Original author: Eric, Foresight News

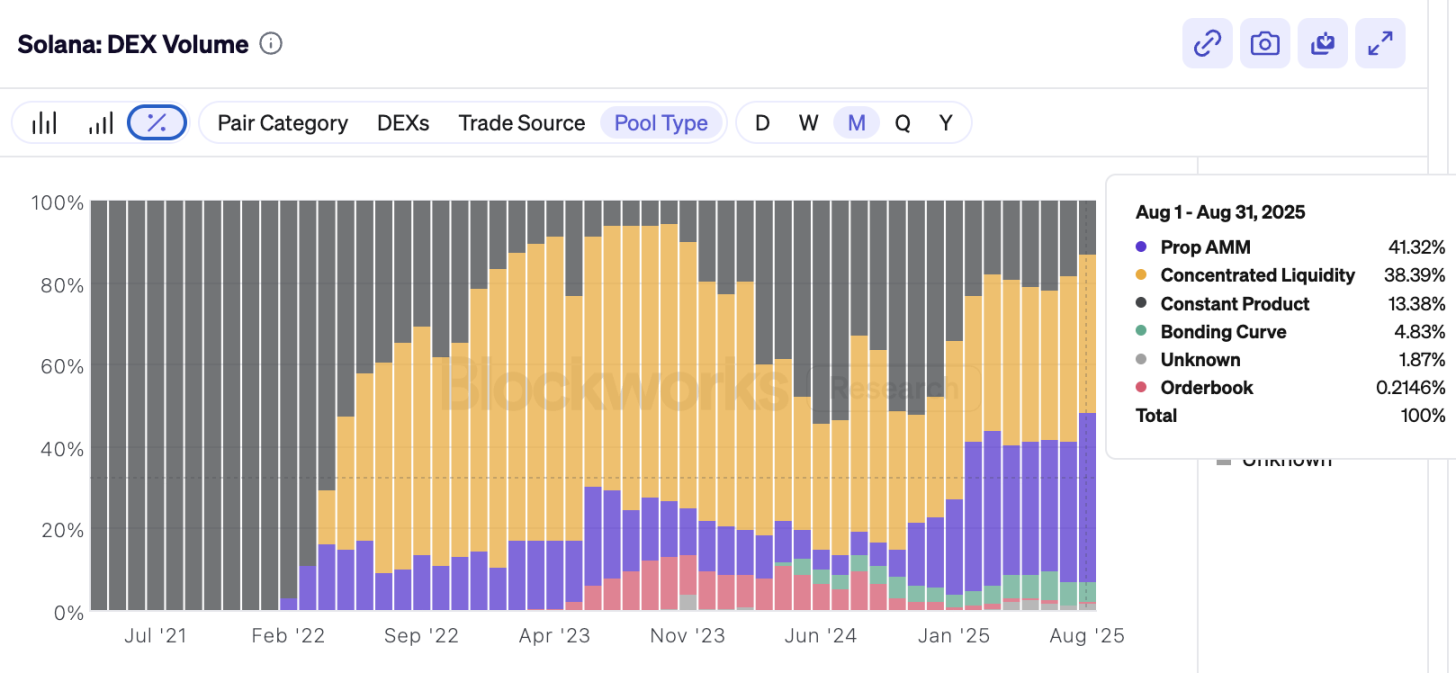

At the beginning of this year, proprietary AMMs on Solana sparked much discussion in the English community. Initially, this was due to the discovery of several previously unheard-of AMMs frequently appearing in Jupiter's routing. These AMM projects lacked front-end websites, had no visible entry points for adding liquidity, and received no promotion. Over time, the trading volume routed to these "unknown" AMMs grew rapidly, and they have now become the largest category of DEX on Solana.

