During the live broadcast of Three Kingdoms College, BTC's monthly chart was bearish, but after closing, it rebounded to the 88000 mark!

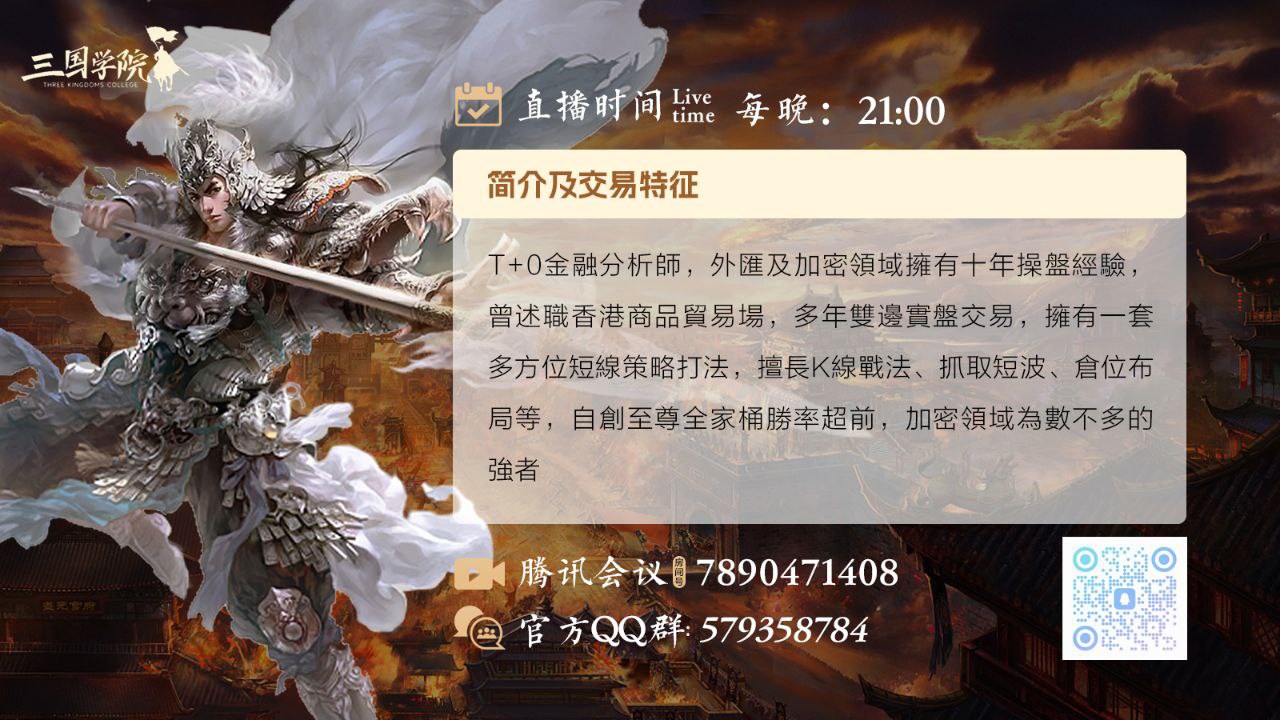

Three Kingdoms College invites you to join the personal conference room from 21:00 to 24:00. Click on the link to join the meeting directly: https://meeting.tencent.com/p/7890471408 Bitcoin's monthly chart shows a "bearish candlestick" pattern, usually releasing short-term bearish signals, indicating the depletion of upward momentum and potentially triggering a pullback. The credibility of monthly level reversal signals is high, and if accompanied by increased volume or a drop below key support levels (such as MA30), selling pressure may intensify. Investors' sentiment has turned cautious, and the exit of profit taking may accelerate the decline. However, multiple factors need to be considered: macro policies (such as interest rate hikes, ETF approvals), on chain data (holding addresses, miner selling pressure), and derivative market leverage. Excessive speculation may amplify volatility. Historical cases show that this type of pattern may lead to a deep pullback (such as a six-month volatile decline in 2019), but there are also false breakthrough traps (reversal after the main force washout) or external positive reversal trends (such as institutional entry in 2021). Strategically, short-term traders can reduce their positions and stop losses, confirm that the price has recovered from the bearish high, and then make up for it; If the fundamentals remain unchanged (adoption rate and hash rate are stable), long-term investors can invest on dips. Be alert to single signal risks, make comprehensive decisions based on weekly trends and market structure, and prioritize position management to cope with high volatility. What do you think about the actual situation BTC Technical Analysis: Last week, the weekly closing line broke through the mid track at 94000, ushering in a bear market trend. There was no unnecessary rebound, and both the weekly and daily MACD crosses were successful. Currently, we are looking to see if the weekly lower track around 70000 can stabilize again. Tomorrow's closing line is highly likely to rebound to around 88000, and a rebound is an opportunity! ETH Technical Analysis: Tomorrow morning's closing line is likely to form a double peak, and a rebound of 2500 is a short selling opportunity. Currently, the 2000 defense battle should be able to stabilize! How can we catch this wealth train? How should we grasp and respond to the bear market situation in the past six months? Teacher Zhao Yun, who has 9 years of practical trading experience in the cryptocurrency industry, will provide a detailed breakdown for everyone. Welcome to the live broadcast room to check in! Join the Three Kingdoms College Exchange Group to receive more services: 1. Real time troubleshooting (online one-on-one question answering and sorting) 2. Professional technical analysis and theoretical learning 3. Construction and improvement of trading system 4. Live streaming courses every day, contract termination, real-time order making, to help you successfully land! Official QQ group: 579358784 Tencent Meeting ID: 789-047-1408 Disclaimers The above content only represents the author's personal opinion and is for communication and sharing purposes only. It does not represent AICoin's position or viewpoint and does not constitute any investment advice. Based on this investment, there may be external contacts, which have nothing to do with AICoin, and the consequences shall be borne by oneself.