Loading...

The 1011 coin circle experienced a single day surge of 19.1 billion positions! AiCoin intelligent split stable ride through black swan

--

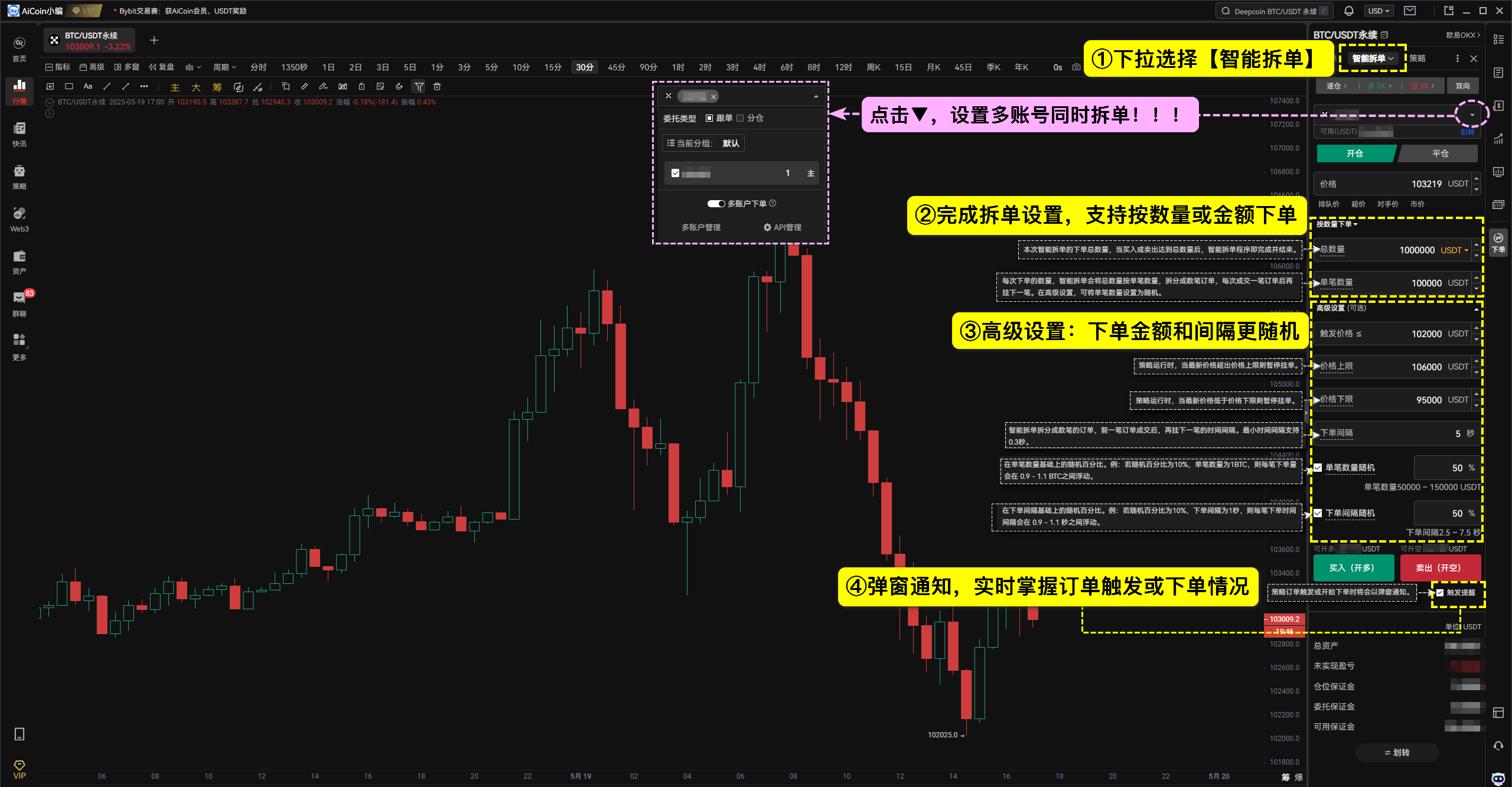

On the early morning of October 11th, the cryptocurrency market suffered a 'bloody massacre'. Bitcoin plummeted by over 15%, plummeting from $122000 to $102000, with a total net liquidation amount of $19.1 billion, setting a record for contract trading history. The sharp decline, known as the "1011 Massacre," was caused by the dual impact of Trump's tariff policy on China and the anchoring of the stablecoin USDe. Ordinary traders' pending orders are swallowed and stop loss is triggered in a chain, while intelligent order splitting users have completed precise hedging. 🔥 The way to break through AiCoin's "multi account+intelligent order splitting" strategy one ️⃣ Intelligent order splitting ambush: Large orders are automatically split, and positions are built in batches within a set range to smooth out holding costs two ️⃣ Multi account collaborative execution: Multiple API accounts open orders synchronously, completing closing positions as quickly as possible three ️⃣ Hidden fund traces: random time intervals and floating quantities, effectively blurring trading intentions 💥 Practical application scenarios A giant whale opened a 1.1 billion short order with 30 million US dollars before the sharp decline, doubled its principal within 5 hours, and quickly left after earning 30 million US dollars. The key to its success lies not only in judgment, but also in the ability of large orders to enter and exit without being detected. AiCoin supports unlimited API authorization and allows multiple accounts to place 200+API orders simultaneously. Whether you are an asset management team or a professional trader, you can synchronize multiple account trades with just one click through the copy mode, building the ultimate risk defense against extreme market fluctuations. Immediately use AiCoin multi account+intelligent order splitting to build an exclusive trading system, making Black Swan your opportunity!