The price of Bitcoin is hovering on the edge of breaking below the $90,000 cost line, with high electricity costs pushing a number of miners to the brink of liquidation. Meanwhile, Wall Street giant JPMorgan has set a long-term target price of $170,000 amidst this chaos.

Recently, JPMorgan has lowered its estimate of Bitcoin's production cost from $94,000 to $90,000, while the current price continues to fluctuate below this critical cost line.

High-cost miners are being forced to sell Bitcoin to maintain operations. However, JPMorgan believes in another report that Bitcoin is severely undervalued relative to gold after adjusting for volatility, with its long-term fair value expected to be close to $170,000.

1. The Dilemma of Miners

The Bitcoin network is undergoing an internal and external pressure test. The root cause points directly to the cornerstone that maintains the security of this decentralized system—miners.

● JPMorgan's report on December 5 clearly states that the recent pressure on Bitcoin prices is mainly due to the decline in the overall network hash rate and mining difficulty. This is driven by two intertwined forces.

● On one hand, China has recently reiterated its ban on Bitcoin mining, affecting some hash power. On a more general and market-driven level, the sluggish Bitcoin price combined with high energy costs is squeezing miners' profit margins, forcing high-cost miners outside of China to exit the market.

● The report has lowered the estimated production cost of Bitcoin to $90,000 and pointed out a harsh reality: the current Bitcoin price still hovers below its production cost. For marginal producers, every $0.01 increase in electricity price per kilowatt-hour will cause their production costs to soar by $18,000.

2. The Survival Game Below the Cost Line

● The financial logic for miners is simple yet brutal: the income side is the wildly fluctuating Bitcoin price, while the cost side is relatively rigid electricity expenses. When the market declines, they become the first group to feel the pressure on their balance sheets.

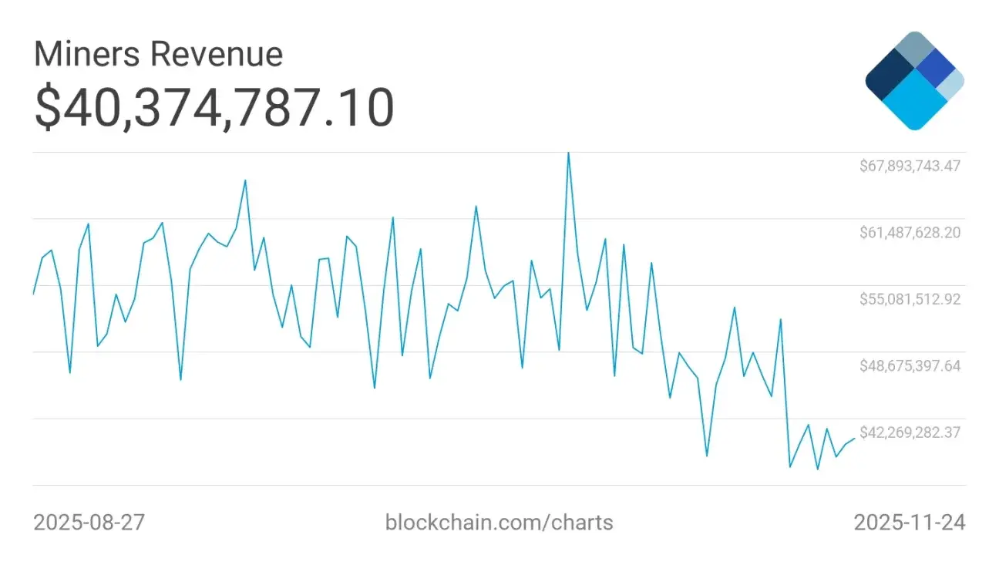

● Over the past two months, the 7-day average income of Bitcoin miners has dropped 35% from $60 million to about $40 million. Although miners with modern, efficient machines and cheap electricity can still maintain positive cash flow, many miners using outdated equipment or paying high electricity bills are nearing or have even fallen below the break-even line.

