism allows Phantom to route user trades to Hyperliquid's order book through a custom interface and enables Phantom to earn additional fees from the transactions. The total fees paid by users = Hyperliquid's base trading fee + Builder (Phantom)'s additional routing fee.

Data Source: https://www.flowscan.xyz/

VI. USDH

USDH is the native dollar stablecoin of the Hyperliquid ecosystem, aimed at replacing the dominant USDC on the platform and capturing substantial interest income back into the ecosystem. In September 2025, Hyperliquid initiated a public bidding process, attracting giants like Paxos, Frax, and Ethena to submit proposals. After 9 days of validator voting, Native Markets emerged victorious.

The $5.5 billion on the Hyperliquid chain mainly consists of USDC held by users (as trading margin or liquidity). The interest generated from these reserves (approximately $200 million/year) is retained by USDC issuer Circle for its operations and profits, rather than being directly distributed to USDC holders. This is because USDC is a non-interest-bearing stablecoin, and holders only enjoy a 1:1 dollar peg, while the issuer earns revenue through managing reserves.

Now, with Native Markets issuing USDH, the situation is similar: USDH is also a non-interest-bearing stablecoin, and Native Markets does not intend to directly distribute any interest (i.e., 0%) to USDH holders. However, they promise to allocate 100% of the net interest income generated from reserves to the Hyperliquid ecosystem: 50% goes to the Assistance Fund for repurchasing HYPE tokens from the secondary market (enhancing HYPE's value), and the other 50% is used to expand USDH's application scenarios, such as incentivizing Builder Code front-end integration, using USDH for HIP-3 market pricing, user incentives, and partner collaborations. This means that USDH holders will not receive interest directly but can benefit indirectly from ecosystem growth (such as higher liquidity, incentives, and HYPE appreciation, if they also hold HYPE). This design aims to "internalize" the revenue within Hyperliquid, rather than allowing it to flow out like USDC.

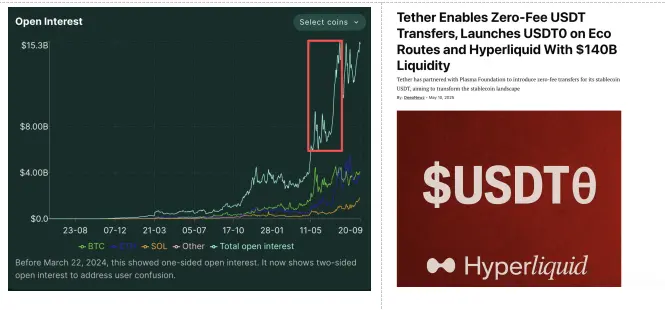

PS: It is worth mentioning that after May, the platform's open interest saw a significant surge (daily OI rose from $5 billion to over $12 billion), primarily due to the collaboration with USDT0, which attracted USDT users to Hyperliquid.

VII. Community Feedback: The Team Conducts Thorough Market Research and Flexibly Adjusts Strategies to Provide Users with Needed Products

According to a podcast by Hyperliquid's Chinese community influencer, Little Raccoon, titled "Web3 101 — Why Do Whales Love Using Hyperliquid?", Hyperliquid captured users in the following six stages:

Early deep users in the precise perp DEX track: The early team actively DM'd deep users from early perp DEX tracks like GMX on Twitter and invited them to participate in Private Beta testing.

Copy trading system: The second wave of early users mainly came from the "copy trading system" funding pool, which is healthier for market making and LP.

Bundled token index combinations: The third wave of user growth, which was also the most concentrated period of user data growth for Hyperliquid, occurred when they launched a FriendTech ecosystem token ETF product, which, although not necessarily profitable, attracted significant attention.

Airdrops: The next wave of large user growth came from airdropping Memecoins Purr, rather than waiting a year and a half to issue governance tokens.

Whale positions: The recent wave of attention came from "whale positions," with traders like James Wynn or Aguila Trades, who have large positions and significant profits and losses, becoming a phenomenon in the Chinese media.