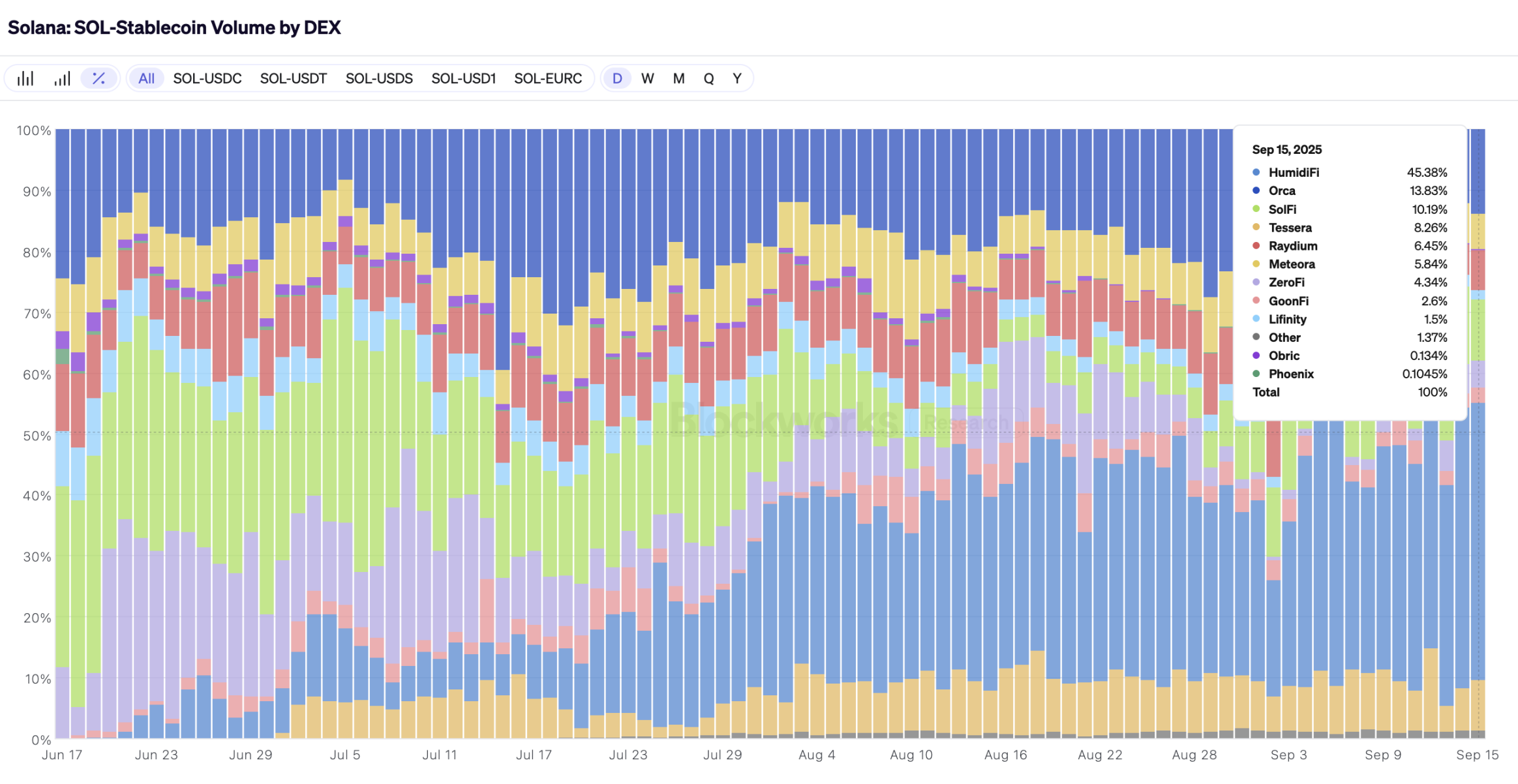

According to data from Blockworks, on September 6 local time, proprietary AMMs, including HumidFi, SolFi, Tessera, GoonFi, ZeroFi, and Obric, accounted for over 70% of the trading volume in SOL and stablecoin transactions on Solana DEX. The share of proprietary AMMs in all transactions on Solana has also reached first place, exceeding 40%.

The growth of proprietary AMMs represents a significant encroachment by professional market makers in the AMM space.

The original purpose of automated market makers (AMMs) was to solve the market-making problem on-chain. In exchanges, user and market maker orders together create trading and price fluctuations. However, achieving order book efficiency on-chain comparable to that of exchanges is challenging. AMMs, based on inverse proportional functions, became almost the only viable solution to this problem. Participants only need to deposit two types of tokens in a liquidity pool in a certain ratio to provide liquidity for trading and earn transaction fees.

