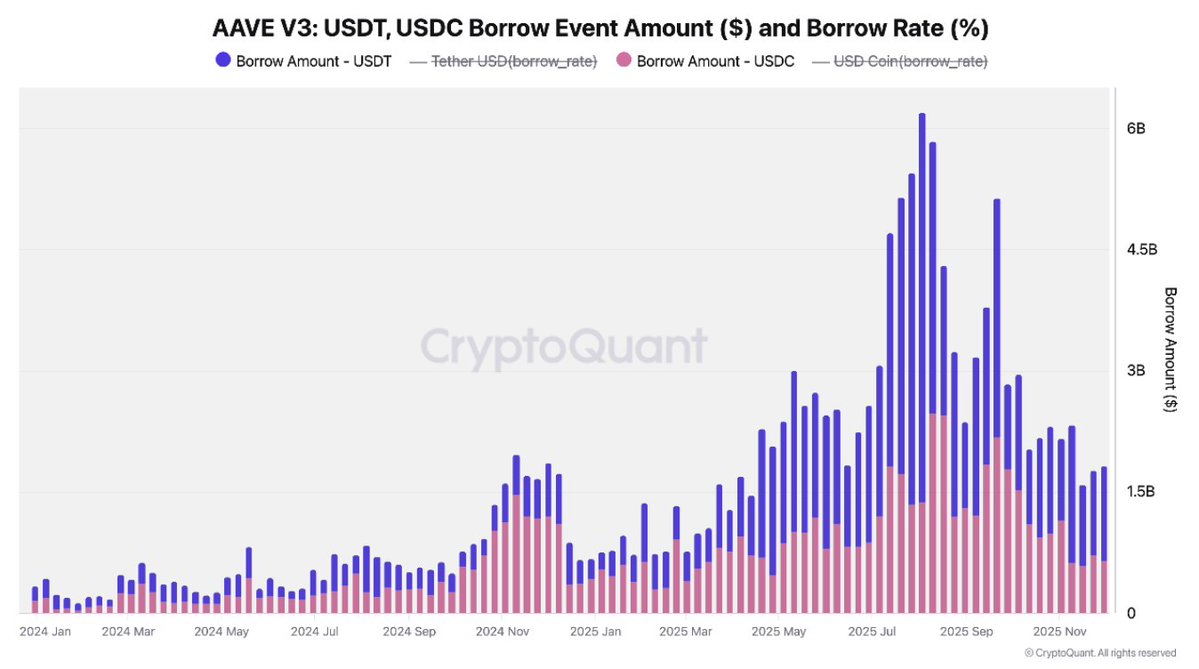

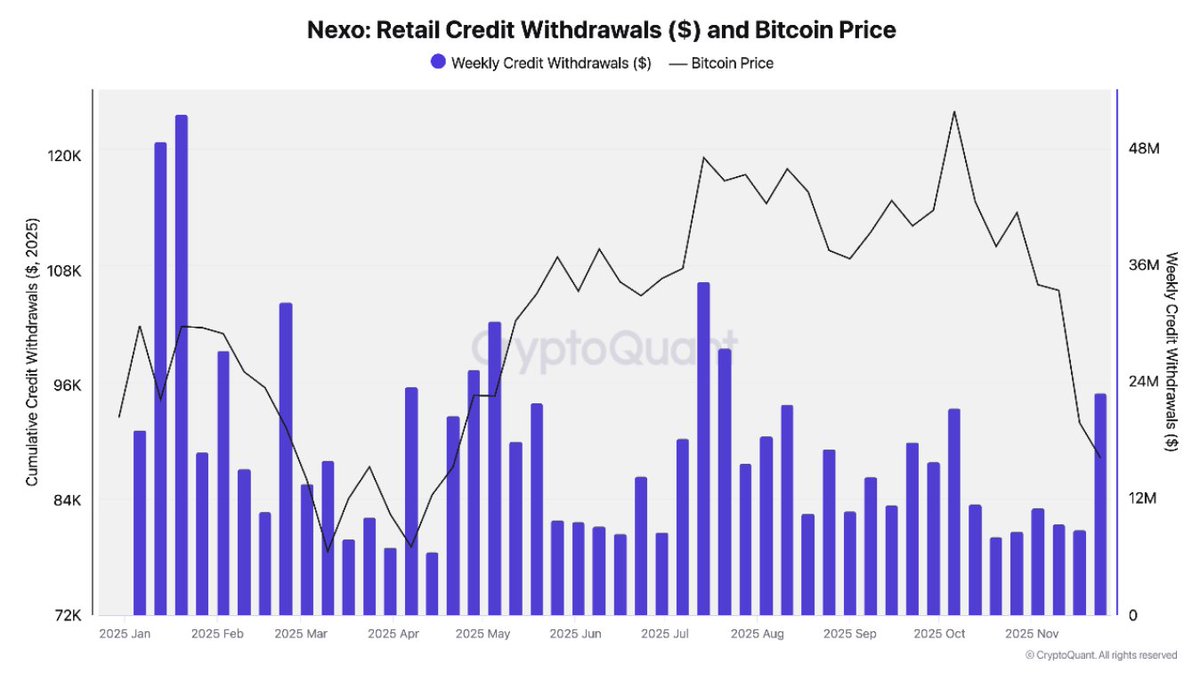

Aave's borrowing volume has decreased by about 70% since August, while Nexo's borrowing volume has increased by 155% on a weekly basis

DeFi leverage demand has decreased, and Aave lending volume has decreased by about 70% since August, reflecting a decrease in risk appetite as prices fall; At the same time, Nexo's borrowing volume increased by 155% on a weekly basis during the price correction period, and users chose to borrow with collateral instead of selling assets. (CryptoQuant)