Analyst Chen Shu: Is Bitcoin and Ethereum stabilizing at the bottom on November 2, ready to rebound upwards?

From the daily chart of Bitcoin, it currently shows three consecutive bearish candles, with the price stabilizing above the MA5 moving average. The bottom support is basically established, and the downward momentum is slowing. The key short-term resistance level to watch is the price range of 11.12-15. If it stabilizes above this range, it will continue to rebound upwards to test the resistance levels of 11.3-11.45. Conversely, if it continues to be suppressed by the 11.12-15 price range and cannot break through, it will maintain a weak oscillation. On the hourly chart, pay attention to the breakthrough of the MA256 moving average at 11.12. If it breaks through and stabilizes, consider entering long positions to capitalize on the bullish breakout.

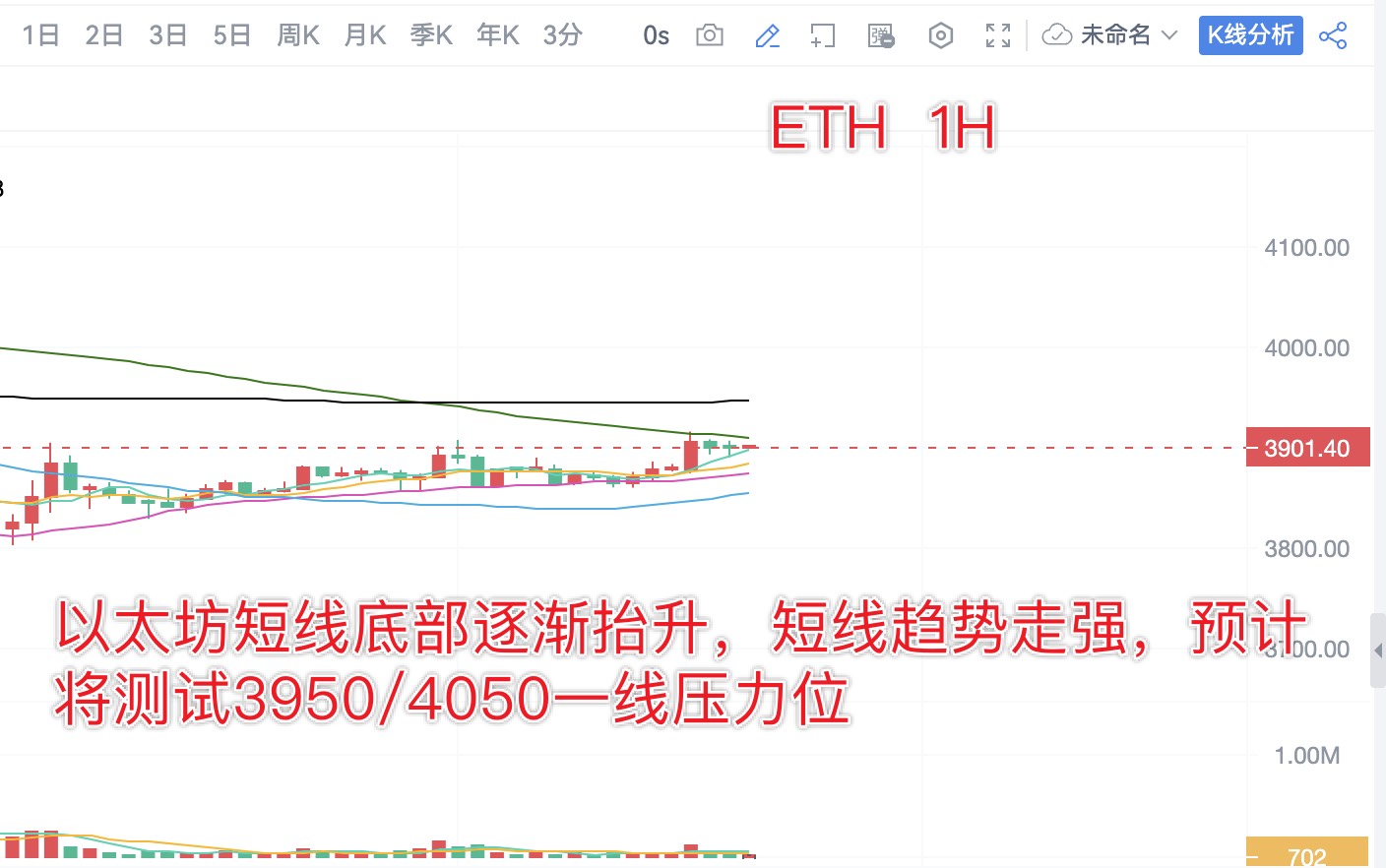

From the daily chart of Ethereum, it is continuously rebounding, focusing on whether it can break through and stabilize above the MA10 moving average at 3950. If it breaks through, it will continue to test the resistance level around 4050. On the hourly chart, the short-term decline has basically stopped, with the key resistance level above being the MA256 moving average at 3950. If it breaks through and stabilizes, it will continue to see a rebound, with short-term support at around 3850.

Trading Strategy (Written at 15:00):

BTC: Long at 11.02, add to long at 10.92 on pullback, target 11.15/11.3; short at 11.3/11.4 looking for a 1-2000 point pullback.

ETH: Long at 3880, add to long at 3830 on pullback, target 3950/4000; short near 4050 looking for a 6-100 point pullback.

The daily analysis strategy has a very high win rate! Analysis is not easy, so I hope everyone can give a free follow, save, like, and comment. Thank you all, and feel free to leave comments below; I will reply to each one.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.