Author: Oliver, Mars Finance

Prologue: "The Big One is Here"

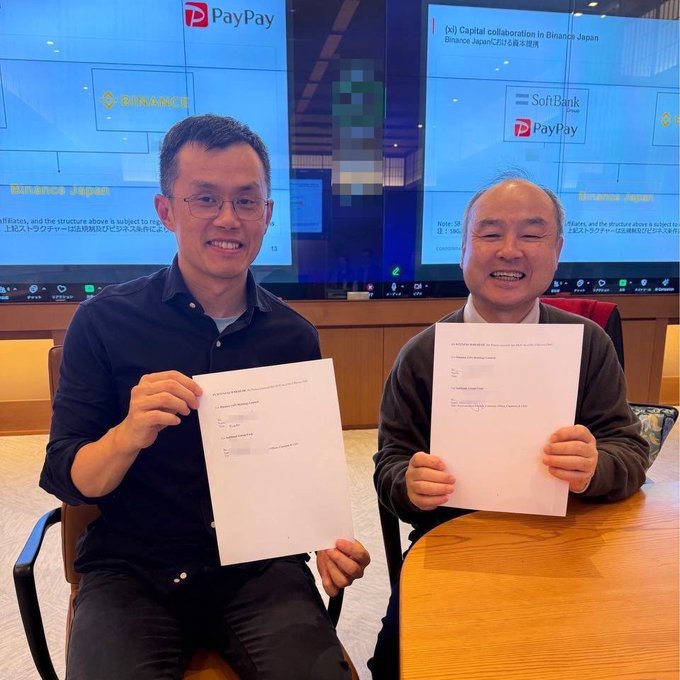

Before Binance co-founder He Yi's succinct "The Big One is Here" ignited social media, a more critical meeting had already taken place beneath the surface in Tokyo. On one side was Masayoshi Son, the architect of the SoftBank technology empire, and on the other was Changpeng Zhao (CZ), who was then at the helm of the world's largest cryptocurrency exchange.

This was not an ordinary business visit. When titans of traditional tech finance and the "rule makers" of the crypto world sit at the same table, their discussions transcend mere business cooperation and delve into a power game concerning the future landscape of digital finance over the next decade.

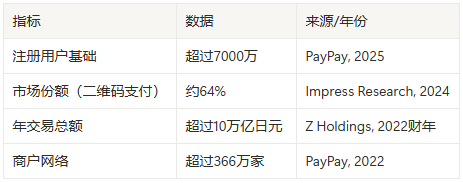

On October 9, 2025, the mystery was unveiled. PayPay, Japan's national-level payment application under SoftBank, announced the acquisition of 40% of Binance Japan's equity. The news sent shockwaves through the industry. This was not a simple financial investment but a clear signal: a grand plan had been meticulously set in motion, aiming to silently embed the narrative of Web3 into the heart of the world's third-largest economy, leveraging PayPay's absolute trust from over 70 million users.

This thunderclap marked Binance's "return of the king" coronation atop the regulatory ruins; it was PayPay's survival battle to resist disruption and actively embrace the future; and it was a significant move by Masayoshi Son in the global digital asset chess game. This article will deeply dissect the alliance's front and back, analyzing how it reshapes the crypto financial landscape in Japan and globally.

Alliance: A Power Balance Named "Symbiosis"

The official definition of this collaboration is a "capital and business alliance," with PayPay listing Binance Japan as an "equity method affiliate." Setting aside these obscure business terms, its essence is a "blood alliance"—the financial statements of both parties will be interconnected, with interests deeply bound; one thrives, all thrive; one suffers, all suffer. This structural design ensures that PayPay's participation is not a superficial business trial but a solemn commitment to firmly bind its core strategy with the future of crypto assets.

The most direct outcome of the alliance is the establishment of a "frictionless highway" to the crypto world for the ordinary Japanese public. PayPay users can easily purchase cryptocurrencies like Bitcoin and Ethereum using their familiar app balance; after selling, the resulting yen can instantly return to their wallets for convenience store shopping or peer-to-peer transfers.

The brilliance of this design lies in its ability to fundamentally change the "user mindset" around crypto assets through extreme convenience and trust endorsement. As Takeshi Chino, General Manager of Binance Japan, stated, this move aims to "make Web3 more easily accepted by the entire nation." It transforms what was once viewed as a high-risk, high-threshold investment behavior into a simple, safe, and seamless daily operation akin to online bill payments. This is not only an optimization of user experience but also a reshaping of market perception.

Return: Binance's Long Road to Redemption

Behind today's handshake lies a past of conflict. Binance's return to Japan has been far more tortuous than imagined.

In 2018 and 2021, Japan's Financial Services Agency (FSA) issued two public warnings to Binance, with stern language pointing directly to its provision of services to Japanese residents without obtaining a license. This marked the collision of Binance's early "barbaric growth" global expansion model against the mature regulatory framework of G7 countries. The FSA's stance was clear and firm: compliance is the only passport in Japan.

