The spark still exists.

Author: antoniayly, Deep Tide TechFlow

In 2025, the cryptocurrency industry presents a subtle buzz. Various ETFs are lining up for launch, compliance frameworks are being introduced in various countries, and traditional institutions are experiencing FOMO; it seems that cryptocurrency is being embraced as a new trendy asset by old money. On social media, some people flaunt their monthly salaries of $10,000 or share various stable arbitrage tips, making many outsiders eager to try.

But behind the excitement, what is the real experience of working in Web3 like? Who is hiring? What kind of people are they looking for? How much can they offer? Are those who want to enter or have already entered thriving? Are they confused? Are they regretting their choices?

To answer these questions, we surveyed mainstream industry recruitment portals such as web3.career, cryptojobslist, Dejob, abetterweb3, the official websites of major exchanges, Solana, and Arbitrum ecosystem recruitment, compiling over 18,000 recruitment data and over 2,700 job seeker data to see:

The recruitment trends, popular positions, salary structures, and regional distributions of various Web3 companies in 2025, to glimpse what Web3 companies are preparing for;

The skill sets, salaries, remote work ratios, layoff experiences, and favorite/least favorite/most desired companies of Web3 Chinese job seekers, aiming to outline the most authentic talent profile in this industry.

Summary:

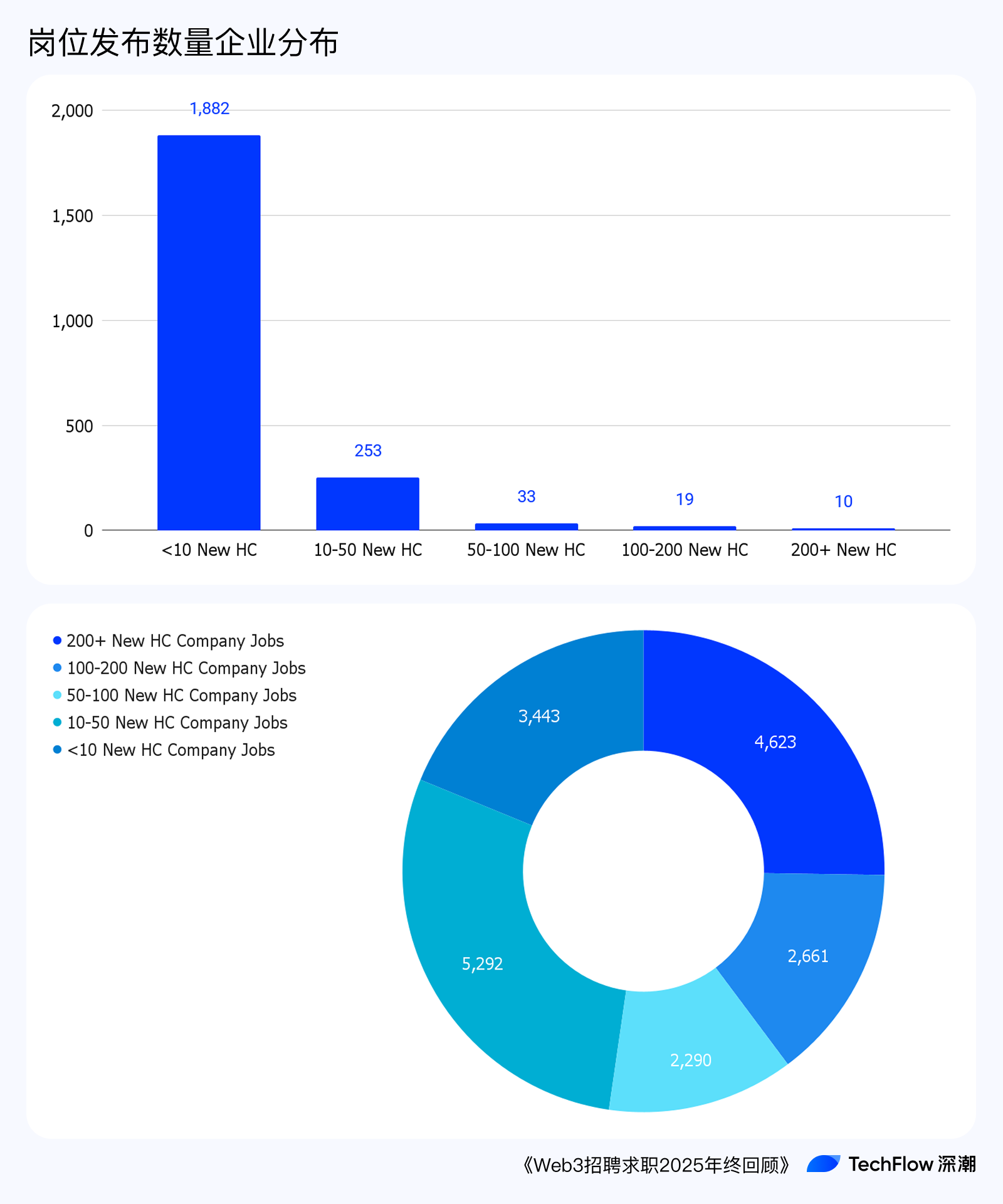

The recruitment market exhibits a significant Matthew effect, with only a few dozen large Web3 companies having over 100 headcounts, yet their positions account for 40% of the total.

The demand for engineers (developers) accounts for 32% of all recruitment; "compliance" related demand ranks 7th in the top 10, reflecting the industry's active transformation under the wave of compliance.

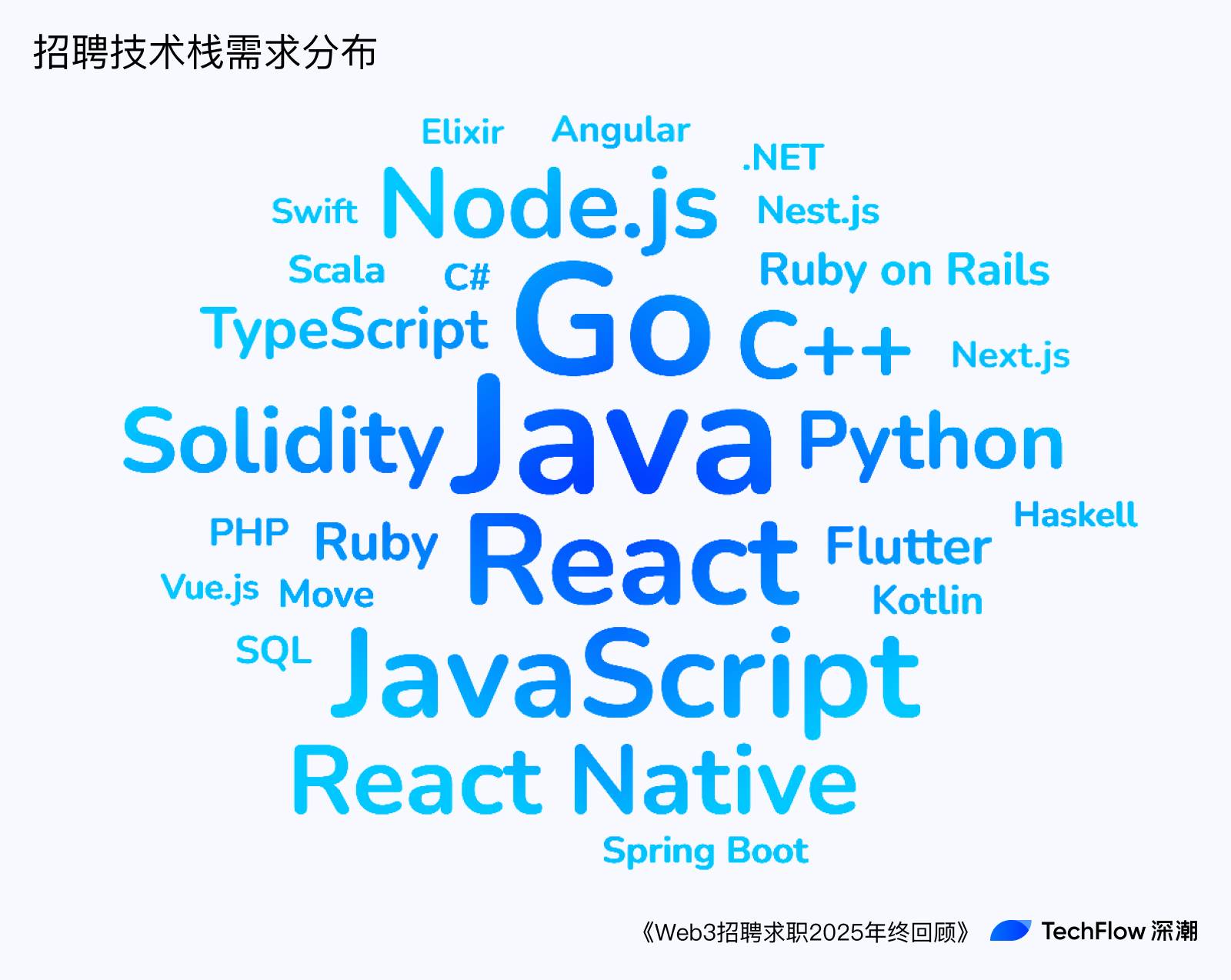

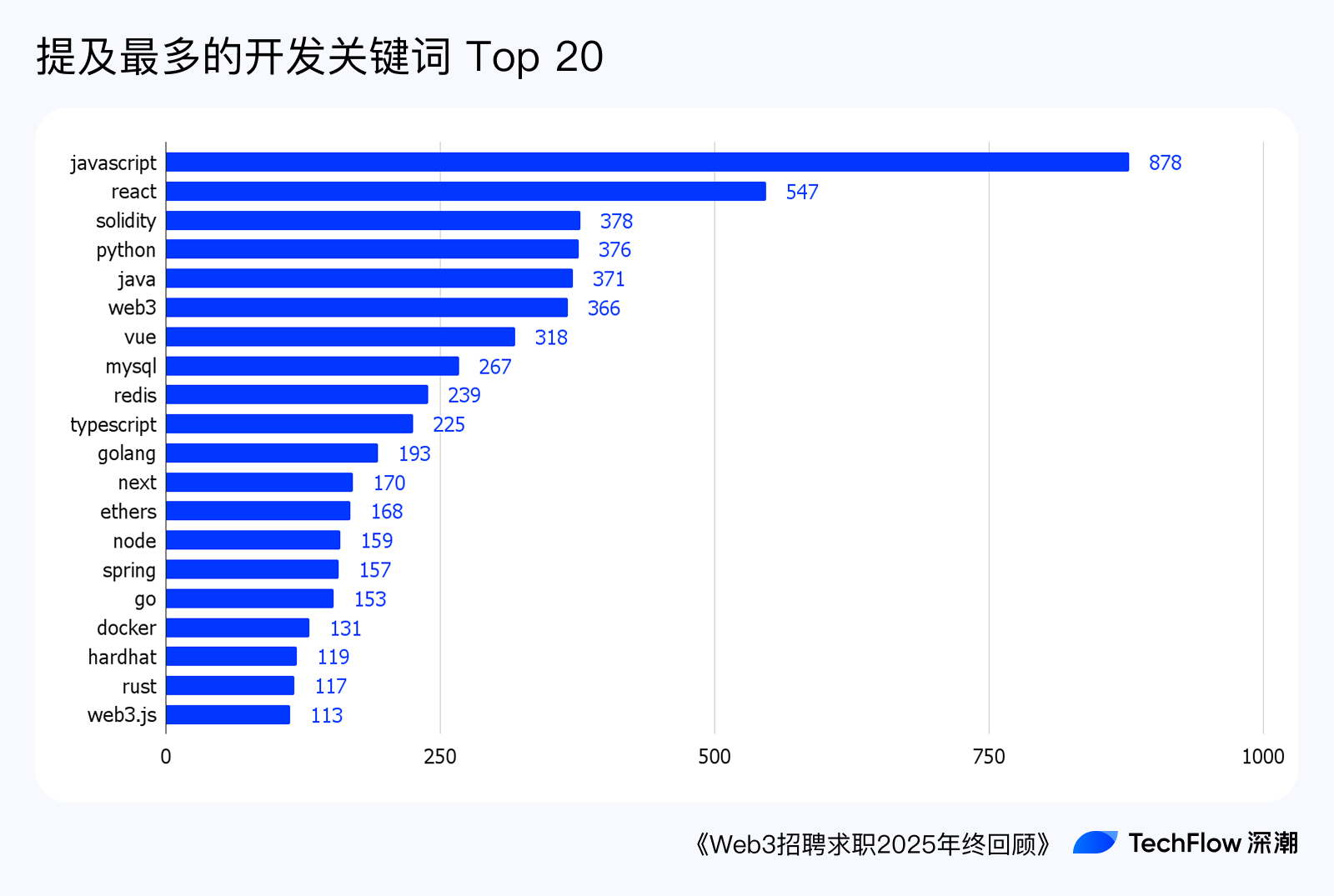

The technical stack demand is primarily focused on AI, blockchain, and backend, while on-chain native languages like Solidity and Move remain relatively niche.

90% of positions support remote work, and 8.8% of positions support part-time work (33.7% of Chinese recruitment supports part-time).

Chinese salaries are 70% to 80% lower than global talent, and in RMB terms, they have reached parity with small to medium domestic internet companies.

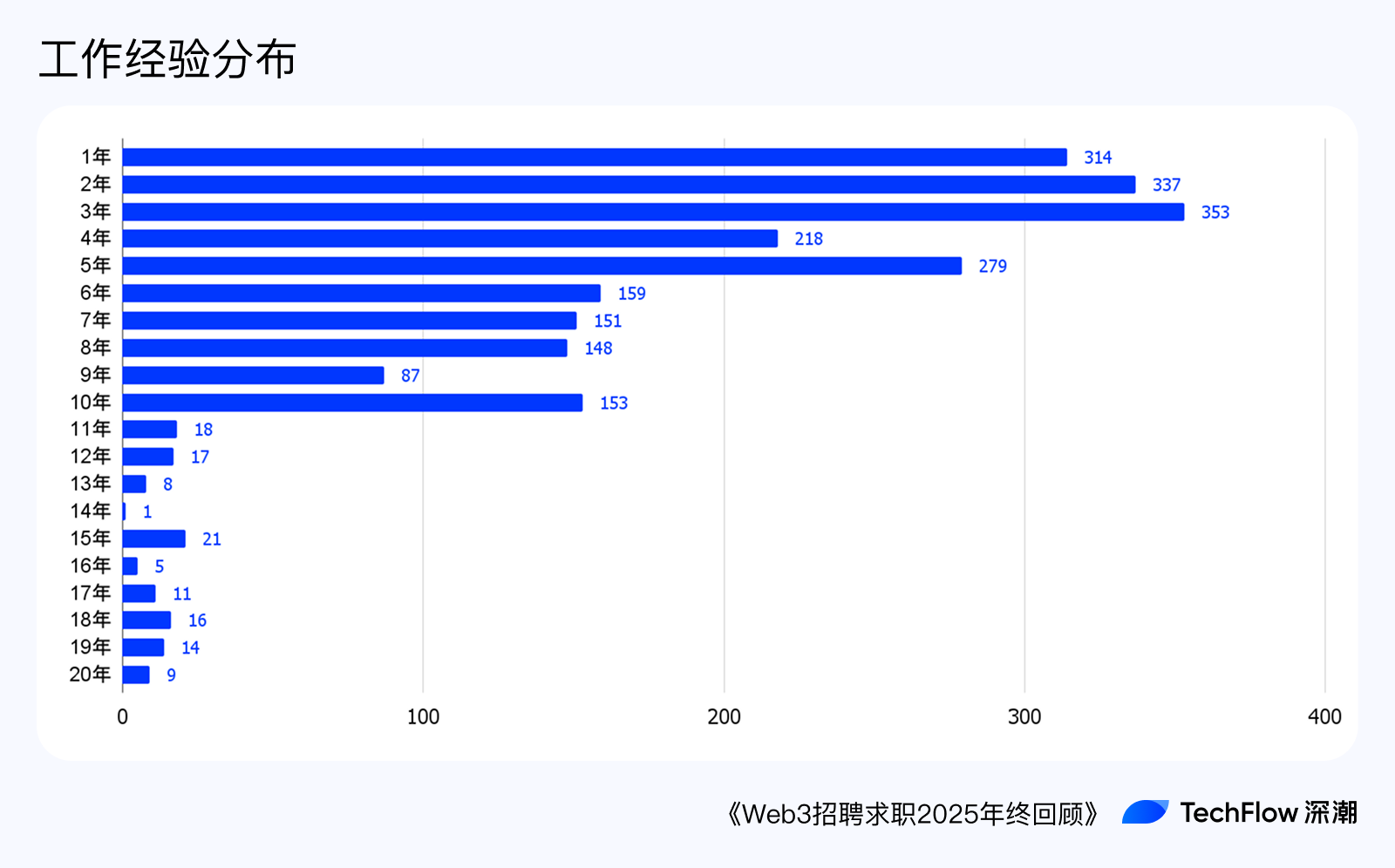

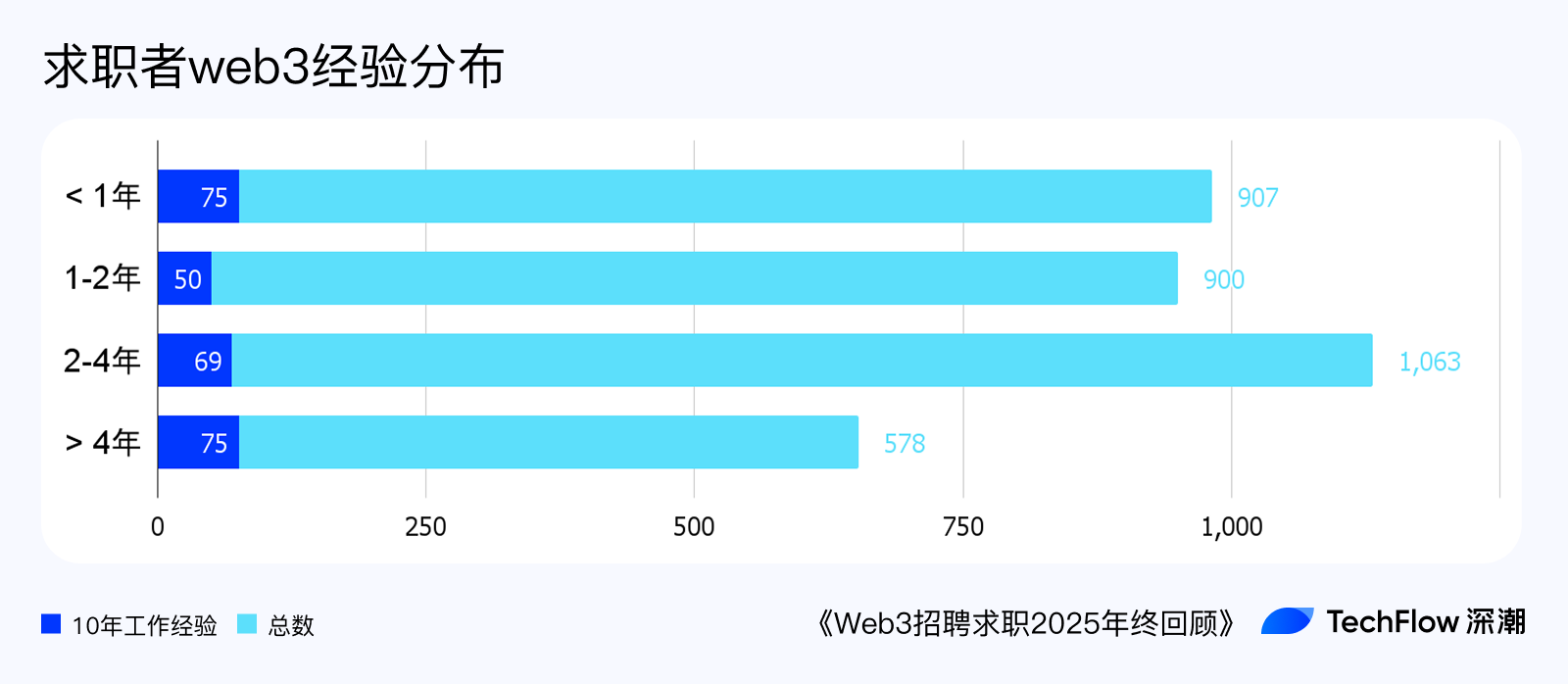

Many Chinese job seekers have backgrounds from large Web2 companies, with those having over 10 years of experience accounting for 10% of the total statistics.

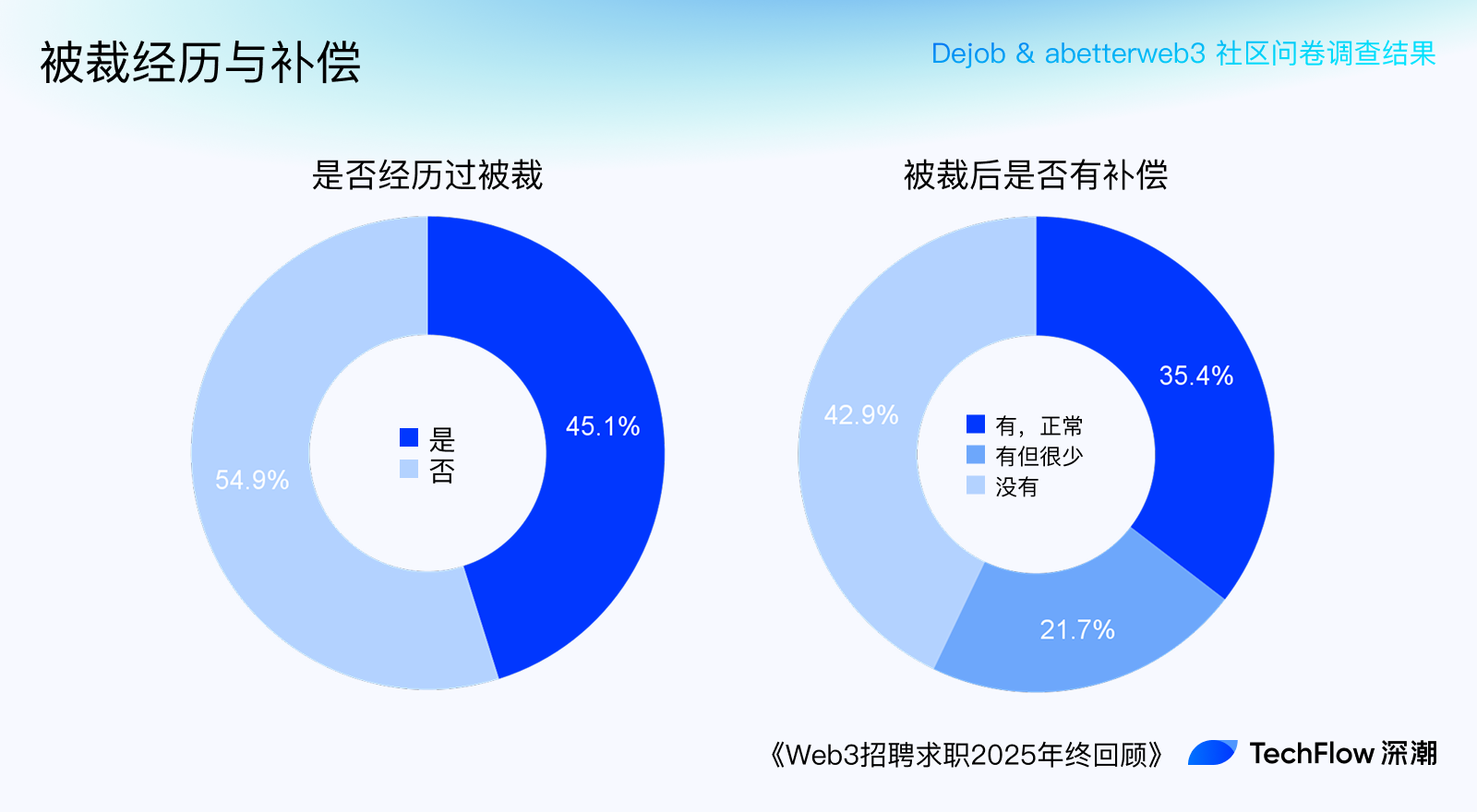

Nearly half of the respondents have experienced layoffs, and none received any compensation after being laid off.