4.2 Aster

Aster is a perp DEX that emerged from the merger of the multi-asset liquidity protocol Astherus and the perpetual contract protocol APX Finance on March 31, 2024. It is highly integrated with the BNB ecosystem, providing perpetual trading backend integration for PancakeSwap and receiving full investment from YZi Labs, with strong ecological resources and traffic support.

4.2.1 Aster Team's Thesis

In May 2025, during a market controversy involving a high-profile liquidation event of well-known crypto trader James Wynn, Hyperliquid's Jeff publicly tweeted the "Transparent Market Theory" in response to the market dispute. Meanwhile, the Aster team responded with a tweet expressing that it was an excellent time to launch a dark pool perp DEX.

Aster CEO Leonard has a completely different view on Jeff's Transparent Market Theory: he believes that large trades significantly impact market prices, leading to slippage and losses. Professional traders and institutions need effective ways to hide their trading intentions to avoid being exploited by other traders, especially those using "front-running" strategies.

We believe it may be difficult to define whose theory is right or wrong. Jeff's theory aims to achieve an end game where all "arbitrage bad actors" who have no effect on pricing the risks of trading systems are eliminated through a game mechanism. This theory is disruptive for traditional trading systems (as even traditional stock exchanges do not have similar protective mechanisms for market makers). Theoretically, this environment could be more friendly to many mid-sized market makers, as the space for arbitrage using tech asymmetry would be lower. However, the tradeoff might be sacrificing some price discovery efficiency, and from the taker's perspective, there could be issues of absolute transparency leading to targeted attacks.

Aster aims to provide a specific solution addressing these two tradeoffs, potentially capturing different users (especially takers who are more sensitive to large trades and fear being front-run or targeted for losses).

4.2.2 Aster Product and Technical Implementation

I. Dual-Mode Architecture (GMX + Hyperliquid) — Serving Two Completely Different User Groups

Aster is known for its "dual-mode" trading experience. For ordinary users, Aster offers Simple Mode: a market-making mechanism based on on-chain liquidity pools, allowing users to trade directly with the liquidity pool, similar to GMX's GLP + Oracle Priced AMM model, without the need for order matching. In this mode, the market's LP acts as the counterparty, and it even supports ultra-high leverage of up to 1001 times, referred to as the "Degen Mode," catering to retail investors who prefer high-stakes trading. The simple mode does not require users to pre-fund their platform accounts; assets in users' wallets can directly participate in trading, lowering the entry barrier.

For professional traders, Aster offers Pro Mode: using a CLOB mechanism to provide a high-performance matching environment for quantitative institutions and market makers. The professional mode is equipped with features including grid trading bots, advanced APIs, and privacy orders. Additionally, the fee structure for Pro Mode is targeted at Hyperliquid: Aster maker 0.010% / taker 0.035%, while Hyperliquid charges 0.015% / 0.045%.

II. Differentiated Features: Privacy Orders — A Theory Opposed to Jeff's Transparent Market Trading System Philosophy

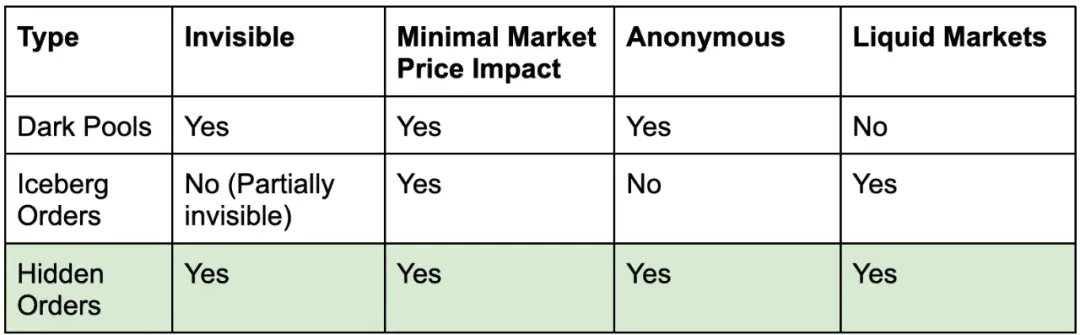

1) Aster’s Main Solution — Hidden Orders

Following the above logic, Aster has outlined three types of existing privacy environments that solve trading orders and their respective trade-offs:

Dark Pools: A private venue completely separate from the public order book for executing large trades anonymously.