Since their launch, AMMs have continuously evolved, from automatically covering all price ranges to allowing users to choose liquidity ranges, and now to protocols that help users move liquidity coverage. The core inverse proportional function of AMMs is also being replaced by more complex functions.

Most of these improvements target two goals: reducing impermanent loss and optimizing execution prices. However, as a public AMM protocol, there is always an invisible ceiling: the protocol cannot arbitrarily adjust liquidity but must do so according to its settings. Based on this premise, the idea of establishing a non-public AMM that can flexibly adjust liquidity began to take shape.

Lifinity, launched in January 2022, is one of the earliest projects to introduce such a mechanism, claiming to be an oracle-based AMM. Currently, most proprietary AMM projects are institutionally operated (e.g., SolFi operated by Ellipsis Labs and Tessera V operated by Wintermute), so the actual pool liquidity and market-making mechanisms are not public. We will explore this through Lifinity, which has disclosed some information.

The two main features of proprietary AMMs are: oracle-based pricing and flexible liquidity adjustment. For ordinary AMMs, their pricing is given after simulating trades through the corresponding liquidity pool, so the actual price usually includes the slippage that would occur. In contrast, proprietary AMMs directly use oracle pricing, which in most cases provides weighted real-time prices that do not include slippage from specific liquidity pools, resulting in better prices.

Proprietary AMM trades are primarily executed through aggregators, and the quotes provided directly to the aggregator by oracles are generally better than those from ordinary AMM pools. After securing orders with better quotes, the flexible liquidity adjustment capability of proprietary AMMs comes into play. In publicly accessible AMMs, the rules for adding liquidity are fixed. For example, in Uniswap, even though it now allows users to choose their own liquidity ranges, there can still be situations where high trading slippage occurs due to insufficient liquidity in a certain price range.

In proprietary AMMs, deployers can concentrate all liquidity near the real-time price during trades to achieve near-zero slippage. This is also the liquidity adjustment method revealed by Obric in its documentation.

