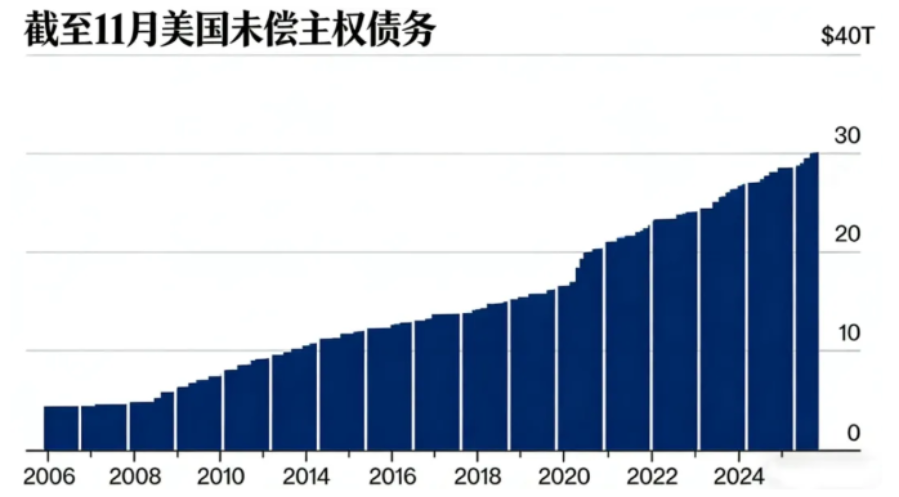

When the $30 trillion mark is officially confirmed in December 2025, the total amount of circulating national debt will have surged to $30.2 trillion over seven years, with the "total national debt" reaching as high as $38.4 trillion, rapidly approaching the statutory limit of $41.1 trillion.

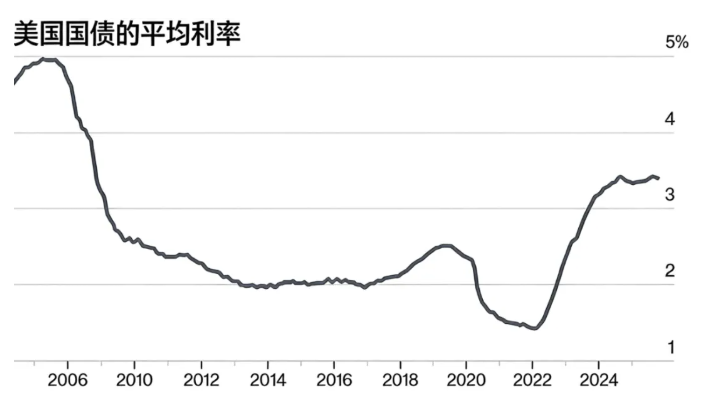

However, a more profound change is occurring beyond the scale expansion: the low-interest-rate foundation that has supported this massive debt system for decades has collapsed. Today, the annual interest expenditure of $1.2 trillion acts like a self-growing fiscal iceberg, with its enormous underwater portion quietly altering the course of the U.S. and even the global economy.

This marks a fundamental turning point—the core contradiction of U.S. finance has completely shifted from the "stock" issue of debt to the survival challenge of interest "flow."

1. Structural Loss of Control Over Debt Scale

The U.S. national debt reaching $30 trillion is an inevitable result that was anticipated yet still shocking. Its structural characteristics determine the uncontrollability of this trend.

● Steep curve of doubling in seven years: Unlike the slow accumulation over the past few decades, this round of debt expansion shows astonishing acceleration. Since 2018, the debt scale has more than doubled, meaning the debt added in the past seven years is equivalent to the total accumulated over the previous decades. The growth curve has steepened sharply, indicating that its driving factors have surpassed conventional economic cycles.

● Total debt crisis under "double leverage": The public often focuses on the $30.2 trillion of circulating national debt, while a more comprehensive "total national debt" (including internal government borrowing) has reached $38.4 trillion. This reveals two layers of the debt issue: externally, there is a need to continuously borrow new to repay old debts in the global market; internally, trust funds like Social Security have effectively become the government's "forced creditors," locking the fiscal maneuvering space in a double bind.

● Real pressure approaching the statutory ceiling: The current debt level is just a step away from the statutory limit of $41.1 trillion. This means that it is almost foreseeable that, in the near future, Washington will once again experience a fierce political deadlock over the "debt ceiling." The debt issue is accelerating its spillover from the economic realm, becoming a trigger for a normalized political crisis.

2. Dual Core Drivers of Debt Frenzy

The steep growth of debt is the result of two crises in relay: one is the sudden external pandemic shock, and the other is the internal policy storm triggered by proactive responses to inflation.

