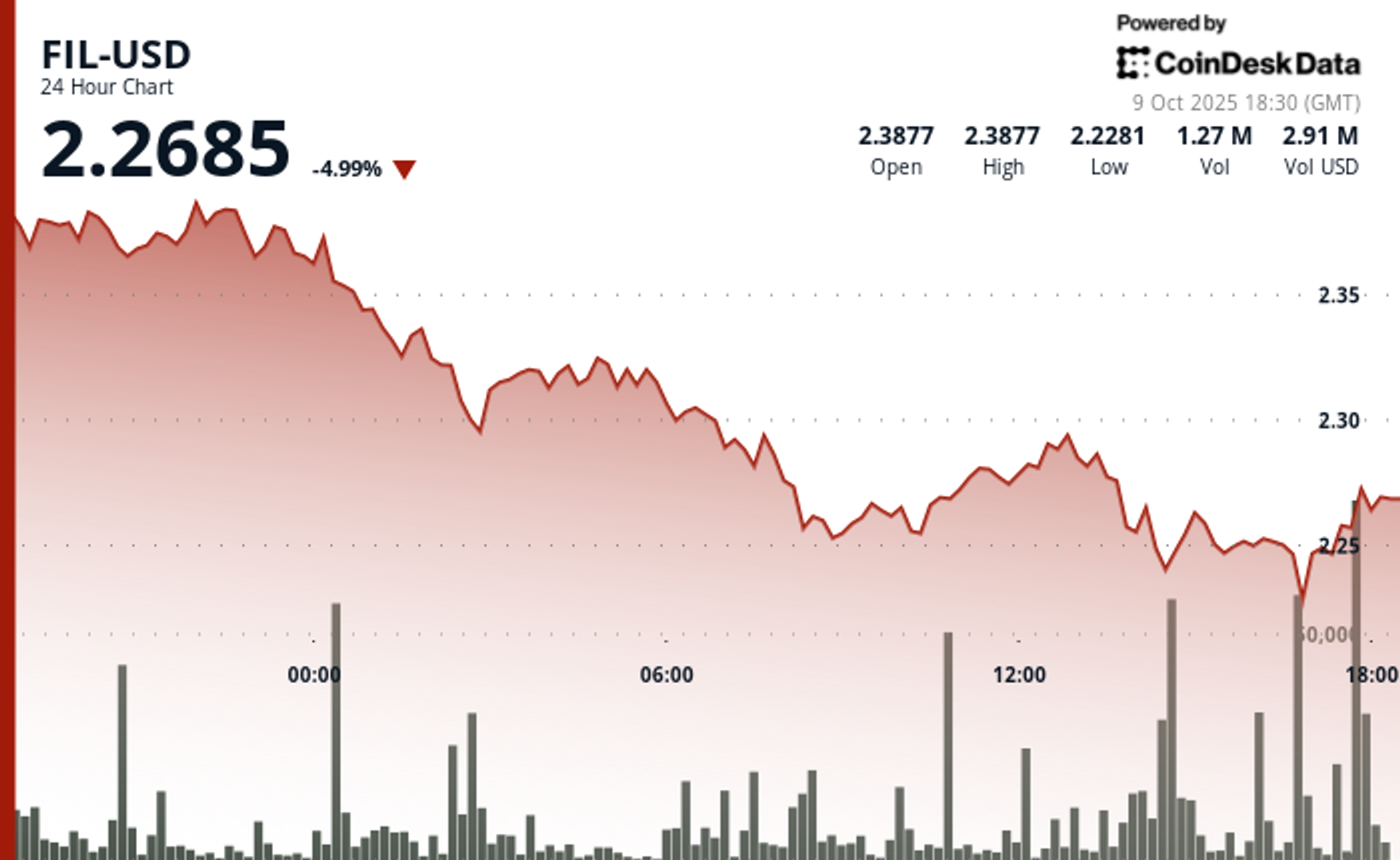

Filecoin (FIL) fell as much as 7% in the last 24 hours, tumbling from $2.39 to $2.23, according to CoinDesk Research's technical analysis model.

The model showed that the token posted a $0.19 range representing 7.9% volatility.

Sellers dominated at the $2.41 resistance level as transaction volume exploded to 5.92 million tokens traded, crushing the 3.42 million daily average. Bulls defended $2.23 support, with volume spiking above 4.8 million, according to the model.

Classic capitulation patterns emerged as selling exhaustion signaled potential base formation above critical $2.23 floor, the model said.

In recent trading, Filecoin was 5.1% lower, around $2.26.

The wider crypto market also declined, with the broad market gauge, the CoinDesk 20, down 3.6%.

Technical Analysis:

- Sellers defended the $2.41 resistance level, triggering a massive volume surge and price rejection.

- Bulls mounted defense at $2.23 support during multiple intraday tests and volume spikes.

- Trading activity exploded past 5.92 million during peak selling, well above the 3.42 million baseline average.

- Textbook capitulation emerges with violent selloff followed by immediate relief bounce pattern.

- Volatility compression and price stabilization suggest seller exhaustion may be approaching critical levels.

- Fresh consolidation zone forms around $2.25 following dramatic recovery from intraday massacre.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.