Close to 70% of people have no token incentives in their jobs.

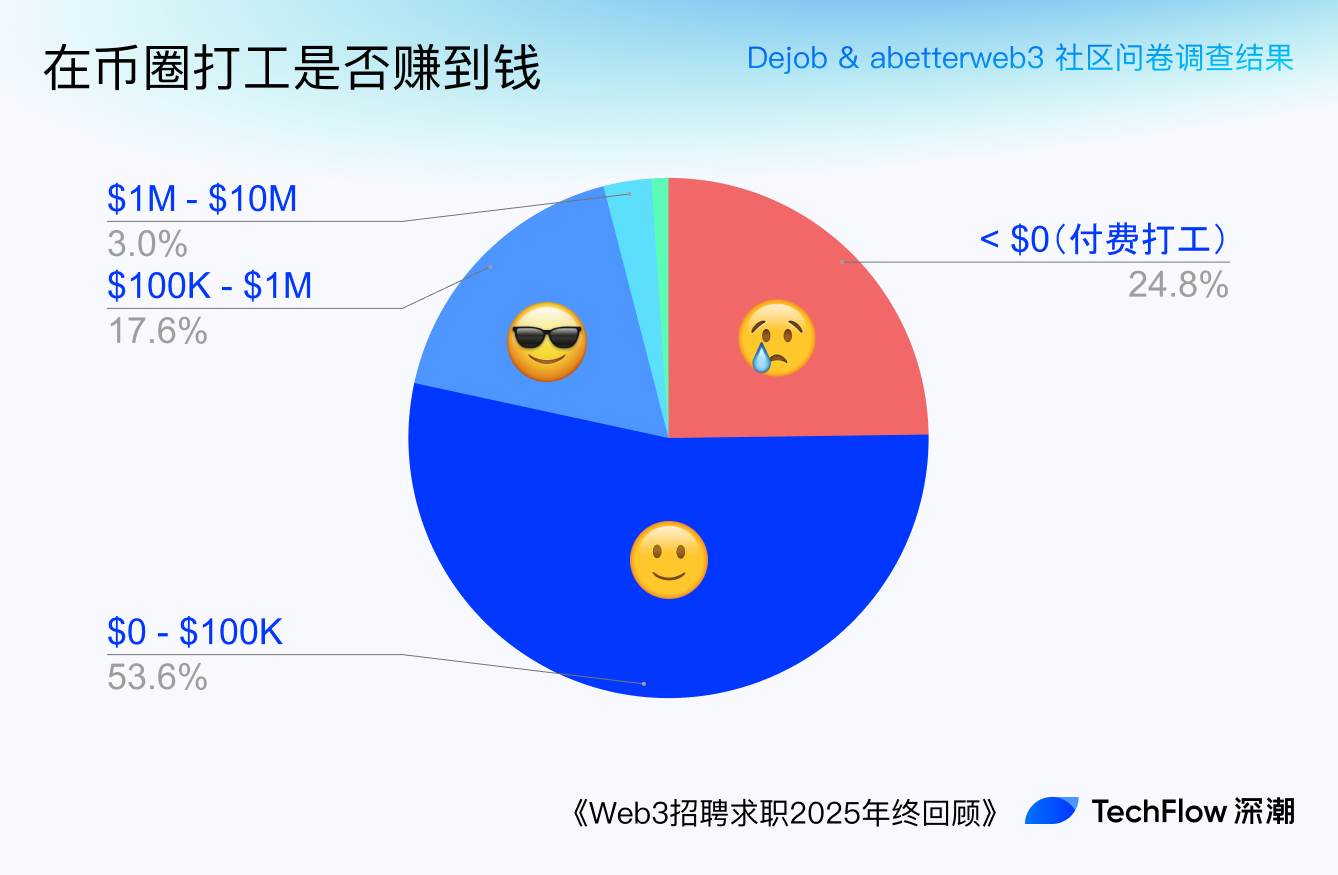

In the survey results, 25% of respondents are working for pay (overall earnings in the crypto space are 0).

80% of people work 40-50 hours a week, with relatively mild overtime.

This article also provides a PDF version for browsing or downloading on other devices. You can go to this link👇

https://docsend.com/view/sgnw468tnq2gjf2e

I. Web3 Recruitment: Preparing for the Next Compliance Era

1.1 Who is Hiring

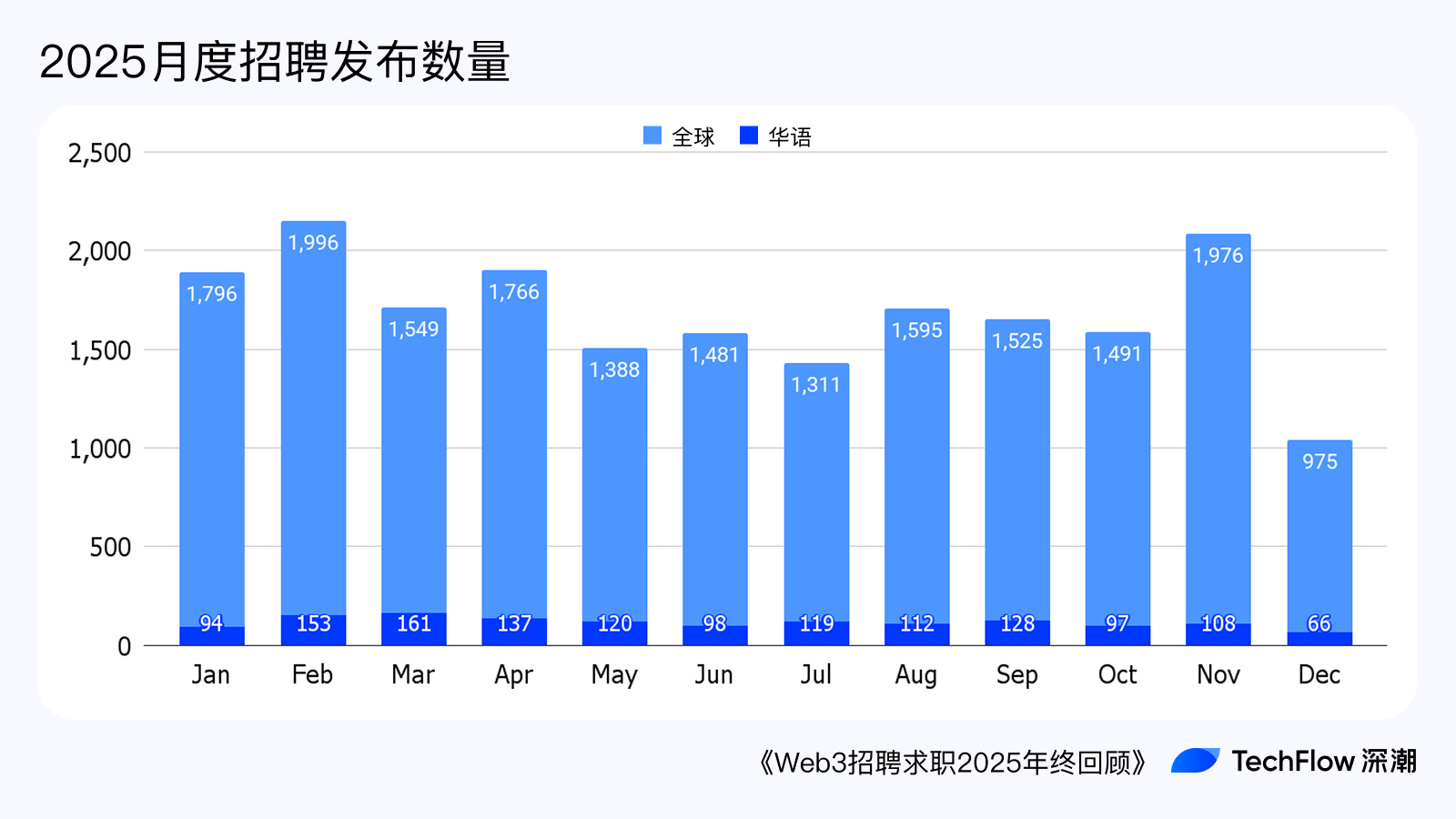

The Web3 recruitment market in 2025 shows little fluctuation throughout the year, but changes in certain months can reflect some common recruitment trends. The number of positions surged in January and February, generally due to companies allocating job demands to various departments at the beginning of the year based on their plans. The spike in recruitment volume before December may reflect that some people left or switched jobs before the Christmas/New Year holidays, leading to a large number of vacancies. The significant drop in headcount (HC) in December indicates the normal work routine of December as a closing and holiday month. In the Chinese-speaking recruitment sector, due to the Spring Festival often falling in January and February, many companies will plan again in March and April, resulting in a peak in HC during those months.

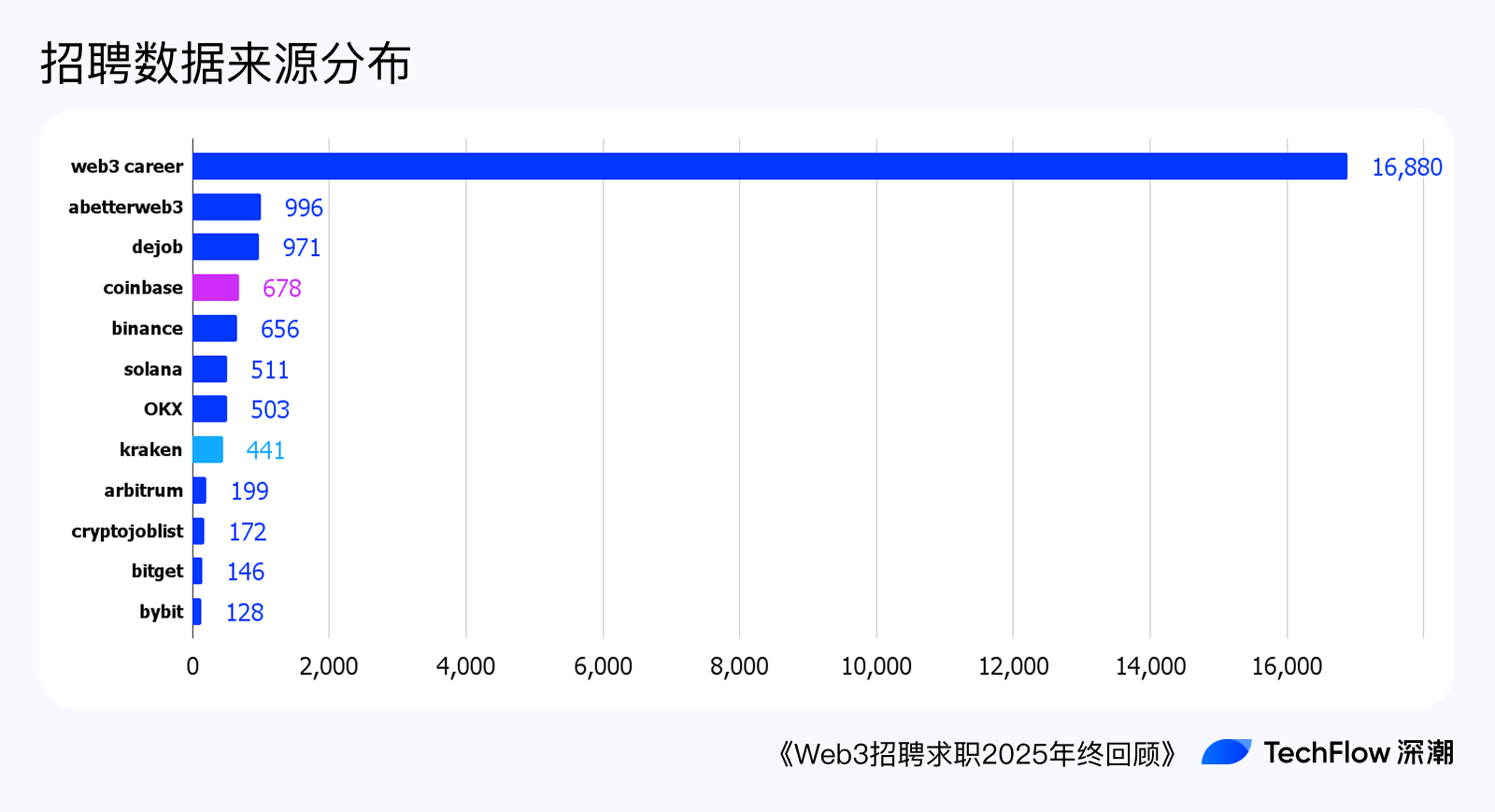

Among various recruitment channels, web3.career has become the first choice for many recruiters and job seekers due to its ability to quickly filter remote positions and its large number of job postings. It leads significantly in the number of postings. Following that are the Chinese vertical recruitment platforms Dejob and abetterweb3, as many Chinese founders prefer to collaborate in their native language and require efficient matching with Chinese talent. Then come the official recruitment pages of major exchanges, such as Binance, OKX, Coinbase, etc. However, since exchanges often publish recruitment on both Chinese and international platforms simultaneously, there may be some overlap in the data here.

The Solana ecosystem recruitment page published a total of 515 positions in 2025 (tracing back to April 2025), while the Ethereum ecosystem recruitment mainly collected data from the Arbitrum ecosystem recruitment page, which published a total of 194 positions throughout the year. These two recruitment pages serve as the main entry points for on-chain ecosystem positions outside of exchanges.

Compared to December 2024, the Solana recruitment page showed a significant increase (298 → 514, +72.5%), while other platforms, except for OKX, experienced varying degrees of shrinkage. However, it is also possible that OKX did not reuse its official recruitment page last year.

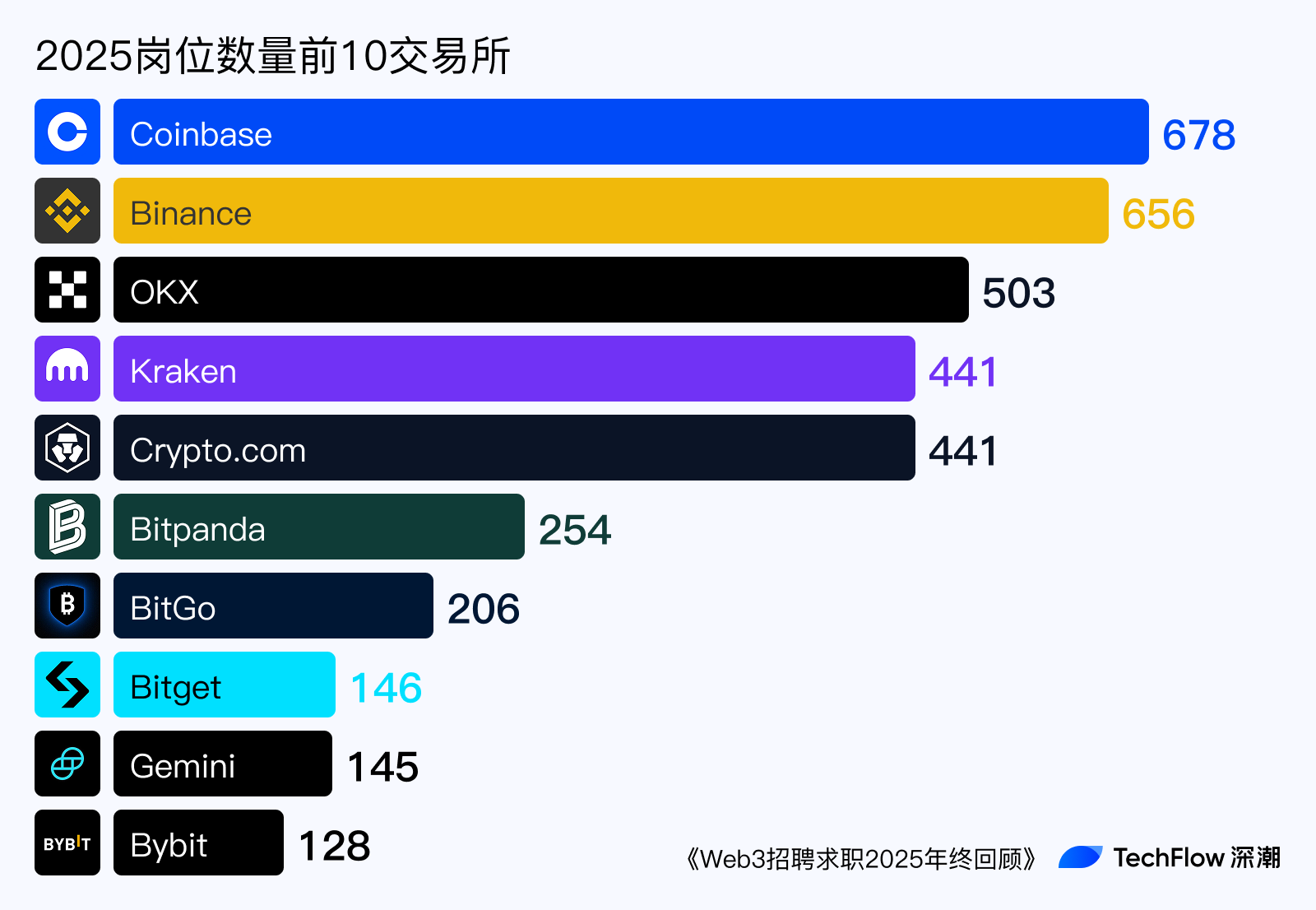

Overall, the top 10 exchanges by recruitment postings in 2025 are:

Coinbase, as a long-established compliant exchange in the U.S., is making a bold leap this year, riding the wave of compliance. Other exchanges are expanding at a normal pace, considering the distinct characteristics of the crypto industry with clear bull and bear markets, neither too aggressive nor overly conservative. However, exchanges may frequently change their business lines, so there may be cases of positions being repeatedly canceled and reposted.

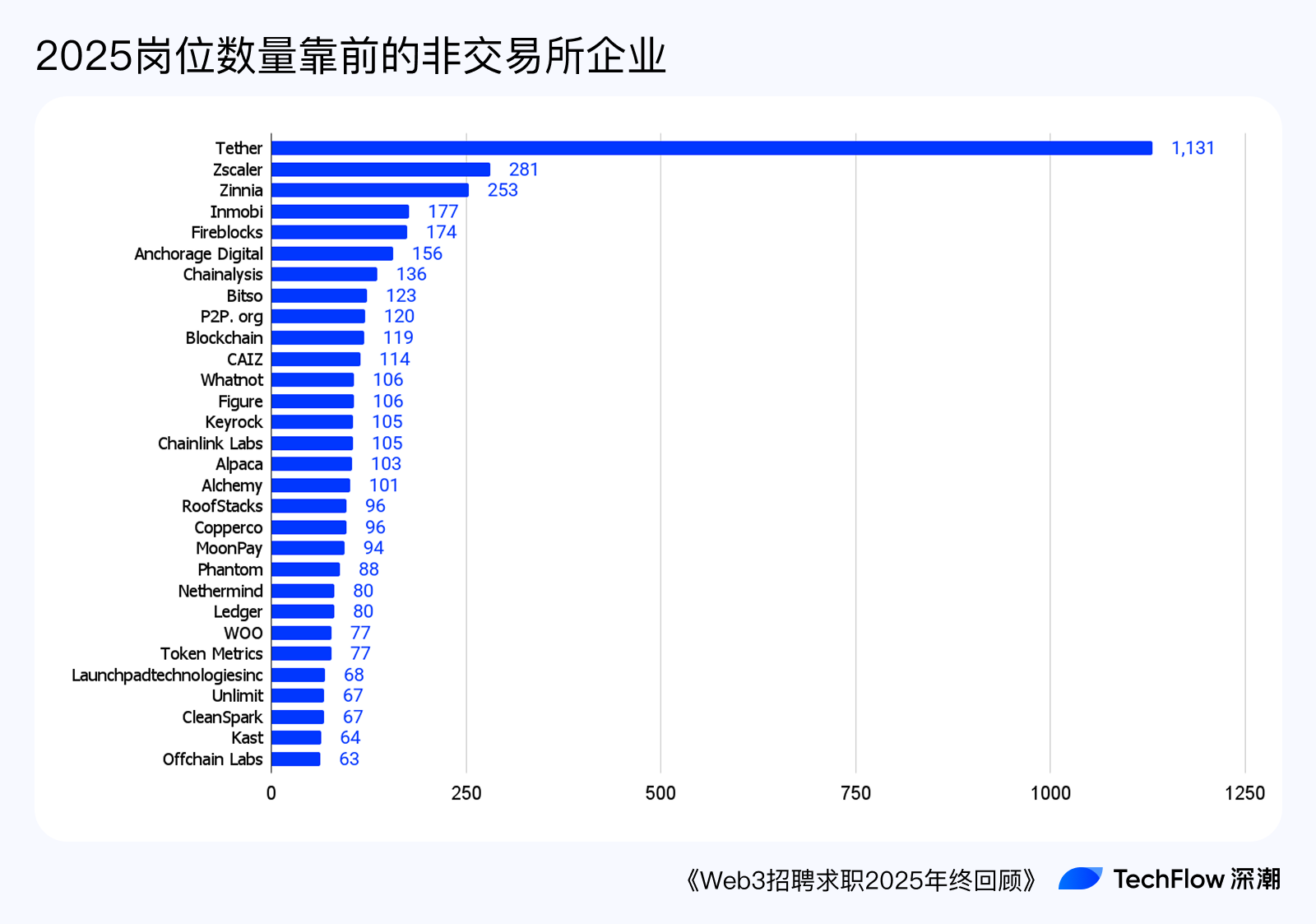

Among non-exchange companies, Tether demonstrated strong profitability and resilience with over 1,000 HC throughout the year; however, other types of enterprises are clearly not as strong as exchanges, and companies with high posting volumes are mainly concentrated in more mature business models such as security and fund custody.