Iceberg Orders: Splitting a large order into many smaller orders, with only a small portion displayed on the public order book ("the tip of the iceberg"). When a small portion is executed, another part is automatically replenished until the entire order is completed.

Hidden Orders: Placing completely invisible limit orders directly into the public market's matching engine, which are only visible to the market after the order is executed.

Aster believes that for the high-leverage, fast-paced crypto perp market, hidden orders are the best choice. They balance execution secrecy, centralized liquidity, and minimal market impact, providing traders with a better trading experience than dark pools and iceberg orders.

2) General Technical Logic of Implementing Hidden Orders

The fundamental problem that Hidden Orders aim to solve is how to execute a completely confidential, private trade in a fully transparent, public system. This problem can be broken down into the following three sub-problems:

I need to prove to the system that I have a legitimate, well-funded order, but I must never disclose any details of the order: cryptographic encapsulation (wallet-local encrypted orders), generating ZK proofs (proving sufficient collateral supports leveraged positions, correct price/quantity format), submitting ZK proofs on-chain, and storing trading intentions in a non-public data structure (private state tree).

How do hidden orders find counterparties and execute trades (invisibility): unified liquidity pool + shadow matching algorithm, unified liquidity pool (hidden orders share a pool with public orders to ensure optimal execution opportunities), shadow matching algorithm (decrypting hidden orders).

When a match occurs, how to prevent attacks at the moment of final settlement: during matching, the engine first submits a hash commitment to lock the transaction fingerprint, then reveals the plaintext data and atomically executes the asset exchange, preventing front-running and sandwich attacks.

4.2.3 Aster's Business and Ecological Operation Strategy

I. Product and User Operations

The Aster team leverages its previous experience from APX (GMX route, Orderbook route) to achieve user segmentation: beginners can start with Simple Mode (high leverage, one-click trading without order placement suitable for degens), and gradually transition to Pro Mode (providing privacy features in CLOB targeting previous controversies of Hyperliquid) to improve user retention.

In terms of asset support, Aster not only supports perpetual contract trading of mainstream crypto assets but also boldly launched 24/7 perpetual trading of traditional stock derivatives like US stocks, allowing users to trade stock contracts like Tesla around the clock.

Image: User discussions in the TG group in April this year (before Yzi Labs invested)

From the beginning, Aster has been rooted in the Binance ecosystem, collaborating with leading projects like PancakeSwap and SafePal to quickly establish brand trust and acquire user traffic (for example, users can trade Aster contracts directly in the SafePal wallet, and PancakeSwap provides liquidity support for its stablecoins). Aster's spot market partnered with the on-chain credit protocol Creditlink upon launch, becoming the only platform for claiming its CDL token airdrop, thus establishing a close connection with the emerging on-chain credit track. Additionally, Aster joined the token support program of Four.meme, providing traffic and channel support for Meme projects, and the three major project parties jointly held a trading competition.

