CZ's tweet can trigger billions of dollars in trading volume, while at the same time, the global currency market is signaling tightening liquidity, with massive funds struggling to choose between mainstream coins and altcoins.

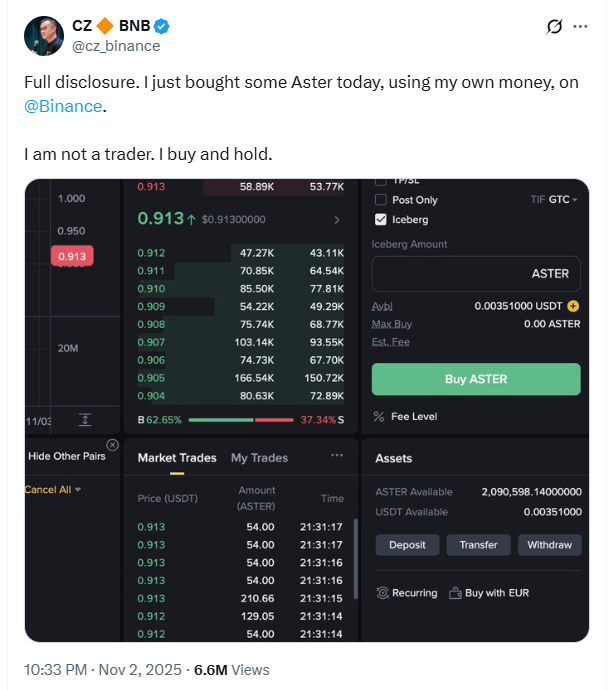

"I used my own money to buy some ASTER on Binance. I'm not a trader; I buy and hold." On November 2, Binance founder CZ (Zhao Changpeng) posted this brief statement on the X platform, instantly igniting the long-dormant altcoin market.

The price of ASTER surged 27% within minutes of the announcement, reaching a multi-week high of $1.27 at one point. On the other side of the market frenzy, two whales quickly established short positions exceeding $71 million in ASTER, marking the beginning of a tug-of-war between bulls and bears.

1. Event Overview: CZ's Personal Purchase of ASTER Sparks Market Frenzy

CZ's tweet was not just a simple purchase statement but contained several intriguing details that the market quickly interpreted as his public endorsement of the ASTER project.

● According to the account screenshot and market data shared by CZ, he purchased approximately 2.09 million ASTER tokens, which, at the purchase price of about $0.913, valued this investment at nearly $2 million. He emphasized that it was "personal funds" rather than institutional funds and clearly stated, "I'm not a trader; I will hold after buying," indicating his long-term investment stance rather than short-term speculation.

● After CZ's tweet, the trading volume of ASTER derivatives skyrocketed by 186%, reaching $3.04 billion, demonstrating the market's high sensitivity to this news.

2. The Celebrity Endorsement Effect

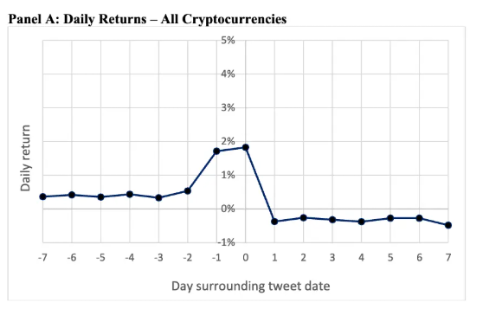

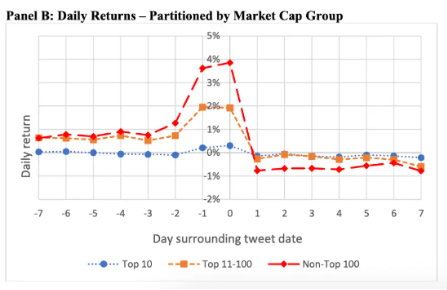

CZ's endorsement of ASTER is not an isolated incident but the latest manifestation of the long-standing celebrity effect in the cryptocurrency market. This effect can create astonishing returns in the short term, but long-term performance is often disappointing.

● According to research published in May 2024 by researchers from Harvard Business School and other institutions, after a cryptocurrency KOL's endorsement, the average return of tokens within a day is 1.83%, but for tokens outside the top 100 by market capitalization, this figure is as high as 3.86%. However, this upward trend is difficult to sustain. Research shows that the average return from the second to the fifth day after the tweet is -1.02%, with more than half of the initial gains eliminated within five days.

● Looking further ahead, the average cumulative returns 10 and 30 days after the tweet are -2.24% and -6.53%, respectively. Investing $1,000 in tokens outside the top 100 and holding for 30 days would typically result in a loss of $79. The research also uncovered an interesting phenomenon: when influencers claim to be experts, the post-event return rates tend to be even more negative; those who claim to be experts and have more followers tend to have worse returns on the tokens they recommend.

