Author: Eric, Foresight News

On October 30, local time in the United States, Bitcoin DAT's first stock, Strategy, announced its third-quarter financial report. The report shows that Strategy's revenue for the third quarter was $3.9 billion, with a net profit of $2.8 billion and a diluted earnings per share of $8.42.

As of October 26, 2025, Strategy held a total of 640,808 Bitcoins, with a total value of $47.44 billion, and the cost per Bitcoin has risen to $74,032. From the beginning of 2025 to date, the return on Bitcoin has been 26%, amounting to $12.9 billion. Strategy's Chief Financial Officer Andrew Kang stated that based on the forecast of Bitcoin reaching $150,000 by the end of the year, Strategy's total operating income for 2025 is projected to be $34 billion, with a net profit of $24 billion and a diluted earnings per share of $80.

The Bitcoin-related data from Strategy is generally public and does not cause much market reaction. However, due to the rebound in Bitcoin's price today and the company's optimistic expectations, Strategy's stock price rebounded in after-hours trading yesterday and in pre-market trading today. As of the time of writing, the MSTR price has rebounded from yesterday's closing price of $254.57 to around $272.65 in pre-market trading.

According to the financial report, Strategy obtained a net income of $5.1 billion through its common stock, STRK, STRF, STRD, and STRC stock sale plans during the three months ending September 30. As of October 26, Strategy still has a financing capacity of $42.1 billion.

It is worth noting that Bitcoin's current price has risen by more than 40% compared to its low this year, while MSTR's closing price yesterday was only about 6% away from its low for the year. Although the stock price movements in after-hours trading yesterday and pre-market trading today indicate that the market still recognizes this financial report in the short term, investors have begun to express concerns about Strategy or the DAT company's model.

mNAV Approaching the Critical Line

According to StrategyTracker data, Strategy's mNAV (the ratio of market value to the total value of held Bitcoins) has reached 1.04. Even when calculated based on diluted shares, this number is only 1.16, very close to 1. If the mNAV reaches 1 or even falls below 1, it means that buying the company's stock is no longer more valuable than directly purchasing the corresponding cryptocurrency.

In the financial report meeting at the end of July this year, Strategy promised, "Unless it is to pay preferred stock dividends or debt interest, it will not issue additional MSTR common stock when mNAV is below 2.5 times." However, just two weeks later, it canceled this restriction in the submitted 8-K document and added an exception clause stating, "If the company believes that issuing additional shares is beneficial, it may continue to issue stock when mNAV is below 2.5 times."

