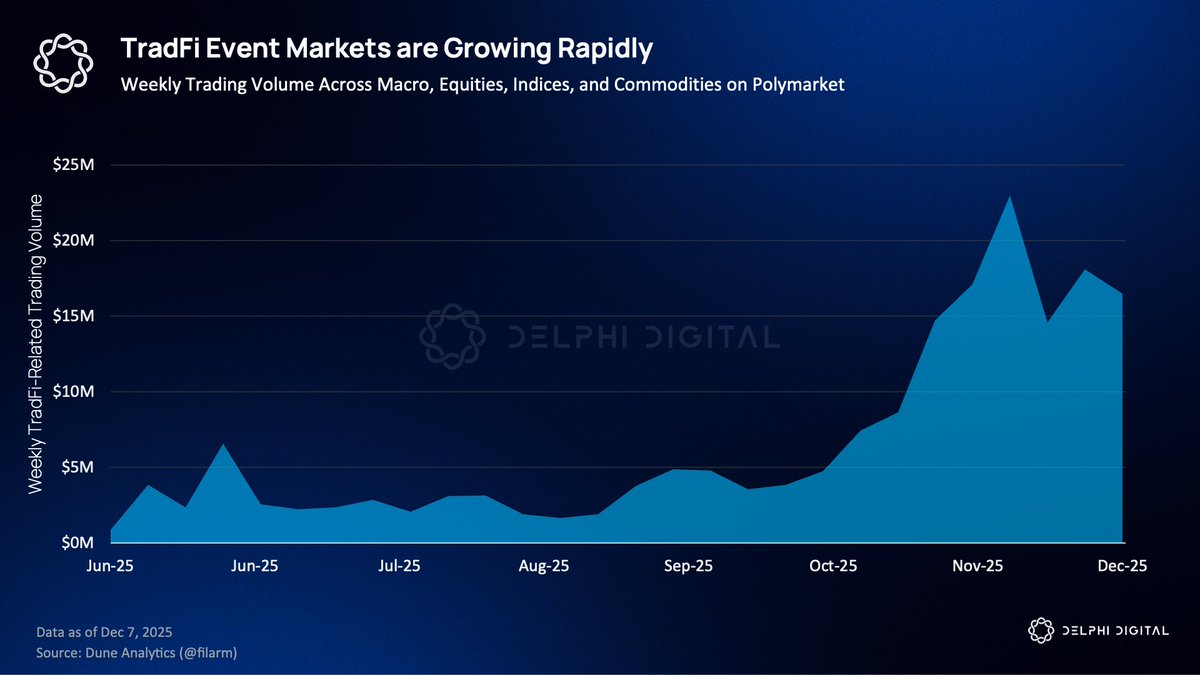

Prediction markets are becoming first class TradFi derivatives.

Earnings reports, CPI surprises, and guidance changes don't map cleanly onto existing products. You can approximate them with options, but event markets collapse all that complexity into a binary outcome with continuously updating probabilities.

As tokenized equities and RWA rails mature, this fits naturally into a unified onchain brokerage account.

A trader holding spot AAPL could borrow against that position and use a slice of collateral to hedge earnings risk, or dynamically update exposure based on a simple quote like "Will Apple beat earnings?"

Earlier this year, Intercontinental Exchange, the owner of the NYSE and one of the most systemically important exchange operators, took a multi-billion-dollar strategic stake in Polymarket.

Thomas Peterffy, founder of Interactive Brokers, framed prediction markets as a live information layer for institutional portfolios.

Early demand on IBKR is concentrated in weather related contracts for energy usage, logistics, and insurance risk, but Peterffy's vision goes further with portfolios updated by shifting probabilities from event markets rather than stale analyst estimates.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.