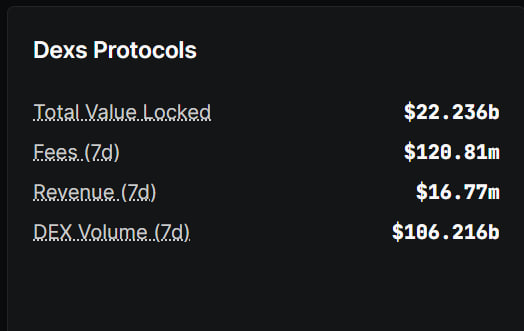

The DEX AMM space is currently the largest category in DeFi by fees generated, roughly $120M over the last 7 days, compared to ~$75M from perp DEXs.

There is a huge demand for providing liquidity on the DEXes given that LPs generate more than $6B in fees per year. I genuinely believe that the next major unlock in DeFi will be structured LP strategies that abstract away complexity for average users, similar to how @ethena_labs (ethena generates $450m fees per year) simplified and tokenized the basis trade. We’ve already seen early proof of this on perp DEXs through products like JLP, HLP, LLP, etc.

Some of these strategies will be built on top of the upcoming @0xfluid DEX v2, which is launching this month, and which will offer LPs extreme flexibility, tooling, and capital efficiency - capabilities not previously available in DeFi or in TradFi/CeFi.

Users will be able to create very complex and very custom pay off structures, pair trading strategies, delta or gamma hedging, and so on.

DEX AMM LPing is a very complex and competitive market, and it will be exciting to see what kind of strategies emerge from DEX v2.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.