On September 14, local time, U.S. President Trump once again publicly pressured the Federal Reserve, expecting a "significant rate cut." Prior market predictions indicated that the Federal Reserve's benchmark interest rate would be lowered from the current range of 4.5% to 4.25%. Trump's statement is not unfounded, as it is based on recent economic data showing signs of weakness in the labor market, along with his consistent criticism of Federal Reserve Chairman Jerome Powell.

Economic Signals Under Political Pressure

In a media interview, Trump stated, "I think there will be a significant rate cut." If this comes true, it would be the first rate cut by the Federal Reserve since December of last year. He emphasized that the Federal Reserve should act immediately to address the cooling labor market and the recent decline in the Producer Price Index (PPI). This statement quickly gained traction on social media, with several financial observers sharing and commenting, calling it "public pressure on Powell." Trump is not new to intervening in Federal Reserve matters. Since the beginning of his second term, he has repeatedly urged the Federal Reserve to accelerate rate cuts, even considering replacing Powell. The timing of this statement is particularly sensitive, as it comes just before the FOMC meeting, where the market generally expects a moderate 25 basis point cut, but Trump's "bold" wording suggests he anticipates a more aggressive adjustment of 50 basis points or more.

The Consumer Price Index (CPI) released on the evening of September 11 showed that U.S. inflation rose to 2.9%, with core inflation stable at 3.1%. Although this is above the Federal Reserve's 2% target, the monthly increase was only 0.4%, slightly above expectations. More critically, the August employment report indicated a slowdown in non-farm job growth, with the unemployment rate rising slightly to 4.2%, showing clear signs of a "cooling" labor market. Trump attributed this to the suppressive effects of high interest rates and reiterated that his tariff policy would not lead to uncontrolled inflation. However, critics point out that Trump's intervention could exacerbate the crisis of the Federal Reserve's independence.