Realizing that the old model was no longer viable, Binance's strategy underwent a 180-degree shift. In November 2022, Binance announced a 100% acquisition of the locally registered crypto asset exchange Sakura Exchange BitCoin (SEBC), which had obtained FSA registration. The value of this acquisition lay not in SEBC's user base or technology but in its precious FSA license—this was the only ticket to re-enter the Japanese market. This was a textbook "backdoor listing," representing Binance's strategic evolution from challenging rules to respecting and utilizing them.

If acquiring SEBC solved the "legitimacy" issue, allowing Binance to return to the table, then the alliance with PayPay addressed the ultimate challenge of "market penetration." It transformed Binance's role from an isolated licensed exchange to a "quasi-national-level" application deeply integrated with local financial infrastructure. This strategy of "first acquiring a compliant entity, then binding with a local traffic giant" may well become a standard model for Binance's future endeavors in other mature markets.

The Payment King's Offensive and Defensive Battle

Before analyzing PayPay's motivations, it is crucial to clarify a key fact: despite the similar names, PayPay is by no means a copycat or subsidiary of the American payment giant PayPal. It is a homegrown Japanese tech behemoth created by SoftBank and Yahoo Japan (now LY Corporation). In Japan, its status is comparable to China's Alipay or WeChat Pay, and in some scenarios, its penetration rate is even more staggering.

From high-end department stores in Tokyo's Ginza to ramen shops on street corners, and even beside donation boxes at some temples, you can see PayPay's iconic red QR code. For young people in Japan, "I PayPay you" has long replaced cash, becoming a common phrase for splitting bills among friends. It can be said that PayPay is not just a payment tool; it has deeply integrated into the social fabric and daily life of the Japanese people.

Why does such an undisputed "king" need an "outsider"? The answer lies in anxiety about the future and a desire for growth.

Despite the impressive data, PayPay's executives are acutely aware that the payment business is a high-traffic, low-profit endeavor. Seeking new, higher-profit growth points is a necessary choice. Crypto asset trading represents such an enticing gold mine. By collaborating with Binance, PayPay can easily tap into this blue ocean without bearing the enormous costs and risks of building a secure, compliant, high-liquidity exchange from scratch, thus achieving revenue diversification.

This is also a defensive battle for survival. For payment networks, the greatest long-term threat is the emergence of a new technology that is cheaper and more efficient. Web3, stablecoins, and decentralized finance represent such potential disruptive forces. PayPay's CEO Masayoshi Yanase has emphasized the need to provide users with "convenience and security." Rather than waiting to be disrupted, it is better to actively incorporate disruptors into its ecosystem. By integrating crypto assets into its platform, PayPay ensures a transition to Web3 finance that is a "controllable evolution" occurring within its ecosystem, rather than a "fatal revolution" from the outside.

At the same time, in Japan's "super app" war, this move is also a decisive preemptive strike. Faced with competitors like Rakuten and LINE, who are also committed to building large ecosystems, PayPay has secured its position as the "number one player" in Japan's Web3 race by deeply binding with the world's leading Binance, forcing competitors to respond hastily.

Masayoshi Son's Global Web3 Ambitions

PayPay's decision must be viewed within the global strategic chessboard of its parent company, SoftBank Group. When linking this alliance to previous market rumors about SoftBank's intention to make a significant investment in stablecoin giant Tether (the issuer of USDT), Masayoshi Son's grand layout becomes clear.

The USDT issued by Tether is the "hard currency" of global cryptocurrency trading, essentially the "digital dollar," and its importance is self-evident. If SoftBank successfully acquires a stake in Tether, it will mean significant influence over the most critical infrastructure layer of the global crypto economy—the settlement asset.

This is a classic vertical integration strategy cleverly applied to the digital asset field. SoftBank's intention is to influence the "value scale" of the global crypto world through Tether while simultaneously controlling the "distribution channel" that precisely delivers its and other Web3 services to 70 million consumers in the world's third-largest economy through the alliance with PayPay and Binance Japan. This series of actions indicates that, in Masayoshi Son's view, Web3 and digital assets are core pillars as important as artificial intelligence, determining the global economic landscape for the next decade.

Integration Has Arrived, the Test Has Just Begun

The alliance between Binance and PayPay signifies far more than a commercial transaction. It is a reflection of an era, a powerful declaration: the future of finance is not a zero-sum game between the crypto world and traditional finance, but an inevitable deep integration between the two.

This collaboration, on an unprecedented scale, normalizes digital assets, bringing them from a specialized, niche investment circle into the daily lives of tens of millions. It paints a highly valuable blueprint for the "TradFi + Crypto" cooperation model globally.

However, the future is not without challenges. The success or failure of this grand narrative will depend on the evolution of several key variables. First, there is the subsequent reaction of the Financial Services Agency (FSA) of Japan. Will the regulatory body choose to cautiously allow a deep binding of a systemically important payment tool with a highly volatile asset market, or will it impose stricter restrictions? Second, what will be the real direction of user behavior? Can the convenient entry translate into large-scale, sustainable adoption, especially during market downturns? How will conservative Japanese investors react? Finally, how will competitors respond? In the face of PayPay's preemptive move, how will giants like Rakuten and LINE collaborate with other crypto forces to enter the fray?

The foundation for the grand edifice has been laid, but the real test has only just begun.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.