Author: Jae, PANews

The much-anticipated Christmas market did not favor the cryptocurrency sector but instead ignited a surge in gold and silver. Recently, the spot gold price quietly broke through the $4,500 per ounce mark, while silver's performance was even more vigorous, first standing above $75 per ounce, with an annual increase that once approached 160%.

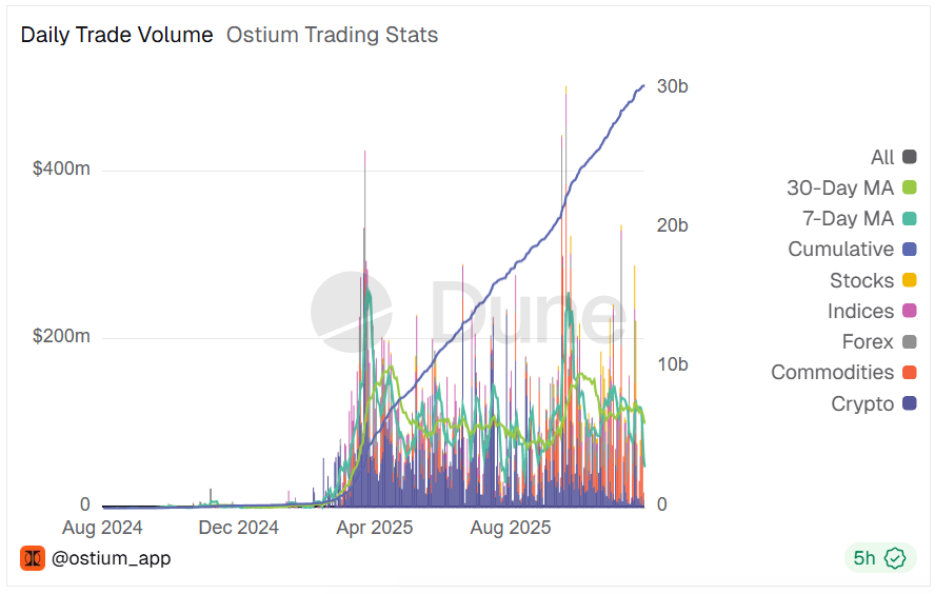

This enthusiasm has also spread to the crypto market. Under the trumpet of the precious metals bull market, the pace of commodity tokenization has further accelerated this year, with the total market value of tokenized gold and silver nearing $4 billion. Many Perp DEXs (decentralized perpetual contract exchanges) have successively launched precious metal products. For example, the leading protocol Ostium has seen its cumulative trading volume exceed $30 billion, with the trading volume of commodity perpetual contracts accounting for as much as 40%.

Macroeconomic Risk Premium Ignites Precious Metals Bull Market

The underlying logic of the epic commodity market is not driven by a single factor but is the result of the resonance of monetary policy shifts, a dollar credit crisis, and geopolitical conflicts. From the perspective of macroeconomic policy, the Federal Reserve abandoned its "higher for longer" tightening stance in the second half of this year, executing three consecutive interest rate cuts to address potential economic recession. This policy shift directly led to the dollar index falling to its lowest level since March 2022, significantly reducing the opportunity cost of holding non-yielding assets like gold and silver.

Major traditional financial institutions have shown a consistent optimistic outlook for the commodity sector. Goldman Sachs predicts that gold prices will rise to $4,900 by 2026, believing that global central bank demand for gold and the Federal Reserve's interest rate cuts will become the dual driving forces for rising gold prices. Analysts point out that geopolitical risks and economic uncertainties are prompting emerging market central banks to accelerate their gold purchases, while potential entry from private investors may further push up gold prices. Goldman Sachs expects global central banks to maintain monthly gold purchases at around 70 tons by 2026.

IG's 2026 commodity outlook report indicates that, benefiting from falling real yields, high government spending, and ongoing central bank demand for gold, the upward trend in gold prices is expected to continue, potentially breaking through $5,000 in a favorable macro environment. Silver has entered a price exploration phase. With supply shortages for the fifth consecutive year and accelerating industrial demand, technical models point to prices of $72 and even $88. The precious metals sector is driven by genuine macro demand, providing long-term structural support.

Yardeni Research has raised its gold price target, predicting it will reach $6,000 by the end of 2026 and possibly touch $10,000 by the end of 2029. Yardeni points out that geopolitical risks and market concerns over excessive monetary and fiscal policy stimulus are the driving forces behind the rise in gold prices.

As mentioned by the aforementioned institutions, significant changes are occurring in the sovereign reserve space. In 2025, emerging market central banks represented by China, Russia, and Poland have shown a strong willingness to allocate gold.

The People's Bank of China has increased its gold holdings for the 13th consecutive month; Russia's gold reserves surpassed $300 billion in November, setting a modern historical record; and the National Bank of Poland has explicitly announced an increase in its gold reserve target to 30% of total assets.

This strategic shift from holding U.S. Treasury bonds to holding gold reserves has effectively built a relatively solid institutional bottom for gold prices above $4,000. In this context, gold is no longer viewed solely as a safe-haven asset but may become a neutral anchor point as the global financial order enters a phase of de-dollarization.

