In the past two years, when we talked about "blockchain" or "RWA (Real World Asset tokenization)," the first reaction from most traditional finance practitioners was: “Isn't this just turning assets into tokens and selling them on compliant exchanges (like HashKey, OSL)? There’s no liquidity there, it’s meaningless.”

This view was correct for a long time. If RWA is merely about moving off-chain assets to a liquidity-starved on-chain island, then it is indeed a false proposition.

However, while we were observing amidst skepticism, the underlying logic of the bond market has quietly undergone a transformation. From Siemens completing a €300 million settlement on a public chain in an instant, to BlackRock bringing U.S. Treasury bonds on-chain, and MicroStrategy leveraging convertible bonds to unlock a market value of hundreds of billions, a brand new "RWA + bond issuance" model is taking shape.

This is no longer about "speculating on tokens," but about restructuring the entire lifecycle of bond issuance, registration, settlement, and circulation.

Before diving into the cases, let’s honestly face the pain points of the traditional bond market. Despite having powerful infrastructures like Euroclear and DTCC, bond issuance remains a "labor-intensive, high-friction, long-cycle" process:

- Settlement delays (T+2/T+3): Multiple intermediaries (custodians, clearinghouses, CSDs) lead to time lags in the delivery of funds and securities, resulting in counterparty risk and capital occupation costs.

- High intermediary costs: Each layer of intermediaries takes a cut, making it extremely costly for small and medium-sized enterprises to issue bonds, creating a high barrier to entry.

- Information silos: Difficulties in penetrating regulatory oversight of bondholders, and different countries' custody systems are not interconnected, making cross-border bond issuance akin to "crossing mountains and rivers."

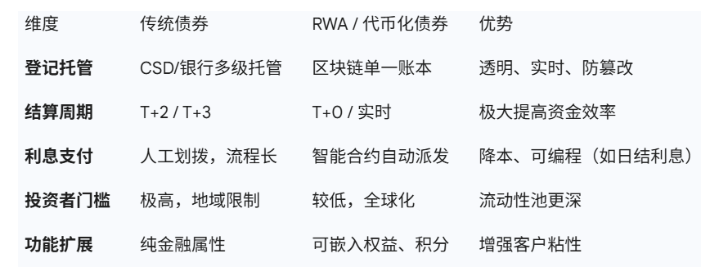

The core of RWA bond issuance is to utilize blockchain as a "unified ledger" to achieve atomic settlement and programmability.

We will explore the next phase of RWA through the following four aspects — financial infrastructure transformation and asset structure innovation.

Public Chain as CSD (Central Securities Depository) — A "Dimensional Reduction Attack" on Infrastructure

- Siemens: Issued €300 million in digital bonds on Polygon (public chain), selling directly to investors, bypassing traditional central securities depositories (CSDs), and completed central bank currency settlement in minutes through the SWIAT permissioned chain.

- BlackRock: Purchased Quincy City’s $6.5 million municipal bond through JPMorgan’s Onyx platform, achieving the first fully on-chain registration and settlement.

This represents the most "orthodox" reform and is the path most easily accepted by traditional financial institutions. Here, blockchain replaces the traditional Central Securities Depository (CSD). In the traditional model, the transfer of securities and funds operates on two parallel tracks, requiring third-party guarantees.

On-chain, smart contracts ensure "payment on delivery," and can even achieve T+0 real-time settlement. Siemens' case demonstrates that without the large-scale involvement of traditional banks as intermediary underwriters, companies can directly face qualified investors. For high-rated bond issuers, this means significant savings on underwriting fees.

In the future, technology service providers capable of offering "on-chain bookkeeping" services will replace some traditional back-office operational functions, becoming new infrastructure giants.

Corporate Bonds' "DTC Model" — Turning Bonds into Customer Relationship Management Tools

- Toyota Financial: Issued ¥1 billion in corporate bonds on the Progmat platform. But this is not just about borrowing money; Toyota linked the bonds to digital wallets, returning points and redeemable benefits to investors based on subscription amounts.