● Legacy of "wartime finance" from the pandemic: In 2020, to cope with the economic shutdown, the U.S. initiated "wartime-style" financing, issuing $4.3 trillion in national debt in a single year, with a fiscal deficit exceeding $3 trillion. This strong medicine stabilized the economy but also permanently raised the debt baseline, akin to the "false fat" that is hard to dissipate after injecting a large amount of hormones into the body.

● "Chronic strangulation" in a high-interest environment: To extinguish the fire of inflation, the Federal Reserve rapidly raised interest rates, completely changing the engine of debt growth. All new and rolling debt issued by the Treasury must bear interest rates far higher than in the past. BNP Paribas points out that high interest rates have made interest costs themselves a core factor exacerbating the debt problem. This means that debt growth has shifted from relying on external "blood transfusions" (new deficits) to a self-circulating model relying on internal "blood production" (interest capitalization).

● Formation of the "snowball effect" of interest: The combination of these two factors has created a deadly closed loop: high debt base × high-interest environment = exponentially growing interest burden. The core of this "snowball" is no longer loose snow but high-cost interest that is solidifying into hard ice.

3. How Trillions in Interest Reshape Finance

The annual interest expenditure of $1.2 trillion has evolved from a mere accounting figure into a "fiscal black hole" with its own life, beginning to suffocate all other functions.

● Transformation from "maximum bearable cost" to "largest single expenditure": This interest exceeds the total budget of most federal departments. It is no longer a financial cost in the background but has become the most demanding claimant on the budget table, competing at the highest level with traditional spending giants like defense and healthcare, continually squeezing their space.

● "Quicksand dilemma" and the futility of income efforts: Citigroup's "quicksand" metaphor accurately depicts the fiscal situation: any new income appears trivial in the face of a trillion-dollar interest burden. Even optimistically estimating that new tariffs could bring in $300-400 billion in revenue is still far below the $1.2 trillion in interest. The fiscal health of the body is sinking, and increasing revenue only slows the descent but cannot change the direction.

● "Pre-emptive seizure" of future policy space: This rigid expenditure acts like a vice, preemptively locking the government's ability to respond to future crises. Regardless of when the next recession arrives, the government will first face the enormous bill from "interest creditors" if it wants to initiate large-scale fiscal stimulus again, severely depriving fiscal policy of flexibility and proactivity.

4. Shockwaves Spreading from the Auction Room to the Globe

The impact of the debt predicament is continuously releasing shockwaves to the global market, centered around the U.S. Treasury.

● Issuance pressure and extreme testing of market appetite: To cover deficits and maturing debt, the Treasury has hinted at "increasing auction sizes." The global market will be forced to digest an unprecedented supply of U.S. debt, which may push up long-term yields, trigger asset price re-evaluations, and even become an amplifier of market volatility during certain liquidity-tight moments.

● The paradox of "safe assets" and structural demand: Despite sustainability concerns, the global core status of the dollar and U.S. debt is unlikely to be replaced in the short term. Ironically, new financial regulations (such as requiring stablecoins to be backed by U.S. debt) may create new rigid demand in certain areas. This "must-hold" paradox is a profound reflection of the structural dependence of the global financial system.

● Disruption of the "pricing anchor" for global capital costs: U.S. debt yields are the cornerstone of global asset pricing. The yield fluctuations and uncertainties caused by its own fiscal issues will directly raise the financing costs for global enterprises, affecting multinational investment decisions and imposing an additional "U.S. fiscal tax" on an already fragile global economy.

5. Dilemmas and Solutions

Faced with this interest-driven debt predicament, policy choices are exceptionally difficult, with every path fraught with thorns.

● First path: "Waiting for a miracle"—hoping for sustained super-fast economic growth (significantly above interest rates) to dilute the debt burden. However, against the backdrop of an aging population and slow productivity growth, this is more of a wishful thinking.

● Second path: "Praying for interest rate cuts"—expecting the Federal Reserve to initiate a large-scale, sustained interest rate cut cycle to lower interest costs. However, this is constrained by whether inflation is truly tamed and may sow the seeds for the next round of asset bubbles and inflation, not a free option.

● Third path: "Fiscal reconstruction"—implementing fundamental tax and expenditure reforms. This includes broadening the tax base, adjusting welfare structures, etc., but in a politically polarized society, this is akin to a high-intensity civil war, with little chance of substantial breakthroughs in the short term.

Fiscal Fatigue of an Era

The $30 trillion national debt and the resulting trillion-dollar interest signify the "fiscal fatigue" of an era. The U.S. may have to learn to operate under a new normal of "high debt-high interest," where its national strategic resources will increasingly be used to "maintain credit" as a basic survival task rather than for future investments.

For the world, this requires countries to re-examine the safety boundaries of foreign exchange reserves and actively explore diversified international monetary cooperation schemes. The global economic vessel is sailing into waters filled with unknown turbulence, reflected by U.S. debt interest, and all passengers need to fasten their seatbelts and start thinking about a new navigation chart.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.