Written by: Glendon, Techub News

On September 11, the blockchain analysis platform Bubblemaps revealed on the X platform that the MYX team has a direct connection with the wallet that obtained $170 million from its airdrop, suspected to be an internal affair. This news immediately embroiled MYX, which had been gaining momentum and was dubbed a "100x coin," in a controversy. The most direct reaction was seen in the market, where 13 hours ago, the price of MYX dropped from yesterday's high of $19, plummeting to a low of $11.8, a decline of nearly 38%. What exactly is going on here?

Before diving deeper, let's briefly understand MYX.Finance. It is a platform focused on decentralized derivatives trading, deployed on Layer 2 networks such as BNB Chain, Arbitrum, and Linea, offering zero-slippage perpetual futures trading services. Its core innovation lies in the Matching Pool Mechanism (MPM), which uses smart contracts to match long and short positions in real-time, achieving a capital efficiency increase of 125 times.

On May 6, Binance Wallet launched the 15th phase of the MYX.Finance token MYX's TGE event through PancakeSwap, providing strong liquidity support for MYX. Following this, MYX entered a stable and rapid development trajectory. Just a few days ago, MYX achieved a 20-fold increase in FDV to $17 billion within 48 hours, soaring to a peak of $19.05, becoming the top performer on Binance Alpha's airdrop/TGE leaderboard.

Because of this, the newly dubbed "100x coin" MYX attracted widespread attention, including from Bubblemaps.

