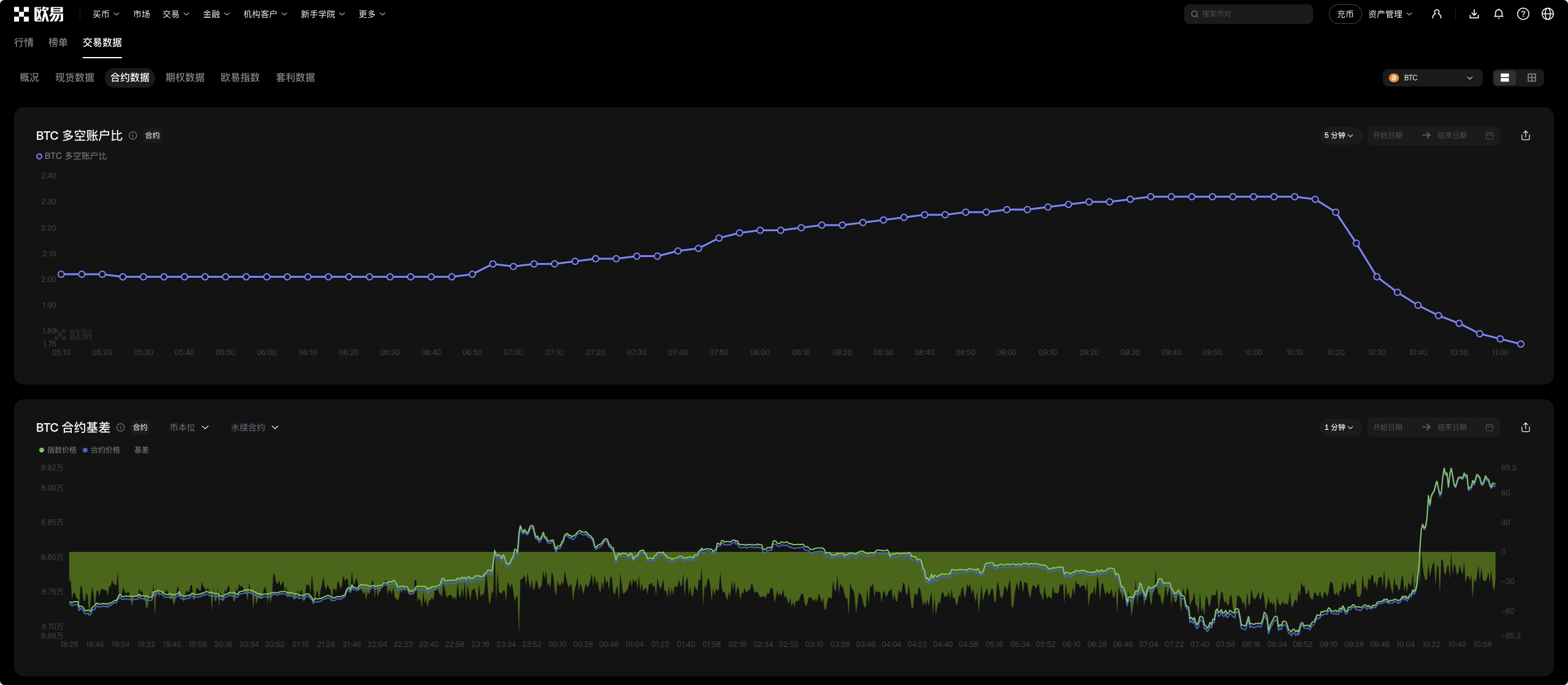

Contract data changes! BTC long short ratio continues to decline

OKX contract data shows that the long short position ratio (number of accounts) of BTC in 5-minute cycles is continuously decreasing. This means that the proportion of short accounts has increased, while the proportion of long accounts has decreased, but the funds of the long side are more concentrated (with higher per capita holdings). In mainstream interpretation, a decrease in the long short ratio (especially to a relatively low level) is often seen as a sign of long positions for professional traders or large investors: retail investors tend to be bearish, while large investors increase their positions on the long side to attract funds. The reverse indicator feature is obvious, and historically, such low signals often lead to rebounds or rises. The long short ratio of a contract is one of the indicators of market sentiment, which can be comprehensively judged based on price trends, total holdings, funding rates, and other factors. Timely pay attention to long short ratio data, manage positions rationally, and invest cautiously! Register OKX now and receive a permanent 20% refund Company Registered Address https://jump.do/zh-Hans/xlink?checkProxy=true&proxyId=2 Risk statement The content of this article represents the author's personal views only and does not represent the position of this platform. The views, conclusions, and recommendations in the article are for investors' reference only and do not constitute any investment advice related to this platform. The market is risky, and investment needs to be cautious.