The cryptocurrency market is turbulent, and a whale claiming a "100% win rate" has increased its position by 140 BTC despite holding a floating loss of $18 million, causing significant market fluctuations.

1. Whale Activity

As of November 3rd, early morning in the UTC+8 time zone, a cryptocurrency whale with a 14-time winning streak has once again become the focus of the market. This whale increased its position by 140 BTC within five hours, bringing the total value of its long positions to $406 million.

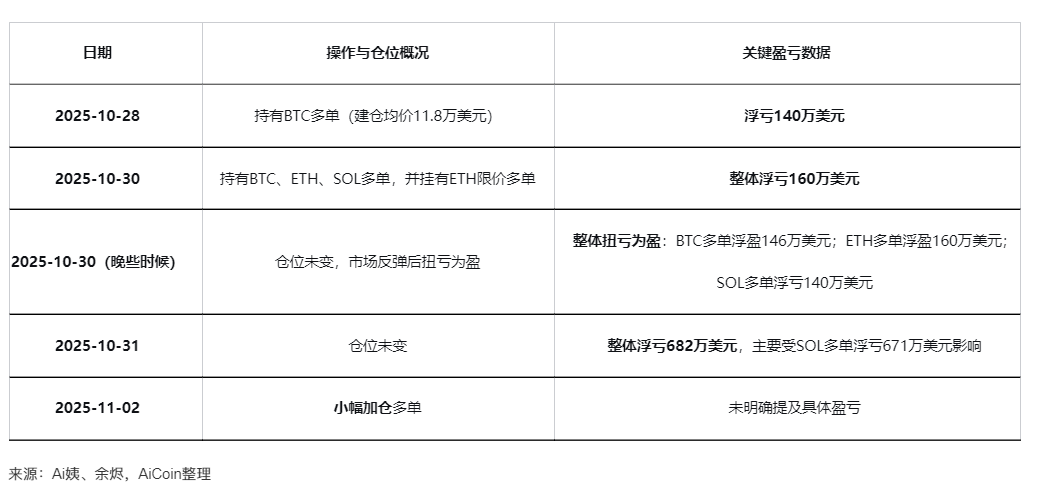

● The whale's holdings have not been smooth sailing. According to monitoring, its positions have been underwater for 4 days, with a maximum floating loss reaching $18 million, which has now narrowed to $1.98 million. Overall, the whale's holdings include various mainstream cryptocurrencies, reflecting a strategy of diversified investment while concentrating on long positions.

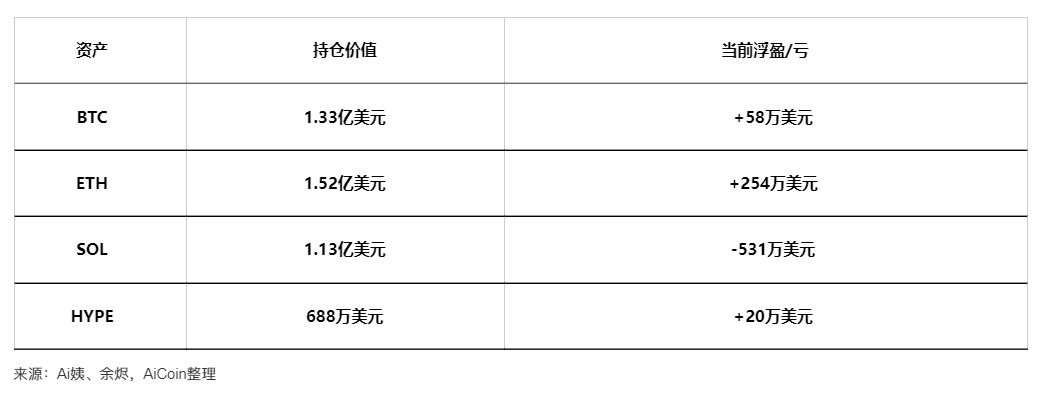

Current Overview of Whale Holdings:

2. Market Impact

The whale's position increase occurred against a backdrop of significant volatility in the cryptocurrency market.

