On November 18th at noon, the Mt. Gox cold wallet, which had been silent for 8 months, suddenly made a big move: it transferred out over 10,000 bitcoins (worth approximately $950 million) in one go.

The market instantly exploded:

"Is it going to crash again?"

"Is it going to drop further?"

"Is this preparation for repayment?"

Don't worry, let's take a look at what impacts this event might bring.

1. What happened?

The fund flow can be divided into two parts:

Large amount (10,422 BTC): Transferred to a brand new, unmarked address (starting with “1ANkD…ojwyt”), valued at approximately $936–950 million.

Small amount (185–186 BTC): Flowing back to Mt. Gox's own Hot Wallet, valued at approximately $16–17 million.

Although there has been no official statement, on-chain behavior and historical patterns point to one possibility: preparation for the next batch of creditors' repayments.

The timing is very delicate because:

The repayment deadline has been postponed three times, with the latest deadline being October 31, 2025.

There are still 34,000–90,000 BTC of repayment tasks that remain unfinished.

📊 After the transfer, the Bitcoin balance held by Mt. Gox's trustee: approximately 34,689 BTC (about $3.1 billion).

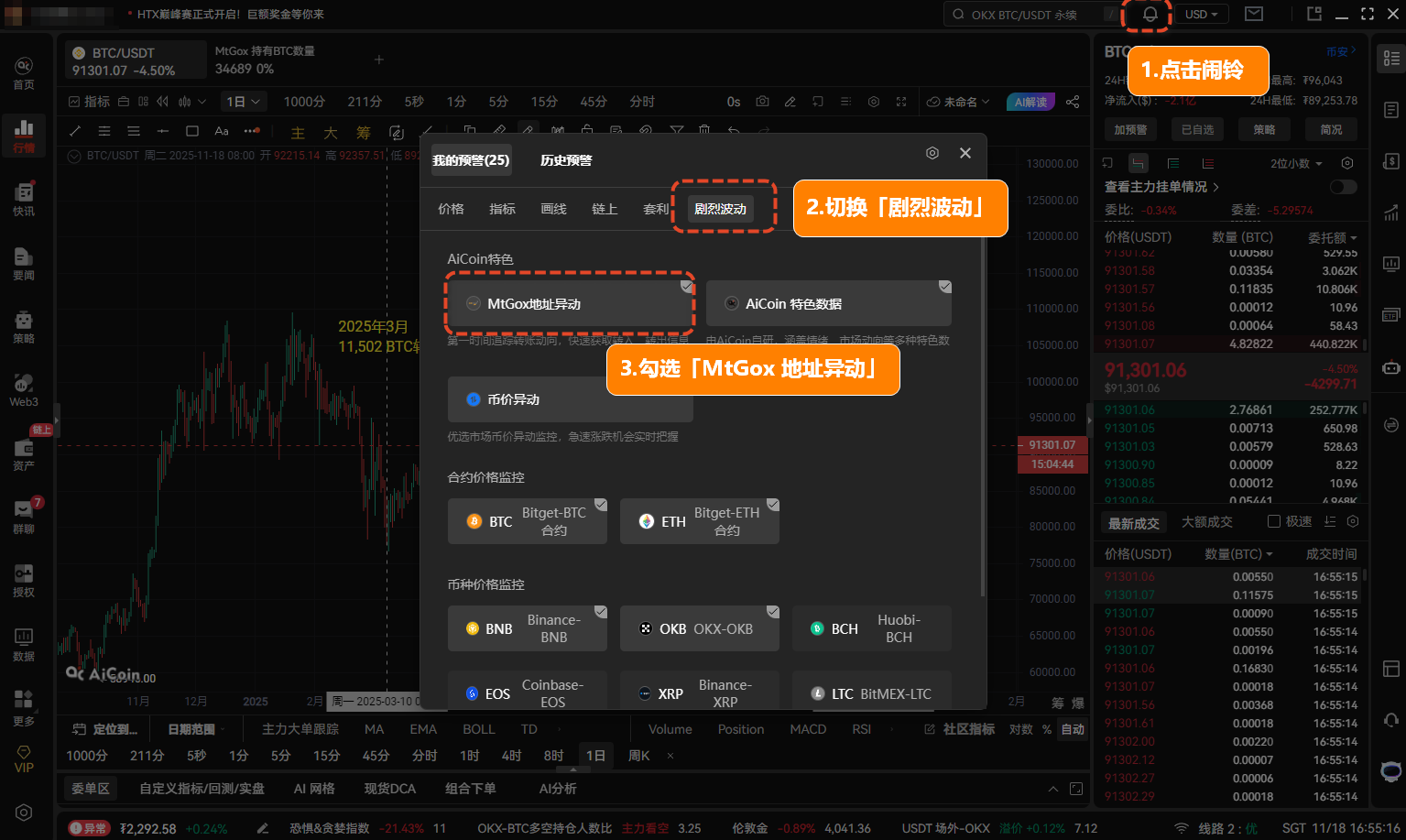

View path: AiCoin Index - MtGox BTC Holdings

2. How did the market react?

BTC price reaction: drop then panic

Before the event: BTC had already fallen below $90,000.

After the event was announced: Today's decline expanded to about -5.3%, with panic sentiment erupting, and the fear and greed index briefly dropped to 15 (extreme fear).

However, analysts pointed out:

This transfer did not flow into exchanges, it is not a sale! The main decline comes from overall market sentiment, rather than being triggered by the Mt. Gox single event.

(Compared to transfers in early 2024 and 2025)

3. Key observation points

✅ Positive signals

185 BTC flowing back to the hot wallet: Indicates that the trustee is still managing allocations, rather than directly liquidating.

Past experience: After the Mt. Gox incident triggered panic, BTC has rebounded multiple times.

⚠️ Pay attention to the following three key signals

Actual selling pressure: If there are "transfers to exchanges" (e.g., Binance, Coinbase) in the coming days, it may indicate actual selling pressure is coming.

Ongoing on-chain anomalies: Whether the “Mt. Gox Trustee” labeled wallet continues to show large anomalies; ongoing anomalies mean the manager is accelerating operations.

Official announcements: Currently, all judgments are based on on-chain inferences; whether the official releases a new round of repayment progress announcements.

Subscribe to MtGox address movements: AiCoin Alert - Severe Fluctuations - MtGox Address Movements

Join our community to discuss and become stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group: https://www.aicoin.com/link/chat?cid=10013

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.