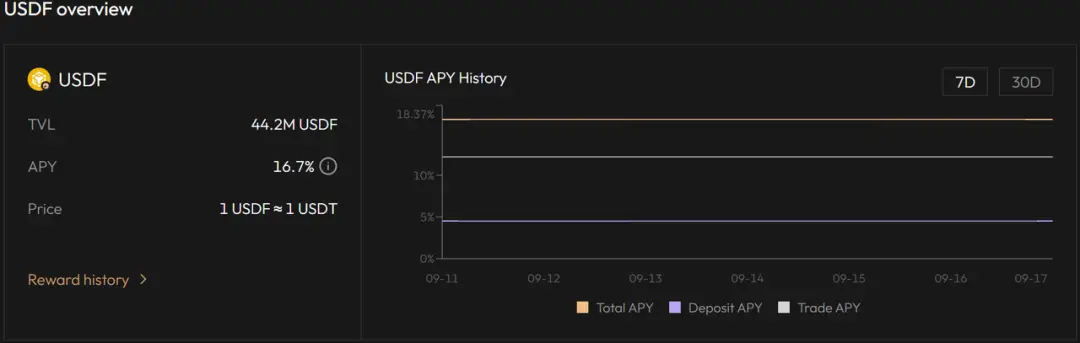

II. Exploring Margin and DeFi Integration: Introducing USDF to Make Margin "Interest-Bearing"

Aster allows users to use liquid staked tokens (like asBNB) and the native yield stablecoin USDF (a Delta-neutral yield stablecoin issued by Lista DAO) directly as margin, meaning users can achieve "multiple benefits": earning staking rewards while using yield-bearing assets for leveraged trading. For example, users holding asBNB can earn ecological staking rewards while also using it as margin to open positions. Aster's extreme pursuit of capital efficiency unlocks another dimension of returns for traders.

Aster has specially developed the Trade & Earn feature, encouraging users to use USDF as margin (encouraging users to convert their USDT into USDF to earn a base APY of 4.5%, and then use USDF as margin for trading to earn an additional 12.2% APY, totaling 16.7% returns). The enhanced wealth effect has also stimulated steady growth in Aster's TVL.

III. Token Distribution and Economic Incentives

The Aster team plans to allocate 53.5% of the token supply to community airdrops to reward early contributors and traders. Among them, as much as 8.8% (704 million tokens) will be airdropped to eligible users in the points activity on the day of TGE, with the remaining portion gradually released over 80 months.

Image: However, as mentioned in the previous section, many in the community question the current perp DEX's generally low OI/Volume ratio, reflecting that most is wash trading to game for airdrops.

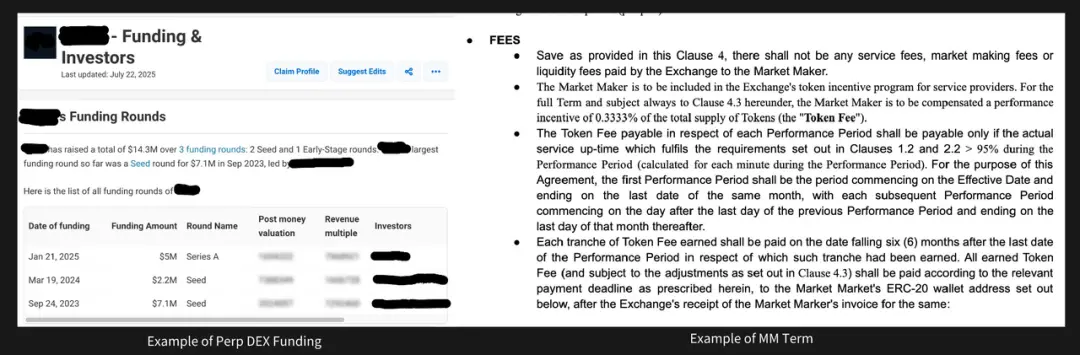

IV. Introducing Market Makers

Aster introduces Market Makers to enhance order book depth and reduce slippage, especially since Pro Mode's Hidden Orders require reliable counterparties. The main operational strategy is to provide fee discounts and exclusive API access to encourage them to inject liquidity. The ecological allocation (30%) is used for market maker incentive programs, such as rewarding high-frequency quote providers through grants or buyback mechanisms. The platform also integrates yield-bearing assets through partners (like Lista DAO) to indirectly attract market makers to participate in USDF pools. To further strengthen liquidity, Aster introduces a market-making fund, allocating from the treasury (7%) and ecological distribution to establish a dedicated fund supporting automated market-making strategies. This fund provides incentives for high-volatility assets (like BTC perpetuals), and fund participants can receive $ASTER rewards and protocol revenue sharing.