3. Global Tightening and Fund Flows

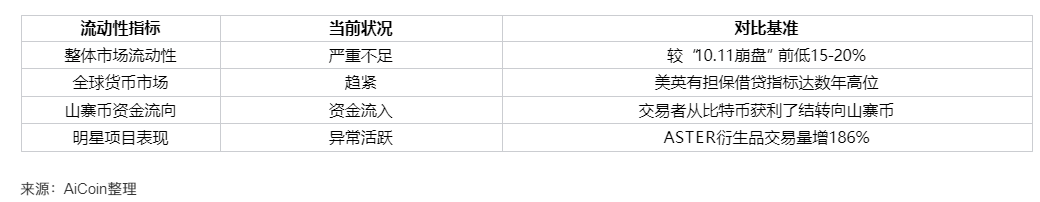

The event of CZ endorsing ASTER occurs against the macro backdrop of the entire cryptocurrency market facing multiple liquidity challenges, with global currency markets generally signaling tightening liquidity.

Global Liquidity Tightening Trend is Obvious

● Key indicators of secured lending in the U.S. and the U.K. have both risen to levels not seen in years. Although the driving factors differ, signs of tightening liquidity are evident across markets.

● The Federal Reserve's main liquidity tool, the reverse repurchase agreement, is being used almost negligibly, and bank reserves have decreased. The overnight general collateral repurchase rate once reached 4.32%, exceeding the Federal Reserve's benchmark rate. This liquidity tension is not unique to traditional markets. Lin, the head of Asia-Pacific business at the cryptocurrency derivatives exchange Deribit, pointed out that current market liquidity is still 15%-20% lower than before the "October 11 crash."

Altcoins Become a Liquidity Refuge

● In the context of overall liquidity tightening, funds are flowing from mainstream coins to altcoins in search of higher returns. Andrew Tu, an executive at the quantitative firm Efficient Frontier, believes that traders may be cashing out profits from Bitcoin and investing them into altcoins.

● This is evidenced by ASTER's market performance. Despite the overall market's lack of liquidity, ASTER managed to attract massive inflows, with daily derivative trading volume surging by 186%, indicating that in a liquidity winter, funds are more inclined to chase short-term high-return opportunities.

4. Intense Showdown Between Whales and Retail Investors

The market frenzy triggered by CZ is not solely bullish; it quickly evolved into a tug-of-war between whales and retail investors, highlighting the significant divergence in the current market.

● After CZ's bullish remarks, two whales quickly acted, opening short positions exceeding $71 million in ASTER, starkly contrasting with CZ's bullish stance. One whale's short strategy was particularly aggressive. He initially shorted 42.96 million ASTER tokens with a leverage of up to 3 times, entering at a price of $1.208, with a liquidation threshold between $1.8085 and $2.0858.

● This high-risk strategy means that if the price of ASTER continues to rise, the whale will face significant liquidation pressure. This also showcases the market's divergence regarding the value of the token endorsed by CZ—some view it as an investment opportunity, while others see it as excessive speculation.

● On the other hand, on-chain data also captured bullish signals. A large holder withdrew 6.8 million ASTER tokens from Binance and transferred them to the Aster ecosystem within six days, indicating that some large players are preparing for a potential price increase.

5. Rational Thoughts Behind the Frenzy

While CZ's endorsement of ASTER has led to a short-term price surge, the risks involved cannot be ignored. Historical experience shows that following celebrity endorsements is often not a wise long-term strategy.

Short-term Volatility Risks Intensified

● The large short positions held by whales directly confront CZ's bullish stance. If the price of ASTER rises further, it could trigger massive short liquidations, exacerbating market volatility.

● Conversely, if the whales' short strategy succeeds and the price of ASTER falls, retail investors who followed the trend may face significant losses. The long-term returns of cryptocurrency KOL endorsements are generally negative, especially for small-cap tokens.

● Reflecting on @boldleonidas's trading experience, he suffered losses on his entire position in BNB due to the thousands of "Brocolli" variants that emerged after the last time CZ promoted a token, leading him to establish a discipline of no longer participating in such recommendations.

Opportunities and Challenges in the Liquidity Dilemma

● In the context of overall market liquidity shortages, the behavior of funds flowing into altcoins for arbitrage also faces greater risks. When market liquidity is still 15-20% lower than before the "October 11 crash," any significant market fluctuation could lead to an instantaneous liquidity drain, preventing investors from closing positions in time.

● Additionally, while the open contracts in the ASTER derivatives market reached $437 million, the quarterly trading volume has decreased by 40.55%, indicating that market participation may not be balanced. Reflecting on the October 11 cryptocurrency market crash, the systemic leverage mismatch hidden in circular loan arbitrage and the failure of exchange liquidity mechanisms triggered a chain liquidation crisis, reminding investors not to overlook systemic risks while chasing high returns.

The game in the crypto market never stops. While retail investors celebrate and chase the rise following CZ's endorsement, whales have already set up massive short positions. The outcome of this capital game will depend on the ebb and flow of power between bulls and bears, and the backdrop of tightening global liquidity adds uncertainty to this confrontation.

The market drama triggered by a single tweet is just beginning its second act.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.