Federal Reserve Rate Decision: From 4.5% to 4.25% Prediction

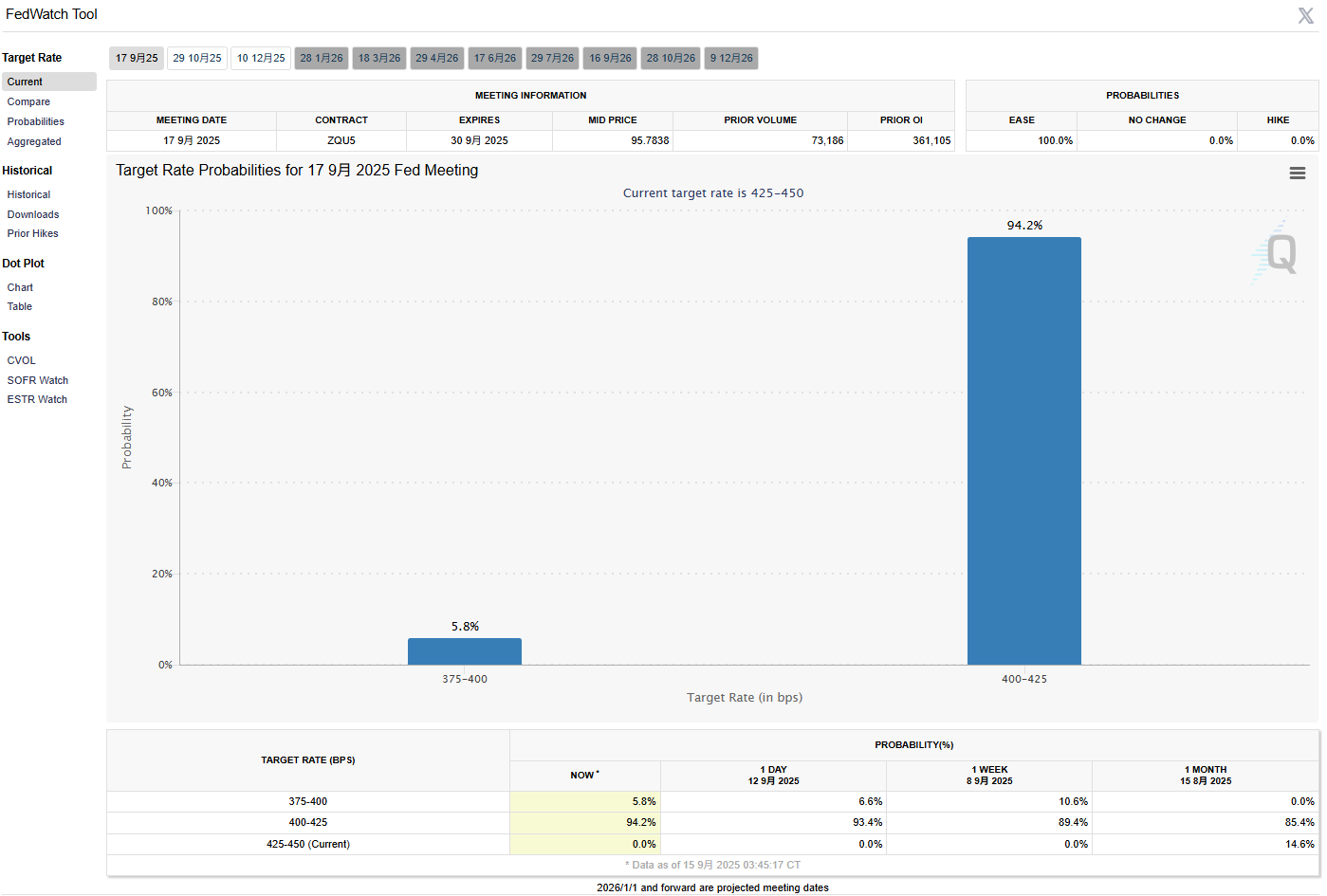

At 2 AM on September 18 (Singapore time), the Federal Reserve will announce its rate decision, having maintained the benchmark rate in the 4.25%-4.5% range for over nine months. Market consensus points to a 25 basis point rate cut, lowering the rate to 4%-4.25%. The CME Group's FedWatch tool shows that 94.2% of traders expect this magnitude. This prediction stems from multiple factors: a weak labor market, stabilizing inflation pressures, and the backdrop of a "36-hour rate frenzy" among global central banks, necessitating the U.S. to follow suit to avoid excessive strengthening of the dollar.

The Federal Reserve's caution stems from dual risks: on one hand, Trump's tariff policy could push up import prices, triggering a new wave of inflation. On the other hand, labor market data shows that job growth in August fell short of expectations, with hiring slowing down, raising concerns for the Federal Reserve about the precariousness of the "maximum employment" goal. Federal Reserve Governor Christopher Waller recently stated that if August data worsens further, he supports "more aggressive rate cuts." However, most economists expect the Federal Reserve to "proceed cautiously," with the possibility of two more 25 basis point cuts in the remaining meetings of 2025 after a September cut. A Bloomberg survey indicated that 40% of economists predict three rate cuts before the end of the year, but the median expectation is for two cuts.

Powell's remarks at the Jackson Hole meeting further reinforced this expectation. On August 22, he stated, "The balance of economic risks has begun to shift," suggesting a potential adjustment in policy stance at the September meeting. Although Powell avoided directly responding to Trump, he emphasized that uncertainties (such as tariffs) could lead to a contraction in business investment. After September 15, the Financial Times reported that the Federal Reserve would "initially proceed with caution," cutting rates to 4%-4.25% in September while remaining vigilant to address the dual risks of inflation and employment. If the rate cut exceeds expectations (such as 50 basis points), the market may interpret it as a signal of economic recession; conversely, maintaining the status quo could exacerbate tensions between Trump and the Federal Reserve.

Chain Reactions from the Stock Market to Global Trade

A Federal Reserve rate cut to 4.25% would directly stimulate a reduction in borrowing costs, benefiting real estate, consumption, and business investment. In the short term, U.S. stock market S&P 500 futures rose 0.5% following Trump's remarks, with technology stocks and cryptocurrencies leading the gains. However, this policy is not a panacea. The New York Times analysis pointed out that high interest rates have suppressed economic growth, and if rate cuts are too slow, the unemployment rate could rise further above 5%. On the other hand, inflation risks remain: if Trump's tariffs are implemented, consumer goods prices could rise, and core CPI might rebound to 3.5%.

From a global perspective, a U.S. rate cut would weaken the dollar, potentially leading to capital inflows into the cryptocurrency market, with assets like Bitcoin and Ethereum possibly experiencing short-term surges or even hitting new highs. However, it is important to note that if the Federal Reserve's statement continues to emphasize "inflation pressures," the market may play out a "buy the expectation, sell the fact" scenario, meaning a quick rise followed by a rapid decline.

This article is for informational sharing only and does not constitute any investment advice for anyone.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=7JmRjnl3w

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.