4.3 Lighter

The Lighter project was initially positioned as a spot DEX but later transformed into a perp DEX. It is a CLOB perp that relies on a self-built zk rollup settlement based on Ethereum, providing matching speeds and experiences close to centralized exchanges. Its main technical highlight is that zk snark proofs ensure that the matching logic and settlement results of each order are verifiable, solving the trust issues of on-chain trading. The project's founder, Vladimir Novakovski, has a financial quantitative background (former Citadel high-frequency trader) and graduated from Harvard University’s economics department. Major investors include a16z, Coatue, and others.

4.3.1 Product Design Philosophy of Lighter Founder Vladimir Novakovski

The Lighter team believes that the main issues with existing Perp DEXs are "compromises on the core principles of decentralization":

Compromises in performance lead to centralization: In pursuit of high performance, almost all order book DEXs have placed the core function of matching on centralized servers off-chain.

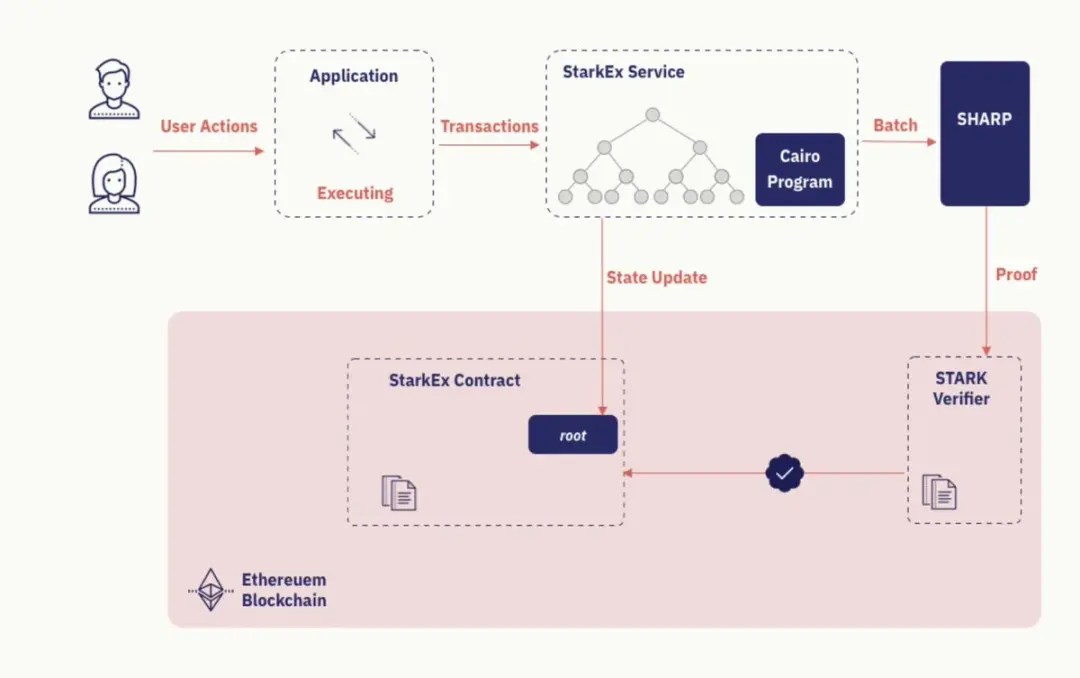

False "verifiability": Existing zk rollup solutions like StarkEx completely entrust the matching process to centralized operators, while ZK proofs only verify results without including verification of the matching process itself. They believe that if the core fairness principle of "Price-Time Priority (the highest bidder and the lowest seller are prioritized; in the case of the same price, the first to place an order is prioritized)" cannot be strictly enforced, then such verification is incomplete, leaving room for centralized operators to act maliciously (for example, failing to verify whether trades were indeed executed in the order they were received).

