Highlights of This Issue

This week's newsletter covers the statistical period from October 3 to October 9, 2025. The RWA market continues to show strong growth, with both on-chain total market capitalization and the number of holders rising simultaneously, although the growth rate of issuers has slowed, leading to increased market concentration. The volume of stablecoin transfers has rebounded, but the number of monthly active addresses continues to shrink, further confirming that the recovery in liquidity is driven by large institutional trades, while retail investors continue to exit the market.

Major global jurisdictions are actively embracing asset digitization under a prudent regulatory framework. India has announced plans to launch a digital rupee, while the UK intends to exempt certain limits on stablecoin holdings and will establish a "Digital Markets Champion" to oversee the tokenization of the retail financial market. RWA infrastructure protocols are continuously enhancing compliance, and the issuance and trading of institutional-grade products are accelerating. Ondo Finance has completed the acquisition of Oasis Pro to obtain SEC licensing, and Plume Network has received SEC approval as a transfer agent. Overall, the market reflects a clear trend of "institutional leadership, compliance first, and ecological integration" across data growth, regulatory breakthroughs, and ecosystem development.

Data Insights

RWA Market Overview

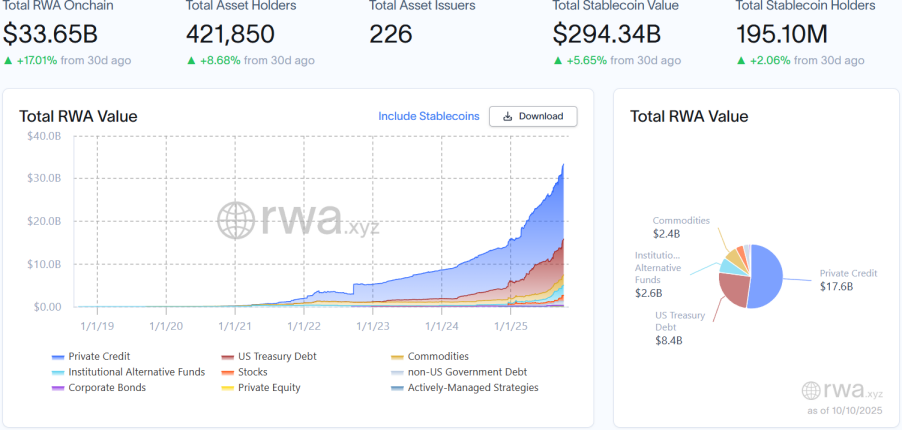

According to the latest data from RWA.xyz, as of October 10, 2025, the total on-chain market capitalization of RWA has reached $33.65 billion, an increase of 17.01% compared to the same period last month; the total number of asset holders has risen to 421,900, up 8.68% from the previous month; the total number of asset issuers has slightly increased to 226, indicating a continued rise in ecological participation, although the concentration pattern remains unchanged.

