The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and reject any market smoke screens!

Since the U.S. ended its tapering, almost all assets have been moving in the direction we anticipated. Many friends do not understand what dollar assets, as mentioned by Lao Cui, actually encompass. There are also many friends starting to question gold and even the cryptocurrency market. They feel that whether it's the crypto market or gold, their performance during the tapering period has been very impressive, but will it lead to a downward trend after it ends? Lao Cui directly gives everyone the conclusion: this situation does not exist. Ending tapering is not the start of a bull market, but it will not cause a downward range to unfold. For the crypto market and gold, the recent trend is very intuitive: spot gold continues to set historical highs, and digital currencies are starting to rebound. Without discussing the sustainability of this rebound, we can clarify the trend based on reality: it is heading upwards. For everyone, do not overthink; go with the trend, and simply go long on the rebound. Yesterday, Ethereum's performance was the best among the coins, while the rebound strength of others was not as strong as imagined.

The rebound of Ethereum is certainly due to technical upgrades. This time, the trading speed successfully broke a thousand, which will attract more capital involvement. However, in terms of trends, Bitcoin's rebound strength has not reached the expected target, resembling a bait for more buyers. Everyone should observe patiently and not take on too heavy positions, as there may be some wash trading during the rebound process. Currently, washing out is not a good thing. Let me integrate the significant positive news from recent and future developments for everyone: Schwab and Citibank will offer Bitcoin collateralized loans in early 2026, Russia's state-owned bank suggests allocating 7% of assets to Bitcoin and cryptocurrencies, the market expects a 94% probability of the Federal Reserve cutting interest rates in December, BlackRock's CEO calls Bitcoin a "fear asset" and holds 780,000 BTC, and the Ethereum mainnet has completed the Fusaka upgrade, enhancing scalability and security. This includes the recent listing of Ethereum ETFs in Hong Kong. All this information indicates that the early reserves for a bull market are about to be completed.

If you are primarily investing in the cryptocurrency market, you cannot look at domestic strategies; your focus should be on the international market. The short-term suppression of sentiment will not last long; perhaps the next market crash will occur when specific measures are implemented. You must understand that there is a certain gap between meetings and their specific implementation. Previous meetings were mainly discussions and did not produce clear terms, so specific measures are still pending discussion. However, once the terms are clear, a market crash is certain to occur. This consolidation is more due to domestic recovery, and it is clear that there will be significant outflows. The domestic rejection is definitely a clear choice, and Lao Cui is also on the side of supporters. The domestic scene is indeed very complex. Blockchain technology itself is of great significance for technological development, but when it reaches the domestic market, it encounters problems similar to AI, where the path taken has issues. The actual application currently does not show much value.

At every critical juncture, there will always be a phenomenon of not being able to see the situation clearly, and this is true for the real estate, internet, and even logistics and express delivery industries. It is only in such unclear situations that heroes are born; circumstances create heroes. Not being able to see the situation clearly is what pertains to us ordinary people. For Lao Cui, what can be seen is the change in attitude from JPMorgan, including Buffett, who now holds a certain proportion of Bitcoin. The data can also support this; at least it is more reliable than the market from the 2010s to the early 2020s. For everyone, just follow the development; the only thing you can do is hold at low positions. The top ten cryptocurrencies should not have too many problems, except for DOGE, which has not shown much improvement since the beginning of the year and lacks significant application value. However, this does not mean it will not grow in the future; there will be growth, but new highs will not appear.