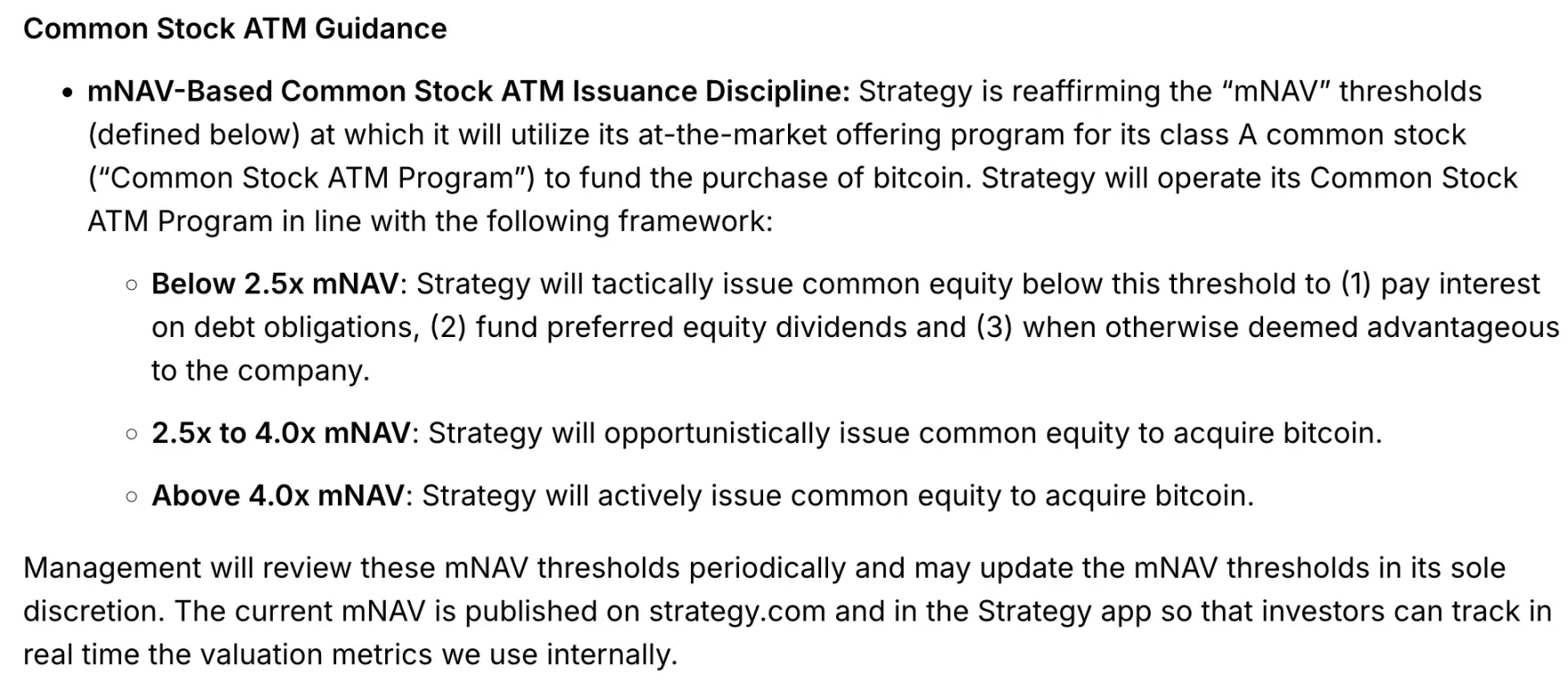

In the recent financial report, Strategy also re-explained the rules for issuing common stock through ATM:

Although issuing common stock when mNAV is below 2.5 is still prioritized for paying debt interest and preferred stock dividends, the reality is that it is now also possible to use common stock ATM financing to purchase Bitcoin when mNAV is below 2.5, and the financing methods for purchasing Bitcoin are no longer limited to common stock ATM. The mNAV calculated from official data by Strategy is 1.25, higher than third-party statistical data. Although it has a more complex calculation method, ordinary investors pay more attention to the simple ratio of total market value to the total value of held Bitcoins, which is 1.04.

Additionally, Strategy has also retained the possibility of adjusting the mNAV benchmark, which undoubtedly adds more variables. In the first three quarters of this year, the number of Bitcoins purchased by Strategy was 81,785, 69,140, and 42,706, respectively. The continuous rise in Bitcoin prices has been accompanied by a gradual decrease in the number of purchases, indicating that Strategy has long recognized potential issues.

If Strategy's mNAV falls below 1, it could significantly impact the overall value of DAT. A few days ago, Ethereum DAT company ETHZilla chose to sell $40 million worth of Ethereum for stock buybacks, aiming to pull back the mNAV value. On the same day, Japan's listed company Metaplanet, the second-largest Bitcoin DAT company globally, also announced a stock buyback plan. Although this plan does not involve selling held Bitcoins, the pressure on mNAV has already led the two largest publicly traded Bitcoin buyers globally to choose to slow down.

Possible Removal from the Nasdaq 100 Index?

During the trading session of U.S. stocks last night, some investors in the Web3 community speculated that MSTR's recent weak performance might lead to Strategy being kicked out of the Nasdaq 100 Index by the end of this year.

Strategy was officially included in the Nasdaq 100 Index components in December last year, which caused its stock price to briefly surge above $500. However, despite Bitcoin prices reaching new highs afterward, MSTR did not break through its previous high.

In fact, the possibility of Strategy being removed from the Nasdaq 100 components this year is almost zero. Components are removed from the Nasdaq 100 only under basic circumstances such as transforming into a financial company, changing listing locations, insufficient liquidity, or violating listing regulations. Additionally, it can only happen if the market capitalization ranking directly falls outside the top 125 or remains outside the top 100 for an extended period, or if the weight is below 0.1% of the total market capitalization for two consecutive months, and there are suitable replacements.

