Master Discusses Hot Topics:

It is already a blessing that the market can pass through these two days of Christmas smoothly. What is a holiday? It is a graveyard for liquidity, especially during the holiday period of Christmas and New Year when there are hardly any real traders in the market.

With little money, few people, and thin order books, prices are most easily manipulated by a few trades. The two waves of market movements from midnight to morning have shown you that it’s just price manipulation, right?

On Christmas Eve and Christmas Day, the trading volume of Bitcoin has shrunk to Sunday levels, only one-third of a normal trading day. In such an environment, anyone still daring to talk about trends, confirmations, or strengthening is basically someone who hasn’t been thoroughly beaten by the market.

And today is Friday, with a massive amount of Bitcoin options expiring and settling. Those in the know understand that this is a time for the big players to clash. Once options start to be gamed, spot and contracts become collateral damage.

If the trading volume doesn’t bounce back, short-term contracts are pure gambling. You think you are trading, but in reality, you are just fuel for the big players, caught in their battles, and you are the collateral damage.

Speaking of funds in the US region, there has been continuous outflow, with a net outflow of 194 million today. Who are the US region players? They are one of the most important sources of buying for Bitcoin. When the main funds are withdrawing, if you see the price suddenly spike, your first reaction shouldn’t be that it’s taking off, but rather who is pulling it up for whom to run. Especially in this low liquidity phase, a casual pull can create a false breakout, and once it’s done, it will crash.

Back to the market, Bitcoin has been consolidating for 34 days, and the range is getting narrower, which simply means it’s holding its breath to choose a direction. But choosing a direction doesn’t mean going up, and it certainly doesn’t mean you can start fantasizing.

With such a weak performance and no decent volume, what are you excited about? If it doesn’t break above 90.7K, the bulls are basically in discomfort. The larger cycle is still downward, and no good news means bad news.

In the medium to long term, as long as it doesn’t break and stabilize above 94K, all upward movements look more like a short squeeze rather than the start of a new bull market. What institutions love to do is to lure in the bulls at such positions, ignite your emotions, and then slam the brakes down.

For me, such a pump is actually a good opportunity to lay out shorts in the medium to long term. This morning, the price poked up near the resistance level of 89.2K, and some people have already started to get excited.

I just want to say don’t rush to take off your pants; a breakout doesn’t count unless it stabilizes. Focus on the 4-hour chart; if at least three candlesticks can’t hold, that’s a standard false breakout. The market is most sinister here, specifically targeting the impatient players.

If it goes down afterward, it will be cleaner. Personally, I hope to see a real buying point around January 1. If the price breaks down, focus on the 84K to 85K range; whether it can stop the decline is key.

If a daily level long lower shadow and a closing needle appear, that would be an opportunity, not this current painful tug-of-war. One more thing must be clarified: whether it’s a surge or a crash during the holidays, once liquidity resumes in early January, it will all be re-evaluated.

What goes up now may be brought back down to reality. What goes down now may also be pulled back up. The direction is not determined by the holidays; it’s determined after the funds return.

On the Ethereum side, support is at 2815 and 2715, with resistance at 3170 and 3400. The key is to focus on the integer level of 2900; if it breaks, see if 2850 can hold. Tonight, with the North American market opening, followed by the weekend’s low liquidity, Friday is usually the day with the largest fluctuations of the week. You’ve all seen the wave of crashes in the early morning and the wave of surges in the morning; this is the current market—crazy, fake, and fierce.

Master Looks at Trends:

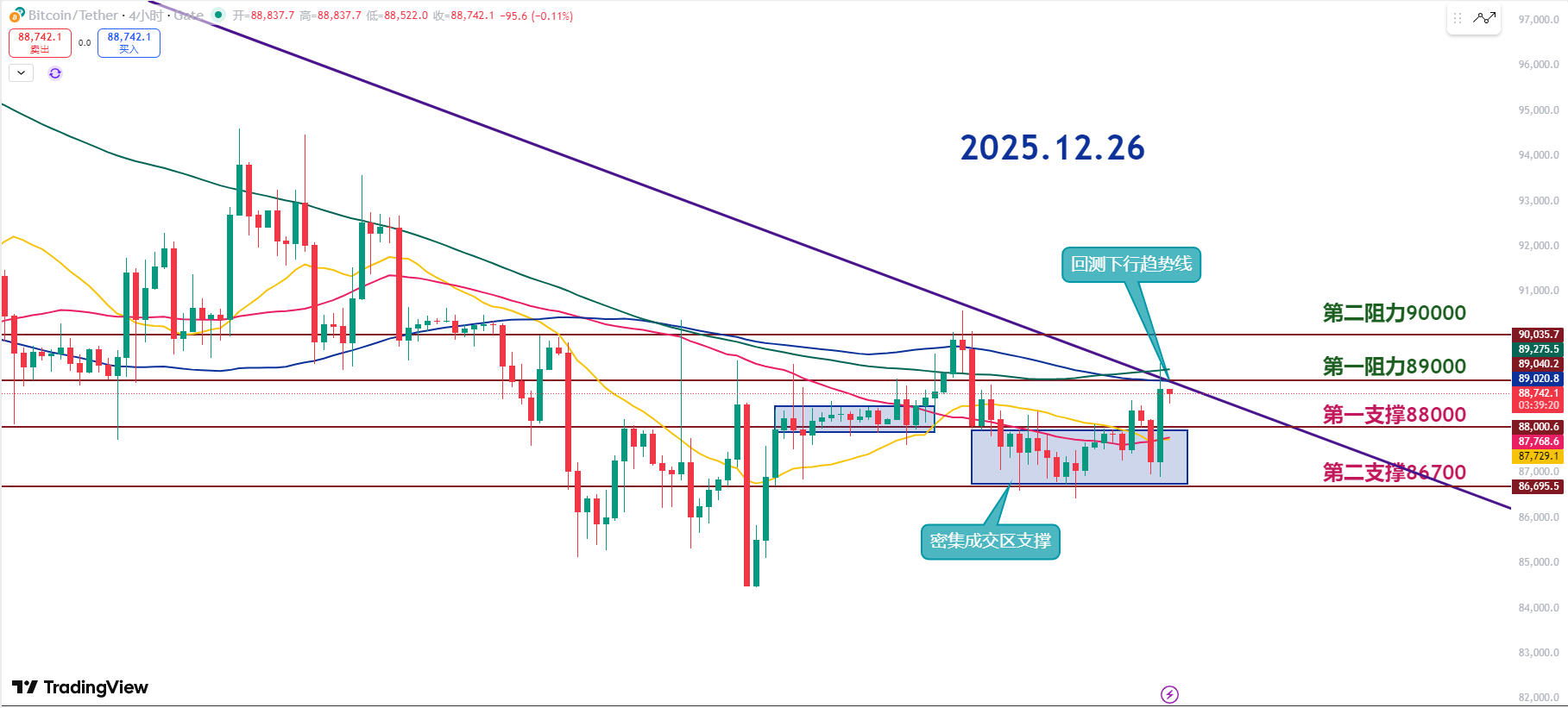

Due to the short-term surge this morning, the support level for Bitcoin has been raised, with 88K becoming the most important defensive level. Above the 4-hour level, there is a confluence of resistance from the 200MA, 120MA, and the downtrend line.

Entering directly during the pullback phase carries high uncertainty; a more reasonable approach is either to wait for effective breakout confirmation or to consider participation after a proper pullback.

The historical trading dense area has been designated as a support area (the blue range in the chart), with the RSI at 57, indicating a short-term probability of continuing upward, but the advantage is not significant.

The first support at 88K is already a short-term support level; if it can stabilize at this position, it will be more favorable for a rebound. Moreover, 88K is also the level that was defended multiple times from December 19 to 23, currently transitioning from resistance to a key support area.

Currently, we are in the pullback phase after breaking the downtrend; if it can break the first resistance at 89K and close above 89.2K, it will be favorable for further rebounds. Continuous attention is also needed on the resistance from the 200MA and 120MA above.

This wave has suddenly surged and broken through some resistance, but it is still far from the level of a trend reversal. Therefore, 88K can be regarded as the core defensive level; patiently observing whether the pullback is effective is more important than recklessly chasing the rise.

12.26 Master’s Band Trading Setup:

Long Entry Reference: Not currently applicable

Short Entry Reference: Short in the 89200-90000 range, Target: 88000-86700

If you truly want to learn something from a blogger, you need to keep following them, not just make hasty conclusions after a few market observations. This market is filled with performative players; today they screenshot long positions, tomorrow they summarize short positions, making it seem like they "catch every top and bottom," but in reality, it’s all hindsight. The bloggers worth paying attention to have trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don’t be blinded by exaggerated data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This content is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official public account (as shown above), and any other advertisements at the end of the article or in the comments section are unrelated to the author!! Please be cautious in distinguishing between true and false, and thank you for reading.

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.