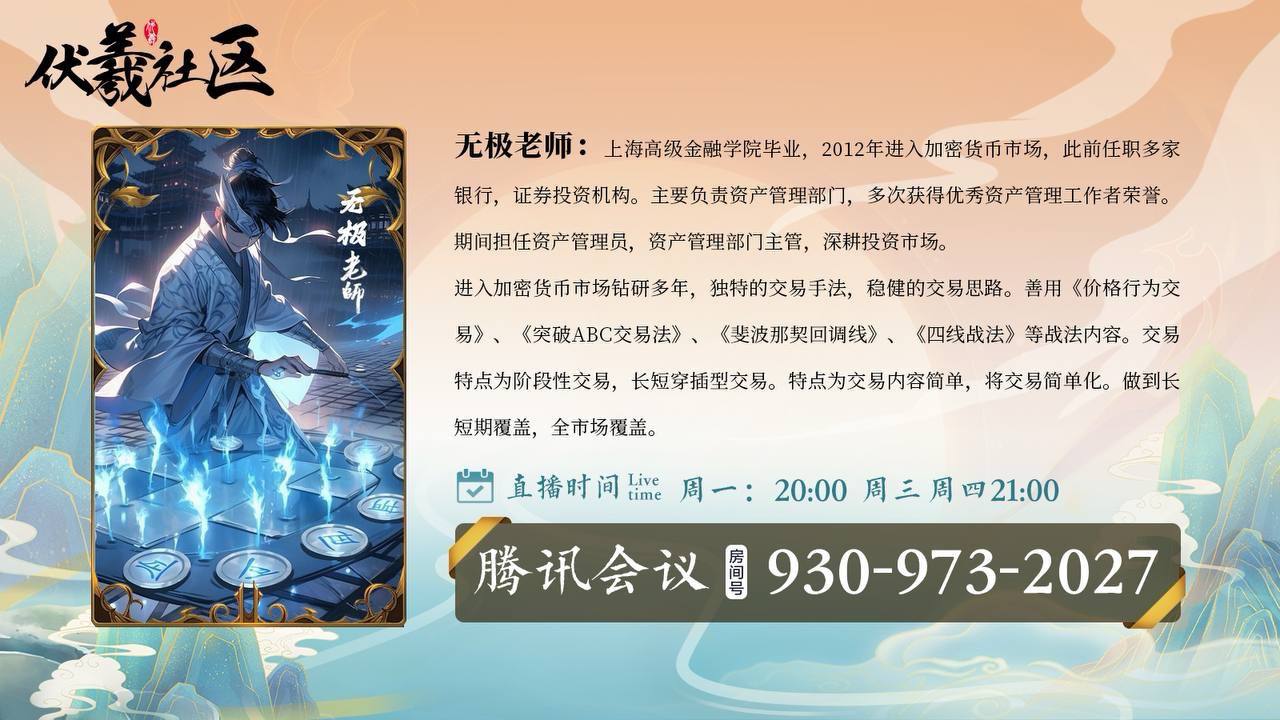

Click on the link to enter the live stream: https://meeting.tencent.com/p/9309732027 BTC: With the release of the CPI data bureau, the market experienced a significant decline and reached the bottom position of the hourly level wedge-shaped structure adjustment. For the overall trend of the subsequent large pie, the hourly level wedge-shaped adjustment has entered the tail. After the previous false breakout market ended, the rebound strength was sufficient. After a 15 minute small level breakout, the structural retracement point at the top position conforms to the breakout trading mode. Currently, the large market is dominated by long orders, with a risk control of 95800 entering the long market below 95000. The target can be seen at the high point of 1025000. Enter from a long-term perspective. ETH: The trend structure of Ethereum hourly level channels is obvious, with channel adjustment as the main trend. At present, channel breakthrough conforms to the breakthrough single trading mode, and can be traded according to the breakthrough ABC structure. The entry positions for multiple orders are between 2680-2670. Just below the risk control 2630, enter at a low multiple. The subsequent action of preventing one handed Ethernet insertion is sufficient, but the overall direction is still biased. Tencent Meeting Number: 930 973 2027 Join the Fuxi Community and enjoy a variety of service offerings 1. Conduct market analysis for daily open courses and develop plans for matching orders and solving problems. 2. Join the member group to enjoy live streaming with orders in the evening; Fixed weekly technical course content. 3. Conduct three market analysis sessions in the morning, afternoon, and evening of the day, and engage in multiple intraday strategic trades. 4. "Price Behavior Trading", "Breakthrough ABC Trading Law", "Four Line Battle Method" 5. Use tactics such as "Gann's Angle of Power", "Fei's Wave Number Example", and "MACD" to deduce the future direction. Disclaimer: The above content only represents the author's personal views and is for communication and sharing purposes only. It does not represent the position or viewpoint of AICoin and does not constitute any investment advice or external contacts. It is not related to AICoin and the consequences are borne by AICoin