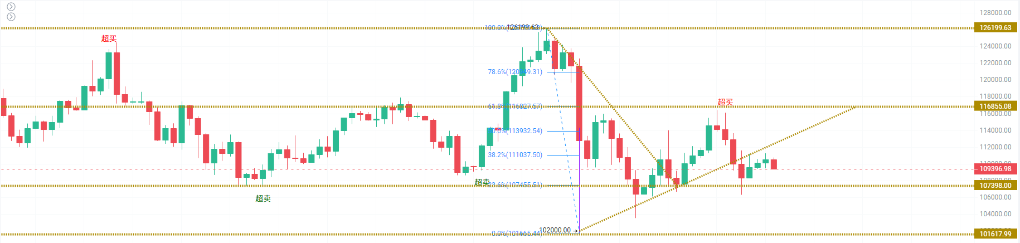

● On the evening of November 2nd, Bitcoin briefly fell below $110,000, triggering a massive liquidation. In the past 24 hours, the total liquidation amount across the network reached $156 million, affecting 104,191 individuals. Among these, long positions accounted for $105 million in liquidations, while short positions saw $51.21 million, indicating that bulls suffered heavier losses during the crash.

● Meanwhile, on-chain data also shows unusual trends. In the past 24 hours, centralized exchanges (CEX) experienced a net outflow of 4,841.74 BTC, with a continuing accumulation trend. Coinbase Pro had the largest outflow, reaching 6,249.16 BTC, while Binance saw an inflow of 1,947.99 BTC, ranking first in inflows.

3. Market Background Analysis

● The current cryptocurrency market is facing a complex macro environment. Since October 1st, the U.S. federal government has been in a "shutdown" for 32 days, marking the second-longest record in history. This political deadlock has had a profound impact on the economy, with over a million U.S. military personnel facing issues with their paychecks, and approximately 42 million Americans facing food shortages in November.

● Federal Reserve Chairman Powell recently warned in a press conference that further interest rate cuts cannot be guaranteed, citing the government shutdown as a reason for interruptions in economic reports. This week, several Federal Reserve officials will speak, with the most significant being New York Fed President Williams, who has considerable influence over monetary policy.

● Following a 25 basis point rate cut by the Federal Reserve, previously strong assets like gold and Bitcoin have both retraced. This is partly due to profit-taking by investors after positive news, and partly due to concerns over future uncertainties.

4. Decoding Whale Strategy

Analyzing the operations of this "100% win rate" whale reveals several key characteristics:

● High Leverage and Long Positions: Despite increased market volatility, the whale continues to adhere to a bullish strategy, maintaining over $400 million in long positions that have withstood an $18 million floating loss.

● Diversified Holdings: Its holdings include various cryptocurrencies such as BTC, ETH, SOL, and HYPE, but the overall direction remains bullish, indicating confidence in the cryptocurrency market as a whole.

● Strong Holding Capability: Even with a maximum floating loss of $18 million, the whale maintains its positions and adds to them at opportune moments, ultimately narrowing the floating loss to $1.98 million, demonstrating strong financial strength and psychological resilience.

This strategy sharply contrasts with ordinary investors. In the same market volatility, over 100,000 investors were forcibly liquidated due to excessive leverage.

5. Market Sentiment

● FOMO Following the Whale: Some investors view the whale's movements as a market barometer, quickly following suit upon noticing its position increase, hoping to ride the wave.

● Cautious Observation: Another group of investors remains wary of the whale's high-leverage operations, especially since its positions are still underwater amid increasing market volatility.

● Pessimistic Expectations: Given the U.S. government shutdown's record length and the Federal Reserve's uncertain stance on future rate cuts, some investors choose to sit on the sidelines.

6. Risk Warnings and Outlook

For investors attempting to follow the whale's operations, several major risks should be noted:

● High Leverage Risk: The whale's ability to endure significant floating losses stems from its vast financial resources. Ordinary investors using high leverage to follow suit may face premature liquidations amid market fluctuations.

● Liquidity Crisis: The U.S. government shutdown has led to interruptions in the release of various economic data, increasing uncertainty as the market relies on corporate earnings reports to gauge economic health.

● Lack of Strategy Transparency: Investors can only observe the whale's position building and increasing actions, without knowing when it will close its positions, making them vulnerable to becoming "bag holders."

In the next 1-2 days, the market should closely monitor the following key developments:

● The U.S. Senate's next vote planned for the evening of November 3rd (the 34th day of the government shutdown), with attention on whether the two parties can reach a last-minute compromise.

● Several Federal Reserve officials will speak this week, particularly New York Fed President Williams, whose statements may hint at future monetary policy directions.

Market volatility continues. Bitcoin has slightly rebounded to $110,521 after falling below $110,000, but the whale's movements continue to trigger chain reactions. Ordinary investors must assess their risk tolerance when following the whale's footsteps and remain clear-headed in the turbulent cryptocurrency market.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.