Tokenized Commodity Market Expands to $4 Billion, Strong Growth of 300% in One Year

While the traditional hard asset market experiences structural premiums, precious metal RWAs (real-world assets) have also entered a fast growth lane.

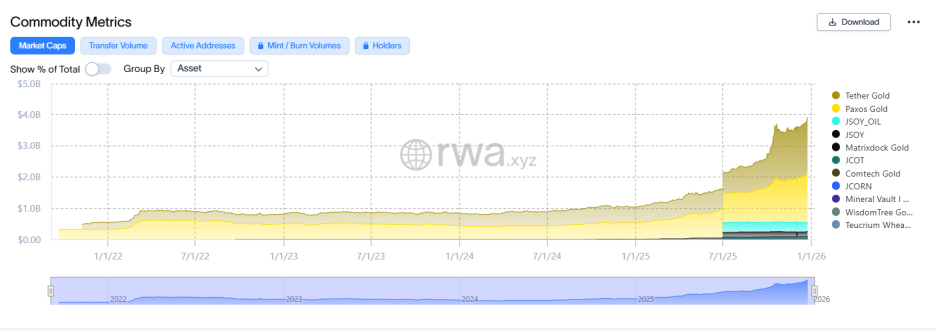

As of December 26, the total market value of tokenized commodities has climbed to $3.95 billion, an increase of nearly $3 billion since the beginning of the year, achieving an annual growth rate of about 300%. Commodities have become the most active asset class in the RWA tokenization space after government bonds, with funds accelerating into the tokenized commodity market.

Currently, tokenized gold dominates this sub-market, accounting for over 80% of the share. Tether Gold (XAUT) and Paxos Gold (PAXG) are the two leading players in this space, with market capitalizations reaching $1.7 billion and $1.6 billion, respectively, and recent 30-day increases of 8.53% and 16.83%.

This on-chain gold model will significantly optimize the holding costs and liquidity of the traditional gold market. By mapping each ounce of physical gold stored in London or Swiss vaults to on-chain tokens, investors will be able to trade with a lower share threshold.

The essence of this trend is the process of financial asset atomization and real-time realization. In the traditional financial system, the delivery of commodities typically requires complex settlement processes and high logistics costs; however, on-chain, reserve proofs enabled by smart contracts will allow the authenticity of each tokenized commodity share to be verified in real-time, significantly reducing the marginal costs of anti-money laundering and due diligence.

On-Chain Gold and Silver Trading Heats Up

Since the beginning of this year, not only have centralized exchanges (CEX) like Binance, Bybit, and Gate gradually launched spot and contract trading for XAUT/PAXG, but Perp DEXs have also successively introduced precious metal products. If RWA tokenization optimizes the settlement and circulation issues of commodities, then Perp DEXs provide tools for speculation and hedging.