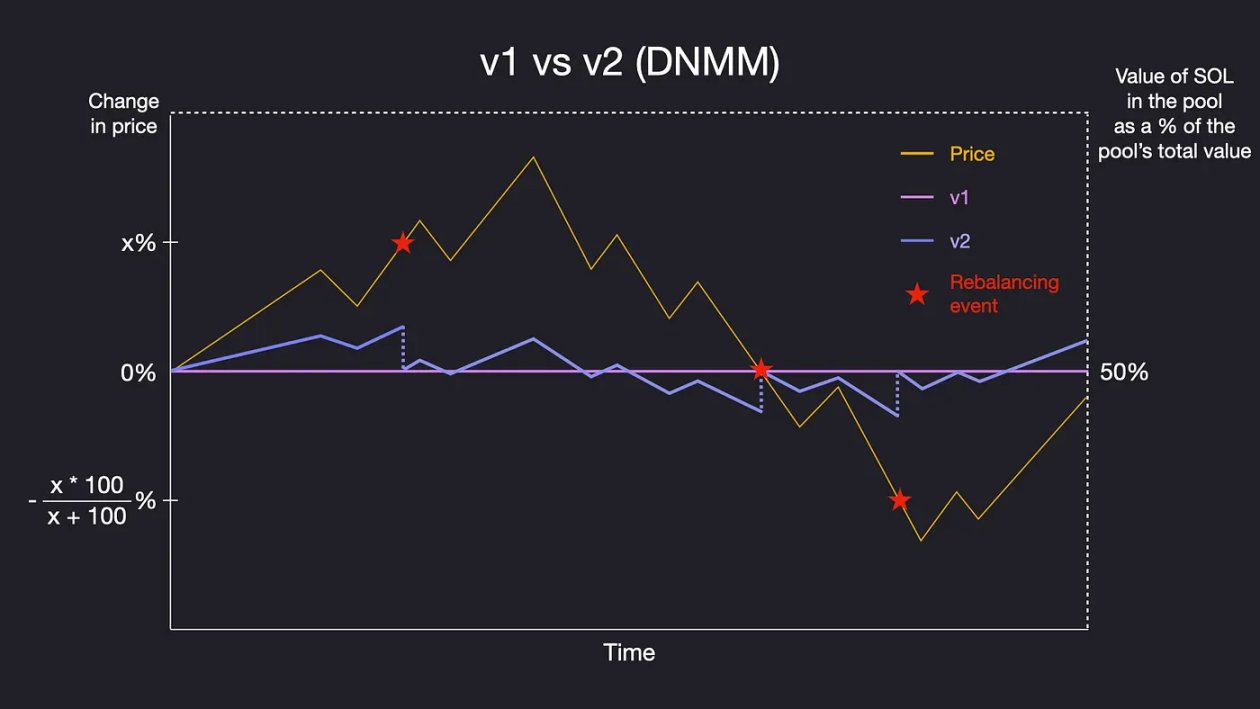

This method of concentrated liquidity is not the only trick of proprietary AMMs, as theoretically, public AMMs can also design mechanisms to concentrate liquidity during trade execution. However, the "killer feature" of proprietary AMMs is their non-public market-making strategy. The market-making strategy in Lifinity v2 is referred to as "Delta Neutral Market Maker," which fixes the number of SOL in the SOL/USDC liquidity pool during the initial phase rather than maintaining an equal value between SOL and USDC (as in Lifinity v1). The liquidity pool actively buys or sells SOL to trigger balance in the liquidity pool, rather than being constrained by oracles and arbitrageurs, achieving proactive low buying and high selling. Unlike ordinary AMMs that need to balance liquidity pools through arbitrage trading, the flexibility of proprietary AMMs allows market-making itself to generate profits rather than incur impermanent losses.

According to data from Lifinity's official website, its SOL/USDC liquidity pool boasts an annualized yield of 1923.68%, with market-making profits even exceeding trading fee profits, reaching 1049.2%.

More proprietary AMMs developed by professional market makers may have better liquidity and more complex balancing algorithms, but since they are not public, we cannot know for sure. Compared to researching how to add liquidity in public AMMs to maximize profits, building proprietary AMM liquidity pools is clearly a more cost-effective approach.