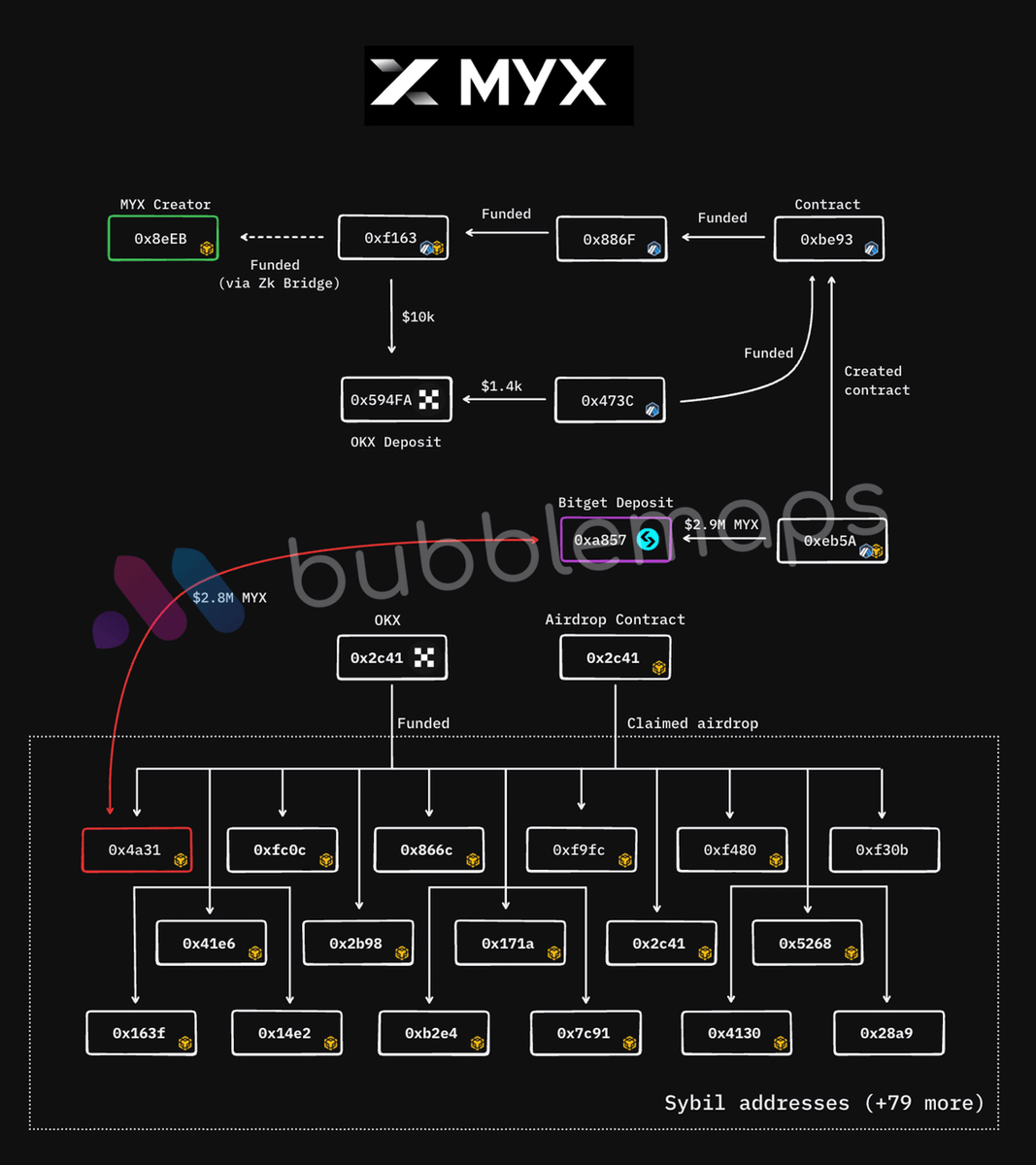

Rewinding to three days ago, on September 9, Bubblemaps disclosed that a single entity had claimed approximately $170 million worth of MYX tokens from the MYX airdrop through 100 newly funded wallets.

One month before the MYX airdrop, about 100 addresses received new funding through OKX, all of which met the airdrop eligibility criteria, and each address received a similar amount of BNB. After the MYX airdrop commenced, these addresses collectively claimed 9.8 million MYX, accounting for about 1% of the total supply. Notably, most addresses initiated their claim operations simultaneously at 5:30 AM on May 7.

In response, Bubblemaps pointed out that these addresses had no trading activity records prior to claiming MYX, and due to the highly consistent funding sources and claiming patterns, it is hard to believe that these wallets exist randomly and independently.

Initially, there were no signs indicating that the MYX core team was involved in this airdrop anomaly. However, new evidence discovered by Bubblemaps changed this perspective.

Bubblemaps traced the funding transfer of multiple addresses on the chain starting from the MYX creator address "0x8eEB" and ultimately found an address starting with "0x4a31," which was one of the wallets that claimed the airdrop.

At the same time, Bubblemaps discovered that the address starting with "0x4a31" had a highly consistent funding pattern with 95 other Sybil wallets, and this address sent approximately $2.8 million worth of MYX to a deposit address used solely by another wallet "0xeb5A," which is also related to the MYX creator.