It can be seen that leading companies contribute a significant number of positions, with only a few dozen companies posting over 100 positions throughout the year, yet their positions account for 40% of the total; hundreds of companies posting 10-50 positions are the backbone of the industry, accounting for nearly 30% of the total. Meanwhile, over 1,800 companies posted only 10 positions throughout the year, accounting for just 18% of the total.

1.2 What is Being Hired

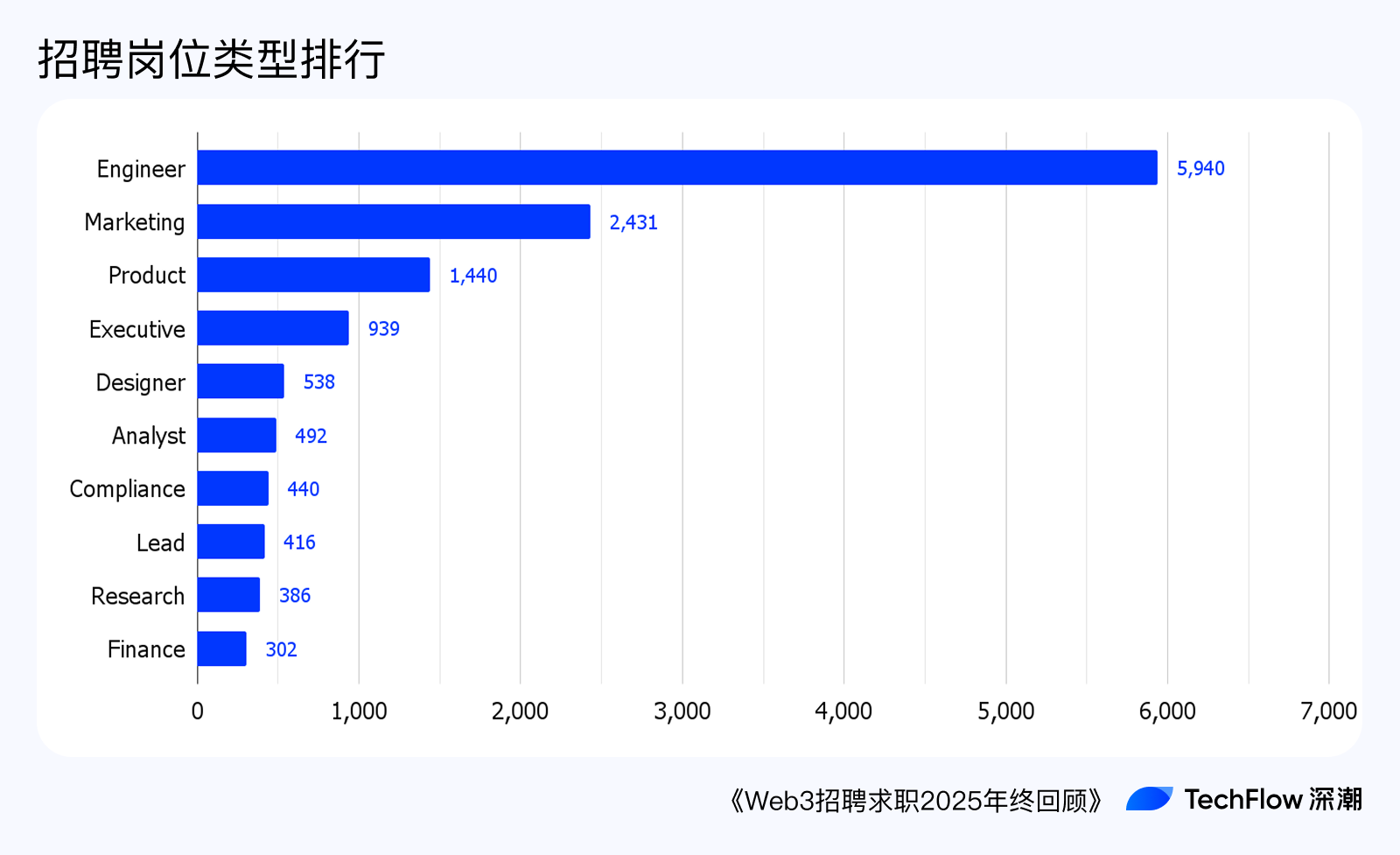

In terms of the distribution of job types, among 18,508 valid data, the top 10 types are:

Engineers (developers) are naturally the largest demand in this industry, accounting for 32% of all recruitment needs. Following closely is the demand from the marketing department, indicating that customer acquisition/growth is an eternal topic.

Notably, "compliance" related demand has reached 7th place in the top 10. In the wave of compliance, capable and ambitious companies will actively fill this important puzzle piece.

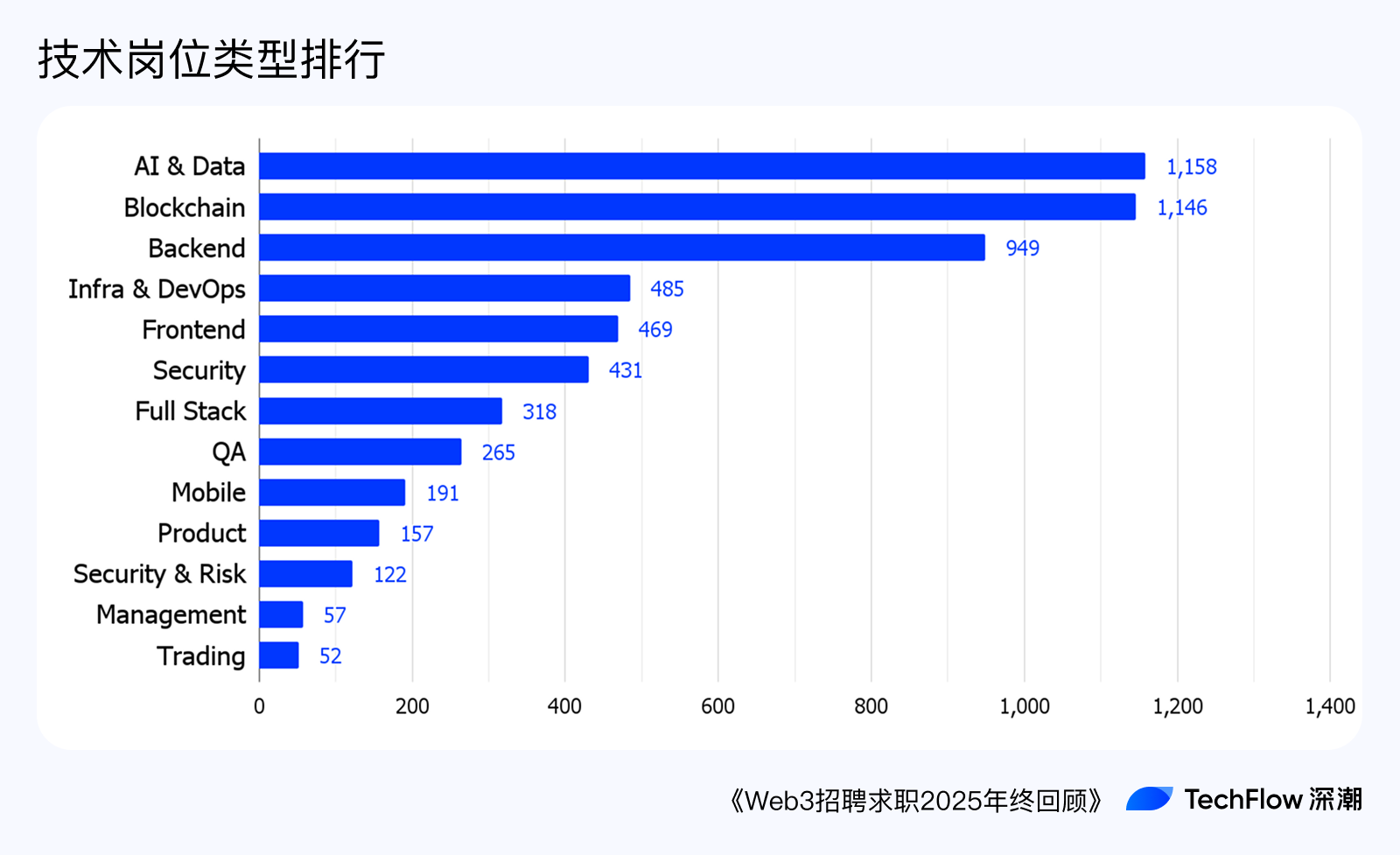

Among technical positions, the most frequently requested demands are:

AI & Data - 1,158

Blockchain - 1,146

Backend - 949

Infra & Operations - 485

Frontend - 469

Security - 431

Full Stack - 318

QA - 265

Mobile - 191

Product (Technical Product) - 157

AI data demand and blockchain development demand are far ahead, followed by backend, infrastructure development, operations, security, and other positions closely related to the existence of decentralized networks, transitioning from the underlying layer to the user side.

Among programming languages, the most in-demand are mainstream backend languages like Rust, Java, and Go, with Rust dominating due to its safety and performance advantages. JavaScript/TypeScript, React, and other frontend technology stacks follow closely, reflecting the significant demand for frontend and full-stack development. Languages like Node.js, C++, Kotlin, Ruby, and Scala also have certain demand in specific scenarios. On-chain native development languages like Solidity and Move remain relatively niche.

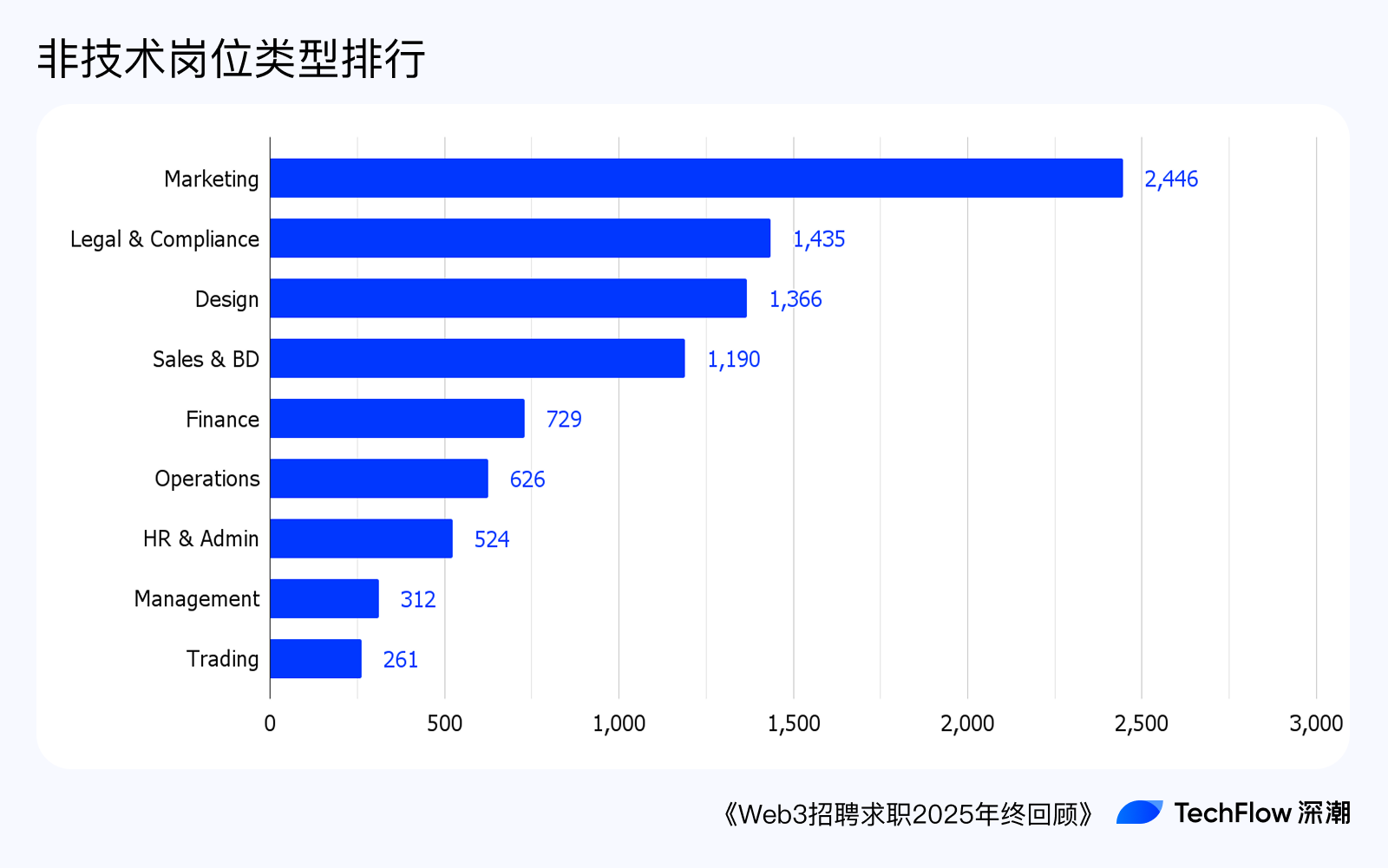

In the demand for non-technical positions, legal/compliance roles account for a significant portion. As mentioned earlier, legal/compliance has become an indispensable part of the transition of past crypto companies into a new chapter.

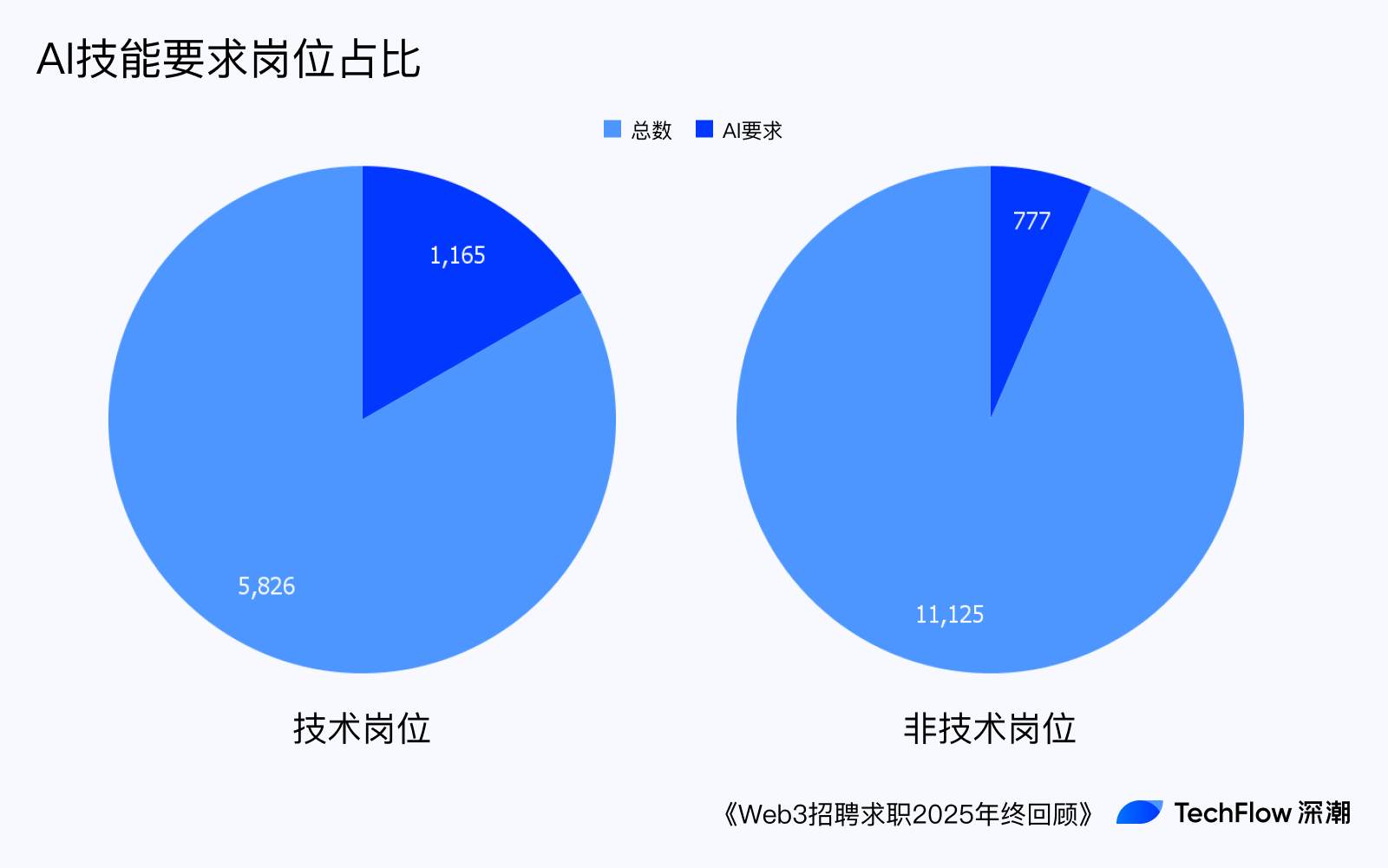

It is worth mentioning that both technical and non-technical positions have shown a coincidental demand for AI skill sets.

1.3 How Much

In terms of salary distribution, among the 14,659 job postings that disclosed salaries, the most concentrated monthly salary range is $6,000 - $12,000, but there are also many entry-level positions in the $2,000 - $4,000 range and high-paying positions above $12,000.

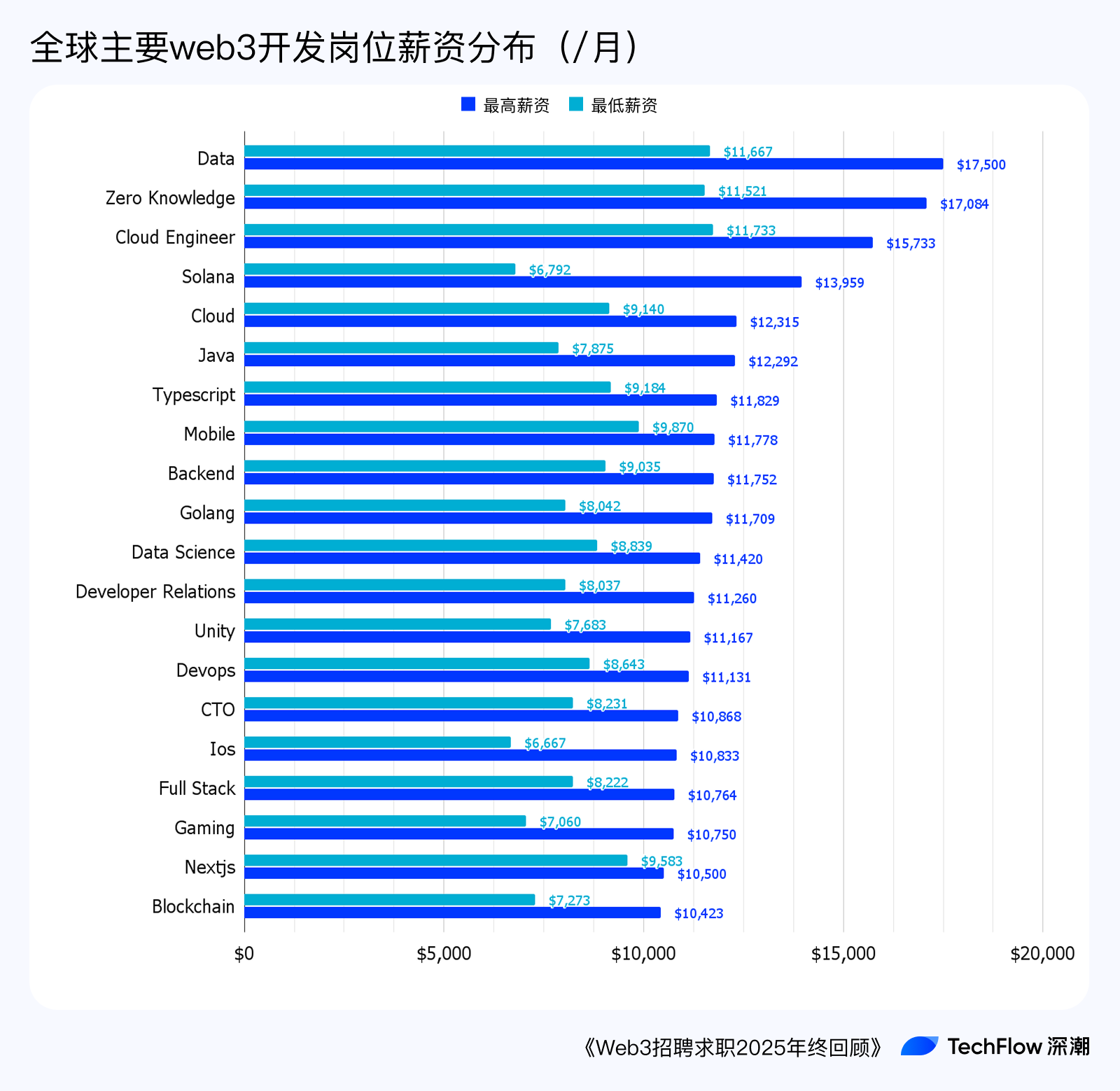

Among them, the top 10 technical positions globally by salary (taking the median of the lowest and highest salaries) are:

Data: $11,667 - $17,500

Zero-Knowledge Proof: $11,521 - $17,084

Cloud Engineer: $11,733 - $15,733

Solana Developer: $6,792 - $13,959

Cloud Computing: $9,140 - $12,315

Java Developer: $7,875 - $12,292

TypeScript Developer: $9,184 - $11,829

Mobile Development: $9,870 - $11,778

Backend Development: $9,035 - $11,752

Golang Developer: $8,042 - $11,709

Positions related to data and zero-knowledge proofs have the highest salaries, with monthly salary caps reaching $17,500 (approximately 125,000 RMB). These positions have extremely high requirements for mathematics, cryptography, and algorithms, and the scarcity of talent justifies the high salaries. Positions like cloud engineers and Solana developers, which align with the trend of on-chain technology stacks, also rank highly.