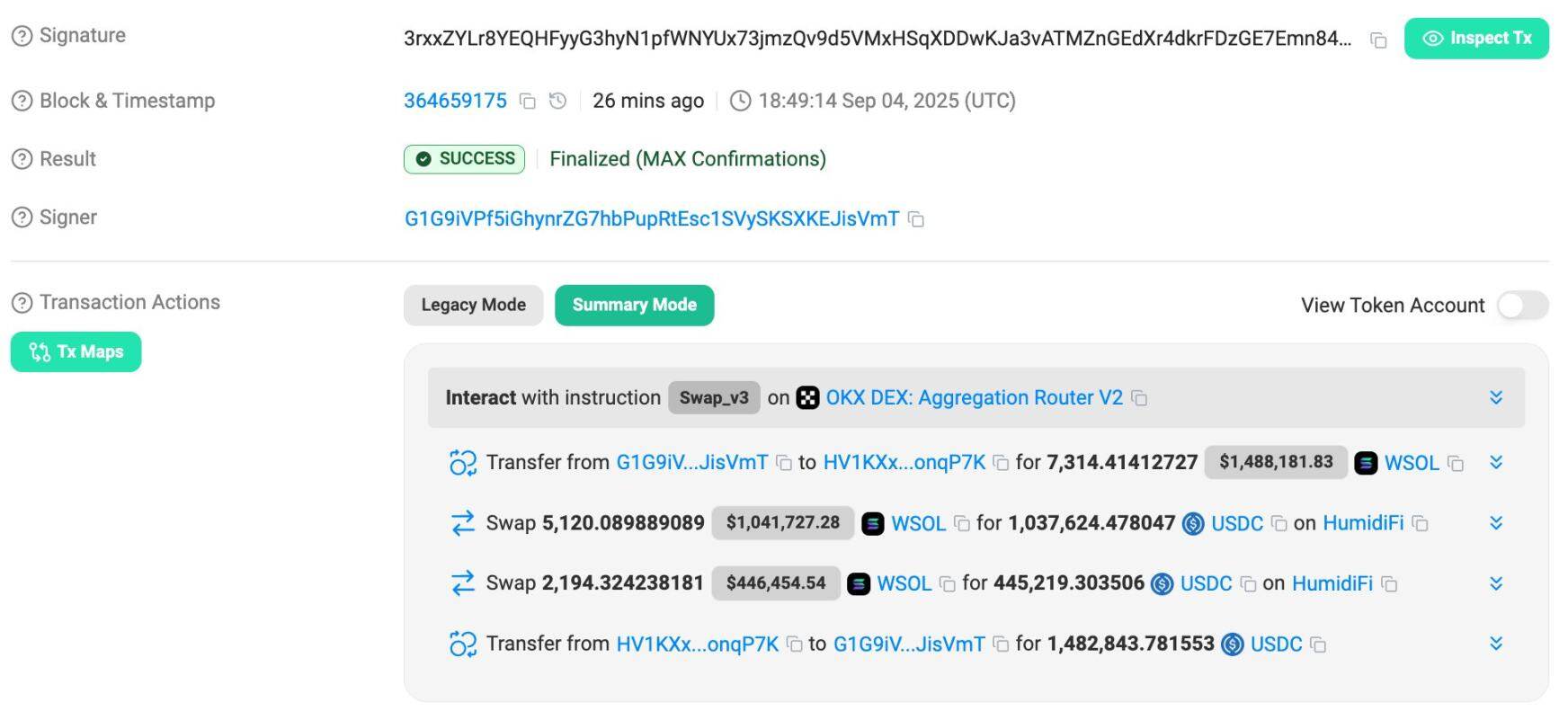

Currently, the largest proprietary AMM on Solana, HumidFi, recently showcased a transaction on X where nearly $1.5 million worth of SOL was sold for USDC. This transaction sold 7314.41412727 SOL, receiving 1,482,843.781553 USDC, with the price of SOL ranging between 202.67 and 202.87 during the transaction. Even using the highest price of 202.87, the total "loss" from transaction fees and slippage was less than 0.07%, which is an astonishing figure on-chain.

All of this is made possible by some unique mechanisms inherent to the Solana chain.

Helius's report points out that proprietary AMMs utilize lightweight development frameworks like Pinocchio and even sBPF Assembly to minimize the computational load required for updating parameters, allowing them to refresh quotes at a cost that is almost negligible compared to the value of the transaction itself. In the widely used HumidFi on Solana, updating a quote consumes only 143 CU, costing less than $0.002. In comparison, trading through Jupiter consumes approximately 150,000 CU.

Currently, the most used Solana client, Jito's auction engine, determines transaction priority based on tips per CU. Oracle updates that consume fewer CUs can offer higher tips per CU, naturally receiving higher priority. This gives proprietary AMMs a speed advantage in price updates over ordinary AMMs. This is not only a key to proprietary AMMs capturing business from ordinary AMMs but also a prerequisite for proprietary AMMs to use oracles for nearly real-time quote updates.

Additionally, Solana's extremely high transaction confirmation speed and lower costs provide an excellent environment. If this were on Ethereum, merely frequently updating oracle prices could incur enormous costs.

Besides the transaction confirmation mechanism, the high trading volume of DEX aggregators on Solana also allows the advantages of proprietary AMMs to be quickly realized.

