The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome all crypto friends to follow and like, and I refuse any market smoke screens!

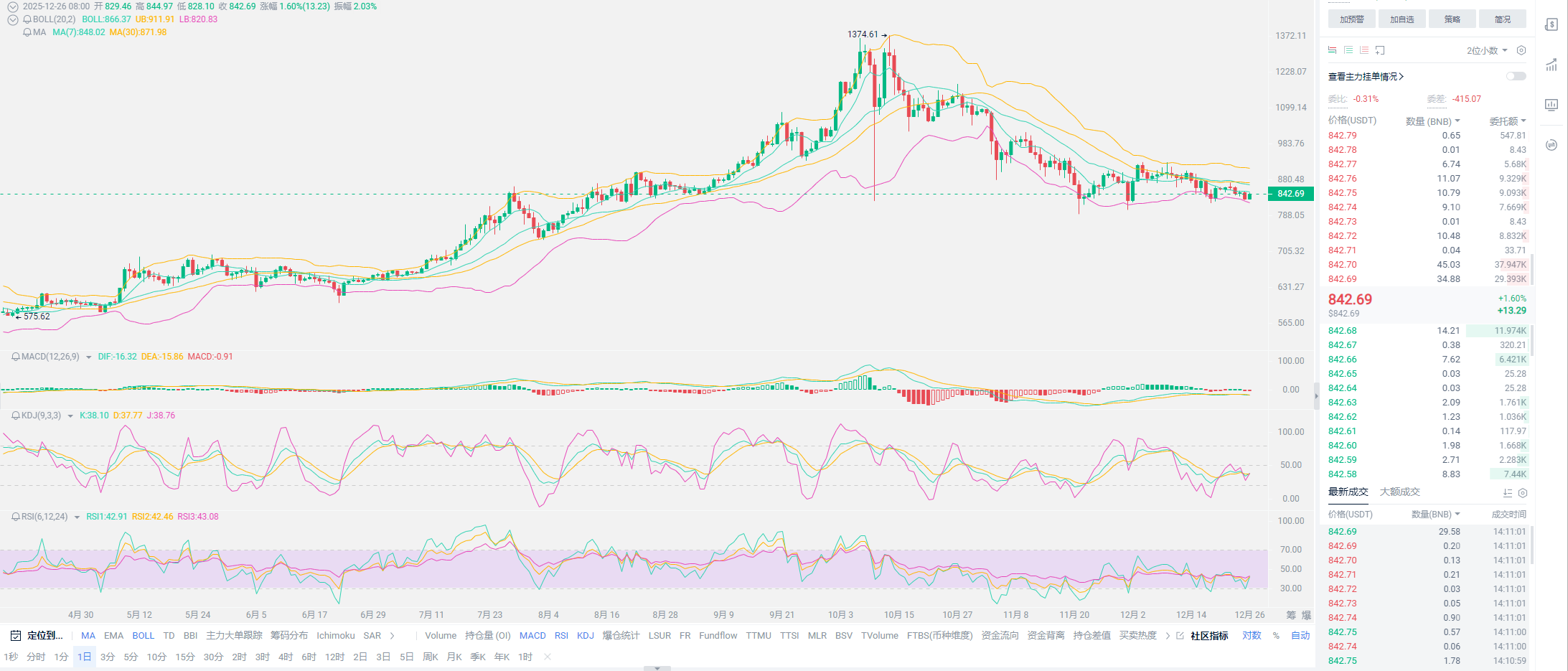

Talking too much about trends is somewhat a waste of breath, so today I will discuss my investment mindset, which is based on my more than ten years of experience in the cryptocurrency world. My writing skills are not great, so please bear with me. Due to the ongoing market downturn, many users have suffered losses. Without evading responsibility, it is more due to my previous blind bullishness. In terms of results, I can say that since SOL was at 200, I have always believed the trend was bullish, and to this day, I still hold this belief, which ultimately is indeed a wrong idea. This has also caused my average price for SOL to be pulled up to a high of 150, and I am currently in a loss position like everyone else. The only thing I have over others is my mindset; I have always maintained a good attitude, filled with confidence. This confidence comes from previously holding over 20,000 Bitcoin, around 1200 Ethereum, even over 90 OKB, and around 100 SOL, and further back, around 400-500 BNB.