Sacrificing security and ecology for sovereignty: Application chain solutions have completely detached from Ethereum for full autonomy, which is a regression. They believe that the security of derivatives exchanges and their composability with the DeFi ecosystem are crucial and should not be sacrificed for performance.

AMMs cannot meet professional trading needs: They firmly believe that order books are the most efficient and professional trading model. Due to inherent slippage and impermanent loss issues, AMMs cannot become the mainstream infrastructure of financial markets.

They envision an ideal Perp DEX:

Not using generic L2s, but building a highly optimized Rollup from scratch for the specific trading scenario to achieve extreme performance.

By implementing a complete matching and settlement engine in the ZK circuit, they take the "execution rights" of trading away from centralized Sequencers and hand them over to immutable mathematical algorithms.

Designing data structures specifically optimized for ZK, creating new tools like "order book trees" to make executing complex exchange logic in the circuit computationally feasible.

Resolutely not detaching from Ethereum to inherit its unparalleled security, liquidity, and composability.

4.3.2 Lighter Product and Technical Implementation

Lighter's core goal is to use zero-knowledge proofs to build a trading protocol that mathematically guarantees process fairness while achieving efficient results, all while inheriting Ethereum's top-tier security, thus completely solving this "impossible triangle."

I. Infrastructure: Application-Specific ZK-Rollup

It can be understood that Lighter is a "trading-specific Layer 2 scaling solution" tailored for itself, with the core idea of processing thousands of transactions at high speed off-chain, then packaging the "execution summary" of these transactions into a concise, tamper-proof zk snark proof, and finally publishing this proof on Ethereum for verification.

How it works: Users send transactions to the Sequencer >> The Sequencer is responsible for ordering the received transactions into a block in chronological order >> The Prover retrieves this ordered block, executes each transaction within the block on its own server, and generates a ZK proof for the entire execution process >> The Prover submits this proof to a smart contract on Ethereum >> The smart contract verifies this proof, ensuring that all transactions that occurred off-chain are valid and compliant, thereby updating the state of the entire system.

II. Core Engine: Verifiable Matching and Settlement Engine

This part of the technical implementation is the most critical differentiator for Lighter. Traditional zk rollup exchanges only verify the "results" of transactions (for example, proving that orders A and B were indeed executed), but the "process" of execution (i.e., why A and B were matched instead of A and C) is entirely determined by centralized black-box service providers. Lighter's engine fully encodes the fundamental principle of "Price-Time Priority" into the ZK circuit, allowing the matching process to be zk-verified for adherence to this principle.

How it works: When the Prover executes transactions, it not only verifies that two orders can match. It is, within the ZK circuit, mandatorily and provably:

Finding the best quote currently available in the market (the lowest sell order or the highest buy order).

If the prices are the same, finding the earliest posted order.

Executing the matching of this highest priority order.

Every step of this process is recorded in the ZK proof. The settlement logic is similarly executed in a verifiable and fair manner within the circuit.

What problem it solves: It fundamentally eliminates the ability of centralized operators to conduct order reviews, favor specific market makers, or engage in front-running trades.

4.3.3 Lighter's Business and Ecological Operation Strategy

I. Product and User Operations

The core unique feature of the product/technology is ensuring that the matching logic and settlement results of each order can be verified through zk snark proof, addressing the trust issues of on-chain trading (ensuring fairness in matching through a customized ZK circuit, with matching adhering to "price-time priority" and hard-coded in the circuit, primarily solving the miner MEV front-running problem).

Additionally, to capture market share from Hyperliquid, Lighter's most differentiated feature in user operations is the implementation of a 0-fee strategy: no fees for placing or taking orders. This strategy immediately attracted a large number of traders and market makers to migrate: over the past month, Lighter's average daily trading volume reached $3.8 billion, ranking second, and its TVL surged from millions to $500 million.