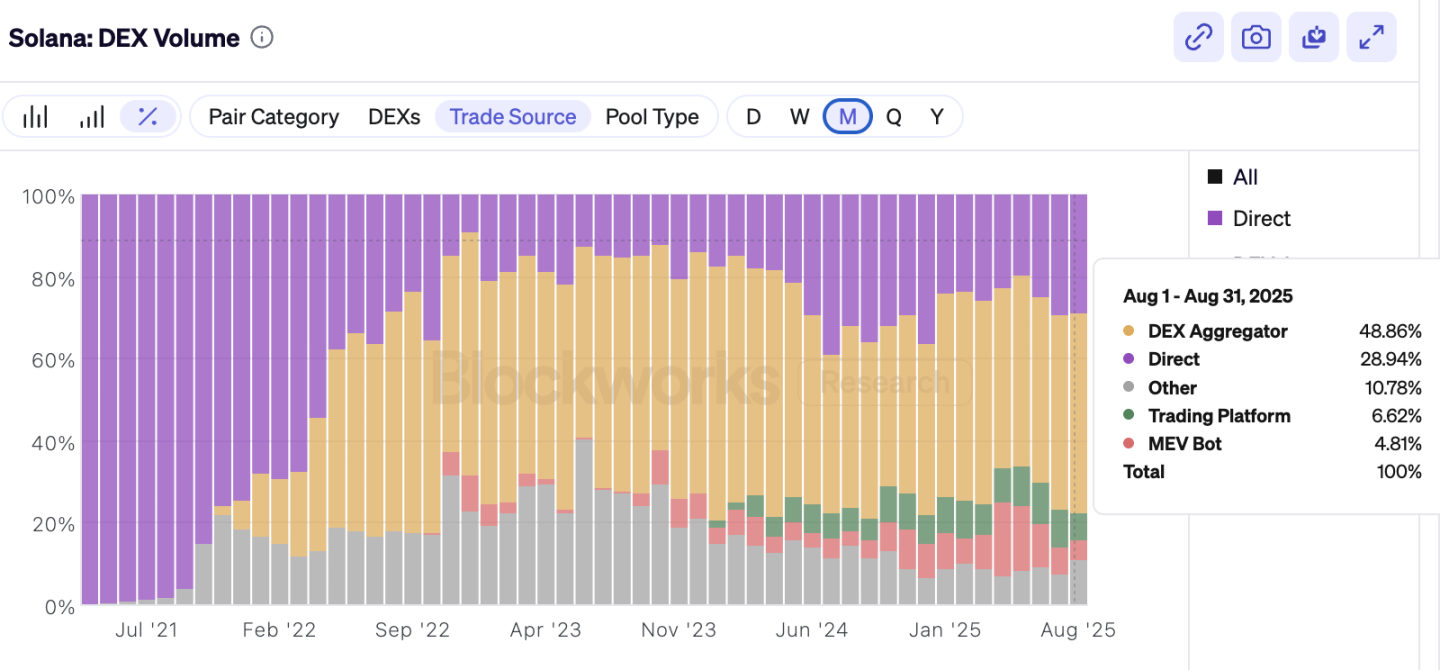

Blockworks data shows that transactions executed through DEX aggregators on Solana approached 50% in August, while the same period saw transactions directly through aggregators on Ethereum slightly above 15%. Since most proprietary AMM transactions are routed through aggregators, if the frequency of aggregator usage is low, the advantages of high-frequency price updates, low slippage, and unique market-making algorithms are relatively difficult to manifest.

Blockworks researcher Carlos Gonzalez Campo predicts that in the future, trading of "mature" assets (i.e., assets that do not experience sustained volatility) may increasingly occur through proprietary AMMs, while trading of new or long-tail assets will still be executed through ordinary AMMs due to their larger price fluctuations, making it difficult for professional market makers to intervene. In fact, some larger market cap meme tokens on Solana have already begun to be routed to proprietary AMMs for execution.

Currently, many materials categorize proprietary AMMs as dark pools, but there is an essential difference between the two. Although the characteristics of liquidity pools make it difficult for MEV trading to intervene, transactions executed by proprietary AMMs remain public and transparent; it is just that the mechanism design for their liquidity pools is not disclosed. However, this also reflects, to some extent, that blockchain is gradually losing its loyalty to "decentralization" and "permissionless" principles. After the collapse of extreme idealism, sacrificing transparency for efficiency is beginning to take root in the mature track of Web 3.

Nevertheless, we still welcome the challenge that DEX poses to exchanges. As Eugene Chen, CEO of Ellipsis Labs operating SolFi, stated, the lowest cost way to buy Bitcoin on Coinbase now is to bring USDC to the Solana chain to buy cbBTC and then transfer cbBTC back to Coinbase.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.