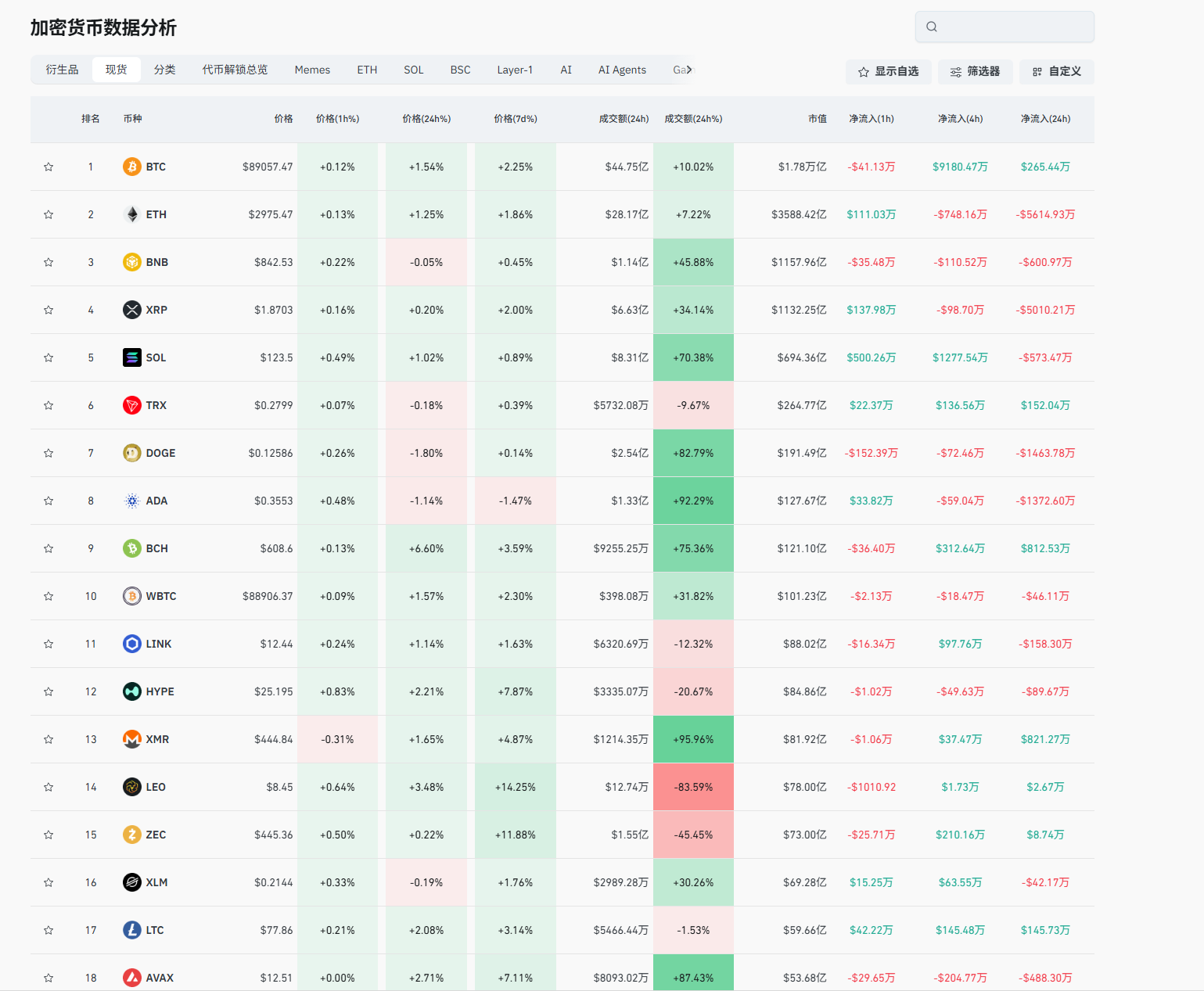

It is precisely because of the smoothness in the early stages that this blind confidence was formed. Please do not think I am bragging; the article serves as self-evidence, especially the fans on private platforms, who are all my witnesses. The downward market indeed tests one’s mindset significantly. The problems in the cryptocurrency world far exceed those of Old A or even the US stock market because the cryptocurrency market has a larger speculative component compared to other investment fields, and many friends do not even know how to check the data. Whether it is on-chain data or investment data, they do not even know which website to look at. Users with such questions can ask me; the article cannot provide information about other platforms. The issue of mindset, as mentioned in the previous paragraph, is related to confidence; it is similar to the issue where everyone feels that contracts are gambling. If the person you are asking is in a loss position, then the concept of gambling is valid. Of course, most players who ask this question will not receive a very good answer because the truly profitable top players are not accessible to you.

I, too, have never actively recommended contracts because too many users have a somewhat immature mindset, which is not suitable for contract operations. 90% of users will fall into a self-cycling loop, which is internal friction. You can self-assess; often, once you enter a position, whether profitable or losing, you cannot complete the expected judgment, and the entire process cannot be fully executed. Once you go long, you start to doubt whether it will drop? Once you go short, you will think whether it will rise? Once this mindset appears, it indicates that this position will end in a loss. Many friends may refute me, saying, "I clearly exited with a profit, why do you think I lost?" Because of this event, I have also been angry with many users. Simply put, my layout could profit 1000-2000 points, but users, due to their mindset issues, only made a profit of 500 points and still felt very satisfied.

At this point in the event's development, I find it hard to empathize. According to investment theory, my perspective is that you have already lost 1500 points; while the user's perspective is that they have already made a profit of 500 points. These two perspectives are contradictory, and this contradiction will only manifest in the next loss. A situation that could have avoided losses has become an irreversible problem due to mindset issues, which is a typical low-level mistake that I cannot tolerate. For every user wanting to engage in contracts, I always tell them one thing, which I also mention in the article: the risk of loss. Engaging in contracts will definitely involve the risk of liquidation. If the risk of liquidation is greater than the profit, then it proves that you are not suitable for contracts; it is better to stick to spot trading. How to judge the ratio of profit to risk? This can be seen from the mindset; if you have the aforementioned profit mindset issues, you will definitely face liquidation and lose everything.