II. Token Distribution and Economic Incentives

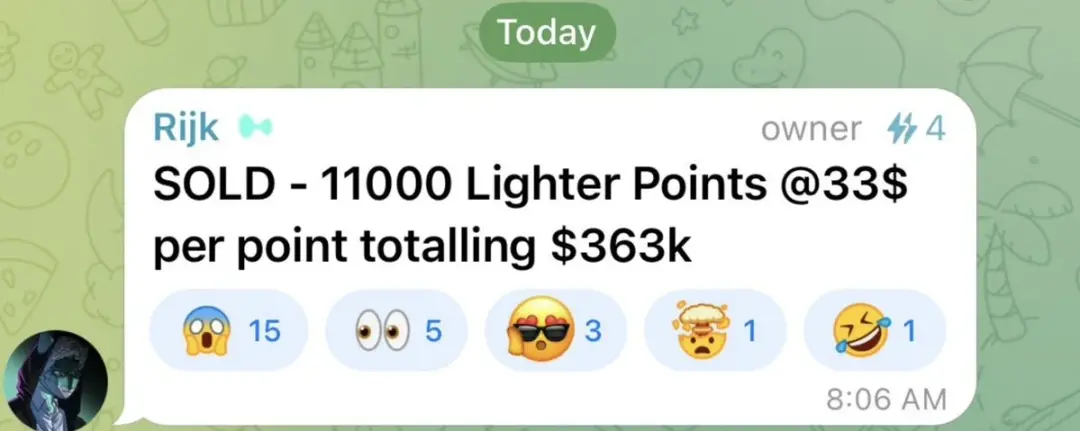

Lighter has not yet issued tokens but has adopted a points program to incentivize early users and liquidity providers, aiming for future airdrops. Users earn Lighter points by trading on the platform or providing liquidity to public pools, and they can also receive additional points for inviting others (via Discord invite codes). Points are settled weekly and rankings are dynamically adjusted.

Due to Hyperliquid's successful precedent (which airdropped 31% of tokens to users), the market generally expects Lighter to convert points into token airdrops at a certain ratio, leading to a surge in OTC trading of points: screenshots show that Lighter points are trading at about $33 per point in the OTC market, with a cumulative transaction volume of $363,000. As the total supply of points has not yet been disclosed, it is currently difficult to provide a reasonable token valuation. However, we can refer to Hyperliquid's path: at that time, Hyperliquid airdropped 30% of its tokens to the community, with a valuation of about $3 billion at launch. If Lighter adopts a similar distribution strategy, its overall valuation is likely to be at least $3 billion. Although the final valuation of the airdrop remains highly uncertain, speculative trading of points has already become a significant driving force behind Lighter's trading volume and OI growth.

4.4 EdgeX

EdgeX is the first batch of projects launched by Amber Group's new accelerator in July 2024, currently gaining popularity in the Korean community, with user feedback indicating a good experience with the mobile app.

4.4.1 EdgeX Design Philosophy

The core of edgeX's product philosophy is "to create products that traders truly love to use." The team has deeply understood the common pain points in the current crypto market between CEX and DEX and has proposed a systematic solution.

CEX's trust crisis and asset security risks: Users cannot self-verify the security of their assets, and issues such as platform misappropriation, censorship, or single points of failure always hang over traders like the sword of Damocles.

Performance and experience bottlenecks of existing DEXs: Most DEXs, especially early AMM models, face issues such as high gas fees, transaction delays, slippage, and MEV attacks. Even order book DEXs often struggle to match the performance and user experience of CEXs, with relatively scarce features (such as advanced order types and leverage) and complex onboarding processes that exclude many retail users accustomed to the smooth experience of CEXs.

Fragmentation and high barriers to entry in DeFi Lego: The existing modular systems remain highly fragmented, with high development barriers, making it difficult for ordinary users to leverage their composability. Developers wishing to launch a financial product need to integrate technologies across multiple levels, including consensus, execution, and settlement, which is costly and inefficient.