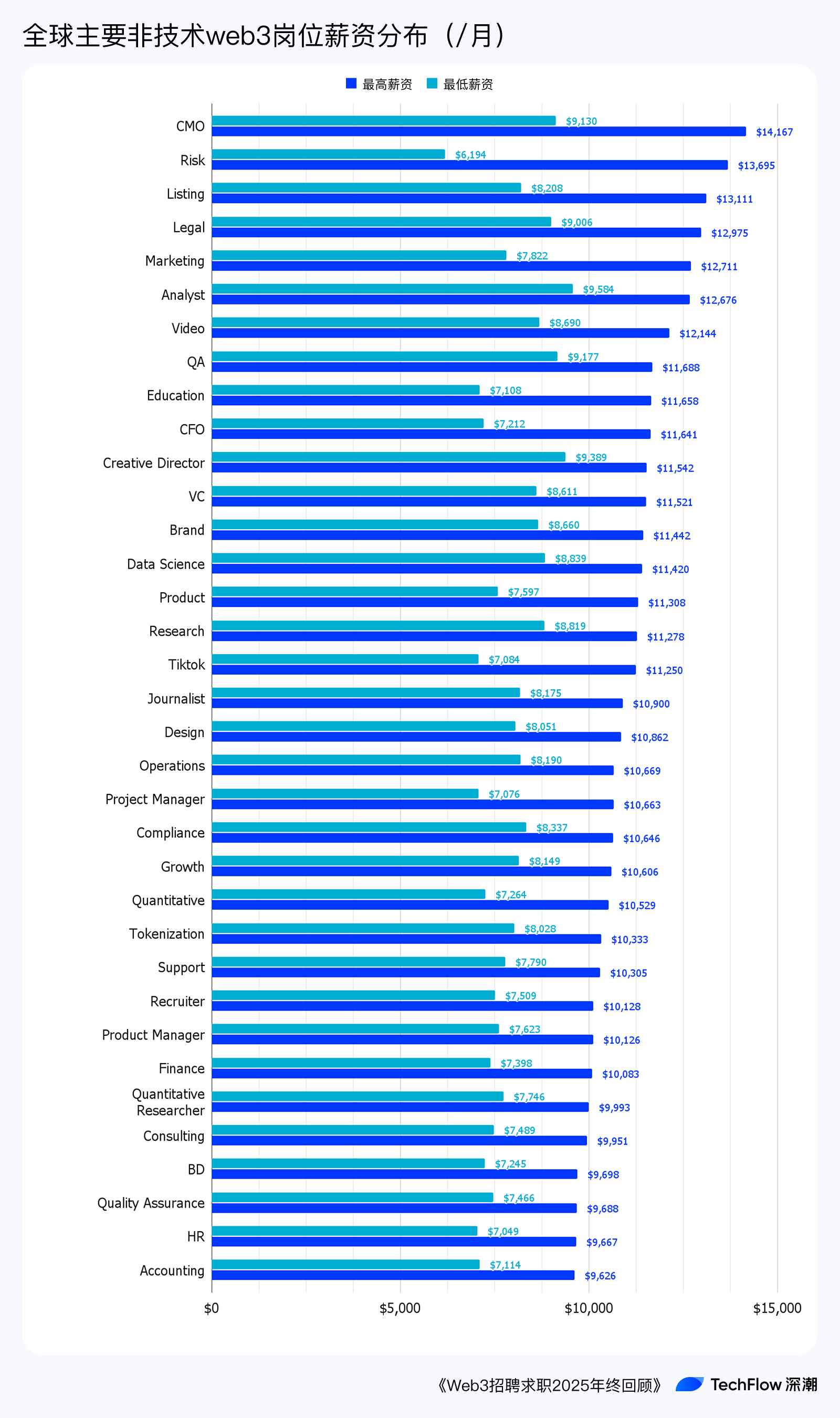

In terms of non-technical positions, the top 10 global monthly salaries are:

Data Analysis: $11,667 - $17,500

CMO: $9,130 - $14,167

Risk Control: $6,194 - $13,695

Listing: $8,208 - $13,111

Legal: $9,006 - $12,975

Marketing: $7,822 - $12,711

Analyst: $9,584 - $12,676

Video Production: $8,690 - $12,144

QA: $9,177 - $11,688

User Education: $7,108 - $11,658

The listing department, as a core position connecting project parties, exchanges, and users, naturally ranks among the high salaries. The high salaries for roles like CMO and marketing reflect the industry's ongoing need for good marketers to build strong communities. The high salaries for risk control and legal positions also indicate the scarcity of such roles in this industry.

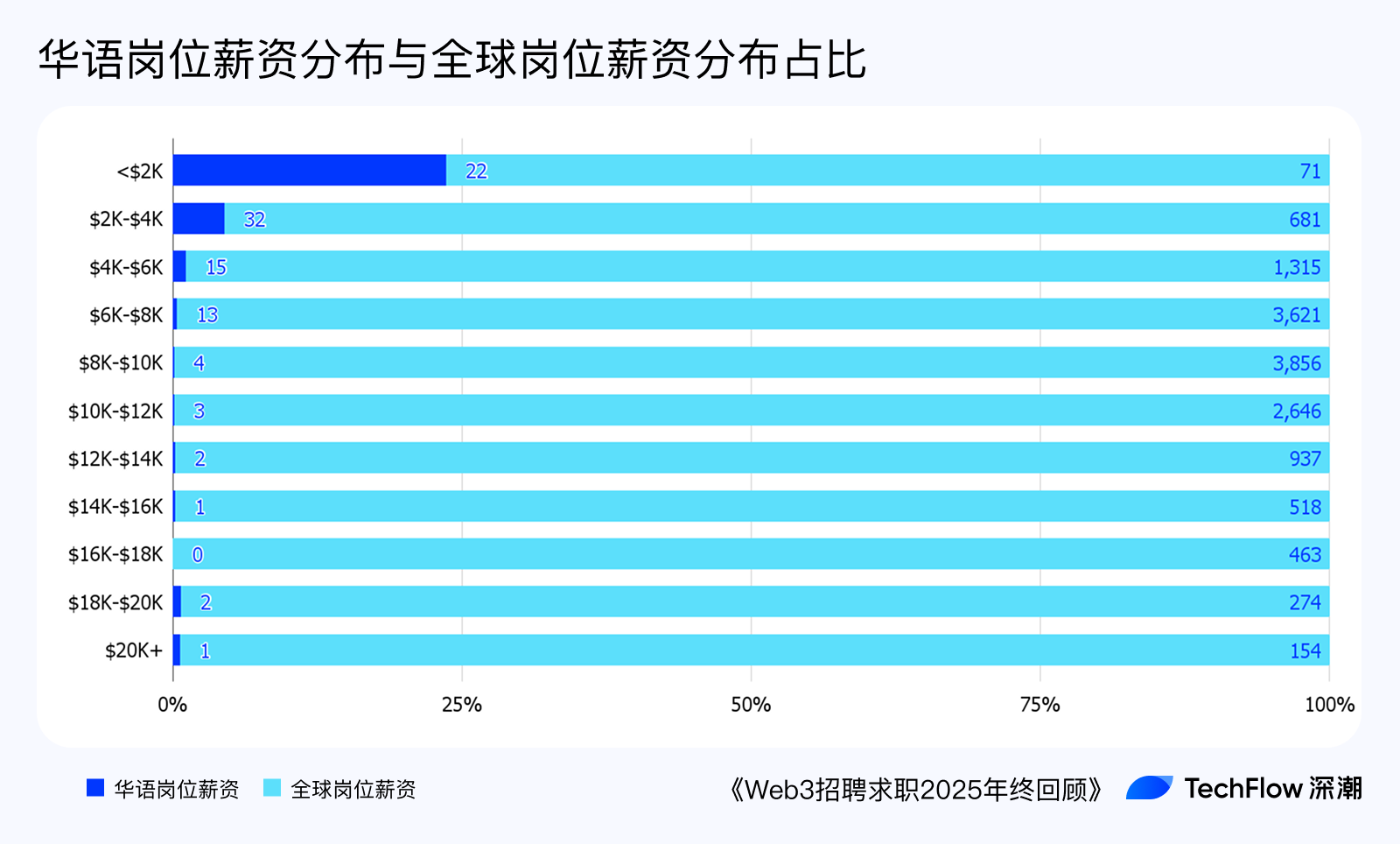

However, in the abetterweb3 Chinese recruitment database, whether for technical or non-technical positions, the salary distribution shows a cliff-like drop, with most concentrated around $2K - $4K, equivalent to 14,000 - 28,000 RMB, which is on par with most domestic small to medium internet companies.

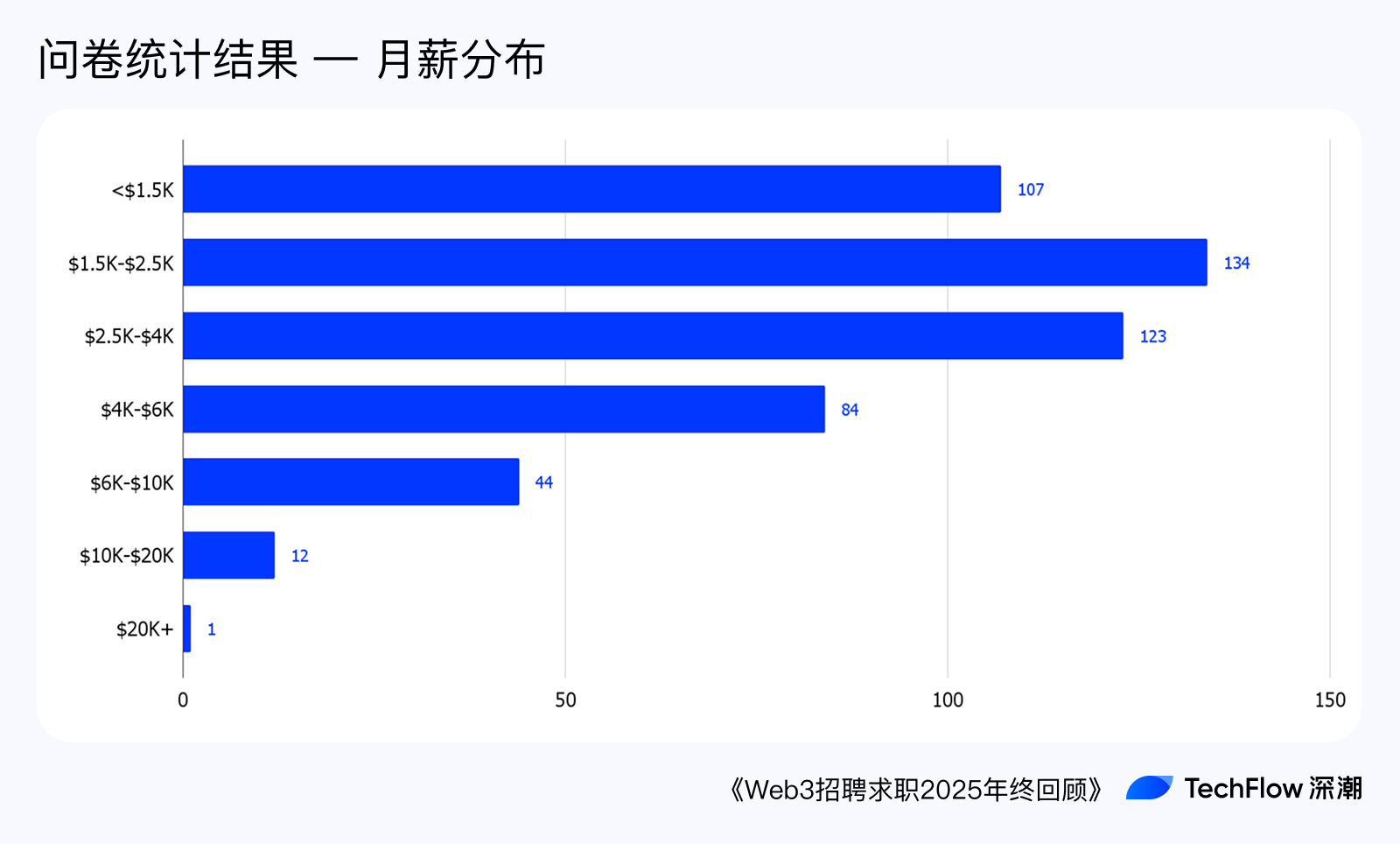

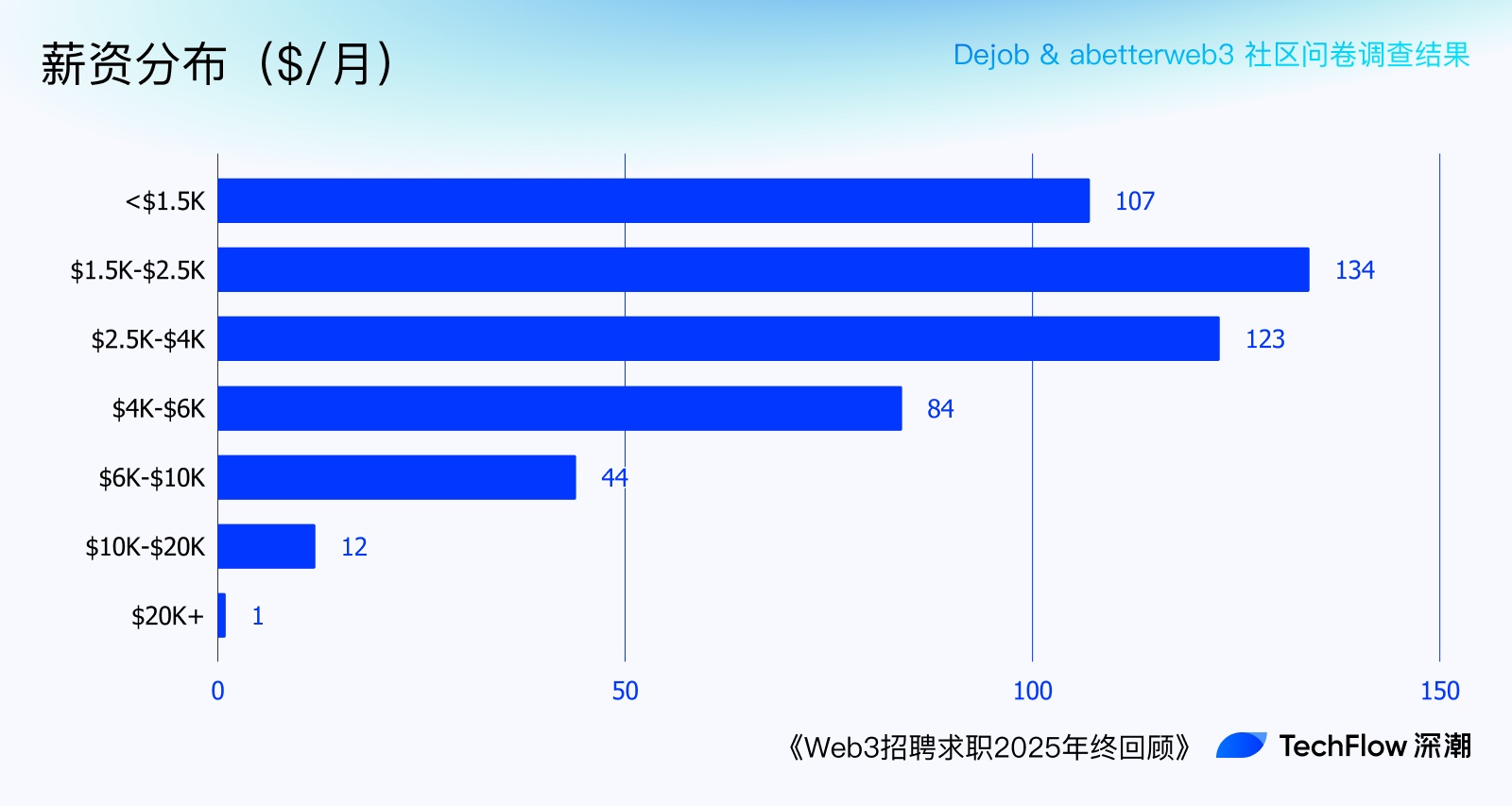

The salary statistics collected from our survey are even more dire, with over 20% of respondents earning less than $1,500 per month (approximately 10,000 RMB), with the vast majority concentrated in the $1,500 - $4,000 range (approximately 10,000 - 28,000 RMB). This may be related to the lack of regulatory environment for Web3 in East Asia—low salaries, or even unpaid wages, only allow companies to thrive, leaving workers with no recourse, and the sustainability of their careers depends entirely on whether they encounter a good boss.

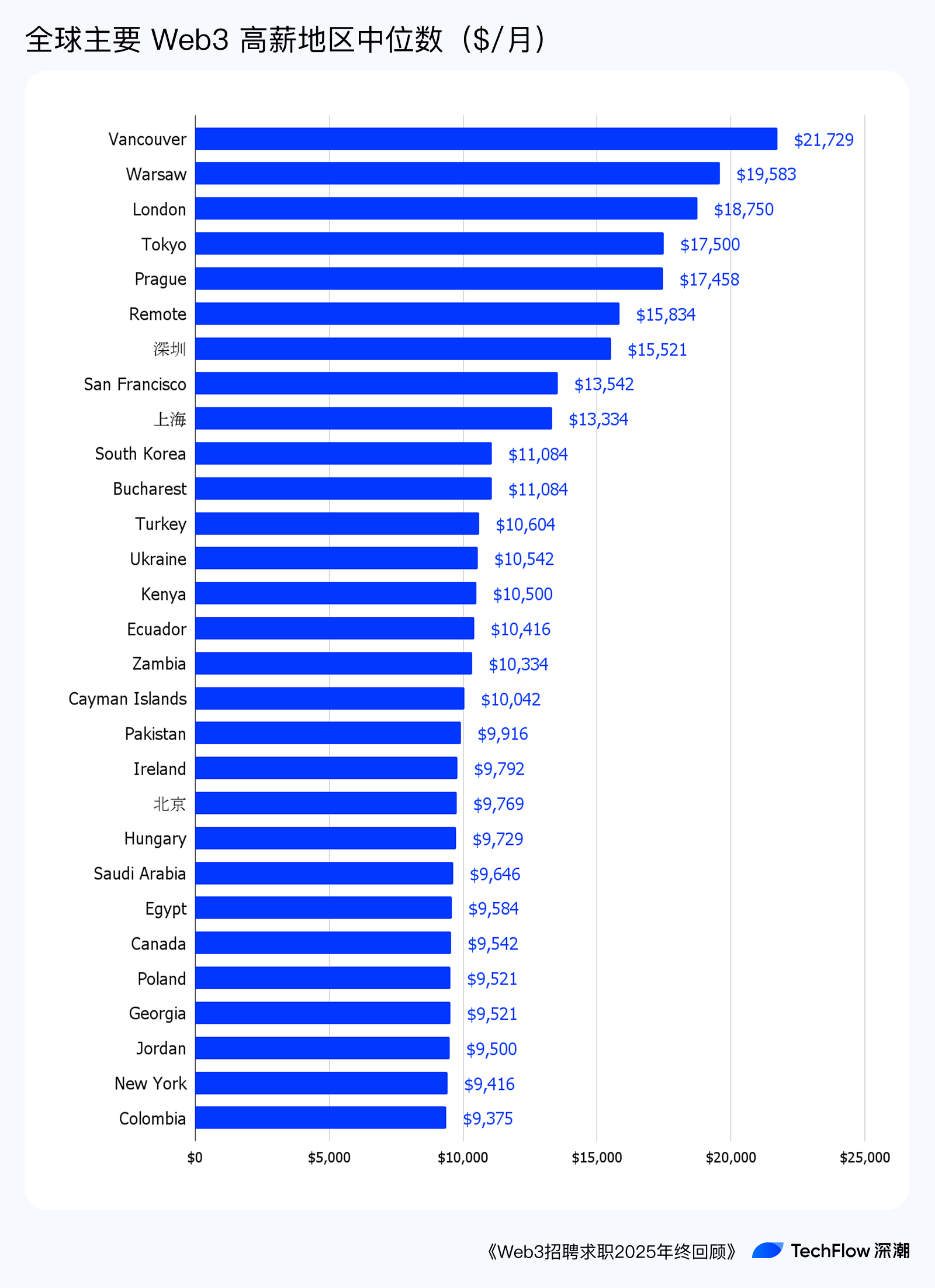

From the job postings that disclosed regional requirements, under the wave of compliance, the United States and the United Kingdom have naturally become global hubs for crypto startups. Canada, Singapore, Hong Kong, and Dubai, as global financial centers, are active in investment and financing, attracting a wealth of talent, and thus naturally gathering many Web3 companies. In mainland China, compared to before 2021, recruitment for Web3 companies has nearly vanished under repeated high-pressure regulatory measures, with only a few scattered teams existing in relatively open cities like Shanghai, Shenzhen, Beijing, Hangzhou, and Chengdu.

In terms of salary distribution rankings, in addition to common cities in Europe and America, two European cities, Warsaw and Prague, and two Asian cities, Shanghai and Shenzhen, unexpectedly entered the top 10 high-salary regions for Web3 (see the chart below). This may be related to the types of Web3 companies in those areas (such as star infrastructure, exchanges), the presence of senior positions, and management/C-level roles.