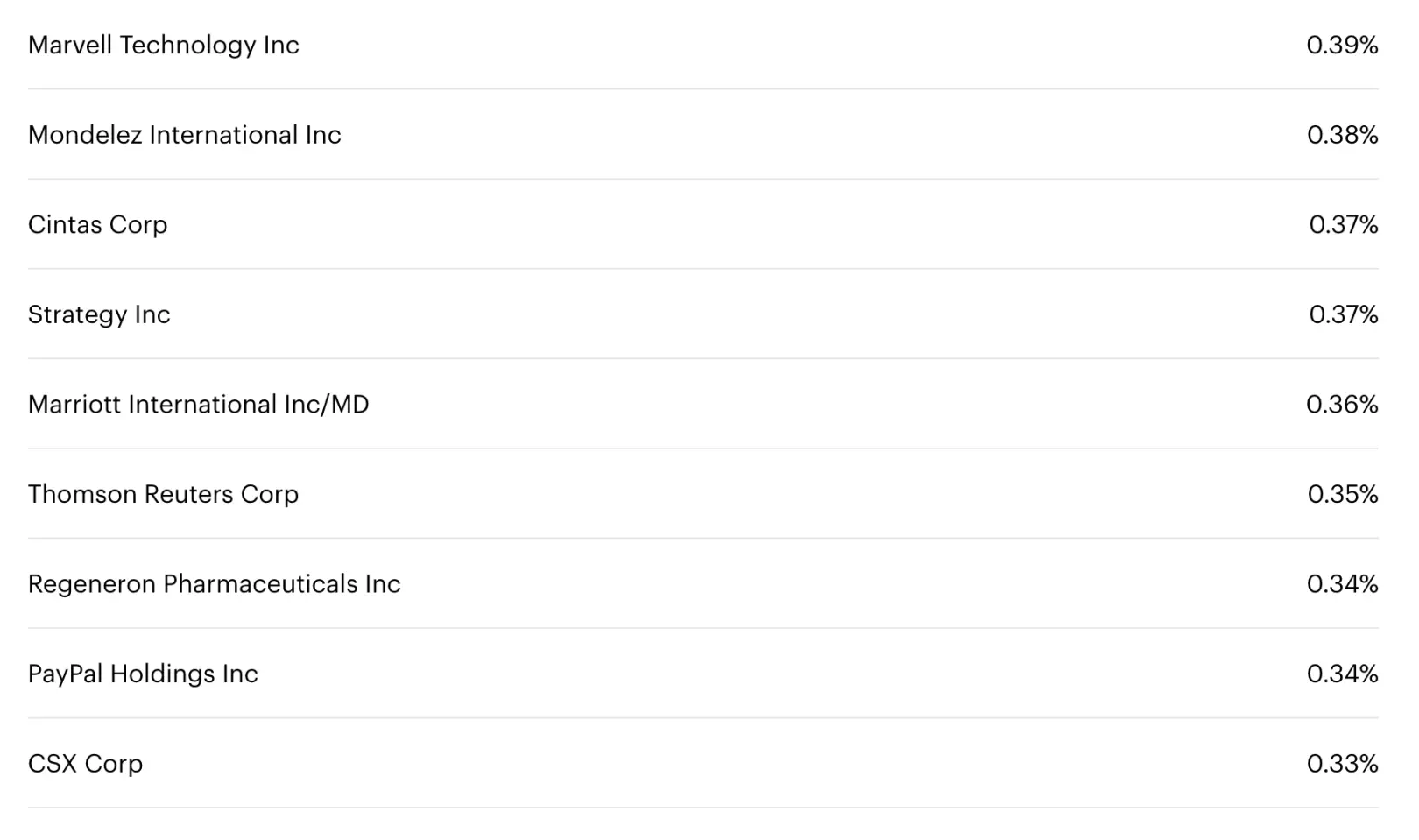

According to QQQ holdings, Strategy currently has a weight of about 0.37%, and its market capitalization has not fallen outside the top 100. The index's year-end adjustment is based on data from the end of October, so it seems that Strategy is still safe this year.

There was a period earlier this year when there was a surge in DAT companies, but I need to remind that the nature of such companies' operations is based on market consensus rather than financial mechanisms. A company's market value can indeed fall below the value of its held assets. An article published by the Daily Economic News in August this year showcased a good example: Sohu, an early internet "orphan," had a market value for a long time that was less than the cash held by the company and less than the value of the office buildings constructed by the company.

Strategy can still continue to operate because new entrants are constantly participating in the DAT game, and its "pioneering" status has restrained many vested interests. However, if the market suddenly decides to abandon recognition of such a "game mechanism," the strategy of investors continuously purchasing new shares based on the ratio of the company's market value to the value of held Bitcoins and cashing out at higher positions may become ineffective, and the risks involved could be greater than most people imagine.

Even if such a mechanism can continue, the attention and funds continuously attracted by AI may lead to sustained weakness in Bitcoin prices, which would significantly increase pressure on Strategy in the short term. The continuation of the DAT model can have a considerable positive impact on industry development, but it is also essential to remain vigilant against the short-term risks brought by stress tests.

After all, the $2.8 billion profit is merely investment income, and investment has never had a guaranteed winner.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.