Stablecoin Market

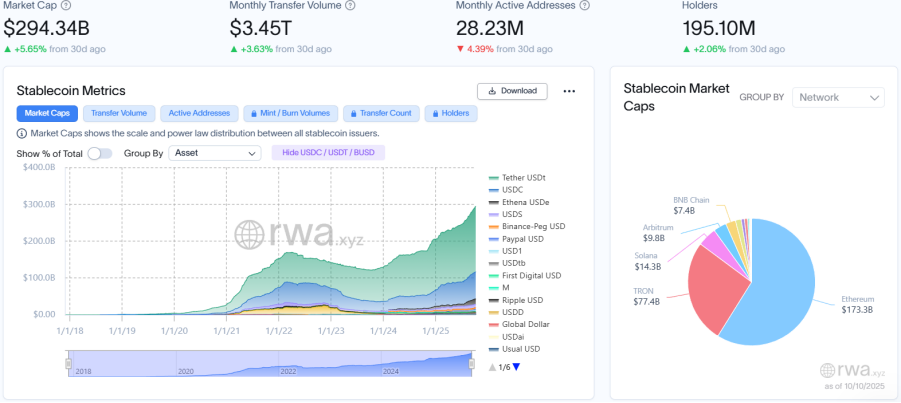

The total market capitalization of stablecoins has reached $294.34 billion, a growth of 5.65% compared to the same period last month; monthly transfer volume has rebounded to $3.45 trillion, a slight increase of 3.63% from the previous month, ending a continuous decline; the total number of monthly active addresses has further decreased to 28.23 million, down 4.39% from the previous month; the total number of holders is approximately 195 million, a slight increase of 2.06% from the previous month, with both metrics continuing to diverge, indicating that the recovery in market liquidity is entirely driven by large institutional settlements, while retail trading activity continues to shrink. The leading stablecoins are USDT, USDC, and USDe, with USDT's market capitalization increasing by 5.53% compared to the previous month; USDC's market capitalization has slightly increased by 4.35%; and USDe's market capitalization has grown by 11.73%.

Regulatory News

India to Launch Digital Currency Supported by the Reserve Bank of India

According to Aninews, India's Minister of Commerce and Industry, Piyush Goyal, revealed that India will soon launch a digital currency supported by the Reserve Bank of India (RBI) to leverage blockchain technology for faster and more secure transactions, similar to stablecoins in the US. However, Piyush Goyal emphasized that the Indian government remains cautious about cryptocurrencies like Bitcoin that lack sovereign backing and pointed out the risks associated with unregulated digital assets.

Bank of England Plans to Exempt Proposed Corporate Stablecoin Holding Limits

According to Bloomberg, the Bank of England plans to exempt proposed limits on corporate stablecoin holdings, indicating a softening stance on crypto assets in the face of competition from the US. Sources revealed that the Bank intends to grant exemptions to businesses, such as cryptocurrency exchanges, that need to hold large amounts of stablecoins, and will also allow companies to settle using stablecoins in an experimental digital securities sandbox. This suggests a shift in the previously skeptical attitude of Governor Andrew Bailey, although the Bank of England declined to comment. The digital payments industry is concerned that the UK may struggle to compete with the US's Genius Act, and the Bank plans to set limits on personal and corporate stablecoin holdings, with a consultation document expected by the end of the year. Previously, Bailey had dismissed stablecoin and digital pound projects, and this exemption is seen as a significant shift.

UK to Establish "Digital Markets Champion" to Promote On-Chain Wholesale Financial Market

According to Bloomberg, the UK Treasury will establish a "Digital Markets Champion" to oversee the digitization (Tokenization) of asset issuance, trading, and settlement in the blockchain-based wholesale financial market. Treasury Economic Affairs Secretary Lucy Rigby stated that a "Dematerialisation Market Action Taskforce" will be formed to supervise the transition from paper equity certificates to electronic formats. The government has released a "Wholesale Financial Markets Digital Strategy" to promote the adoption of blockchain and artificial intelligence and has initiated a tender for "Digital Gold-Backed Bonds" (DIGIT), inviting technology providers to participate in the issuance of UK government bonds on the blockchain.

Local Developments

Derlin Holdings Advances RWA Tokenization, Involving ByteDance, Kraken, and eSelf AI

According to an announcement from the Hong Kong Stock Exchange, Hong Kong-listed Derlin Holdings has announced that it has obtained approximately $5.7 million in private equity through funds and SPVs for RWA tokenization; this includes indirect holdings in ByteDance (approximately $2 million, with an implied valuation of about $315 billion), Kraken (approximately $3 million, with an implied valuation of about $15 billion), and eSelf AI (approximately $700,000, with an implied valuation of about $21 million). The company plans to tokenize the relevant SPVs after completing the transaction and advance the tokenization projects of Derlin Tower LPF and Animoca Brands LPF; the Animoca Brands LPF plan utilizes the XRP Ledger and has received pilot funding from Hong Kong Cyberport. Derlin Securities and Derlin Digital Family Office have submitted materials to the Securities and Futures Commission, aiming to launch distribution and platform operations in early 2026.

Project Progress

WisdomTree Acquires Ceres Partners to Expand Custody and Tokenization Market

According to Businesswire, crypto ETF issuer WisdomTree has announced the completion of its acquisition of alternative asset management firm Ceres Partners. This transaction will allow WisdomTree to expand its business into exchange-traded products (ETPs), custody, and the tokenization market. The acquisition amount includes $275 million in cash paid at the time of closing and up to $225 million in earnouts.

(Note: Earnouts are a common valuation adjustment mechanism in acquisition transactions, where the buyer can pay additional funds based on the target company's achievement of specific metrics after paying the base consideration. Unlike a betting agreement, earnouts focus more on quantifiable objective data, reducing human intervention factors.)

SIX Group Integrates SDX Digital Asset Business to Create Unified Tokenization Platform

According to Cryptopolitan, Swiss stock exchange operator SIX Group AG has announced that it will integrate the business of its digital asset division, SIX Digital Exchange (SDX), into the group's main exchange and post-trade services division. This move marks the end of SDX's independent brand identity. In the future, SDX's trading operations will be handled by SIX's main exchange, while settlement and custody services will be transferred to SIX Securities Services. SIX Group stated that by integrating digital asset capabilities, it aims to create a unified and robust platform to simplify processes for banks and asset management companies in adopting blockchain technology for trading, custody, and token issuance, thereby accelerating the growth of digital asset businesses and the tokenization transformation of the financial system. SIX will also continue to collaborate with the Swiss National Bank (SNB) and other partners to advance important projects such as wholesale central bank digital currencies (CBDCs).

RWA (Real World Assets) tokenization protocol Ondo Finance has announced the successful completion of its acquisition of regulated digital asset broker-dealer Oasis Pro. This strategic acquisition provides Ondo Finance with a comprehensive set of licenses and infrastructure, including SEC-registered broker-dealer, alternative trading system (ATS), and transfer agent (TA), enabling it to develop and offer a compliant tokenized securities market within the United States. Oasis Pro's infrastructure supports the tokenization, issuance, transfer, and secondary trading of RWA and is one of the first regulated ATSs in the US authorized to use stablecoins for digital securities settlement. Ondo CEO Nathan Allman stated that through this merger, Ondo is committed to building a transparent, accessible, and compliant on-chain financial system and accelerating the development of the US tokenized securities market.

RWA Layer 2 network Plume Network has announced that it has successfully obtained approval from the U.S. Securities and Exchange Commission (SEC) to register as a Transfer Agent. This move marks a significant milestone for Plume Network in bringing real-world assets onto the blockchain, meaning it will be able to provide compliant share registration, transfer, and management services for securities tokens issued on-chain. Plume Network CEO Chris Yin has stated that the network aims to provide a compliant, open, and transparent blockchain environment for asset issuers and institutional investors. This registration makes it one of the few blockchain infrastructures with such SEC licenses, greatly facilitating the tokenization of over 180 projects (involving $4.5 billion in assets awaiting tokenization) on its platform and further bridging the gap between traditional finance and decentralized finance (DeFi).

BNY Mellon Explores Allowing Tokenized Deposits and Blockchain Payments

According to market news, BNY Mellon, one of the world's largest custodial banks, is exploring the possibility of allowing tokenized deposits and blockchain payments.

According to Globenewswire, ETF solutions provider Amplify ETFs has announced that it has submitted applications to the U.S. Securities and Exchange Commission for the Amplify Stablecoin Technology ETF (QSTB) and the Amplify Tokenization Technology ETF (QTKN). The former primarily tracks companies and assets that leverage stablecoins as digital payment and settlement mechanisms, while the latter tracks companies and assets that benefit from the digitization of real-world assets.

BlackRock and Brevan Howard Tokenization Funds Launch on Sei via KAIO

According to the Sei blog, KAIO has integrated its tokenization funds into the Sei Network, providing KAIO tokens representing shares of the BlackRock ICS US Dollar Liquidity Fund, as well as on-chain access to the Brevan Howard Master Fund. This integration supports institutional-grade compliance, subscription/redemption, and reporting processes, and can be used as stablecoin reserves or DeFi collateral and yield assets. Sei claims its high-performance chain offers a superior trading experience for money market products; KAIO is currently open only to institutions and accredited investors.

ARK Invest's Fund Holds Approximately $10 Million in Securitize Shares

According to CoinDesk, ARK Invest holds approximately 3.25% of its fund assets in Securitize through the ARK Venture Fund, amounting to an investment of about $10 million based on the fund's net asset value of $32.53 billion as of September 30, making it the eighth-largest holding. Securitize, founded in 2017, has issued $4.6 billion in tokenized assets, partnering with firms like BlackRock, Hamilton Lane, and Apollo, and has issued BlackRock's tokenized money market fund BUIDL (with a size of $2.8 billion). The tokenization market has grown by 112% this year to $33 billion, and it is expected to reach $18.9 trillion by 2033.

Tokenized Stock Infrastructure Block Street Completes $11.5 Million Financing, Led by Hack VC

Block Street has announced the completion of a strategic financing round of $11.5 million, led by Hack VC, with participation from Generative Venture, DWF Labs, StudioB, Bridge34, and others. Block Street focuses on building the execution and lending layer for tokenized stocks, with a technology stack that includes Aqua (RFQ intent) and Everst (hybrid clearing). The project plans to launch on the L1 project Monad in the fourth quarter of this year, with subsequent expansions to Ethereum, BNB Chain, and Base. Team members come from well-known institutions such as Citadel, Point72, and Google, and they plan to launch a transparent dashboard to enhance user experience.

Tokenized Stock Trading Platform MSX Launches Spot and Contract Assets in Multiple Hot Tracks and Contract Assets

According to official news, on October 6, MSX completed the launch of quantum computing "dual standard" new products, namely the spot and contract trading of $RGTI.M and $QUBT.M. $RGTI.M recently received new orders from the Novera system, while $QUBT.M received an initial "buy" rating from institutions and completed private placement to promote commercialization.

On October 7, MSX simultaneously launched contract trading for $RKLB.M and $SOXL.M (semiconductor 3x leveraged ETF). $RKLB.M is a small rocket and satellite launch service provider, with market attention on its completion of national space agency cooperation tasks and multiple task windows in mid-October. $SOXL.M is driven by AI chip and high computing power demand, with active trading aimed at high-risk investors tracking short-term industry trends.

Insights

In an Era Where Everyone Can Issue Stablecoins, Why Does Success Belong to a Minority?

PANews Overview: This article explains why it is technically easy to issue stablecoins, but only a few, like USDT and USDC, achieve widespread success. The core issue is that the success of a stablecoin depends not on its creation but on its ability to establish strong network effects and utility. This relies on four pillars: sufficient liquidity (easy exchange for other assets), convenient fiat on/off ramps, widespread utility (acceptance in many scenarios), and cross-chain interoperability. Existing giants have established significant advantages in these areas, making it extremely difficult to challenge them in an open ecosystem. In contrast, within closed or custodial systems (such as centralized exchanges or custodial wallets), operators can enforce their own stablecoins and profit, but these stablecoins are often limited to their own "walled gardens," making it hard to break into broader markets.

PANews Overview: This article outlines three feasible paths for enterprises (especially in the new energy sector) to bring real-world assets (RWA) onto the blockchain, resembling a staircase from easy to difficult, with increasing value. Path one, "Rights Confirmation/Certification," is the simplest, utilizing blockchain to record asset data (such as power generation) to enhance transparency and trust, but does not issue tokens, thus not directly financing; path two, "Payment/Store of Value," goes further by issuing tokens for payment or exchange of rights (such as charging service points), significantly improving capital settlement efficiency, but must comply with payment regulations; path three, "Financing/Revenue," is the most complex and valuable, issuing security tokens representing asset revenue rights (such as packaging future income from charging piles into tokens), allowing direct financing from global investors, but facing high compliance costs and legal risks.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.