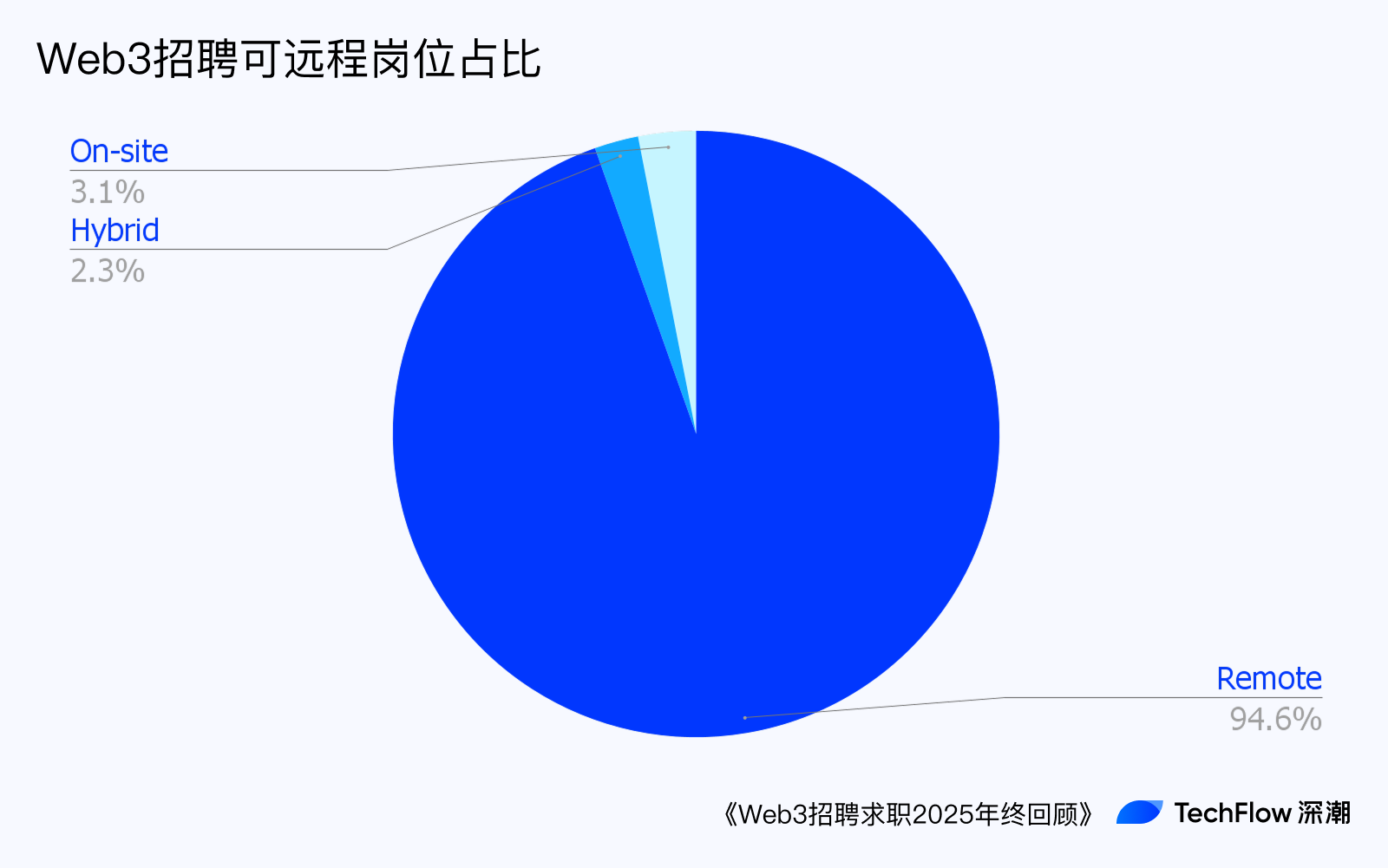

It is worth mentioning that among 5,467 valid data points, remote positions reached 5,171, accounting for 94.6%. This reflects the "nomadic" cultural gene characteristic of the Web3 industry—after years of regulatory scrutiny in various countries, Web3 companies have long been accustomed to weakening national/regional restrictions on talent for survival, opting for loose collaboration in exchange for more discreet existence.

Additionally, an interesting statistic is that positions supporting part-time (Part-time / Contract) work account for 8.8% of global positions, while in Chinese recruitment positions, it reaches 33.7%. This type of part-time work is not similar to the side jobs many engage in at traditional internet giants, such as e-commerce, but rather involves genuinely working for multiple projects and companies to earn multiple incomes. This may be related to the widely accepted anonymous collaboration culture in the Web3 industry.

II. Web3 Chinese Job Seekers: Transformation and Involution Inside and Outside the Fortress

Based on the job-seeking data from the two major Web3 Chinese recruitment platforms abetterweb3 and Dejob (a total of 2,666 entries), we can see some industry truths that appear golden on the outside but are rotten on the inside.

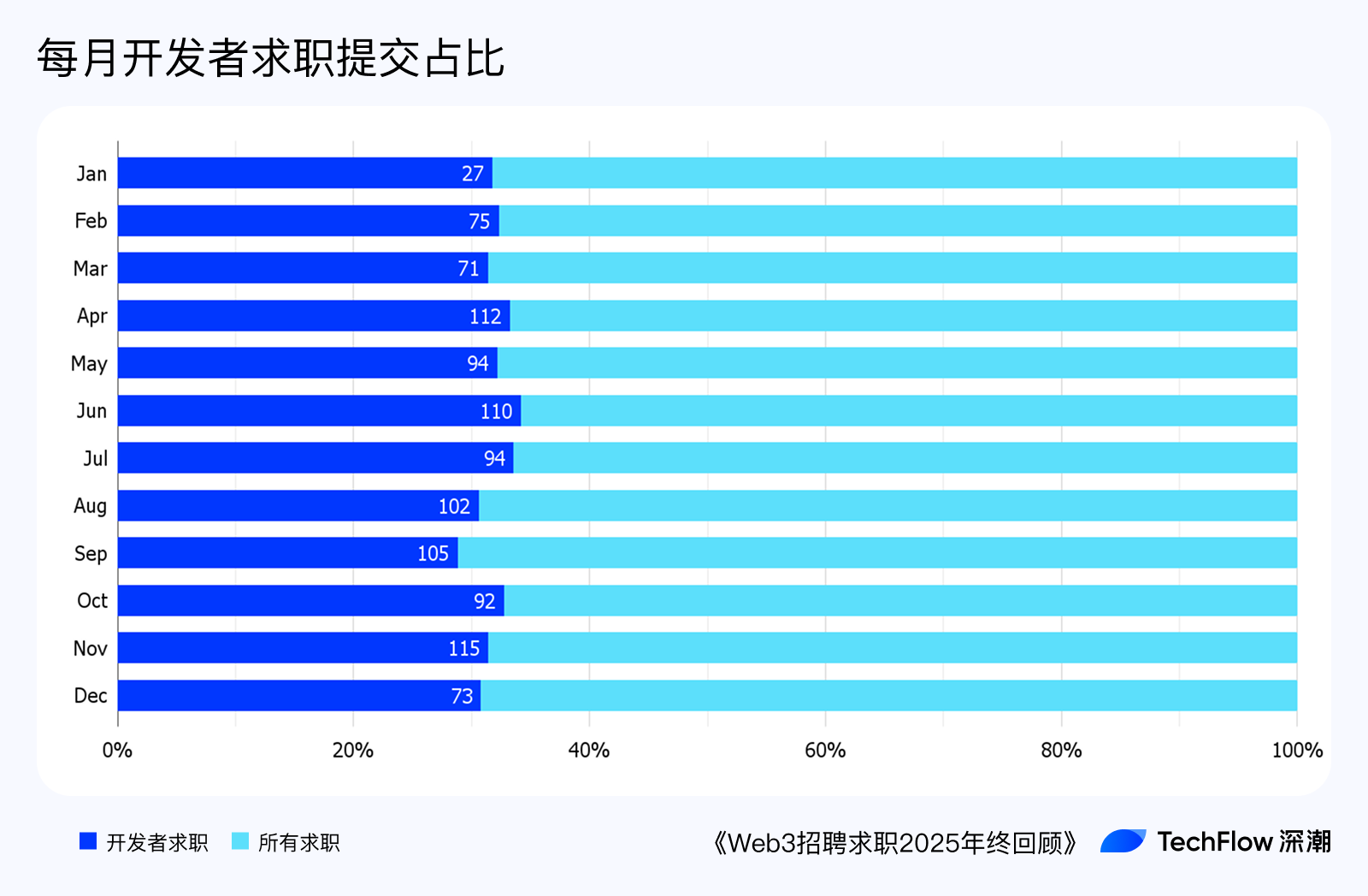

The submission trend of Chinese job seekers generally increased from the beginning of the year to mid-year; however, aside from the spring months, there is not much difference, lacking the significant characteristics of traditional recruitment's "golden three silver four" or "golden nine silver ten."

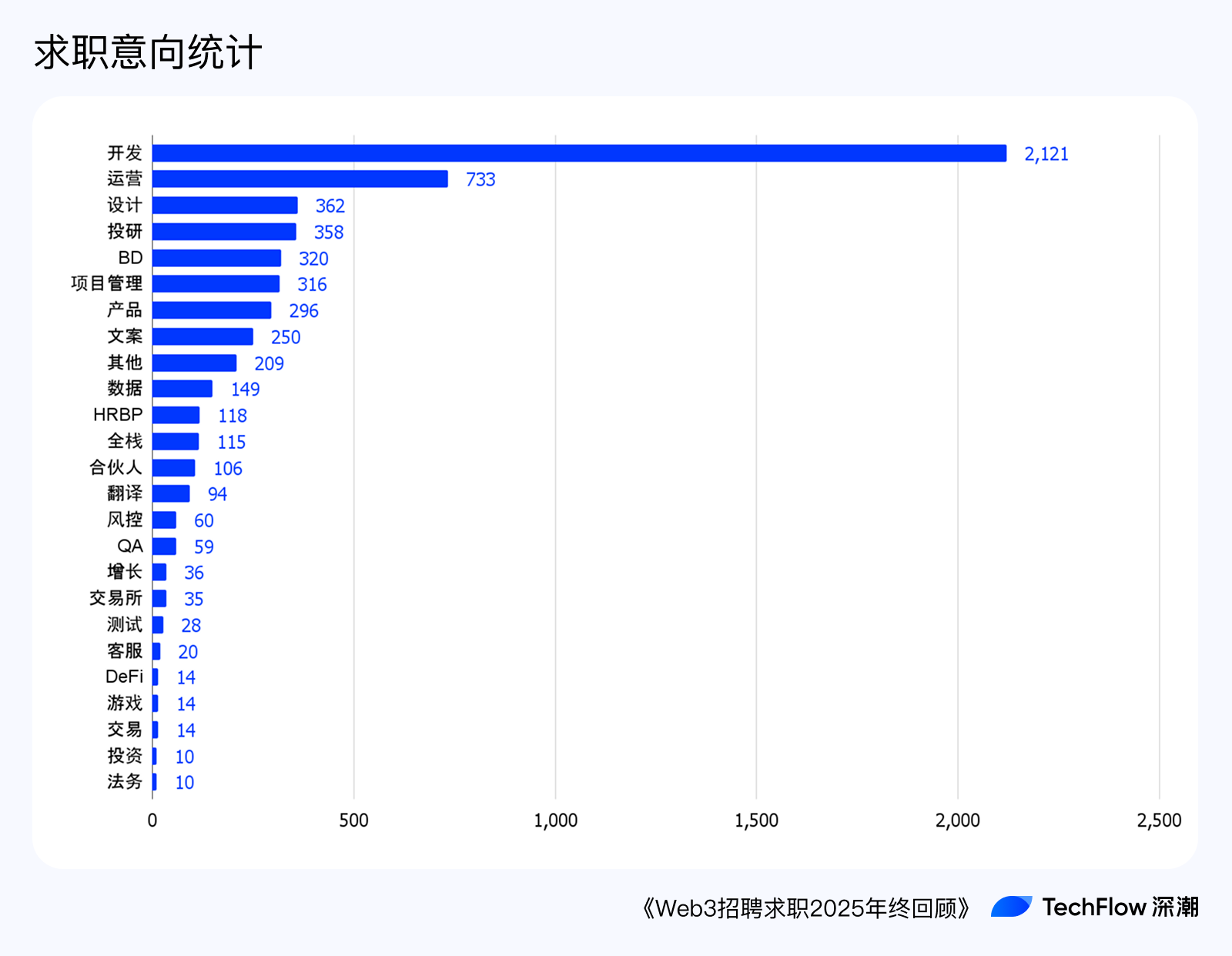

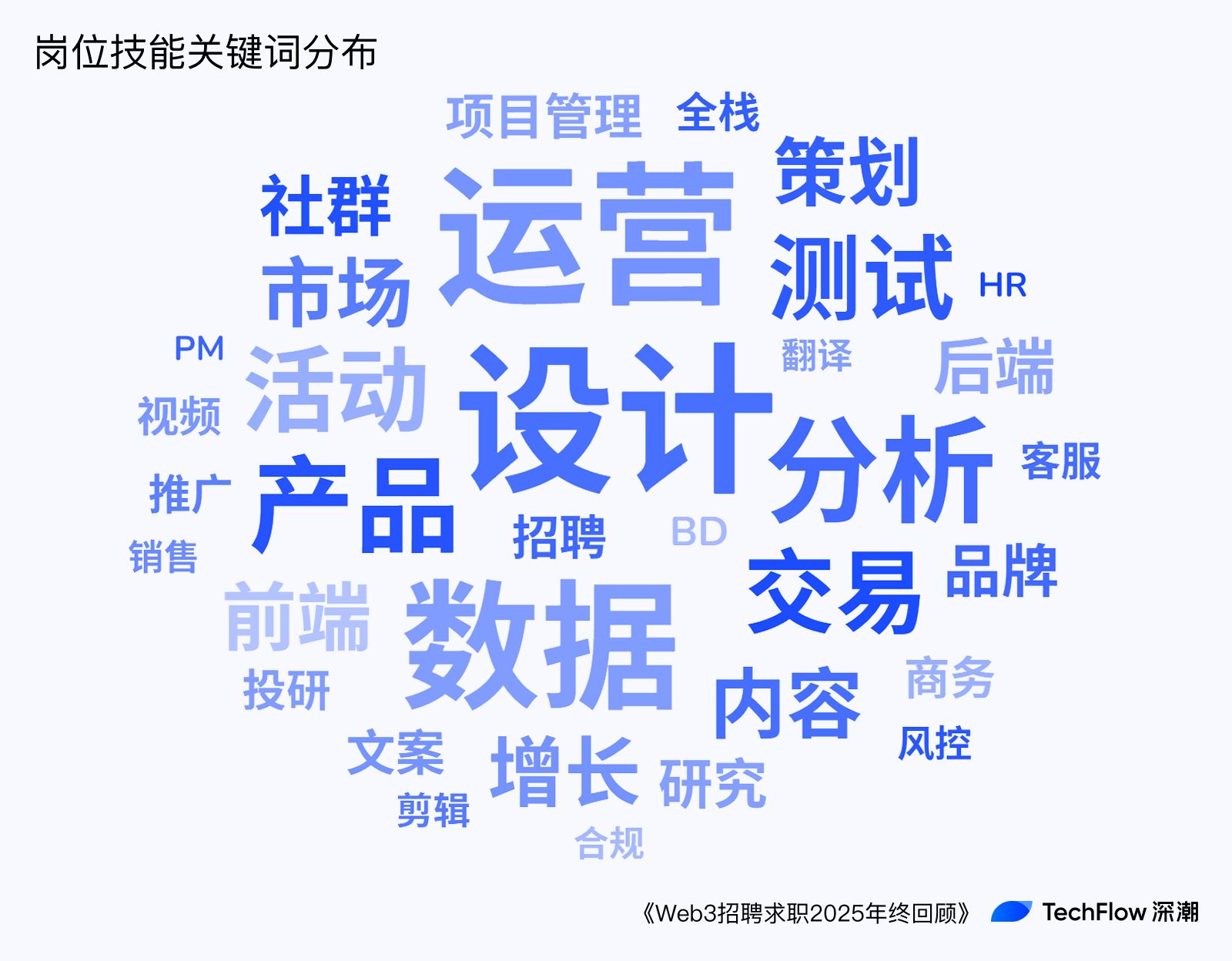

The top 10 most sought-after positions are: development, operations, frontend, backend, investment research, business development, project management, product, design, and copywriting. This basically encompasses the main job types in this industry. The appearance of the term "partner" 106 times indicates a strong entrepreneurial atmosphere in the crypto industry, but it also shows that there is currently no mature entrepreneurial matching mechanism, leading individuals to express their entrepreneurial intentions on job-seeking platforms.

Developer job-seeking information accounts for about 30% of the total job seekers each month. The active job-seeking of technical talent reflects that there are still many developers entering this industry, but it may also indicate that the recruitment headcount is far from meeting the number of job seekers, leading to an unusual squeeze on the job-seeking side.

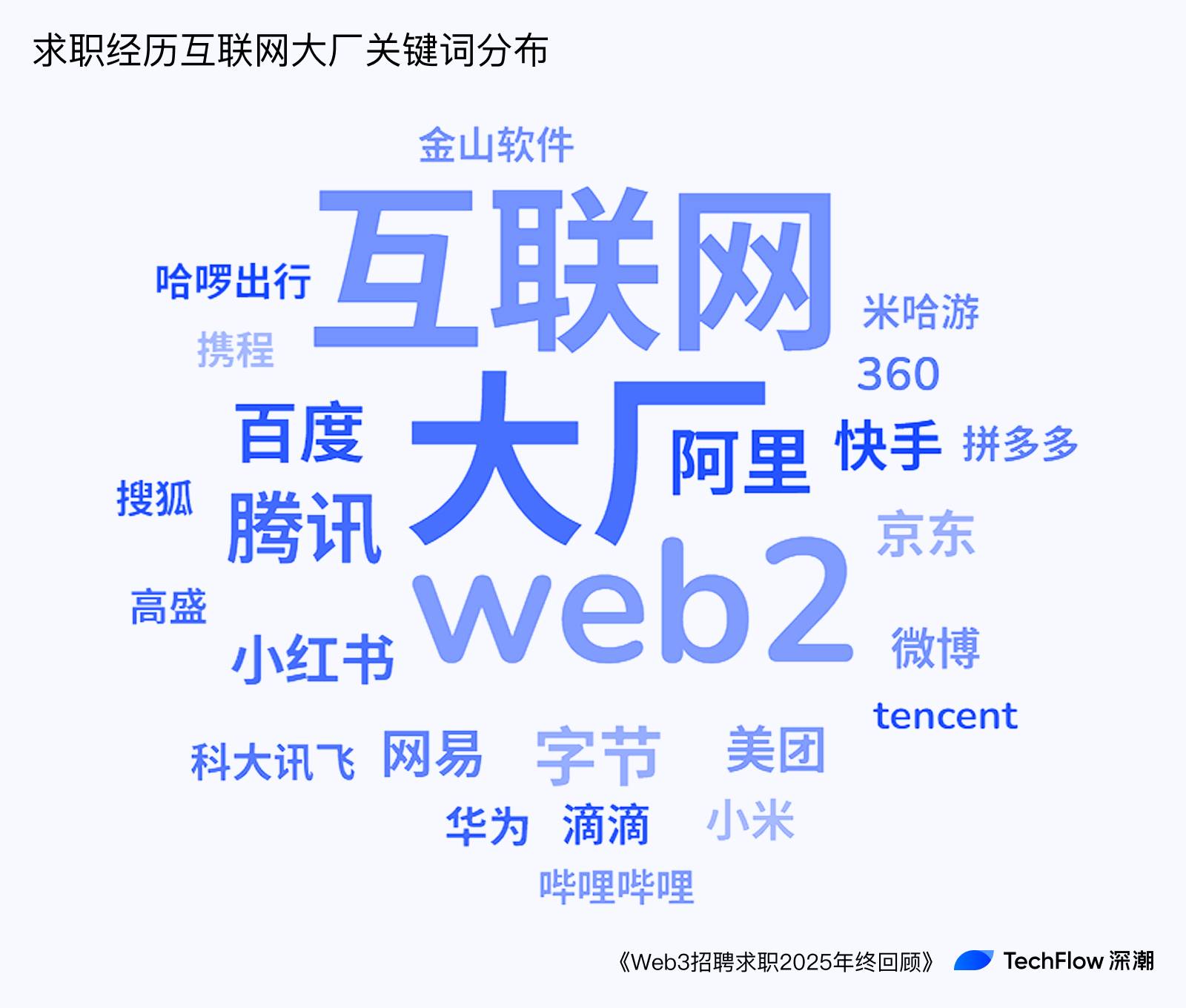

It is worth mentioning that many job seekers have mentioned their backgrounds from major internet companies like BAT. It can be seen that talents with experience in mature internet companies are actively seeking transformation opportunities, possibly due to the common "35-year-old barrier."

In terms of work experience distribution, newcomers (1-3 years) account for as much as 30%, but there are also many veterans with 7, 8, or even over ten years of work experience. Although these numbers do not constitute a majority, they reflect the helplessness of many middle-aged individuals being forced out of their comfort zones.

Regarding Web3 industry experience distribution, among all job seekers, those who have been familiar with Web3 for no more than 2 years account for half. This indicates that as of December 2025, even in vertical recruitment channels for Web3, there are still many newcomers who are curious about the industry and are actively seeking entry opportunities. Of course, this may also be related to the fact that senior Web3 talents tend to move through referrals and no longer use recruitment platforms. Among those with over 10 years of work experience, most also have a shallow understanding of Web3, which may pose difficulties in transitioning, as most Web3 companies place a high value on candidates' crypto-native experience.

In the descriptions of past experiences and preferred technology stacks, commonly used frontend technologies like JavaScript, React, and Vue frequently appear. In the backend technology stack, mainstream languages like Golang and Python dominate, while blockchain-specific languages like Solidity and Move remain relatively niche. (The world's best language brawl scene)

In terms of job capabilities, verbs related to design, operations, data, products, and analysis are very prominent.

