BTC Large Transaction Unveiled: Short Selling Trend Reveals, Main Fund Underflows Surge

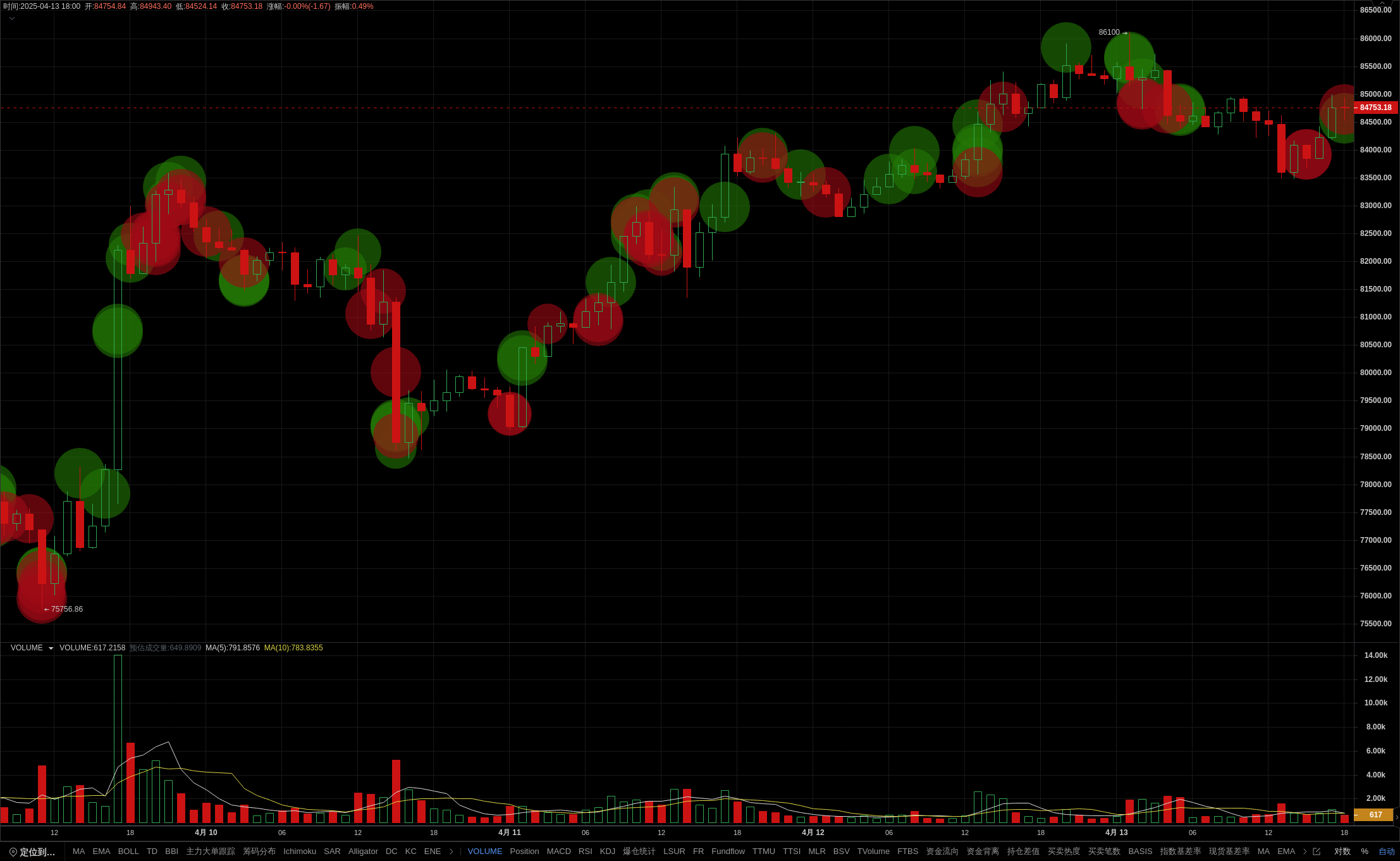

In the past 12 hours, the total amount of large market price sell orders from the main force reached $37.12 million, far exceeding the buy order of $24.6 million, with a net outflow of $12.52 million and a buy to sell ratio of 1:1.51, indicating a clear trend towards short selling. Especially at 23:04 last night, the main force sold two large orders totaling $10.24 million, directly suppressing the price. Although a large buy order of $4.22 million attempted to support it this morning, subsequent sell orders of $1.43 million and $3.8 million put pressure again. At present, although BTC is on the EMA24/52 moving average, trading volume has shrunk to recent lows, and the K-line has shown a cross star and pregnancy line pattern, indicating a risk of change. The J value is extremely overbought, with increasing pressure for correction, and the indicator signal is consistently bearish. Open a membership, stay ahead of the main trends, accurately capture abnormal signals, and plan for the next wave of market trends! The data is sourced from the PRO member's [BTC/USDT Binance 1-hour] candlestick, for reference only, and does not constitute any investment advice.