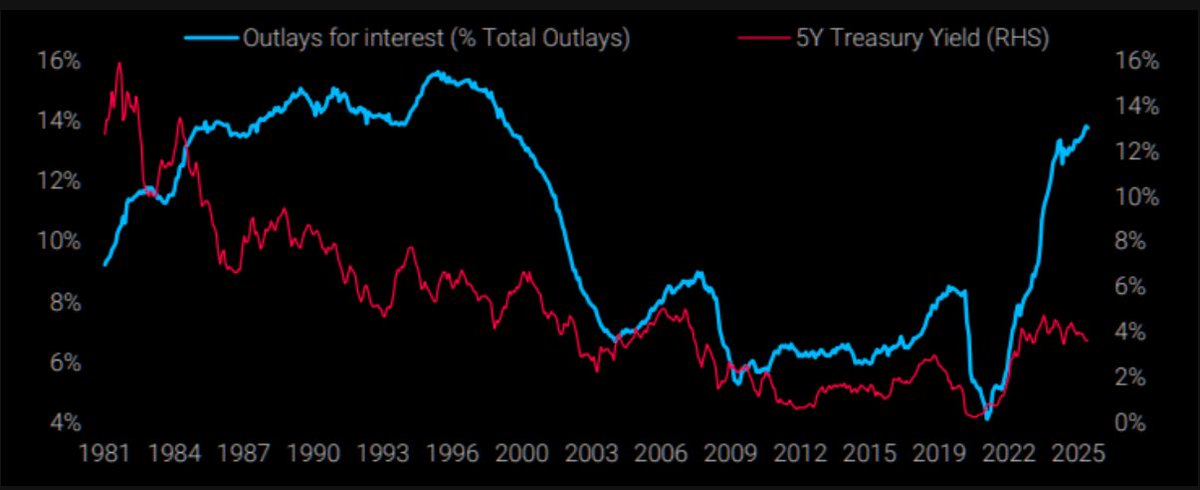

⚠️ The U.S. Treasury has entered the interest rate hostage zone —

Interest expenses now account for about 14% of federal spending, but the current yield on government bonds is only 3.7%.

If we return to the 6% levels of the 1990s? The Treasury estimates it would blow up directly.

This is the precursor to what is called Fiscal Dominance: monetary policy is no longer free and must revolve around fiscal sustainability.

The next new chairman, Hassett, advocates for rapid interest rate cuts, and those playing in the bond market on Wall Street are getting anxious.

Because in the logic of the bond market, rapid interest rate cuts only mean one thing — the Treasury can't hold up, and the Federal Reserve is preparing to concede.

Once this expectation forms, long-term interest rates will rise, and everyone will demand higher yields to compensate for potential future inflation, monetary easing, and policy uncertainty.

We may witness this particularly magical scenario:

Short-term interest rates drop,

Long-term interest rates are pulled up by the market,

Fiscal pressure not only fails to ease but becomes heavier.

We are likely facing a chaotic market lasting several years!

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.