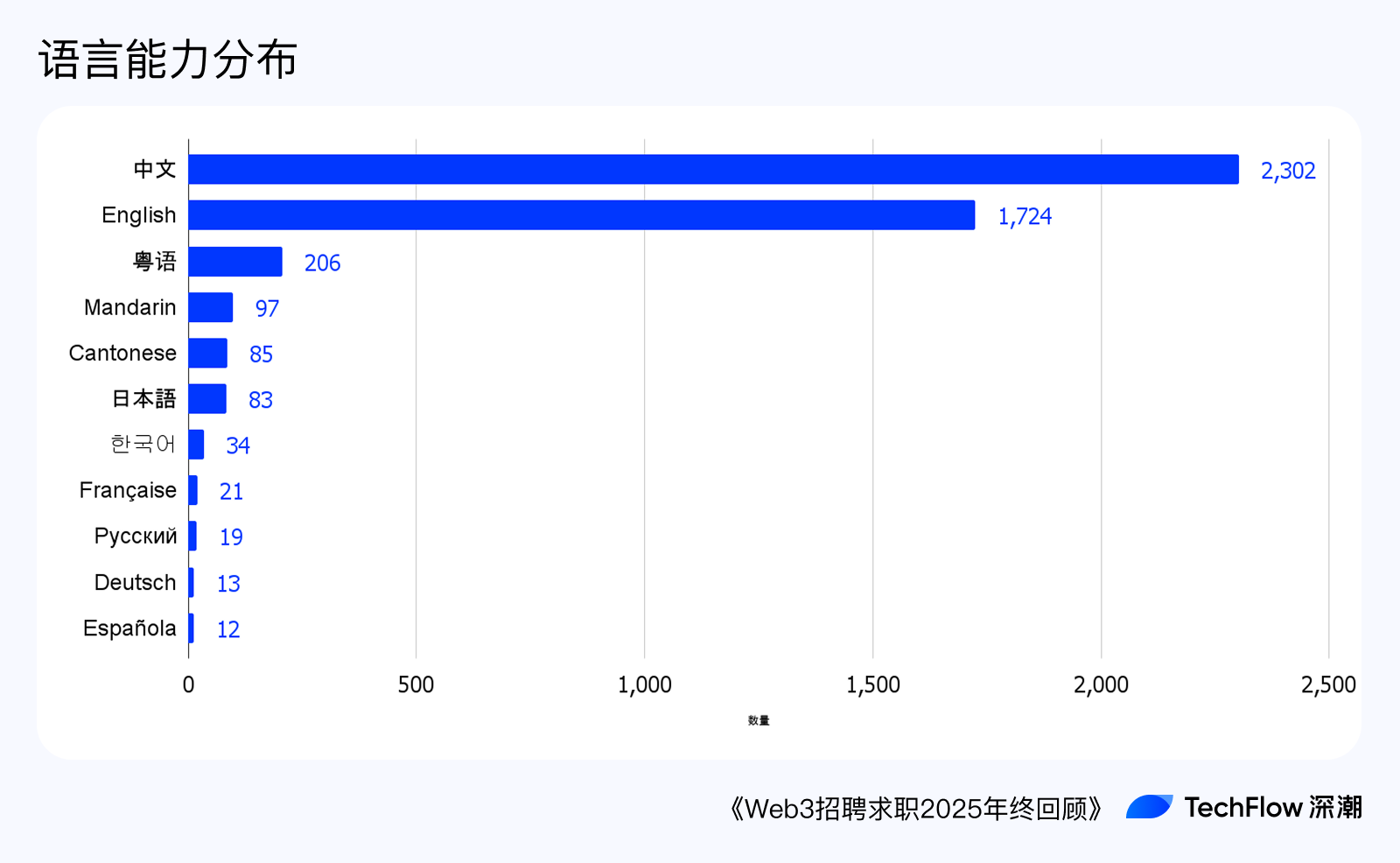

Regarding language skills, over 62% of job seekers selected both Chinese and English, indicating that bilingual proficiency in Chinese and English is a necessary skill. Talents with proficiency in less common languages like Cantonese, Japanese, and Korean are important reserves for specific markets (such as Hong Kong, Japan, and South Korea) and are very scarce among the population.

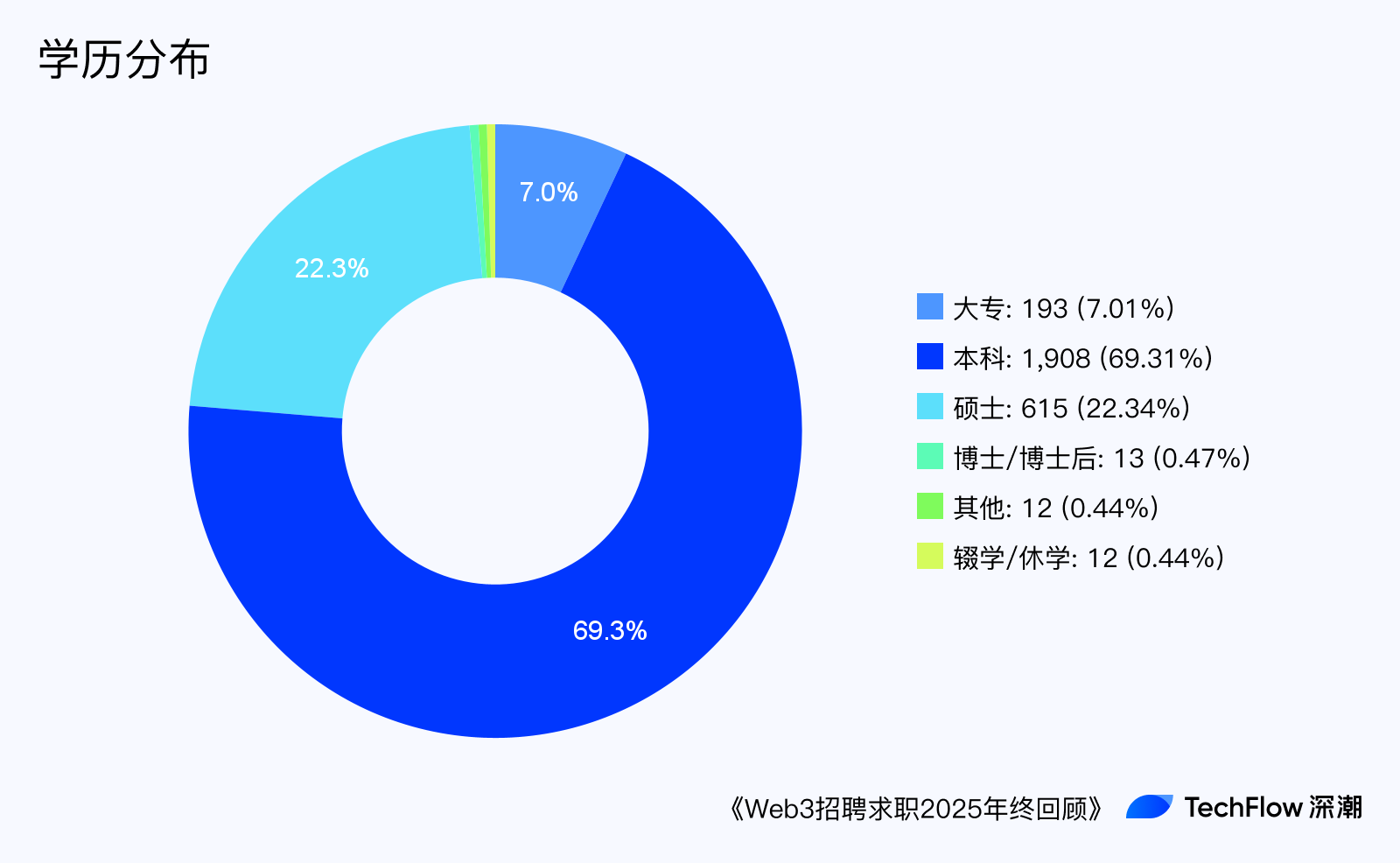

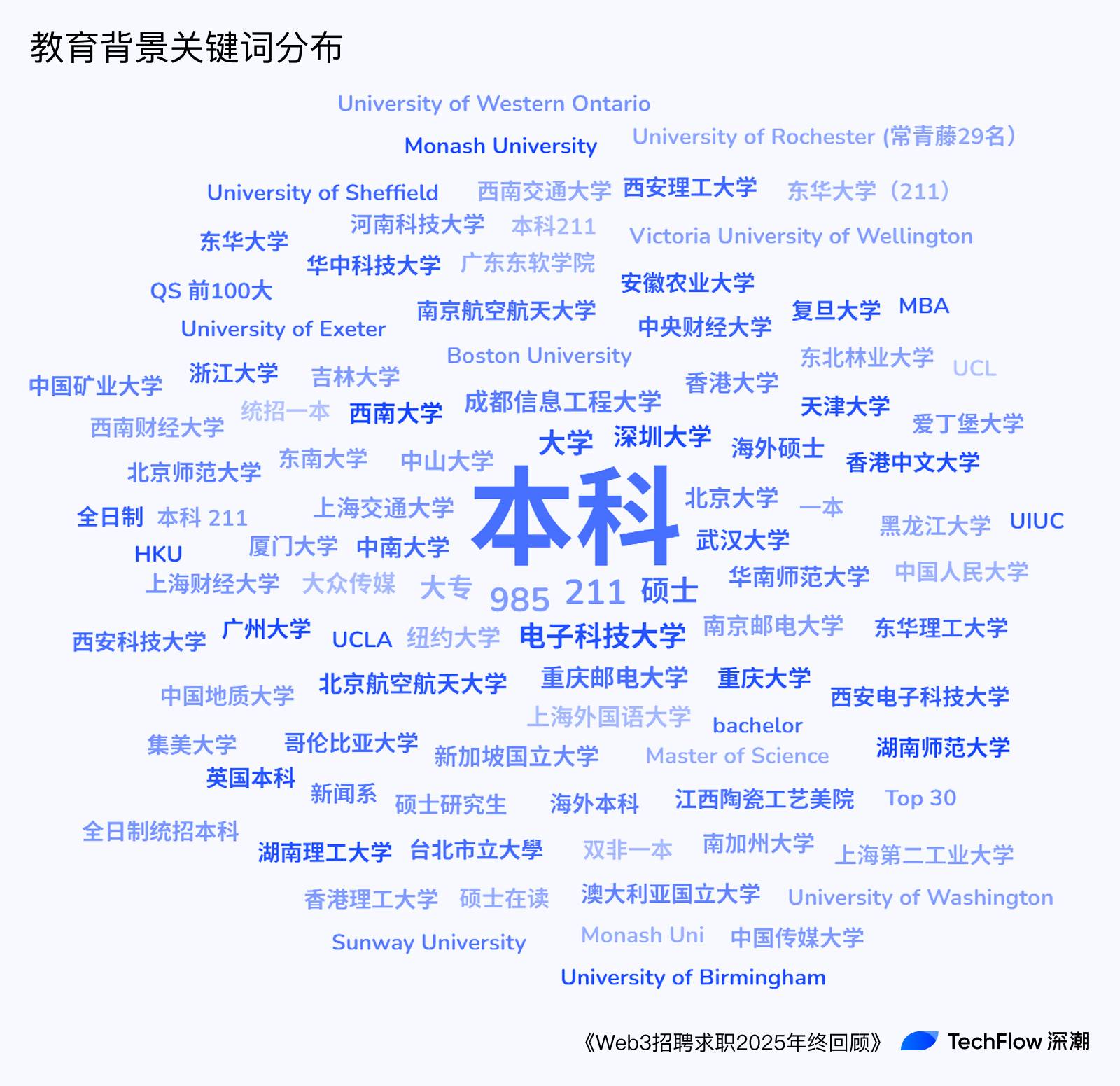

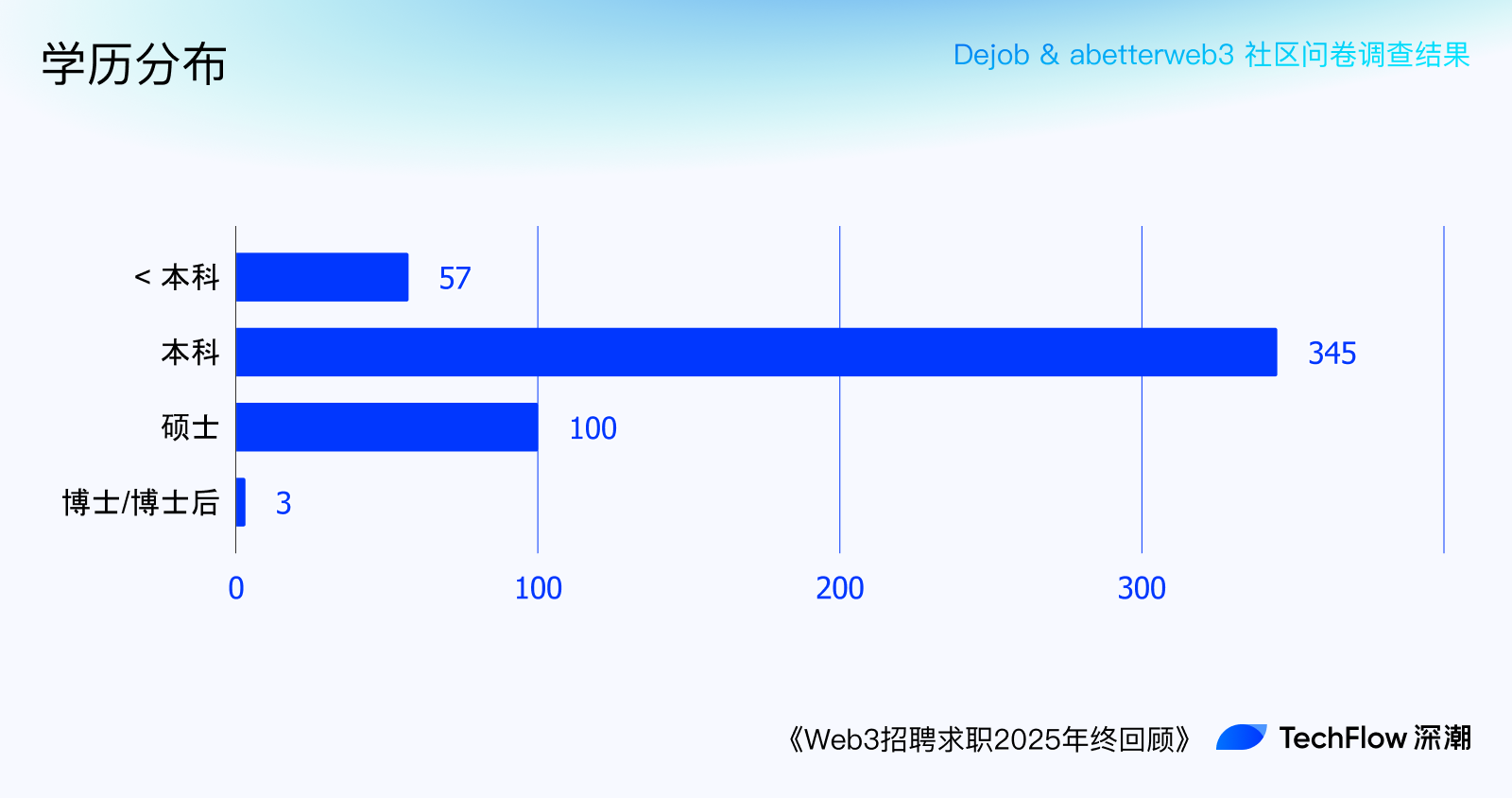

In terms of educational background, most have a bachelor's degree, but whether in recruitment or job seeking, those from 985/211 universities do not constitute an absolute majority. Among the hot keywords in educational backgrounds, there are both domestic prestigious universities like Peking University and Wuhan University, as well as well-known overseas institutions like New York University and the National University of Singapore, along with many ordinary universities and even vocational college backgrounds. This indicates that the Web3 industry currently values capability more than being saturated to the point of using educational qualifications to block upward mobility.

The professional backgrounds are also diverse; although computer science/CS occupies a significant number, individuals from other majors also have backgrounds that match roles in design, product, and analysis.

In terms of salary expectations, among the 1,083 valid data entries that filled out salary expectations, the job-seeking expectations of Chinese-speaking talents are dramatically lower than the global average monthly salary level—an astonishing 94% earn below $3,000.

This phenomenon may have several reasons:

Information gap: Given that most people mentioned earlier actually have limited Web3 experience, they may not have a deep understanding of the salary levels in this industry, leading to a certain mismatch in self-evaluation.

Cost of living: Most Chinese-speaking job seekers may be active in regions with lower living costs, such as mainland China, Southeast Asia, South America, and Central Europe, allowing them to engage in geographical arbitrage through remote work.

Industry cycle: Since this data collection occurred in December 2025, the market has entered a bear phase, and many job seekers urgently need a job, hoping to increase their chances of employment by lowering their salary expectations (i.e., involution).

In summary, at present, most Web3 talents are not as expensive and arrogant as portrayed by the outside world. Through several years of expansion and dissemination, the salary levels in the Web3 industry have basically aligned with those of Web2.

III. Survey Results: The Silent and Humble Majority

From the 506 collected practitioner survey responses, we can obtain a more direct and authentic industry portrait.

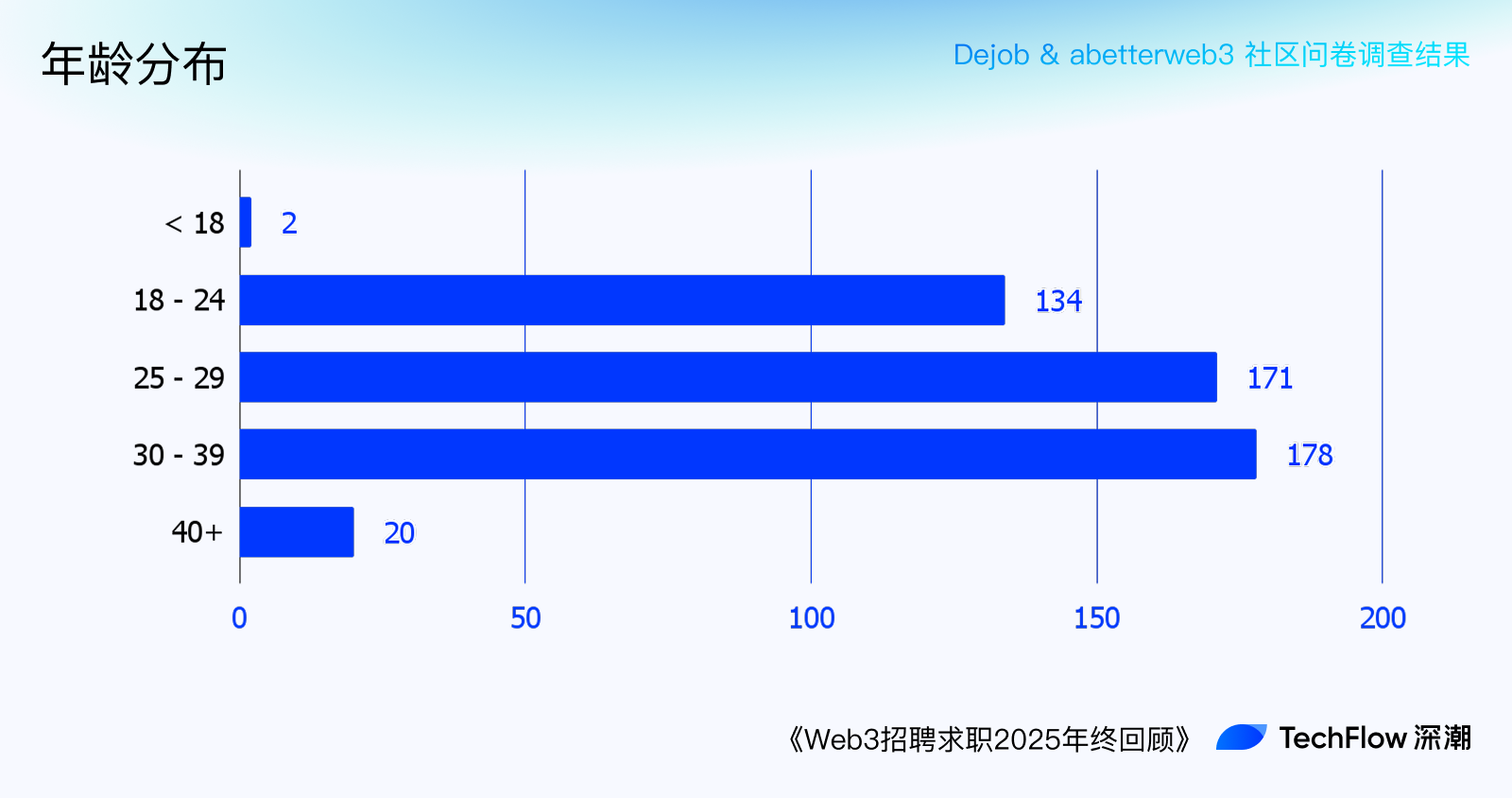

In terms of age distribution, the main workforce aged 18-29 is indeed the majority, but there are also a significant number of young and middle-aged practitioners (>30 years old). This may be related to the less severe "35-year-old barrier" in the Web3 industry. Compared to internet companies, Web3 companies place more emphasis on experience, capability, and efficiency, with each company preferring seasoned professionals who can "plug and play" to quickly build products.

The distribution of educational backgrounds is consistent with the earlier talent data statistics, primarily consisting of bachelor's degrees, with some individuals having less than a bachelor's degree and others holding master's or doctoral degrees, though the proportion of master's and doctoral degrees is not high.

In terms of professional identity, the largest group consists of market-related roles (operations/BD/customer service, etc.), followed by developers (frontend/backend/smart contracts/blockchain, etc.). Next are product, human resources, investment research, design, trading, etc. In the "other" submissions, there are many mentions of risk control & security, KOLs, etc.

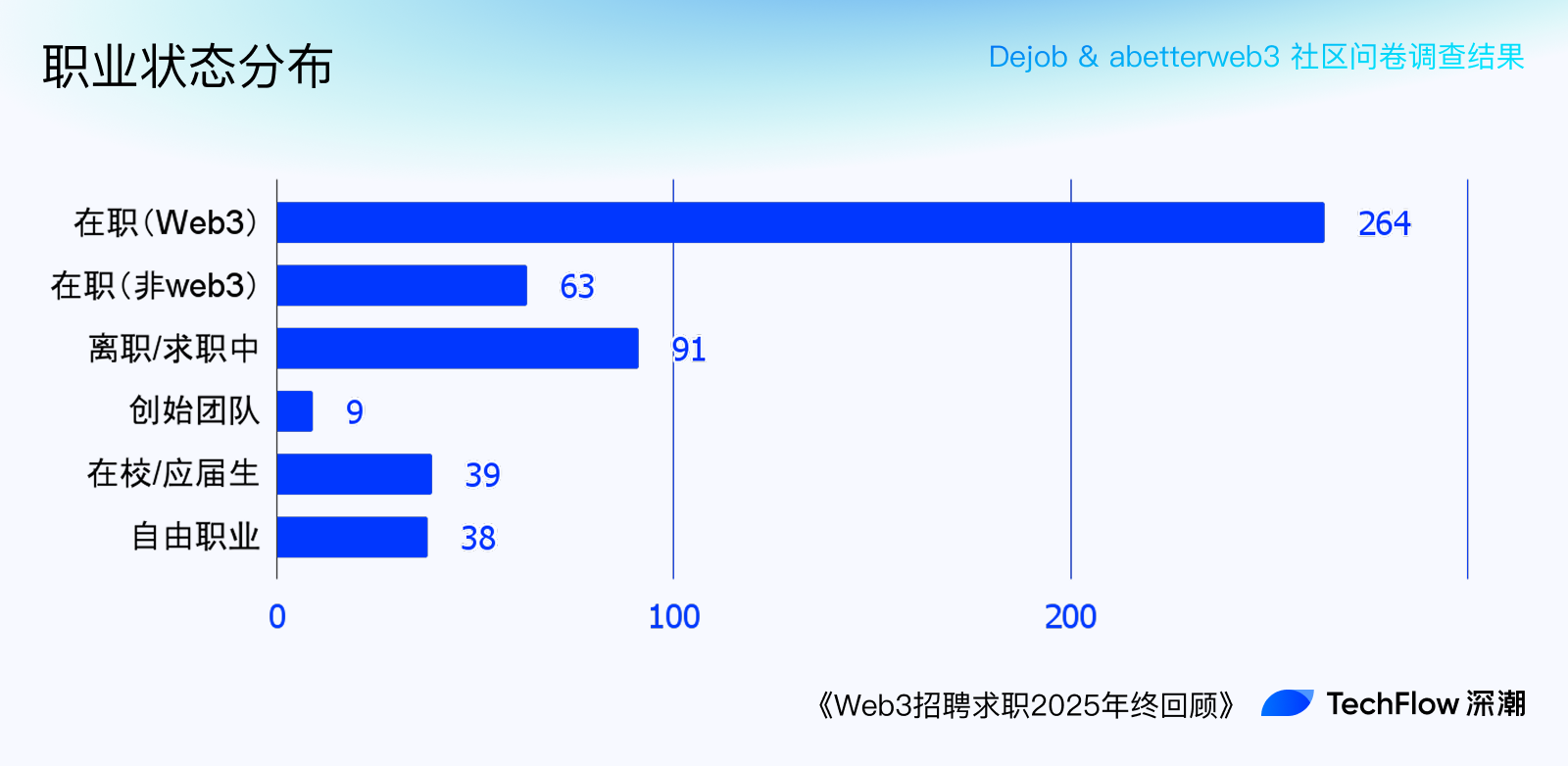

Regarding employment status, only 52% of respondents are currently employed in Web3. Over 30% are in a more flexible life situation. This indicates that market conditions have affected many people's employment opportunities; on the other hand, it may also be because certain unique business models in Web3 have allowed some individuals not to rely on traditional employment for cash flow, such as KOLs and traders.

