Selected News

Selected Articles

2025 is coming to an end. Most people can clearly feel that since the second half of this year, the narrative in the crypto industry has gradually dried up, and the trading groups have become much quieter. So what changes will occur in the upcoming 2026, and which narratives will gain favor in the market? Rhythm BlockBeats analyzed over 30 predictions for 2026, sourced from top research institutions like Galaxy, Delphi Digital, a16z, Bitwise, Hashdex, and Coinbase, as well as several industry KOLs who have been conducting research, developing products, and investing on the front lines for a long time. From this, five consistently optimistic narratives for 2026 were summarized, and workers must read to the end.

In the past 24 hours, the crypto market has witnessed a multifaceted dynamic ranging from macroeconomic discussions to specific ecosystem developments.

Mainstream topics are focused on protocol governance and value return mechanisms, from token burns to fee structure adjustments, as mature protocols recalibrate their relationships with token holders. In terms of ecosystem development, Ethereum is focusing on the continued expansion of DeFi credit and asset management scale, while Perp DEX is accelerating the extension of trading categories to commodity assets like silver, indicating that on-chain finance is moving from crypto-native to broader macro targets.

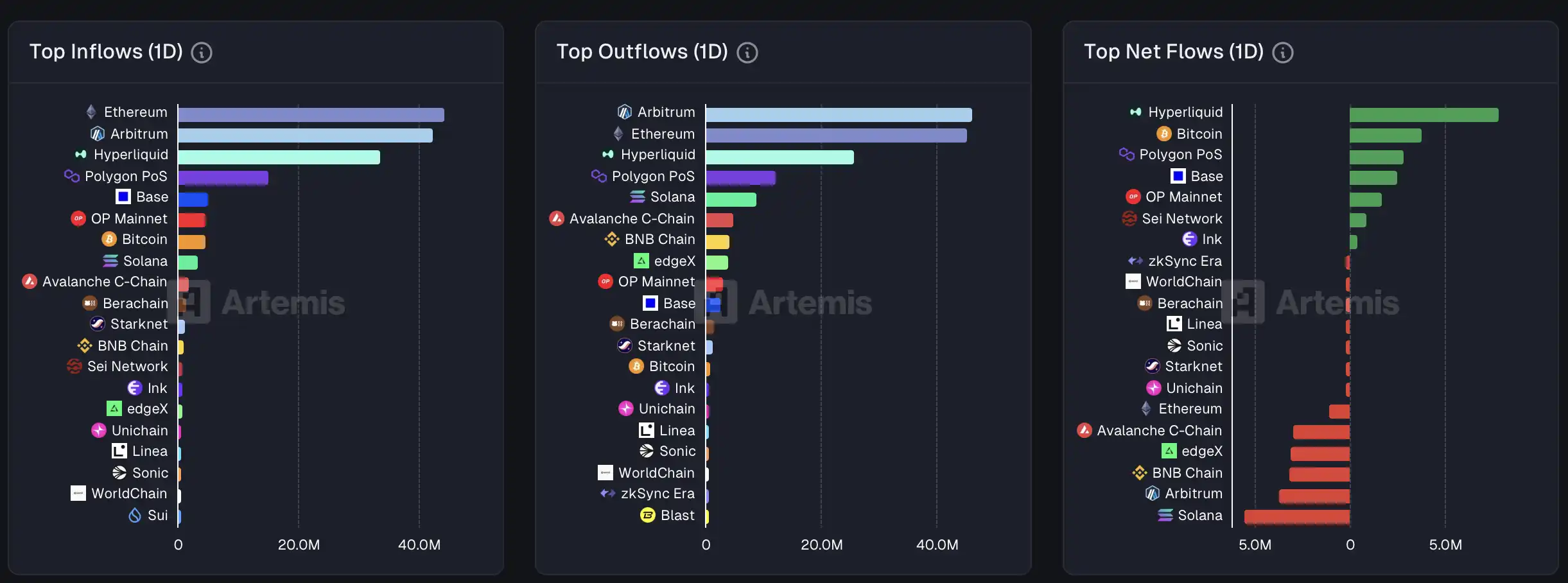

On-Chain Data

On-chain capital flow situation on December 26

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.