- Muff Trading: A Swiss precious metals trader issued bonds directly on Polygon through the Obligate protocol, with no banks involved.

This is the DTC (Direct-to-Consumer) revolution in bond issuance. Traditional bonds are cold financial contracts; once investors buy the bonds, they have no connection with the company beyond receiving interest. But Toyota's case showcases the programmability of RWA bonds.

For corporate finance departments, issuing bonds is no longer just a financial action; it has become part of brand marketing and customer loyalty management. This "functional bond" is extremely difficult to achieve under traditional securities account systems but is easily accomplished on a programmable blockchain.

A "rights-based bond issuance platform" designed specifically for consumer-oriented companies (aviation, hospitality, automotive) will be a huge untapped market.

On-Chain ABS — Activating the Liquidity Engine of "Long-Tail Assets"

- Centrifuge / MakerDAO / Maple: These protocols package real-world invoices, trade financing, and real estate loans into NFTs (non-fungible tokens), collateralizing them to on-chain stablecoin protocols (like Maker) to exchange for DAI or USDC to lend to businesses.

This represents the globalization and atomization of asset-backed securities (ABS). The barriers to traditional ABS are extremely high; legal fees, rating fees, and SPV setup costs can easily reach millions, making it feasible only for large asset packages. Credit assets from small and medium-sized enterprises (like a $500,000 supply chain invoice) find it hard to enter the capital market.

What can RWA protocols do:

Structured Layered Automation: Automatically split senior and junior priorities through smart contracts, eliminating the need for manual calculations and allocations.

Global Liquidity Access: The asset side may be in Southeast Asia or Latin America, while the funding side consists of global DeFi players (investors holding USDT/USDC).

This effectively opens up a global permissionless bond market. For practitioners focused on private bonds for small and medium-sized enterprises, this is akin to accessing a 24/7 trading pool, no longer limited by the lending limits of banks in a single region.

Those who can assess the quality of off-chain assets and "bridge" them on-chain will become the coveted assets initiators and risk control experts in DeFi protocols.

Convertible Bonds 2.0 — Cryptographic Assets as New "Underlying Beta"

- MicroStrategy (MSTR): This is an extremely unique case. They issued convertible notes with very low interest rates (even 0%), raising funds to purchase BTC.

Investors are essentially buying a "call option." If BTC surges, the stock price skyrockets, and the bonds convert to equity, yielding huge profits for investors; if BTC falls, the bonds mature with principal and interest (backed by the company's cash flow).

This brings immense imagination to traditional bond design. The conversion value of traditional convertible bonds is tied to the company's operational performance. MicroStrategy has created a convertible bond linked to "digital asset reserves."

This is essentially a perfect closed loop of "issuing bonds in the crypto space, raising funds in fiat, and asset repatriation." For companies with substantial computing power, energy reserves, or digital asset reserves (like mining companies and tech firms), issuing such rights-linked bonds can yield massive liquidity at low costs, while investors gain a high-quality asset with "downside protection (bond characteristics) and unlimited upside (equity/crypto characteristics)."

Designing and underwriting "crypto asset allocation convertible bonds" for publicly listed companies will be a new high-profit business line for investment banks.

Returning to the initial question: Are RWA bonds merely a conceptual hype?

If your understanding stops at "just listing on a compliant exchange," then indeed it is. But if we look beyond the surface, we will find that the essence of RWA bonds is a "revolution" formed by the aggregation of various "micro-innovations" in financial infrastructure:

For traditional bond practitioners, RWA is not about overturning their current jobs, but about upgrading their "Excel spreadsheets" and "SWIFT messages" to "smart contracts." In this blue ocean, it is no longer a solo act by exchanges, but a stage for professionals who understand compliance, asset structure, and dare to leverage technology to enhance efficiency.

Rather than watching from the sidelines at the liquidity-starved exchange, it is better to think: How can blockchain technology be utilized to issue a "next-generation bond" for the assets in your hands that settles faster, costs less, and has a more flexible structure?

The winds are rising from the edges, and the digital wave in the bond market has just begun.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.