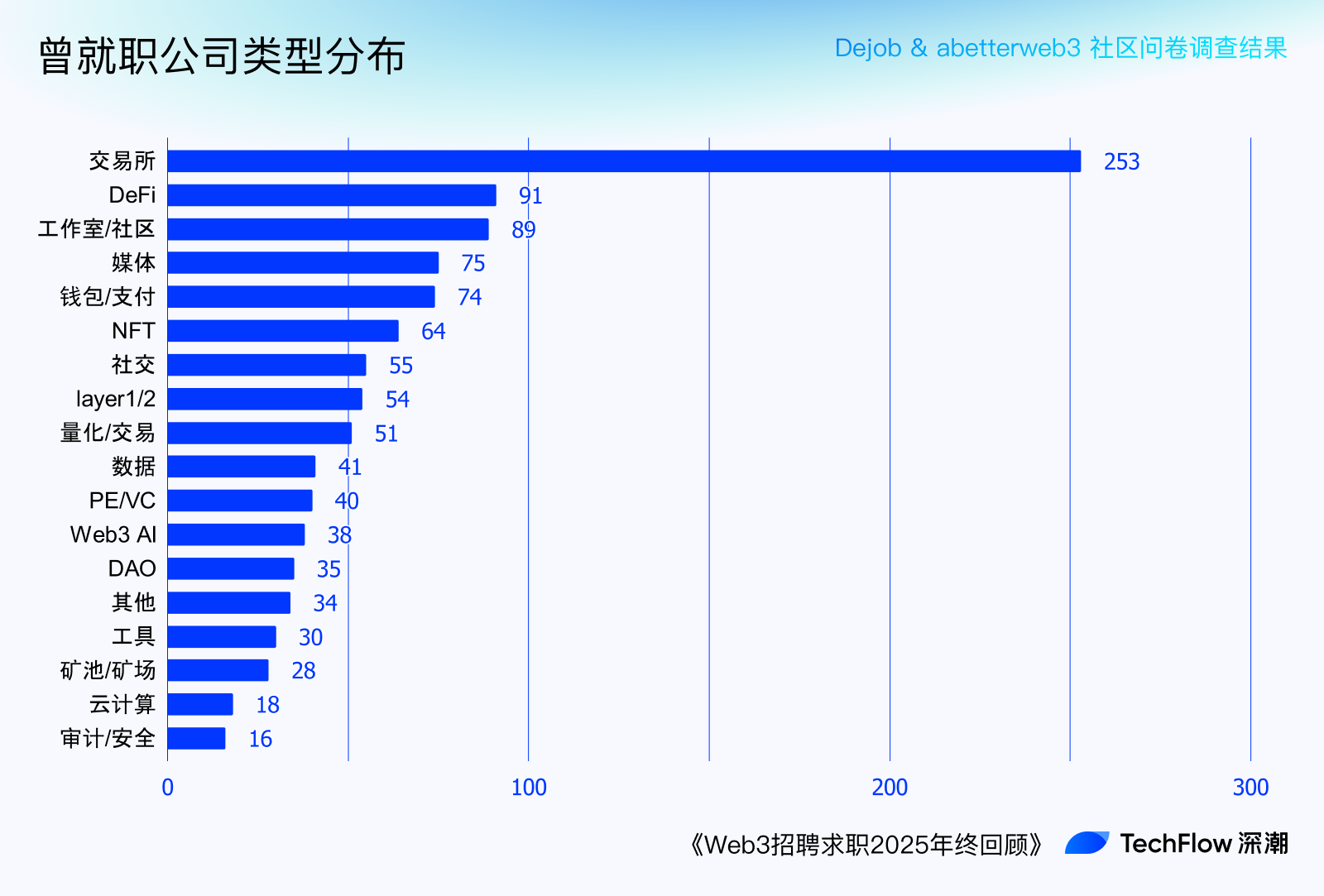

More than half of the respondents indicated that they have worked in exchanges, followed by studios/communities, DeFi, media, wallets, and other common business types. Both talents and job providers are overwhelmingly concentrated in exchanges, reflecting the current industry dilemma: apart from exchanges, the revenue-generating capabilities of other business models generally decrease from C-end—tools—to the underlying layer.

In terms of remote collaboration tools, since this survey took place in a Chinese vertical Web3 recruitment community, Telegram is favored by most companies for its confidentiality and usability, followed by mainstream domestic tools like Feishu and WeChat, and finally foreign companies' commonly used tools like Google Suites, Discord, and Slack.

In terms of income levels, contrary to the myths of sudden wealth circulated outside, most Web3 individuals earn less than most leading internet companies, and there is a severe lack of long-term incentives (tokens/equity), year-end bonuses, and severance compensation.

Over 70% of individuals earn less than $4,000 per month (equivalent to 28,000 RMB), and the widely seen monthly salary of $10,000 on platforms like Xiaohongshu is indeed rare.

Nearly half of the respondents have experienced layoffs, and among those laid off, 40% reported no compensation, while 21% indicated that even if there was compensation, it fell far short of the legally mandated standards (such as n+1).

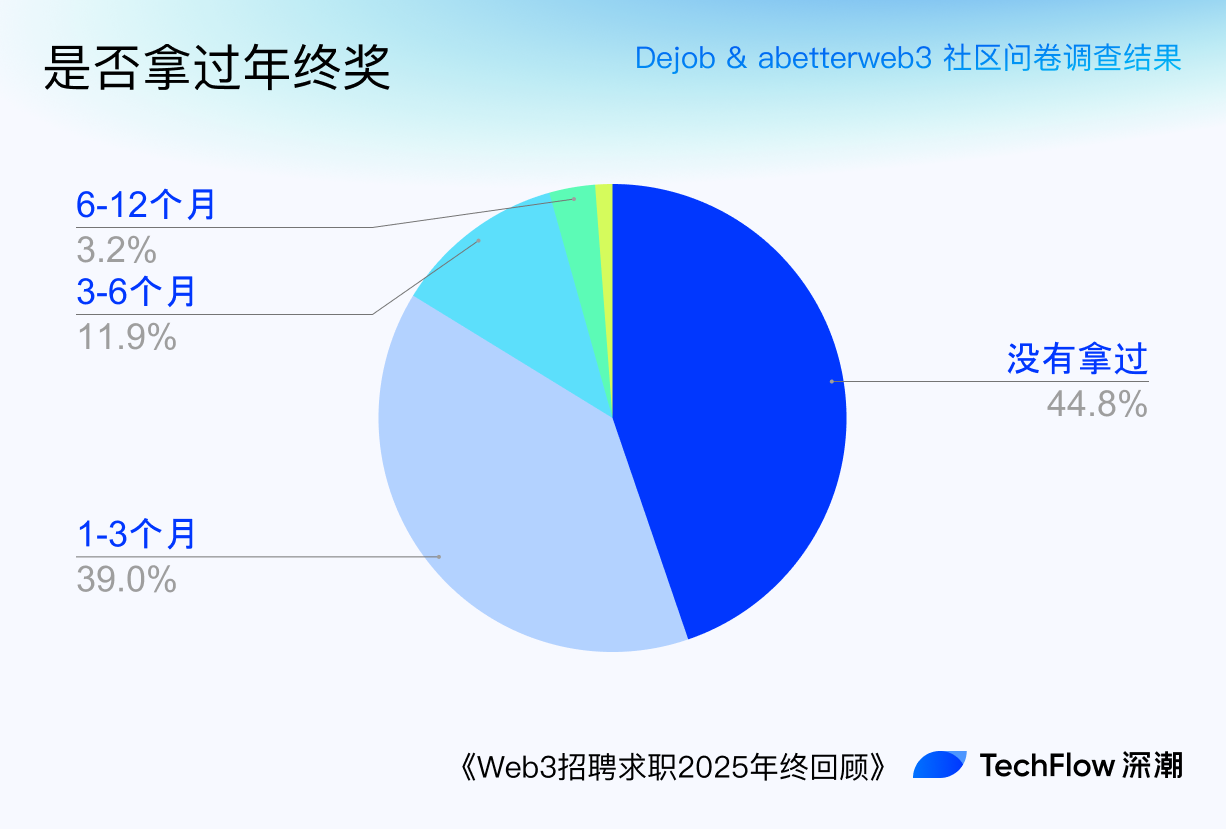

Nearly half of the respondents indicated that they have not received a year-end bonus; even those who did receive one generally got 1-3 months' worth, which is basically on par with the vast majority of internet companies outside the Web3 industry.

In terms of the well-known "upward channel" token incentives, nearly 70% of practitioners reported that they have not received any. Even when they do, very few receive more than 20% of their salary.

In fact, about a quarter of individuals reported an overall wealth accumulation of "loss" after entering the crypto space, indicating a "pay-to-work" status; other responses mostly indicated wealth accumulation around $100K (approximately 700,000 RMB).

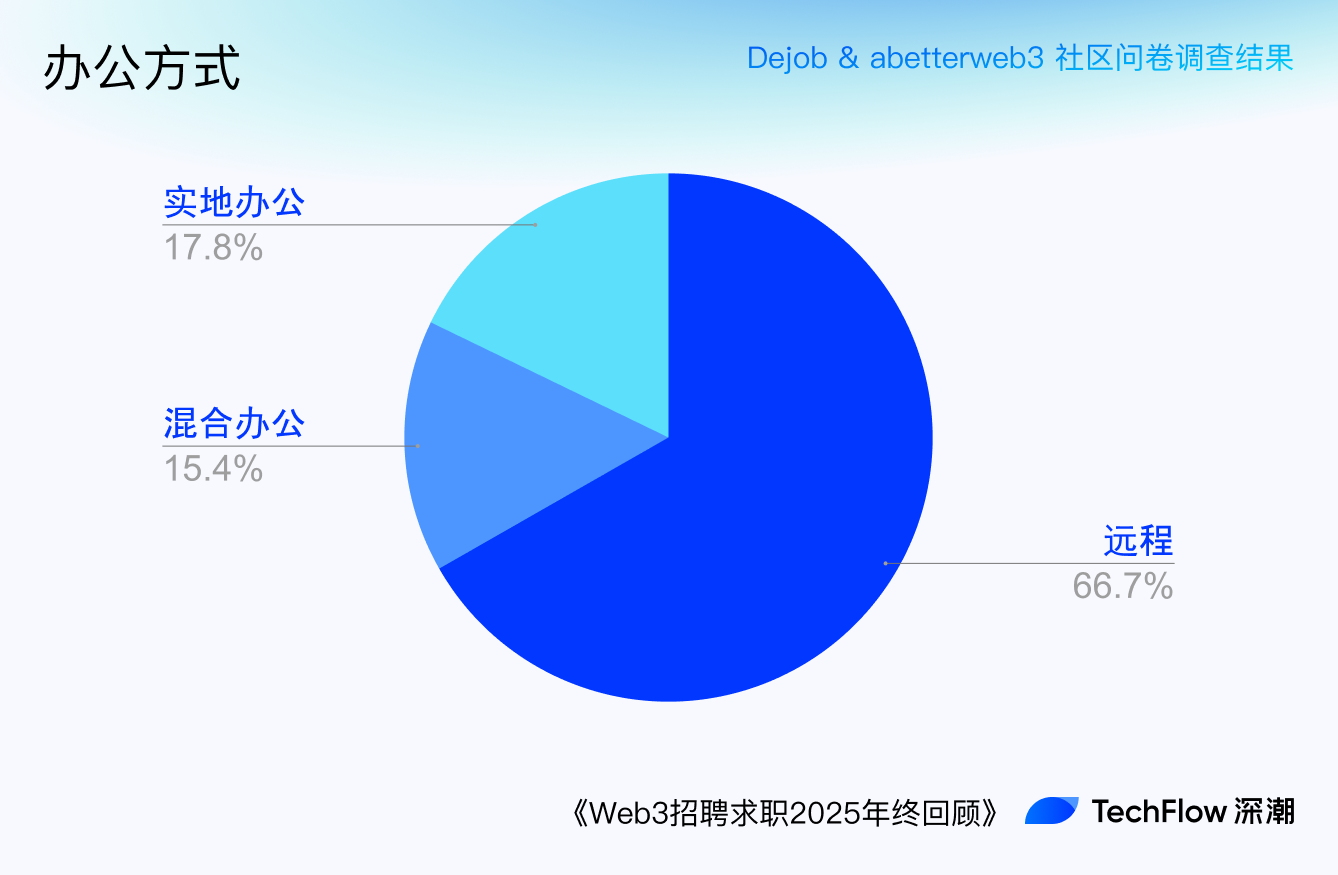

However, on the other side of seemingly hopeless income levels, the strong remote work culture in Web3 can be said to provide some relief for many workers. Nearly 70% of responses indicated that their companies support remote work, and another 15% reported support for hybrid work, meaning that while there is an office, attendance is not mandatory, or there are several days a week when employees can work from home.

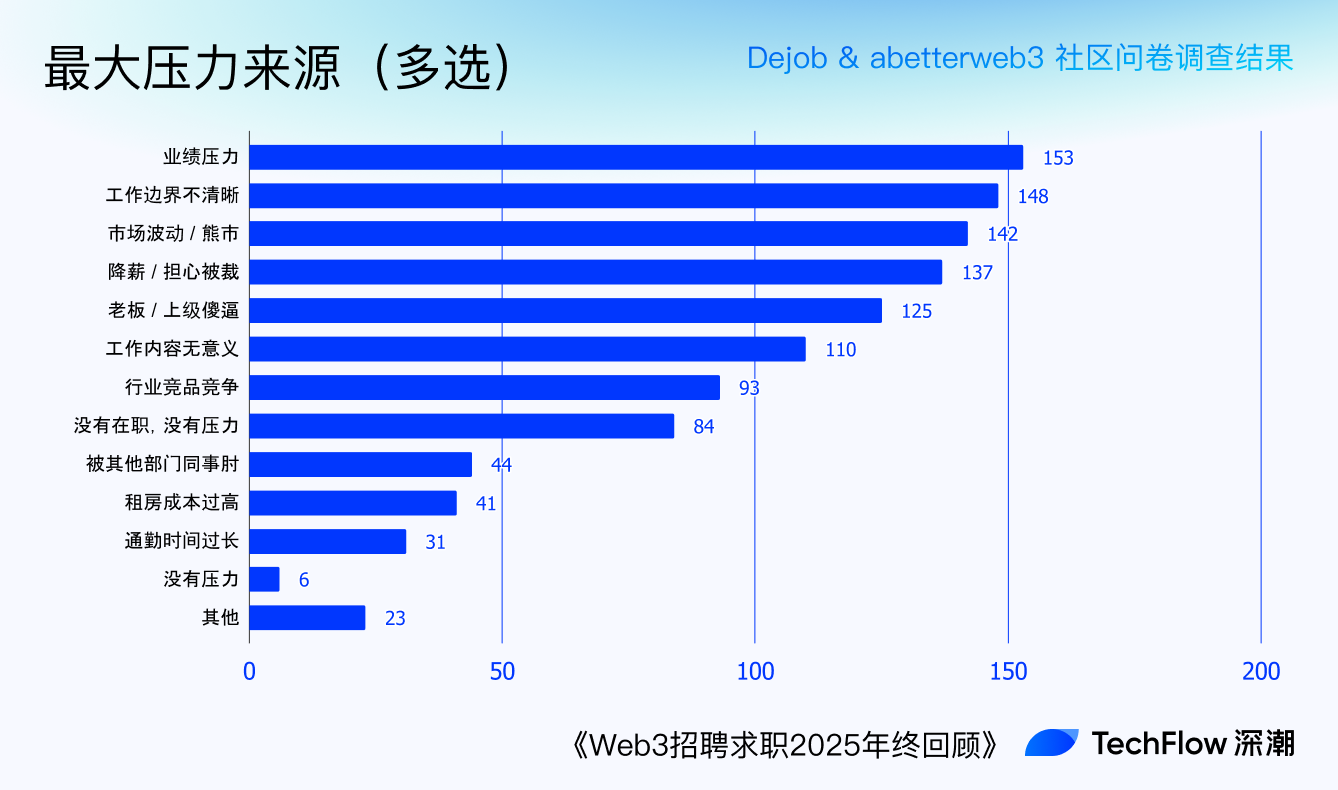

Remote work does alleviate some of the pain of working to a certain extent. In the question about the "biggest source of stress," 31 responses chose "long commuting time." Other leading sources of stress included product growth, work boundaries, market fluctuations, fear of layoffs, and difficult bosses.

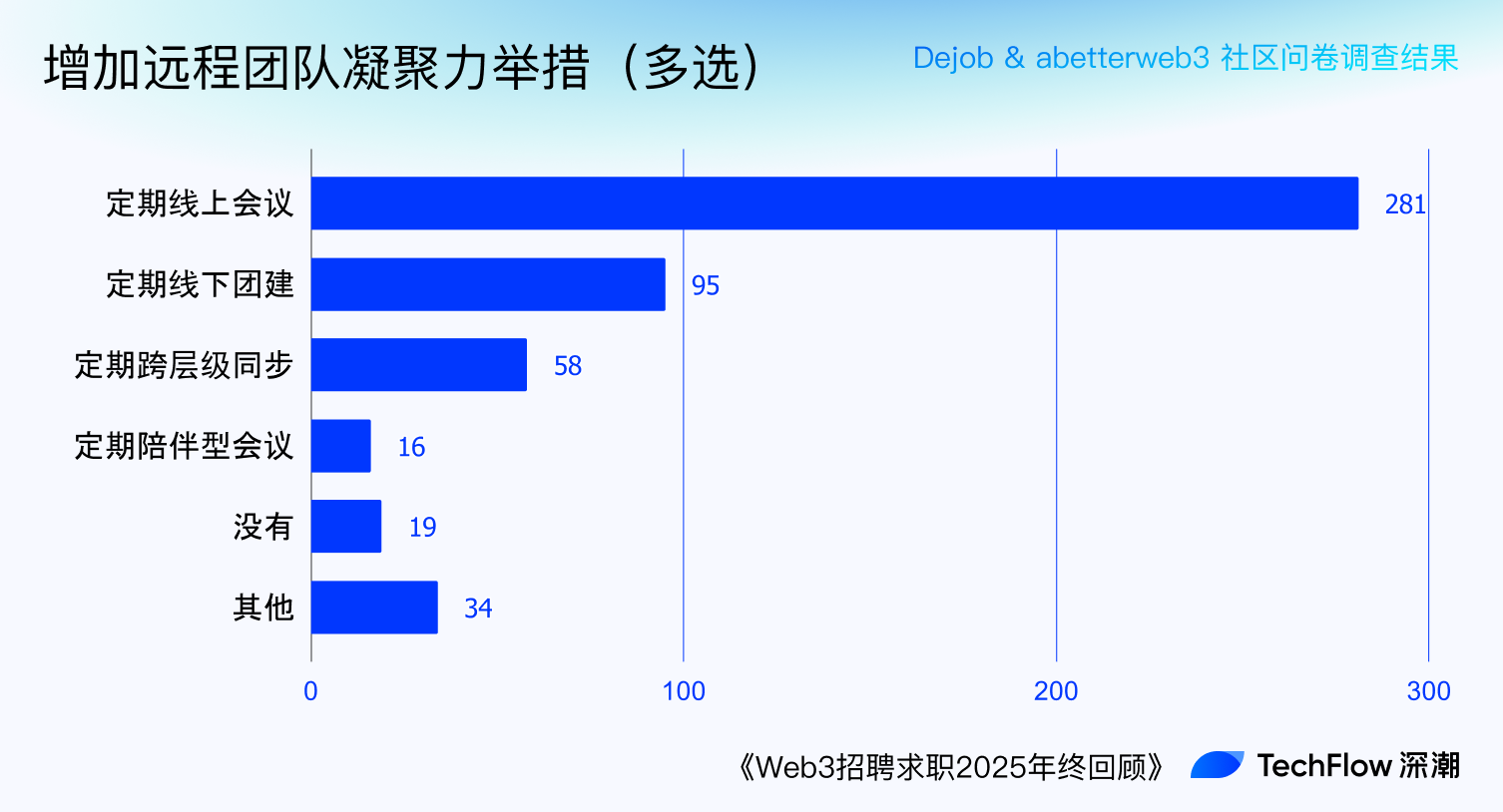

To maintain the mental health of employees as social beings, many companies have also taken measures to sustain team cohesion.

Under the combined effects of low income and instability, many individuals choose to take on multiple jobs. In the responses, 20% indicated that they have part-time jobs. This also reflects the technology-oriented culture in most Web3 companies, where as long as problems are solved and capabilities are in place, they do not interfere with employees' lifestyles and income methods.