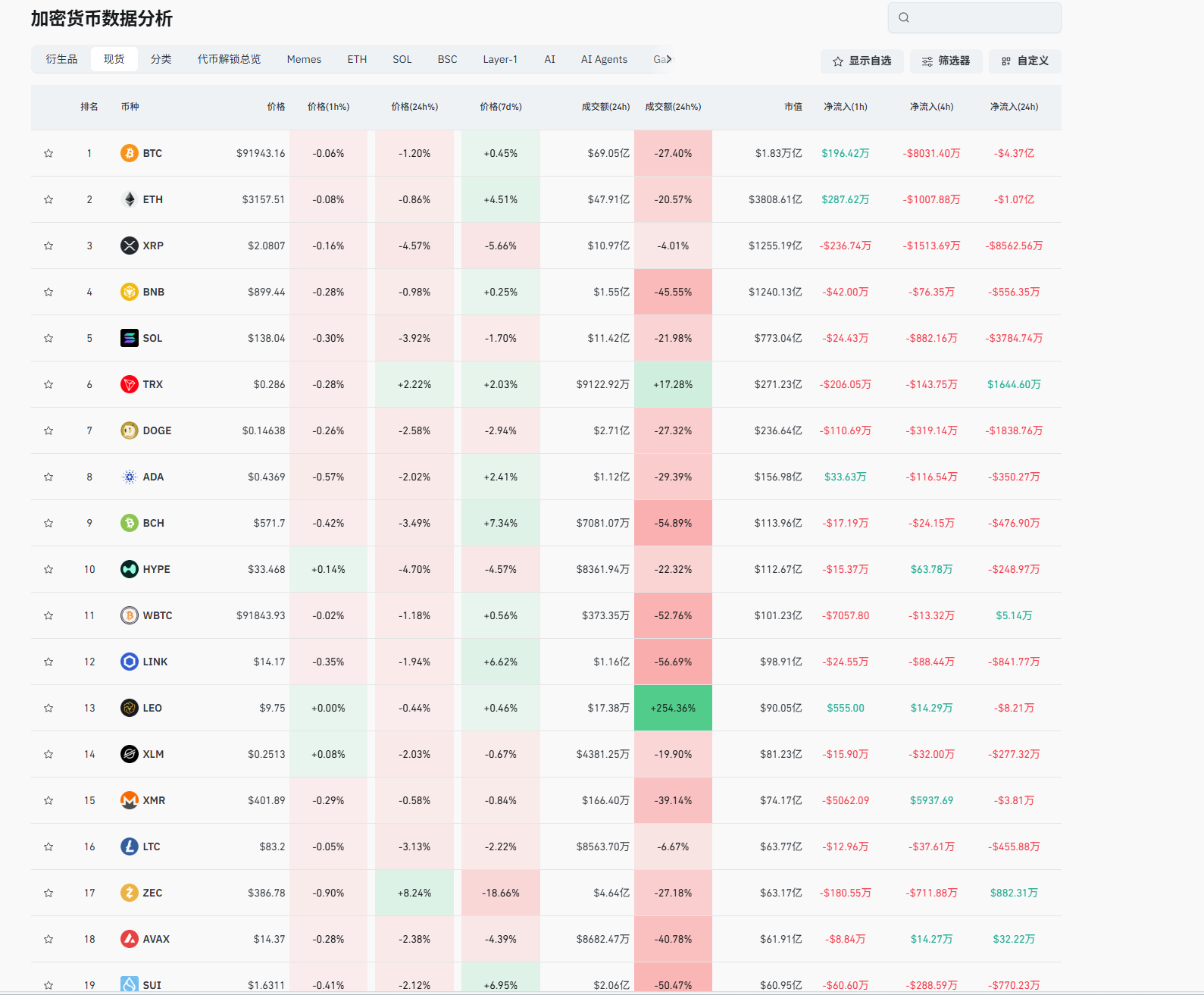

Lao Cui summarizes: The current explanation can only clarify one point, which is the choice of direction. As long as everyone does not misunderstand the direction, there should not be too many problems. Do not be overly attached to the present; 2026 is very much worth looking forward to, especially if there are still interest rate cuts at the beginning of the year, which may continue for a long time. Only some unnecessary cryptocurrencies need to be considered carefully. Earlier, Lao Cui discussed BNB, BTC, ETH, and SOL; these cryptocurrencies should not have too many problems. Other candidates include XRP and ADA. Investment must find application targets with sufficient capital volume, and the first choice is always BTC. For contract users, you must firmly establish your direction and not elaborate too much. Lao Cui is currently focusing on recuperation. The two bearish theories, Japan's interest rate hike and the implementation of domestic strategies, will at least last for a week. Interest rate cuts are getting closer; do not short easily. The current trend does not favor bears, unless there is a washout before the interest rate cut, and there will not be new lows!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on one piece or one territory, aiming for the final victory. The novice, however, fights for every inch of land, frequently switching between long and short positions, only seeking short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.