The real "Alt Season" is unfolding in the crypto stock market.

Author: Alana Levin

Translation: Deep Tide TechFlow

There are many questions about whether this round of the crypto cycle will see an "Alt Season." Some are looking towards January 2024 or 2025, hoping for a significant appreciation of non-Bitcoin crypto assets (altcoins), even reaching historical highs.

In past cycles, a significant rise in Bitcoin's price typically triggered similar performances in many long-tail crypto assets, and sometimes these assets even outperformed Bitcoin. However, this pattern seems to have not repeated in recent years. Currently, Bitcoin's market share has reached 58%, showing a steady upward trend since November 2022.

So, will this cycle skip the "Alt Season"? Or is the "Alt Season" yet to come? Or perhaps… the "Alt Season" is actually quietly unfolding in a completely different market, and we haven't noticed?

My intuition leans towards the last scenario. The real "Alt Season" is taking place in the crypto stock market.

What are the typical characteristics of an "Alt Season"?

Price increases attract new capital → The question is, where does the new capital come from?

Price increases lead to profit rotation → The question is, who is profiting and where is the profit being redeployed?

Indeed, there is new capital looking to enter the crypto space today, but this funding is more from institutional investors rather than retail. In contrast, retail investors are often quick early adopters, while institutional investors are more cautious and typically require external legitimacy as a driving force. And this legitimacy is happening: In 2024, the U.S. Securities and Exchange Commission (SEC) approved Bitcoin and Ethereum spot exchange-traded funds (Spot ETFs); SEC Chairman Atkin recently announced "Project Crypto"; Nasdaq CEO Adena Friedman has also publicly supported the tokenization of equities. Similar examples abound.

Institutional investors are pouring in fresh capital, and I suspect that most of this capital is directed towards crypto stocks rather than crypto assets. The stock market is more familiar and accessible for institutions. Institutional investors already have a well-established operational system (including custody, compliance processes, dealer relationships, etc.), while directly purchasing crypto assets may require entirely new capability building. Moreover, buying stocks falls within their responsibilities—whereas directly purchasing crypto tokens (especially long-tail assets) may exceed their scope of duties.

Therefore, institutions are investing in crypto stocks or crypto-related stocks. For example:

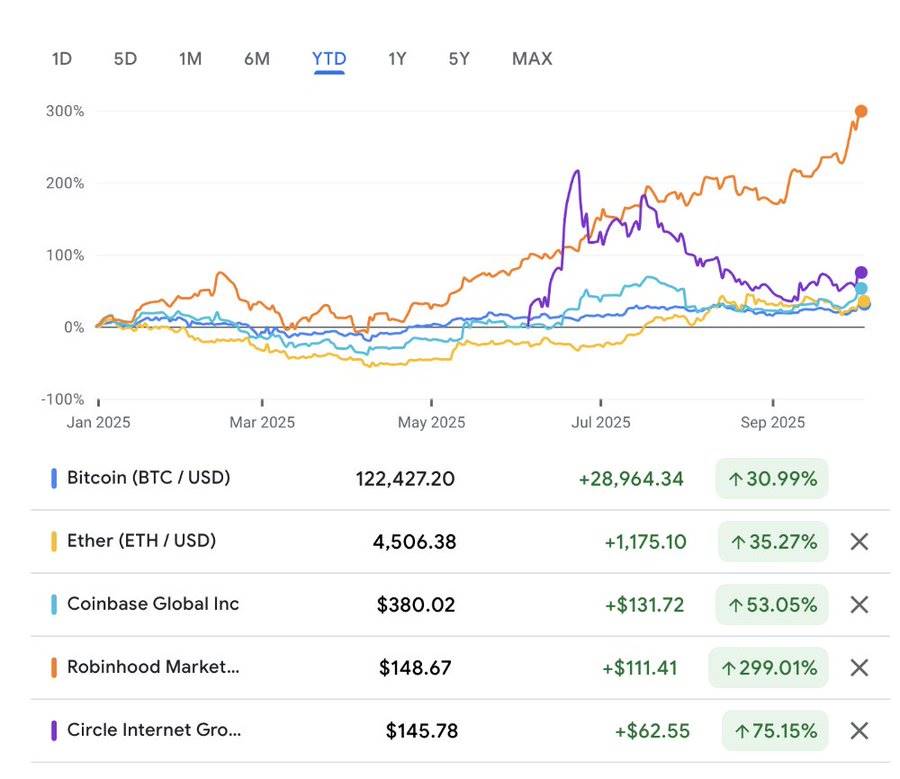

Coinbase is up 53% year-to-date;

Robinhood is up 299%;

Galaxy is up 100%;

Circle has risen 368% since its IPO in June (up 75% based on the closing price on the first trading day).

In contrast, Bitcoin is up 31%, Ethereum is up 35%, and Solana is up 21%. The performance of crypto stocks is clearly more eye-catching.

If we look at Bitcoin's performance since it bottomed out on December 17, 2022, the situation is similar.

There is reason to believe this trend will continue. A series of crypto stock IPO plans will be launched in the future, and more late-stage companies may submit listing applications in the coming years.

Like a typical "Alt Season," not all assets will perform well. I expect some capital rotation, such as traders possibly taking profits from overvalued assets (like CRCL, which currently has a price-to-sales ratio of 26) and redeploying funds into other assets.

In the crypto market, we often see different hot spots rotating, such as the market shifting from DeFi assets to gaming tokens, and then to AI-related tokens. The crypto stock market may also be similar, with an "Alt Season" potentially seeing funds rotate from stablecoin-related stocks to exchange stocks, and then to digital asset reserve companies (or other trends).

I believe that the crypto stock altcoin season may ultimately look more like a historic altcoin season rather than any future altcoin season in the crypto-native market, for several reasons:

Asset concentration. Currently, only a few stocks offer cryptocurrency investment. This is similar to past cryptocurrency cycles when buyers found attractive tokens that might number fewer than 100. Notably, this is in stark contrast to today's crypto-native market, which has millions of tokens, leading to a more dispersed deployment.

Leverage utilization. In the last cycle, many crypto-native lending platforms collapsed one after another, and we have yet to see their reconstruction. However, stock investors can use leverage, which means the market's boom could be more pronounced (but the crash could also be more severe).

We may see an "Alt Season" for crypto-native assets in the future. But this will take time, as new marginal capital sources need to gradually build the operational capabilities to support investments in crypto assets.

Therefore, for now, this may not be the altcoin season many are looking forward to—but in any case, we are in an altcoin season.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.