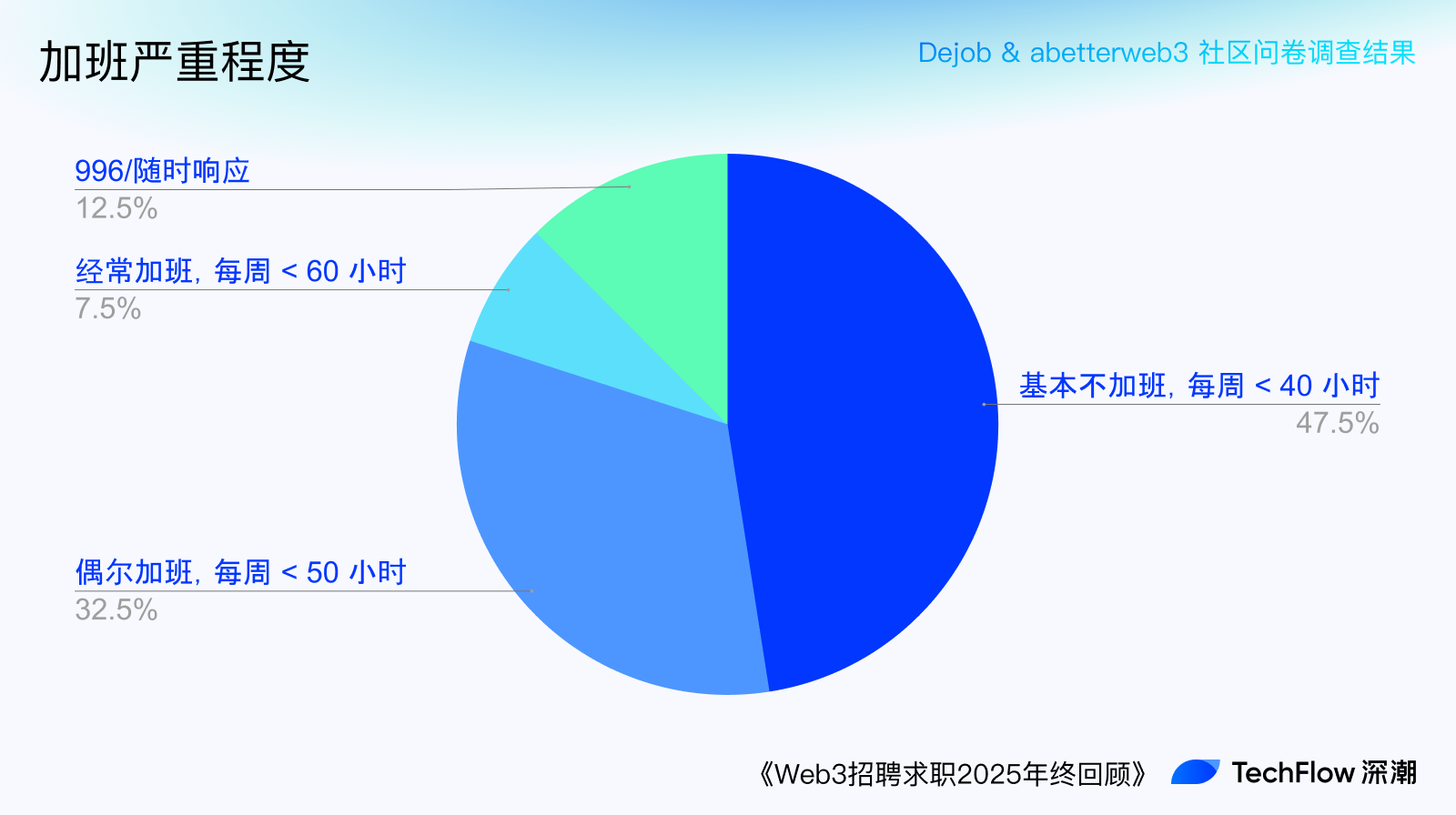

Regarding overtime intensity, 80% of individuals reported working approximately 40-50 hours per week. Thus, it appears that the overtime intensity in Web3 is significantly less than the 996/007 sweatshops of Web2.

When it comes to job hopping, more than half of the respondents expressed a desire to change companies, with 30% planning to do so within 3-6 months. However, about a quarter of individuals reported being satisfied with their current situation, and 8 respondents found "dream companies" they hope to work for for a lifetime.

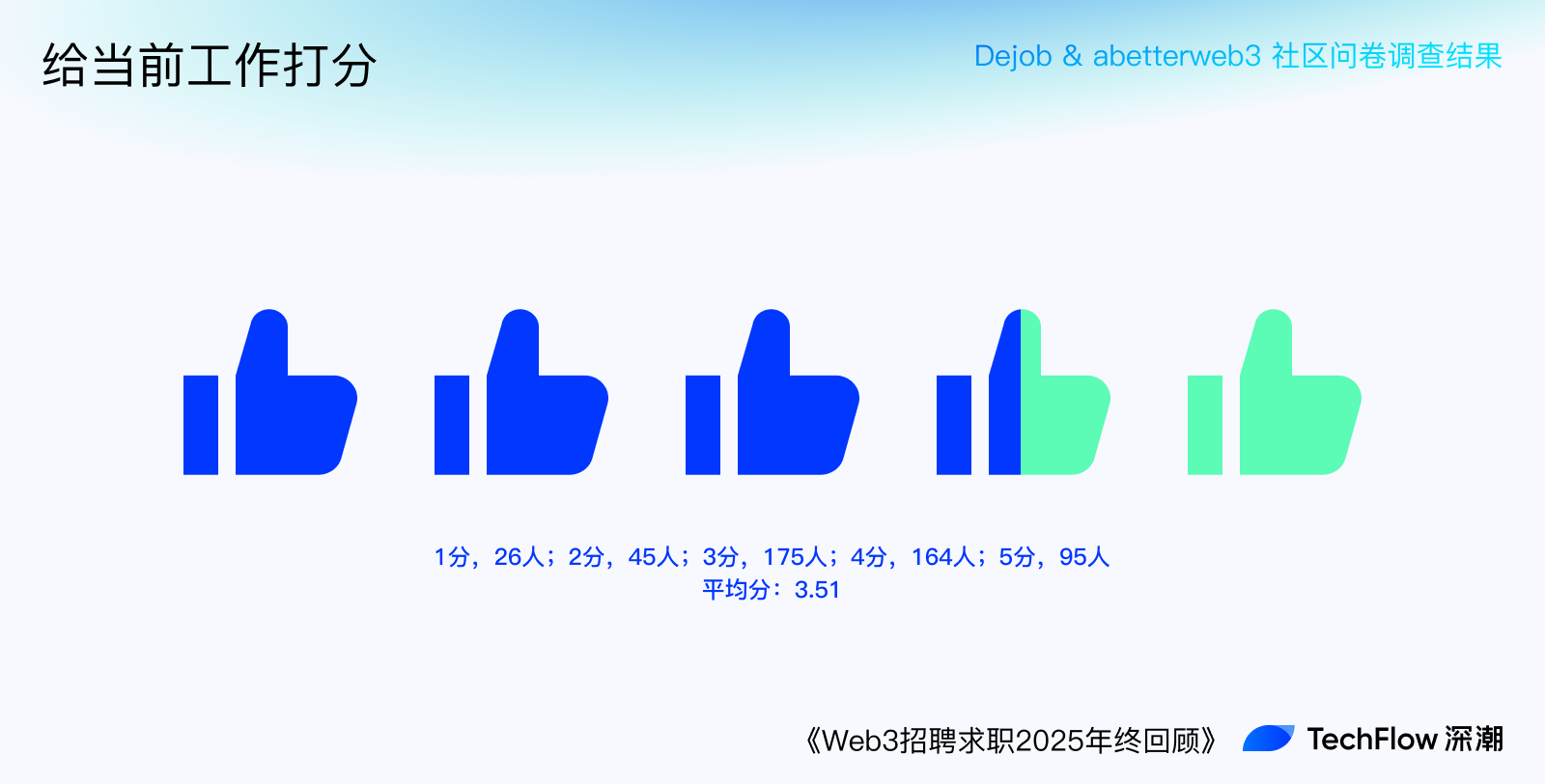

Considering factors like less overtime, the ability to work remotely, and the option for part-time work, many individuals rated their current jobs positively. The average score given for their current work was 3.51.

Regarding whether their next job will still be in the crypto space, over 80% chose to stay, while 7% opted to leave.

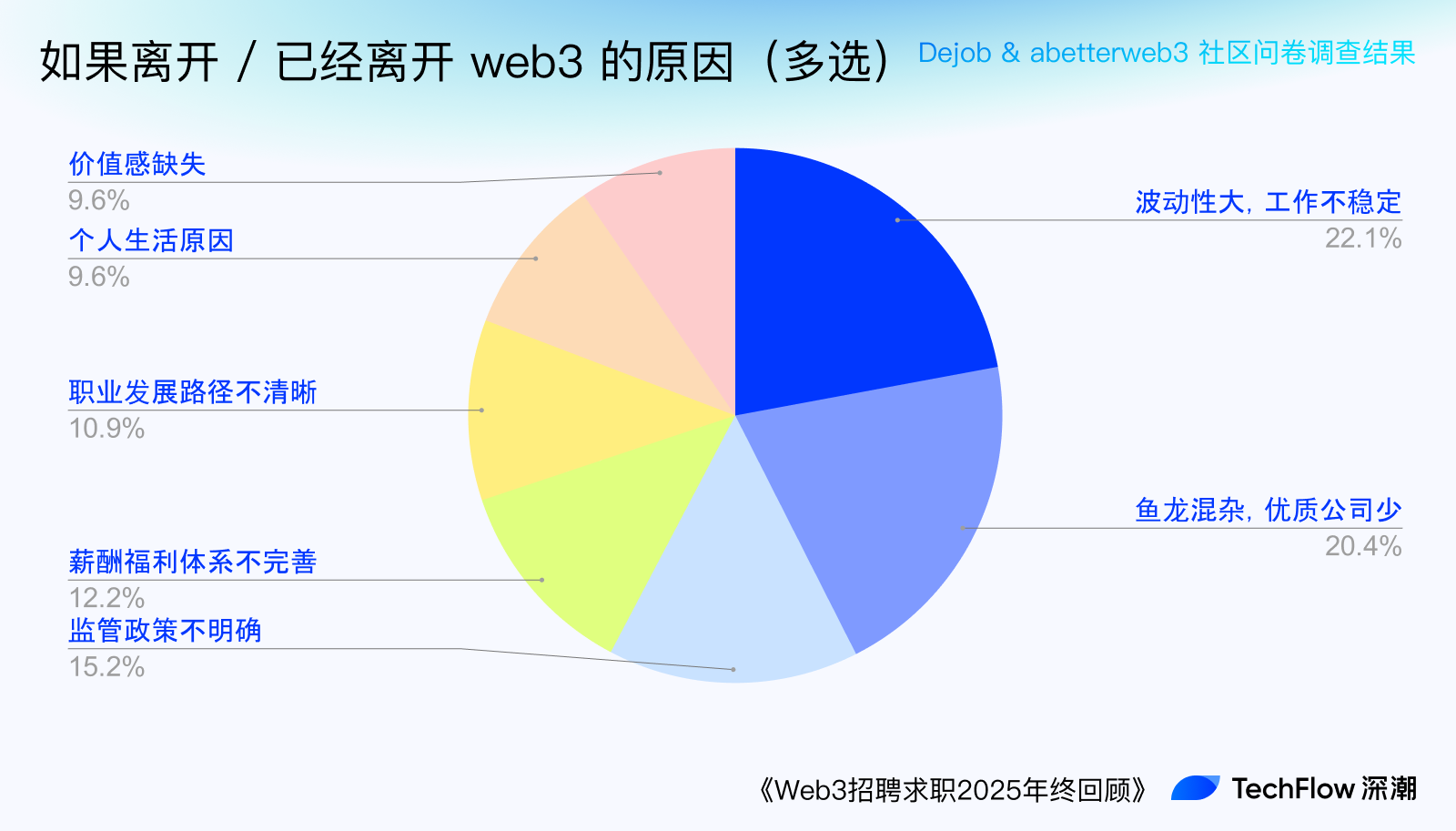

As for the reasons for leaving, the choices reflect the industry's most genuine indifference.

However, all the preparations for the future are aimed at early retirement. When asked "how much wealth would make you consider resigning," the vast majority chose $1M - $5M (equivalent to 7 million to 35 million RMB). This may indeed represent the wealth limit that one can achieve through working. However, 20% of respondents chose "no limits," reflecting their confidence in their own abilities.

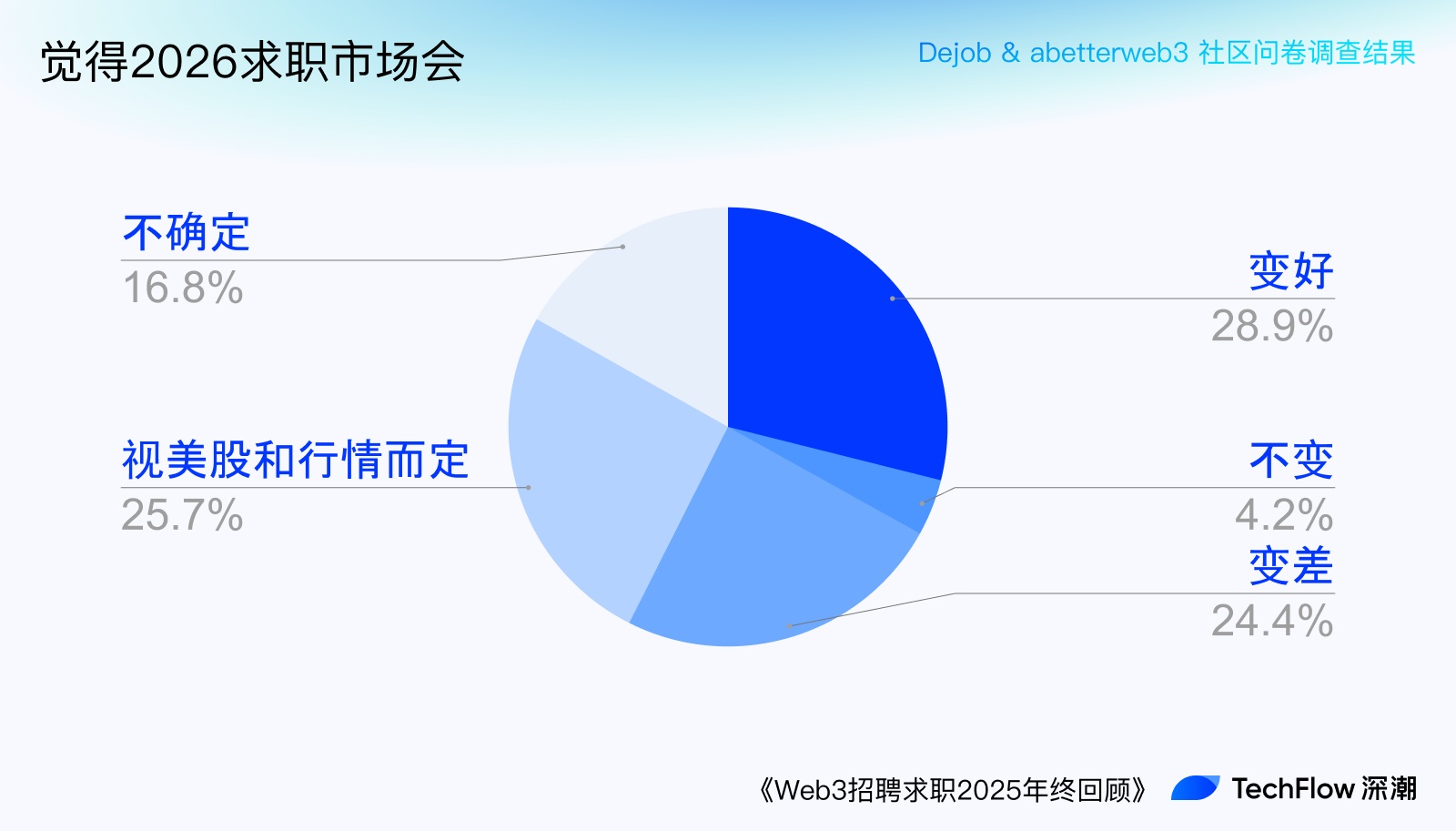

Regarding the job market outlook for 2026, only 28% of respondents believe it will improve, while most hold a pessimistic or wait-and-see attitude.

Truthful Words Section👀

In addition to the above questions, we also added a few optional questions to gather some of the most genuine opinions from job seekers about current industry companies (for entertainment purposes only).

In the question "What is the best crypto company in your opinion," the top ten companies are:

- OKX(26), Binance(23), Bitget(10), Gate(9), MEXC(7), Bybit(6), Old Huobi(5), Huobi(4), Deep Tide TechFlow(3), OneKey(3)

Surprisingly, some teams that have already disbanded were also mentioned, such as Huobi during Li Lin's time, a certain disbanded team from Bitget, and the now-defunct Consensus Labs. Perhaps these dream companies are worth a lifetime of nostalgia.

In the question "What is the worst crypto company in your opinion," the top ten companies are:

- Gate(43), Bitget(13), OKX(12), MEXC(8), Huobi(7), Binance(5), WEEX(5), CoinW(2), Kucoin(2), Lbank(1)

Some exchanges appear on both the best and worst lists. This may indicate that the internal business lines of exchanges are vast and complex, and the working experiences of different departments and leaders can vary greatly.

In the question "If you could ignore real-world conditions, which company would you most like to join," the top ten companies are:

- Binance(177), OKX(50), Coinbase(25), Hyperliquid(11), Bybit(11), Bitget(10), Tether(10), Circle(6), Solana(5), Ethereum(5)

As expected, Binance, as the industry leader, was rated first. As the "Tencent of the crypto space," Binance has both the filter of outsiders and the role of a prestigious resume within the industry, truly supporting individual career development. The on-chain newcomer Hyperliquid, as a non-exchange entity, made it into the top 10, reflecting its strong community and people's desire for non-exchange products. Besides the leading exchanges, the names of foreign companies and overseas infrastructure have significantly increased in this answer, which also reflects the disappointment of most job seekers towards Chinese teams.

In the question "What do you think is the most profitable profession in the crypto space," the high-frequency keywords include:

- Trader(85), KOL(68), BD(47), Exchange(32), Quant(32), Project(27), Developer(20), Contract(17), Market Maker(16), Technical(14)

Traders ranked first, likely because the ghostly market conditions over the past two years have made many realize that regardless of the company or profession, it might be better to directly engage in the game themselves; KOLs closely follow, likely because they have the opportunity to access primary tokens from project parties, possess information advantages, or can directly influence specific targets for profit. Pure technical positions, which are far from the market, were also mentioned, perhaps because, in the eyes of most non-developers, "technology" is an indispensable part of achieving leaps as "super individuals."

If you're interested in more answer details, we have made this part of the answers public in an online document, which you can click to view👀.

Crypto Workplace Survey [Truthful Answers to Questionnaire]

You can also click here to view the pure version of the questionnaire results↓

《Crypto Workplace Survey Results Pure Enjoyment Version》

Side Note: Traits Valued by HR

To better help job seekers understand the perspective of recruiters, we also interviewed several senior HR professionals from different companies.

Regarding whether the recruitment demand in Web3 has been shrinking over the past few years, an HR representative from an exchange stated that since 2020, the recruitment they have handled has indeed shown a downward trend. By 2025, the situation is that development headcount is hardly being updated, with only BD, marketing, and operations personnel being hired and then leaving repeatedly. The reason is clear: there aren't that many new features to develop in this industry, but there is still a need for growth.

Another HR mentioned that the overall demand has not decreased, but the demand for junior positions has reduced, while the demand for senior/experienced positions has increased. A third HR indicated that while demand has not shrunk, the hiring standards are becoming higher, especially with the obvious increase in educational requirements, although it is not as competitive as in Web2.

When asked what kind of candidates tend to make a "good first impression," the HR professionals agreed on two points: good education and a strong background (from large companies or relevant experience).

However, there is a survivor bias here: companies that can afford to hire HR are often more mature, so it is understandable that they have requirements for education and background. Some interviewed HRs also mentioned that educational requirements vary by job type; positions that require education, such as backend, algorithms, and blockchain, have always had such requirements; positions that do not require education are not likely to demand it too much now. Additionally, one HR noted that for product research and development roles, a Web2 background is a plus, but for non-product roles like marketing and operations that require active empathy with users, a Web2 background can actually be a disadvantage.

Regarding the traits they value, several interviewed HRs emphasized the importance of capability, self-motivation, learning ability, and willingness to integrate into Web3. Industry veteran HR Oona stated that teams may prioritize "plug-and-play" and "problem-solving" professional skills; as an HR, she tends to evaluate whether a candidate is "suitable" more comprehensively, which often includes the aforementioned traits as well as whether the candidate is "smart"; she also places great importance on whether a candidate has a stable work history, preferring candidates with a more stable and organized background.

When asked if there are positions that have been difficult to fill for a long time, several HRs indicated that there are basically no positions that cannot be filled, but some hybrid roles may take longer to recruit, such as those requiring both product awareness and development skills. However, such hybrid headcounts are relatively rare.

Conclusion: The Spark Still Exists

We hope to demystify the industry for some people with this data, but we also want to preserve a snapshot of the industry in 2025. Today, this industry no longer offers the grassroots wealth-building opportunities of 2017, nor the liquidity feast of 2021. Exchanges are absorbing most of the employment, while startups at various levels and in various tracks are waiting for the next wave of change. The wealth stories on platforms like Xiaohongshu and Bilibili are either survivor bias or belong to a very small number of people at the top of the pyramid. The vast majority of silent individuals in this industry are just ordinary people trying to support their bosses' million or multi-million financing stories with salaries of two to three thousand dollars.

Even so, over 80% of people choose to stay in this industry. Behind this persistence lies not only an obsession with financial freedom but also an acknowledgment of lifestyles such as remote work and flexible hours, along with a sense of helplessness after going "all in." The true background of the industry consists of middle-aged individuals transitioning from large internet companies, young graduates who cannot find good jobs and thus enter the crypto space, and freelancers juggling multiple projects. Here, there is no utopia for crypto geeks, only a city filled with uncertainty and a flicker of hope.

However, this article is not meant to disparage the industry; it simply aims to provide a guiding light for those who will enter the field in the future. Perhaps after rounds of stories, applications, manipulations, and bubbles, a true ideal land will emerge. This industry has never belonged to Wall Street, whales, or old money; remote culture, anonymous collaboration, efficiency above all, and a focus on community—these tangible changes have already occurred and are irreversible. What ordinary people can strive for is to find a ship that won't sink amid this trend.

After every mass extinction, new species will emerge. After repeated claims that "the industry is gone," those companies that survive the bear market, those teams that continue to refine their products, and those individuals who have not given up on learning and growth will be the true and everlasting winners.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.