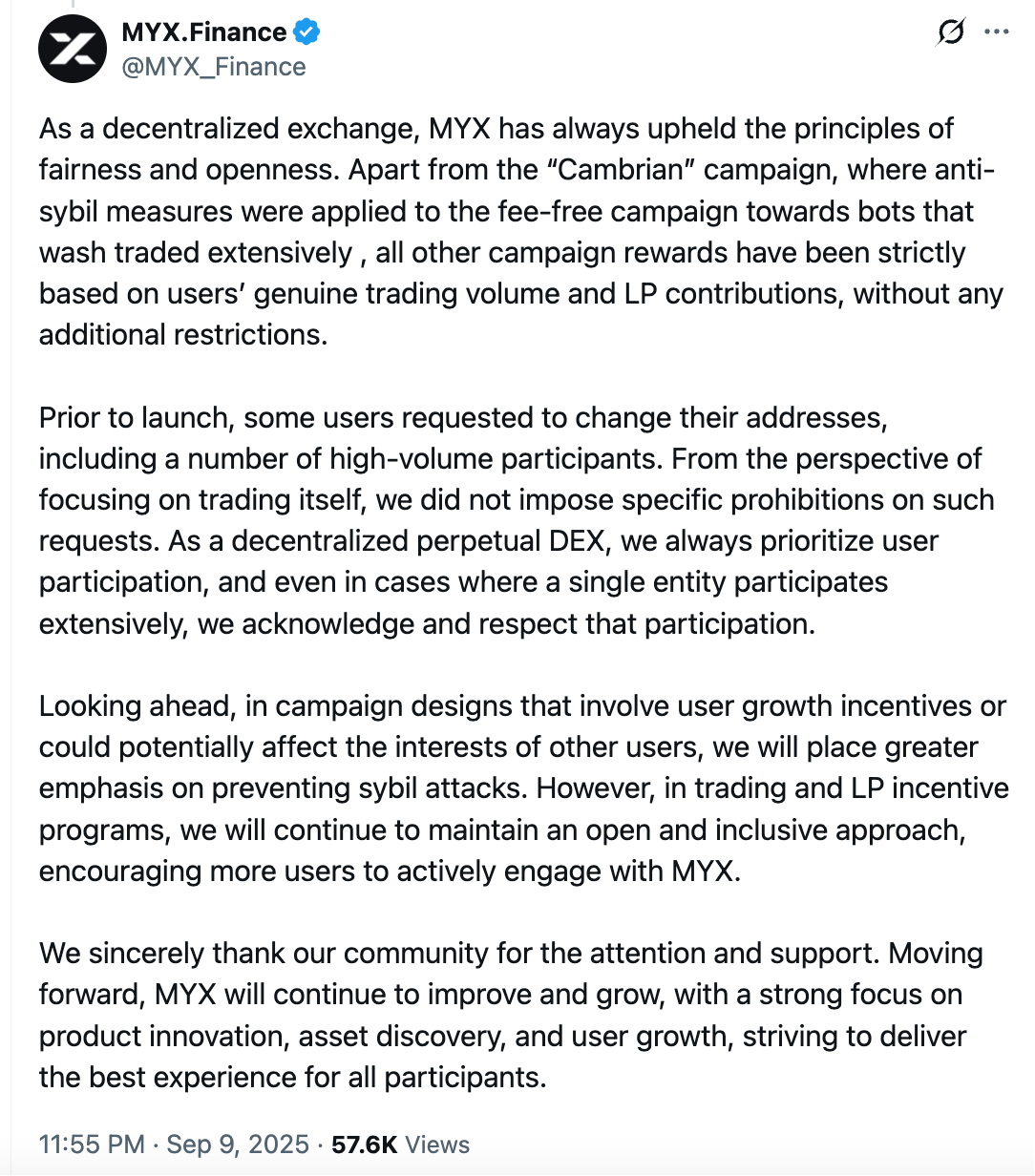

Things became interesting, and when Bubblemaps first questioned these addresses, MYX.Finance officially responded by stating: "As a decentralized exchange, MYX always adheres to the principles of fairness and openness. Except for the anti-Sybil attack mechanism implemented for the fee-free activity targeting high-frequency trading bots in the 'Cambrian' event, all other activity rewards are strictly based on users' real trading volume and liquidity provider (LP) contributions, with no additional restrictions."

MYX.Finance further explained that before the airdrop went live, some users requested to change their addresses, including some high-volume participants. From the perspective of the transactions themselves, they did not impose any specific restrictions on such requests. As a decentralized perpetual DEX, it always prioritizes user participation, so even if a single entity participates extensively, it recognizes and respects user involvement. They promised to place greater emphasis on preventing Sybil attacks in future designs involving user growth incentives or activities that may affect other users' interests. Additionally, MYX.Finance emphasized that they would continue to maintain an open and inclusive attitude regarding trading and liquidity provider incentive programs, encouraging more users to actively participate in MYX.

However, Bubblemaps was unimpressed by this response, stating that it was merely a long and vague AI reply that not only failed to clarify the issue but also made the entire event more suspicious. This prompted Bubblemaps to continue in-depth tracking and analysis, ultimately locking onto the MYX creator address.

A key question is: why do these 100 wallets exhibit the same funding acquisition and claiming patterns? And why does one of the wallets share a deposit address with the token creator?

As this series of questions fermented, investors began to sell off their MYX tokens. Around midnight last night, the price of MYX plummeted. As of the time of writing, MYX was quoted at only $12.08 on Binance Alpha.

The so-called Airdrop Sybil Attack is a fraudulent tactic in the cryptocurrency industry targeting airdrop activities. Attackers manipulate multiple fake identities, such as wallet addresses and social accounts, disguising themselves as different users to participate in airdrops, thereby illegally obtaining excessive rewards.

It is worth mentioning that as early as 2023, MYX.Finance had already fallen into a "harvesting" controversy due to the severe price fluctuations of the BRC-20 inscribed token BMYX it launched. After the controversy erupted, its CEO Mark Zhang admitted during an AMA live stream that there was room for improvement in the token mechanism and promised compensation for early holders of BMYX, specifically through a phased unlocking of 30% USDT equivalent stablecoins and 70% MYX tokens. It wasn't until August of this year that the compensation for the third phase of BMYX holders was fully completed.

Currently, many community users are calling for Binance to quickly launch an investigation and consider delisting the token. Coingecko data shows that MYX's market capitalization has dropped to $2.215 billion, with FDV (fully diluted valuation) falling back to $11.6 billion, and its market cap ranking has slid from a peak of 35th to the current 68th. According to Coinglass data, approximately $10.32 million worth of MYX was liquidated across the network in the past 24 hours.

As of the time of writing, MYX.Finance has not made an official response to this matter. However, it is foreseeable that once the "Airdrop Sybil Scam" is confirmed by Bubblemaps, the price of MYX is likely to continue to decline, and being labeled as "fraudsters" will severely damage the credibility of the MYX team. Meanwhile, the community and investors are in urgent need of a reasonable explanation from the MYX team. So, how will MYX respond?

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.