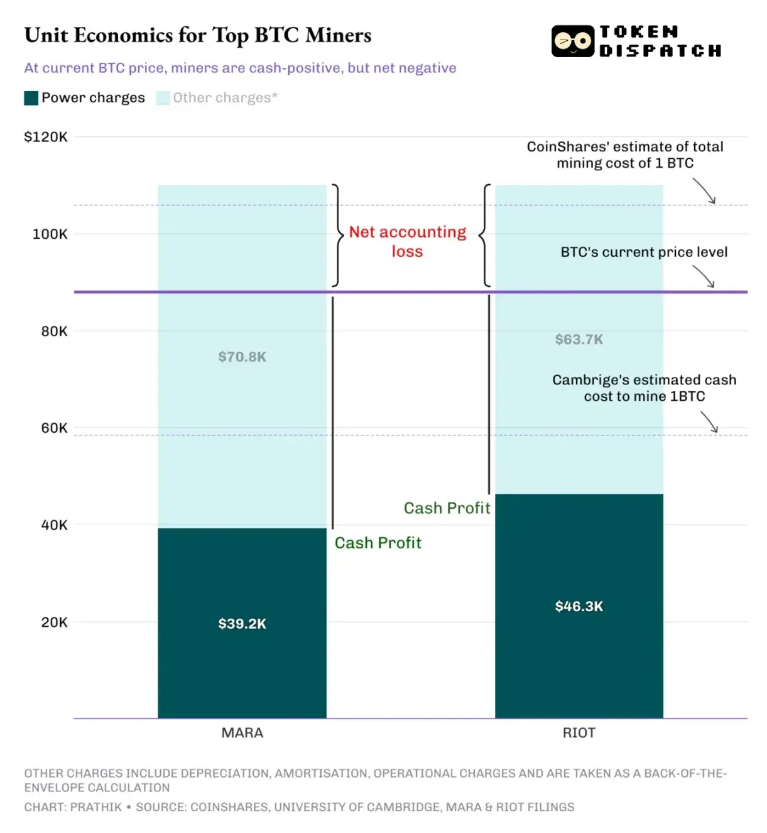

● "Miners are in trouble when Bitcoin prices are below $90,000." Industry analysis points out that once non-cash costs like equipment depreciation are accounted for, the total cost of mining a single Bitcoin can easily exceed $100,000.

● This means that at the current price level of over $80,000, many miners are actually in a loss position on an accounting basis, relying on hoarding Bitcoin or seeking external financing to maintain operations.

3. The Lifeline of Energy

● Today's miners face not only the price cycle but also a "energy run" from the macro world. The explosive growth of the artificial intelligence (AI) industry is competing for electricity from the same energy pool as cryptocurrency mining.

● AI data centers and Bitcoin mining farms are essentially very similar: both require dense computing units, large areas of land, stable high-density power supply, and massive cooling systems. Tech giants are willing to pay several times more than miners to secure power contracts and critical infrastructure.

● Morgan Stanley's analysis shows that if mining companies transform their mining sites into data centers and lease them, the equity value created would far exceed the current trading levels of Bitcoin mining stocks. The policy balance has also tilted; the U.S. strategic support for AI clearly takes precedence over cryptocurrency mining.

● Mining companies are caught in a "sandwich": above them is the dimensional attack from AI capital, and below them are the deflationary revenues from Bitcoin's own halving cycle and the continuously rising mining difficulty. This forces the entire industry to rethink its survival path.

4. The Valuation Blueprint of Long-Termism

● In sharp contrast to the immediate predicament of mining is JPMorgan's grand blueprint for Bitcoin's long-term prospects. In another significant report dated November 7, the bank's analysts set a target price of $170,000 for the next 6-12 months.

The core logic of this valuation is to place Bitcoin within the narrative framework of "digital gold," conducting fair value calculations adjusted for volatility.

● The model used by analysts compares Bitcoin's market capitalization with the total investment in gold by the global private sector (approximately $6.2 trillion). Currently, Bitcoin's market capitalization is about $2.1 trillion, needing to rise about 67% to match.

● The key adjustment factor is risk. The report points out that the current volatility ratio of Bitcoin to gold is about 1.8, meaning the risk of holding Bitcoin is 1.8 times that of gold. After this risk adjustment, Bitcoin's theoretical price should be close to $170,000.

● This target price is a significant increase from the bank's August prediction of $126,000 and October prediction of $165,000, reflecting its growing confidence in Bitcoin's mid-term prospects.

5. The Struggle of New and Old Orders and Market Structure Changes

● Beneath the surface of the market, a deeper structural change is occurring. JPMorgan's report highlights a key shift: what is currently more important for Bitcoin's short-term trend is not miner activity, but the resilience of one of its largest holders, MicroStrategy (MSTR).

This company has become a crucial bridge connecting traditional capital with the Bitcoin world. By issuing bonds and preferred stocks, it "converts" funds from the fiat world into Bitcoin exposure.

● Some market views suggest that this makes MSTR the focal point of the struggle between two monetary systems—the old order centered around the Federal Reserve and traditional banks, and the emerging order anchored by the U.S. Treasury, stablecoins, and Bitcoin. Suppressing MSTR is seen, to some extent, as a way for the old financial system to maintain its position.

● Meanwhile, the composition of market participants is also undergoing dramatic changes. Citibank's report indicates that the number of "whale" addresses holding over 1,000 Bitcoins is decreasing, while the number of retail addresses holding less than 1 Bitcoin is rapidly increasing. This trend of chips dispersing from large holders to retail investors is often seen as a sign of a specific stage in the market cycle.

As high-cost miners struggle for survival below the $90,000 cost line, Wall Street's models point to the distant horizon of $170,000. The power for mining farms is being fiercely contested by AI data centers, while the valuation story of Bitcoin unfolds in comparison to millennia-old gold.

On one side is the temporary retreat of hash power and difficulty, while on the other side is the vast sea of the volatility model; one side is the harsh reality of miners shutting down, while the other side is the shining dream of digital gold. This test of ice and fire will ultimately determine whether Bitcoin remains a risk asset or truly transforms into a new paradigm of value storage.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.