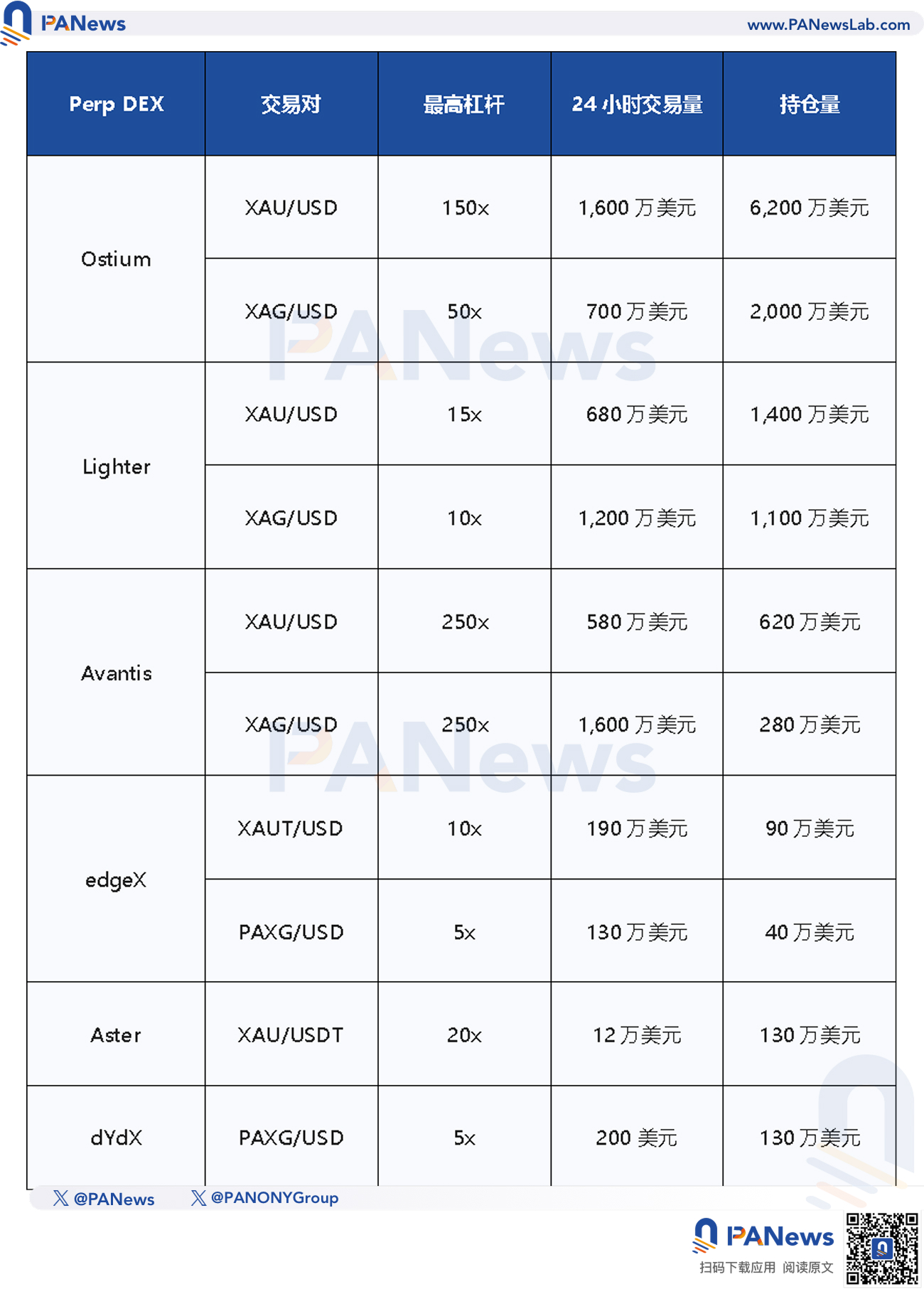

Perhaps due to the warm winds of the precious metals bull market also blowing into the Perp DEX space, PANews has compiled statistics from several platforms offering commodity trading, among which three have daily trading volumes exceeding $10 million. The leading commodity protocol Ostium has shown considerable growth momentum this month.

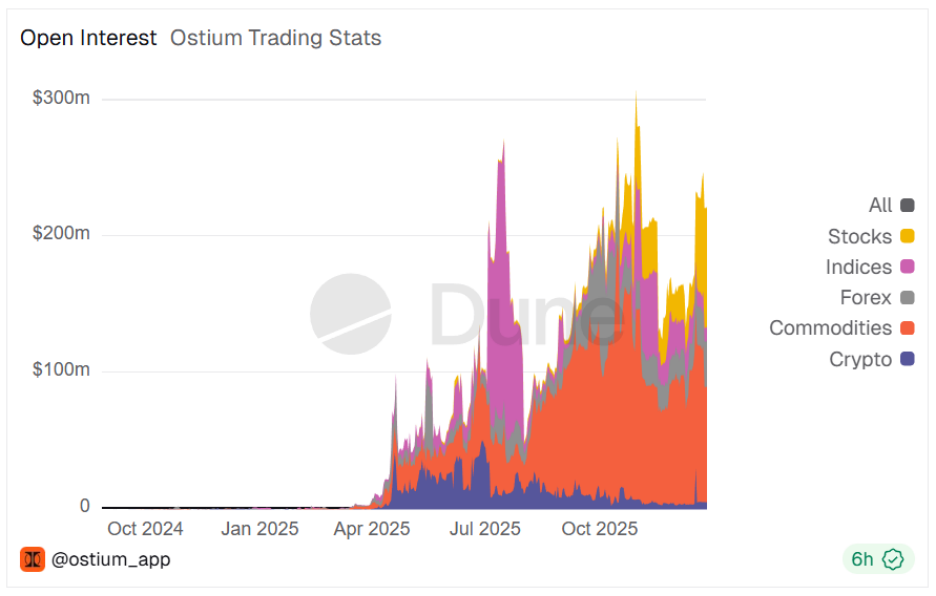

Ostium's differentiated positioning in commodity trading may be the main reason for its standout performance in the fiercely competitive Perp DEX space. While competitors like Hyperliquid are still focused on cryptocurrency derivatives, over 95% of the open interest on the Ostium platform is concentrated in traditional assets such as gold, energy, and foreign exchange. During the surge of gold prices to $4,500, Ostium captured over 50% of the on-chain gold perpetual contract open interest.

As of now, Ostium's cumulative trading volume has surpassed $30 billion, with commodity trading volume accounting for about 40% of the total trading volume. The platform's growth path reflects the diversification of the crypto user profile: from a single "cryptocurrency speculator" to a "macro hedging trader."

The rise of on-chain commodity trading reveals not only the changes in monetary credit but also the migration of macro asset trading paradigms. A parallel market driven by smart contracts is quietly maturing.

This also signifies that the crypto market is beginning to offer mainstream assets beyond alternative assets to investors. This is not only a technological victory but also an inevitable choice for investors seeking diversification in asset allocation during uncertain times.

The on-chain war for commodities may have just begun.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.