The essence of trading is survival, and only then comes profit. Therefore, before each operation, think carefully about whether your actions are reasonable and whether your capital is safe. You need to develop a trading mindset that belongs to you, continuously optimizing and improving it. Although the suggestions from the crypto circle scholars may not make you rich overnight, they can help you stay in the game. Only those who survive in the crypto space for the long term and persist until the end can achieve the results they desire. I hope you understand this.

Don't forget, the darkest moments are often just before dawn. On the road to pursuing your dreams, you are never alone; you still have me.

I am a warrior in the crypto circle, always protecting the retail investors. I wish my fans financial freedom by 2025. Let's work hard together!

Crypto Circle Scholar: October 10, 2025, Ethereum (ETH) Latest Market Analysis Reference

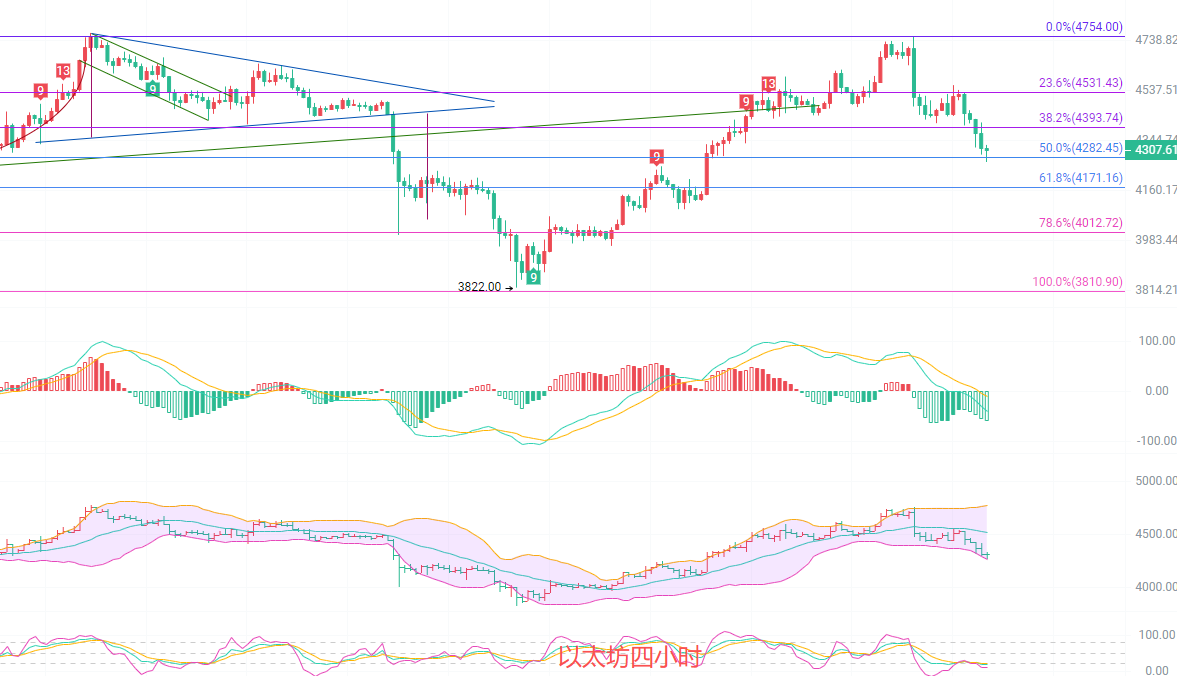

The current price of Ethereum is 4310. It is now 1:30 AM Beijing time during the holiday period. The three southern points are 4700, 4500, and last night's 4400 for your reference. The practical details have been updated by the author for reference. If Bitcoin drops back to 115000, where will Ethereum go? It is highly likely to test the 3800 support level. With more and more whales entering the market, small fluctuations are inconsequential, and large fluctuations will become the norm. We need to be mentally prepared for this and avoid any complacency.

Before the article was published, the daily K-line reached a high of 4530 and a low of 4262. It has already fallen below the EMA30 support of 4365 and is now above the EMA60 support of 4230. The MACD divergence has been horizontal for a long time, with DIF and DEA contracting above the 0 axis. If the market further declines and breaks below the EMA60, then DFI and DEA will form a death cross. Currently, the K-line is blocked by the Bollinger Bands and has not broken below 4300. If it loses 4300 after the 8 AM close, the market will likely continue to decline.

The four-hour K-line has lost the EMA120 trend line at 4385, with consecutive bearish candles. The EMA trend indicator has started to alternate and expand downwards. The MACD is shrinking and moving downwards, with a clear increase in bearish positions. DIF and DEA have also fallen below the 0 axis. Additionally, the K-line has touched the lower Bollinger Band at 4260 three times, indicating that the bearish trend will continue. Friends in the south should pay attention to the first support at 4230 and the second support at 4175. If these levels cannot be effectively broken, consider taking profits on the way down and either look for short-term upward opportunities or wait for a chance to continue the downward trend after a pullback.

Short-term reference: Safety first. Remember that the market is never 100% certain, so always set stop-losses. Safety first; small losses and big gains are the goal.

For upward testing, the entry point is 4230 to 4180, with a defense at 4130, stop-loss at 50 points, and a target of 4280 to 4330. If broken, look at 4360 to 4400.

For downward testing, the entry point is 4380 to 4420, with a defense at 4470, stop-loss at 50 points, and a target of 4340 to 4300. If broken, look at 4250 to 4180.

Specific operations should be based on real-time market data. For more information, you can consult the author. There may be delays in article publication, so the suggestions are for reference only, and risks are borne by you.

This article is exclusively contributed by the Crypto Circle Scholar and represents the scholar's unique perspective. In-depth research has been conducted on BTC, ETH, DOGE, DOT, FIL, EOS, etc. Due to the timing of the article's release, the above views and suggestions may not be real-time and are for reference only. Risks are borne by you. Please indicate the source when reprinting. Manage your positions reasonably and avoid heavy or full positions. The scholar also hopes that all investors understand that the market is always right. If you are wrong, you should reflect on where the problem lies. Do not let the profits that should be yours slip away. There is no need to be smarter than the market. When a trend comes, respond to it; when there is no trend, observe and remain calm. It is not too late to act once the trend becomes clear. Tomorrow's success stems from today's choices. Heaven rewards diligence, the earth rewards kindness, humanity rewards sincerity, business rewards trust, industry rewards excellence, and art rewards passion. Gains and losses often occur unexpectedly. Develop the habit of strictly setting stop-losses and take-profits for each trade. The Crypto Circle Scholar wishes you happy investing!

Warm reminder: The above content is solely created by the author of the public account. The advertisements at the end of the article and in the comments section are unrelated to the author. Please discern carefully. Thank you for reading.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.