4.4.2 EdgeX Product and Technical Implementation:

In response to the above pain points, edgeX's solution reflects a clear evolution path from application to platform, from V1 to V2:

V1 Implementation - Perpetual Contracts and Forced Withdrawals Based on StarkEX

EdgeX uses StarkEX perpetual contracts to achieve trustless settlement and censorship resistance (such as forced withdrawals).

Since it operates on Layer 2, users' transactions are executed off-chain first, then submitted to StarkEx to generate proofs, and finally settled on Ethereum. This ensures both the integrity and verifiability of transactions.

If EdgeX fails to process a user's withdrawal request within the grace period (usually 1-2 weeks), users can initiate a forced withdrawal.

First, users can register their Stark Key to a certain L1 address and then directly submit a withdrawal request to Ethereum. If the request is ignored, users can exit directly through a Merkle proof.

It is important to emphasize that EdgeX never holds user funds. Funds are always kept in Ethereum contracts, and only the user's own signature can move them.

V2 Implementation - Building a Modular Financial System to Lower Barriers to DeFi Innovation

EdgeX V2 aims to provide a series of plug-and-play financial modules (trading, liquidity, lending, wallets, etc.). This system is like Lego blocks in the financial field, allowing users and developers with little programming experience to easily customize and build their own financial products, significantly lowering innovation costs and entry barriers.

At the same time, EdgeX in V2 completes the construction of a unified DeFi entry point: by aggregating multi-chain liquidity and providing a unified front-end UI (web, app, TG bots), EdgeX aims to become a bridge for retail users to enter the vast and complex multi-chain DeFi world from CEX, simplifying the complexities of multi-chain and multi-protocol.

In summary, EdgeX's philosophy is to start from a trader's most urgent "point" (a user-friendly Perp DEX) and gradually build an open, efficient, and secure "plane" (a modular financial ecosystem), with the ultimate goal of leading a more innovative, efficient, and inclusive decentralized financial future.

Mobile-first experience. Currently, most traders access Hyperliquid or Lighter through OKX Wallet or Phantom, while EdgeX simplifies this process by launching a native mobile application (now available on the App Store), allowing users to trade conveniently anytime and anywhere (popular in the Korean community).

5. Why dydx and GMX Lost the Competition

5.1 Why dYdX's First-Mover Advantage Failed - The Ponzi-like Token Rebate Incentives Ultimately Burned Out

DHM, COO of Fulid/Instadapp, tweeted in May this year "What did dydx do wrong" and discussed with the community why dydx lost the competition despite its advantages, sparking widespread discussion (240,000 views, 246 comments), with reasons summarized in the comments section.

Topic: Why did dydx lose to hyperliquid?

Funding advantage: Raised $85 million through several rounds of financing, with top VCs like a16z, Paradigm, Polychain, and Dragonfly investing.

Airdrop scale: dYdX's initial airdrop value reached $2 billion, exceeding Hyperliquid's $1.6 billion.

First-mover advantage: Had 5 years of development time to build the most competitive product (white paper released in 2017).

Revenue capability: Generated over $530 million in cumulative revenue.

Technical autonomy: Also built its own chain (dYdX Chain), theoretically giving the team all the tools to create the best-performing matching engine.

I. Summary of Reasons: Problematic Liquidity Incentive Model

dYdX used its native token to pay market makers as rebate rewards. This led to a negative cycle: market makers engaged in wash trading/fake trading to obtain tokens, and upon receiving the tokens, they immediately sold them, creating continuous selling pressure.

In contrast, Hyperliquid did not heavily rely on rebates; for large traders and high-frequency traders, what truly matters is slippage and funding rates, while the fees themselves are not as important. This is similar to how people prefer to pay high gas fees on the mainnet to obtain lower borrowing rates. Additionally, fee issues can be addressed through VIP tier systems. Furthermore, Hyperliquid adopted the HLP treasury model, where users deposit assets to become counterparties to traders and earn fees, eliminating the need for the protocol to pay tokens for subsidies.

As early as 2022-23, market analysis data raised significant doubts about the sustainability of this token subsidy model: