🧐 Sui ecosystem's liquidity engine Momentum @MMTFinance $MMT lands on Buidlpad

Key points to pay attention to that will affect your allocation | This article focuses on the UGC activity team participation model, which content creators must read —

Hitting it means earning it! The best new project is Buidlpad!

Yes: The popularity of Buidlpad @buidlpad continues, welcoming its 5th major project — Momentum Finance $MMT

The rules have been announced, and this article mainly studies the gameplay this time!

Based on the popularity of Falcon Finance and Lombard, this time may be even more competitive, but the profit effect is truly impressive!

This new project participation is the same as $FF, but Momentum is more special: it is the project with the highest TVL and trading volume in the Sui ecosystem, and it is also the first experimental activity to integrate "HODL + new project + content contribution."

Here is my research 👇

1️⃣ What is Momentum? Why is it worth paying attention to

Momentum is a leading CLMM DEX on Sui, providing high capital efficiency and top APR. The TGE will activate the ve(3,3) model (drawing on Curve's voting lock mechanism, incentivizing governance and liquidity locking).

Core products include:

1) xSUI: The liquid staking token for SUI.

2) MSafe: A multi-signature treasury tool that supports ownership and dApp integration.

Momentum benefits from Sui's unique architecture, such as Programmable Transaction Blocks (PTB), allowing users to bundle multiple DeFi operations into a single atomic transaction, achieving a seamless, low-cost experience suitable for both retail and institutional users.

The goal is to become the liquidity hub of the entire Sui ecosystem.

The core feature can be summarized in one sentence: "It allows social interaction, trading, and earnings to circulate in a frictionless system."

📊 Data performance:

2.1 million+ active users;

$550 million TVL;

$18 billion cumulative trading volume;

The architecture adopts the ve(3,3) model (similar to Solidly), balancing long-term incentives and yield rights.

The ecosystem includes:

Momentum DEX (efficient market making);

xSUI (liquid staking SUI);

MSafe (multi-sign treasury and ownership management);

Momentum X (RWA compliant asset platform);

In simple terms, it is a "financial operating system" that integrates all elements of DeFi.

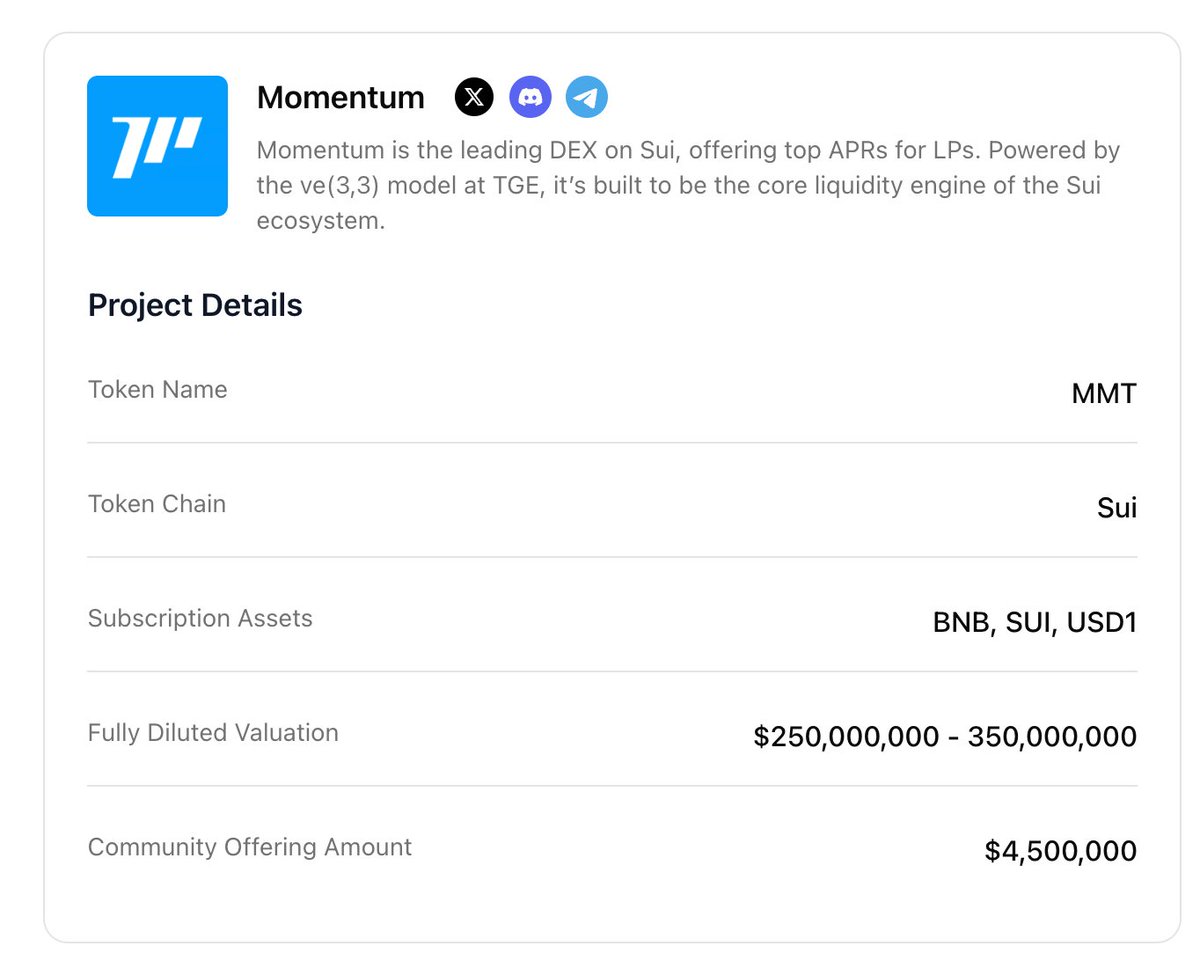

2️⃣ Core information related to the $MMT public offering

Total amount: $4.5 million; TGE will be 100% unlocked

Participating assets: SUI, BNB, USD1

Subscription period: October 27 – October 28

Settlement: To be completed by October 31

This time, a dual-layer mechanism is still used, divided into two market cap tiers (Tier system) 👇

🎯 Tier 1 ($250 million FDV)

Conditions: Staked in Buidlpad HODL LP ≥ $3,000

Benefits: Lower valuation + higher cap (up to $20,000)

🎯 Tier 2 ($350 million FDV)

Conditions: Complete KYC and Subscription registration

Benefits: Base allocation $50 – $2,000

However, the official rule: even if you stake $3,000, it does not guarantee a full allocation, so everyone needs to judge for themselves!

Additionally, up to 30% of the slots will be reserved for content creators (winning teams of the UGC activity).

3️⃣ Buidlpad's new model for new projects: HODL × Points × Content

This time, Buidlpad's new gameplay is a complete three-layer structure:

1) HODL: Liquid staking points

At http://buidlpad.com/hodl/momentum

Stake Momentum LP (such as SUI-USDC, xSUI-SUI trading pairs) to earn double Bricks points; the earlier you stake, the higher the points.

LP deposits support stablecoin suiUSDT-USDC trading pairs, xSUI-SUI trading pairs, LBTC-wBTC, xBTC-wBTC trading pairs, choose which to deposit based on your assets; okx supports BTC on the Sui chain, and funds can be withdrawn at any time without affecting accumulated points;

Staking before October 25 allows you to enjoy 2× Momentum Bricks points, with rewards calculated based on investment amount × holding days;

Not only are there earnings, but it can also directly enhance your new project level.

Recommended staking amount ≥ $3,000, so you can automatically enter Tier 1.

2) UGC: Content creation competition

From October 15 to 22, users can: publish original content (tweets, long posts, videos); this is the part where I focus on the UGC team gameplay,

As this is the first time Buidlpad platform has introduced a "team participation model" for content creation.

It is completely different from previous individual submission content activities, representing a new attempt, with the core purpose of enabling collaboration and win-win among creators, rather than going solo.

Let me break it down:

💡 Core logic of the UGC activity:

From "individual posting" → "team co-creation, shared scoring"

Previous Buidlpad activities (like Falcon, Lombard, Sahara) only had individual submission systems, where posting, writing, or retweeting could earn points or priority allocation.

But this time, Momentum's gameplay has been upgraded: everyone no longer competes individually but can form teams (1–10 people) to create content. The system will comprehensively calculate the performance of all team members to ultimately determine the rewards for the entire team.

In other words, this time it's not about "who posts more," but about "the overall quality and influence of the team."

So if a few influential individuals team up, the rewards could be quite good; for example, if a team of 10 produces strong content and ultimately receives a $10,000 allocation (just a random guess, not a reference), then each person would get $1,000, which is great!

💡 Mechanism details of the team participation model:

✅ Team size: 1–10 people, each person can only join one team;

✅ Invitation mechanism: Join the team via invitation code or link;

✅ Scoring method: Comprehensive score based on the team's "overall content quality" + "natural dissemination influence";

✅ Weight distribution: Content quality 60%, natural influence 40%;

✅ Reward calculation: The higher the team's total score, the larger the reward pool; then it is evenly distributed among team members;

✅ Reward types: Priority allocation or additional rewards (Bricks bonuses, etc.);

✅ Time period: October 15, 18:00 – October 22, 17:59 UTC+8; during this period, teams can be formed, invitations sent, and posts made.

✅ Submission requirements: Tweets/long posts/videos/articles are all acceptable, must be original and linked to a Twitter account;

3) Community Offering: Final subscription

After completing KYC and Subscription, you can participate by contributing within 24 hours on October 27–28,

Supporting SUI / BNB / USD1,

Tokens will be fully released at TGE after settlement.

4️⃣ Three reasons worth participating

1) Strong project + strong ecosystem

Momentum is the core liquidity infrastructure of Sui,

This Buidlpad new project is almost a "home field debut."

2) Innovative mechanism + high returns

Combining staking points, content bonuses, and open allocation,

It is not only fair but also allows users to truly become participants rather than bystanders.

3) 100% unlock at TGE + reasonable FDV

No lock-up, and the price range is reasonable,

Against the backdrop of an average 1.5x in previous rounds, the probability of short-term returns remains high.

Buidlpad's new project value return

Buidlpad is redefining the concept of "new projects."

Not relying on connections, not competing for insider information, but obtaining qualifications through real participation + holdings + creation. And Momentum, as the liquidity engine of the Sui ecosystem, is the best demonstration of this mechanism: from capital flow to content flow, from liquidity to narrative, Momentum has activated the entire ecosystem.

5️⃣ Timeline overview:

October 15: UGC activity starts

October 22: UGC ends

October 25: HODL snapshot

October 27–28: New project period

By October 31: Settlement completed

🔗 Official website link: http://buidlpad.com/projects/momentum

🧩 Official account: @MMTFinance

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.