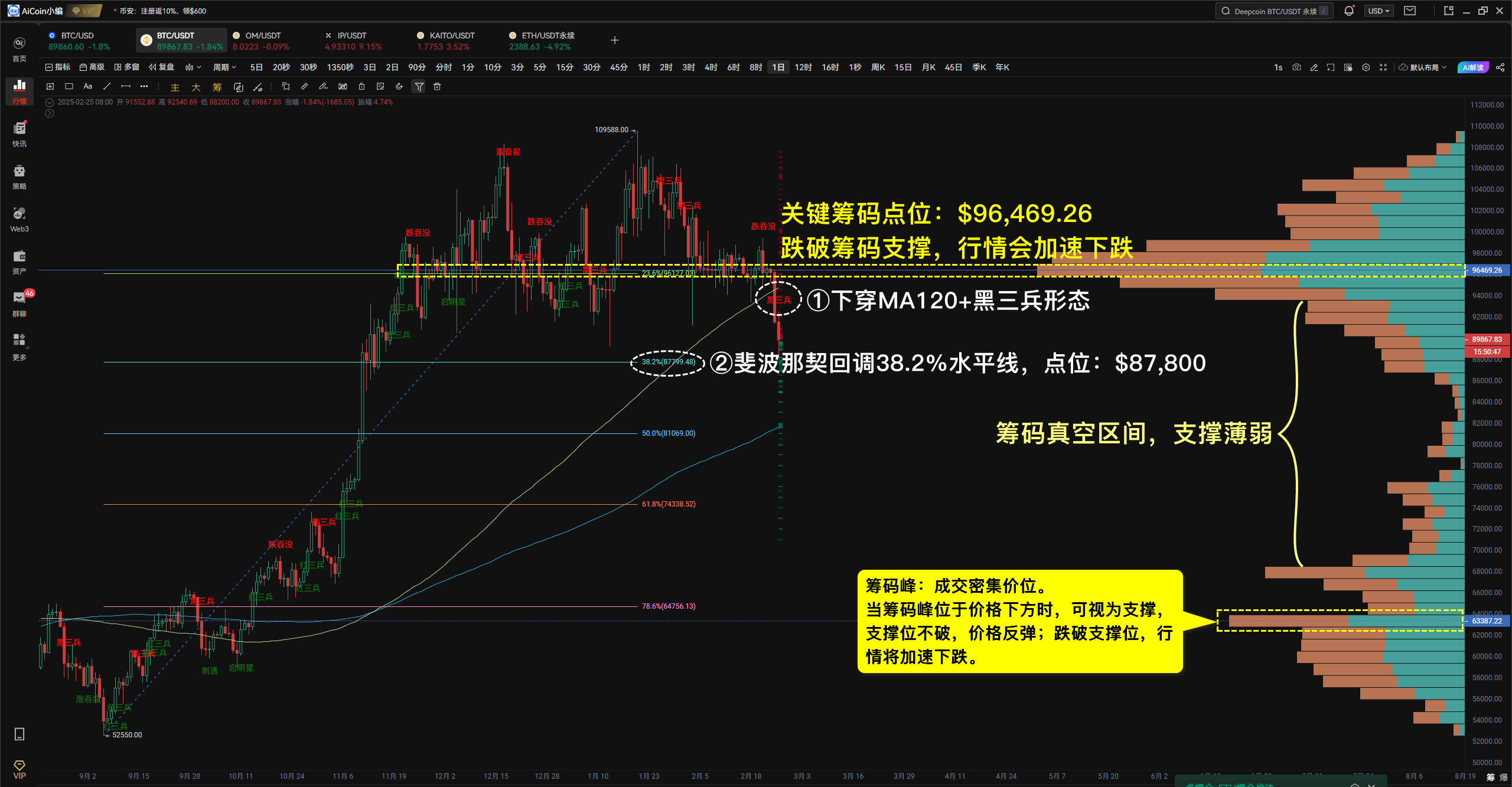

By Omkar Godbole (All times ET unless indicated otherwise)The crypto market is a sea of red, with bitcoin trading at three-month lows under $88,000 and the CoinDesk 20 Index down more than 10% in 24 hours. There are several catalysts for the swoon, including risk-off sentiment in traditional markets and influence from memecoins, especially the recent trading in TRUMP and LIBRA.See all newslettersAs we discussed Monday, market makers attending the Consensus Hong Kong conference last week were worried the memecoin frenzy had sucked liquidity from the productive crypto sub-sectors, leaving the broad market vulnerable.Another reason is President Donald Trump's inaction. Although he made significant promises in the lead-up to the elections, concrete action has been scarce. The anticipated strategic BTC reserve remains absent, and even state-level reserves are proving challenging to implement."The industry is still waiting for this to manifest in a tangible way in the form of measures such as a mooted Bitcoin Strategic Reserve," Petr Kozyakov, co-founder and CEO at Mercuryo told CoinDesk. "In the meantime, sentiment has been hit hard by the biggest ever hack at the Bybit exchange, leaking 401,000 ETH, and a memecoin sector plagued with high-profile pump and dump schemes."Lastly, renewed concerns about the U.S. economy are zapping demand for riskier assets."There is also some concern about the slowdown in U.S. growth since last week's U.S. Services PMI release, the lowest in 22 months and consistent with GDP growth tracking at 0.6% only," Nansen's principal research analyst Aurelie Barthere said. "Our Nansen Risk Barometer also just turned Risk-off from Neutral today."Together, they sent BTC diving out of its two-month-long range play between $90,000 and $110,000. Technical analysis theory suggests it could drop to $70,000, though the maximum open interest in BTC put options listed on Deribit sits at the $80,000 strike, indicating that this level could provide some support.What could stabilize prices? Perhaps an announcement from Trump regarding a strategic reserve or a sharp reversal by the Nasdaq 100. However, that index has fallen below its 50-day SMA, while the yen, a risk-aversion signal, continues to strengthen against G7 currencies, including the dollar.The next major catalysts for risk assets are Nvidia's earnings on Feb. 26 and core PCE inflation on Feb. 28. Stay alert!AMA on RedditPascal hard fork network upgradeReactive Network mainnet launchCosmos (ATOM) network upgradeRedStone (RED) farmingcommunity AMA on DiscordSonic SVM (SONIC) mainnet launch (“Mobius”)Richmond Fed President Tom Barkin delivers a speechBTDRCIFRMARAreducing the Flash Mint fee to 0.5%establishment of a DYDX buyback program upgrading the protocol ETHDenver 2025HederaCon 2025Crypto Expo EuropeBitcoin AliveMoneyLIVE SummitWeb3 Amsterdam ‘25Next Block ExpoDC Blockchain Summit 2025Solana APEXBy Shaurya MalwaSource: Farside InvestorsBitcoin Slides Below $89K to 3-Month Low as Nasdaq Futures Dip, Yen Sparks Risk-Off Fears U.S. Bitcoin ETFs Post Year's 2nd-Biggest Outflows as Basis Trade Drops Below 5%USDe Issuer Ethena Labs Integrates Chaos Labs' Edge Proof of Reserves Oracles to Strengthen Risk ManagementForget MAGA, Investors Want MEGA: Make Europe Great AgainChina Learned to Embrace What the U.S. Forgot: The Virtues of Creative DestructionAsian Shares Slide as U.S. Curbs China Investment, Euro Gain Fades