Let’s explain it more thoroughly for better understanding. For example, if this time the profit can be 2000 points, it proves that the next time you incur a loss, you will not lose your principal within at least 2000 points. This is the confidence I mentioned earlier, and it is also what I said before: success is not replicable. If you look at the top players in the cryptocurrency world, you can see that the operations of Liangxi are a typical example of a second Livermore, with countless liquidations combined with countless profits. Many friends cannot understand; isn’t this just a gambling strategy? Why is he so confident? This is because he has seen profits, allowing others to follow him. No one has the courage, but some will appreciate it. His trades are all transparent; do you have that courage? Without the foundation laid by previous profits, you cannot understand the subsequent losses. If you really want to learn about the cryptocurrency world, your mindset is often your first step.

The users who frantically attack the cryptocurrency world and contracts are basically the same group of people who have incurred losses in the cryptocurrency market. If you ask the group of people who are profiting in the cryptocurrency world, their answers will be completely different. Users who profit from spot trading will tell you that long-term holding is the way to go, while contract users will tell you to stick to your ideas and validate yourself; as long as you are right once, you can cross the class barrier. Those who incur losses will only tell you that this is gambling, stay away from the cryptocurrency world. The bottom line is that regardless of the type of investment, users with a poor mindset are not suitable for the investment market. Because they will always scrutinize the market with prejudice, and once prejudice appears, they will frantically seek viewpoints that resonate with them. I also have such somewhat subjective thoughts. At the beginning of the Russia-Ukraine conflict, I reminded everyone to buy gold, energy, and military stocks, and I also bought a large portion myself. What was the result? The result was that I sold all my gold holdings when it rose to a 10% profit because my prejudice led to a failure to keep up with my understanding. I do not believe that spot gold can rise above 3000 USD, while the reality is that it has already reached 4500 USD.

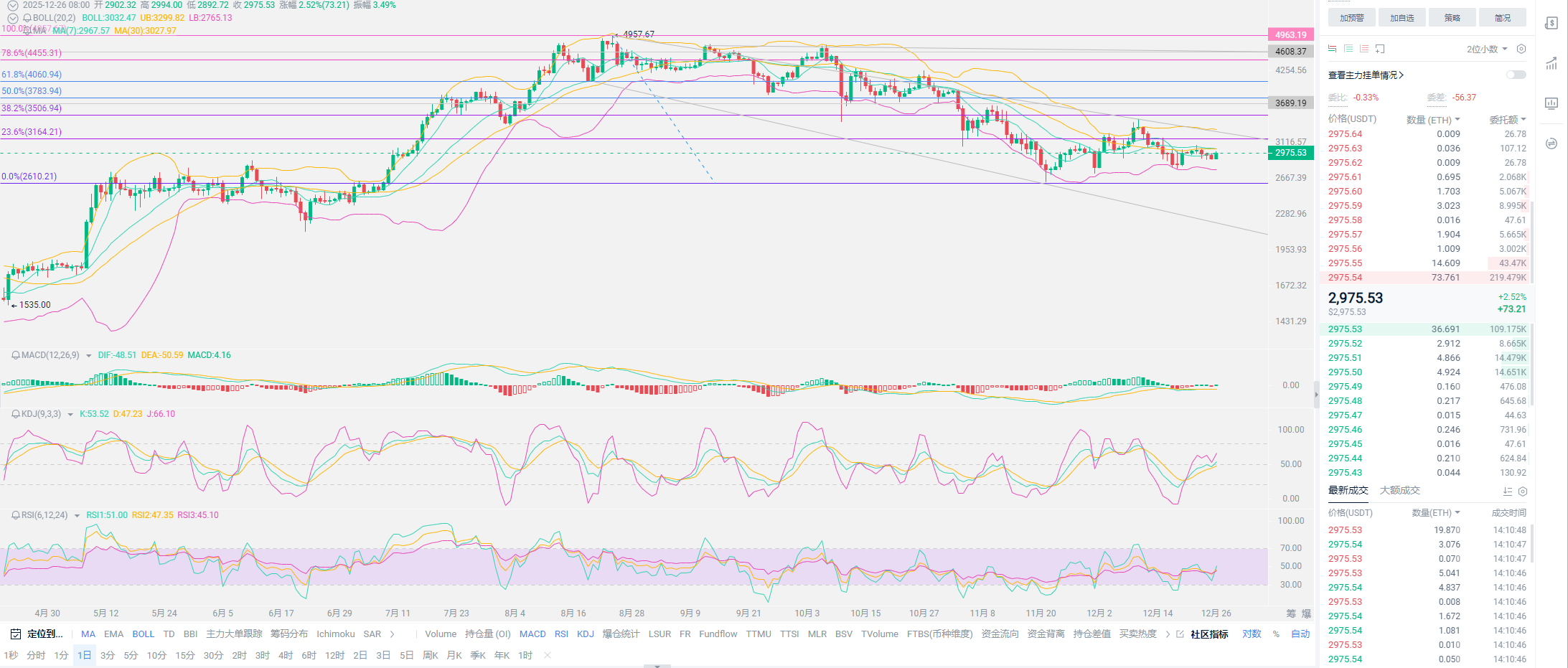

In summary, I have talked about many things, and perhaps many friends feel that I haven’t said much. I am an investor who prioritizes results above all else. In any investment market, as long as the result is a loss, it can only indicate that there is a problem with oneself. If there is no problem with oneself, then there would be no losses. This theory applies to any investment market. The main purpose of this article is to hope that everyone will reflect on their problems rather than seeking breakthroughs externally after incurring losses. External seeking will not find the root cause; one must have the ability to think independently and discern right from wrong. Regarding market issues, from a linear perspective, the downward trend of Ethereum and Bitcoin has already opened up, forming a typical downward channel. According to capital theory, December is the most dangerous time period. As long as December does not create a new low, January will likely push up a bit, and the stable market value will reach a new high. The closer we get to 2026, the market may become more stable, especially with stable issuance. After a maximum accumulation of six months, perhaps a bull market is already on the way.

Original article created by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate goal of winning the game. The novice, on the other hand, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries consequences at your own risk!

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.