Loading...

Fuxi Community Live: Ethereum Breaks 4000, Institutions' Enthusiasm and Technological Breakthrough Build a New Blueprint for Rising Prices Together

--

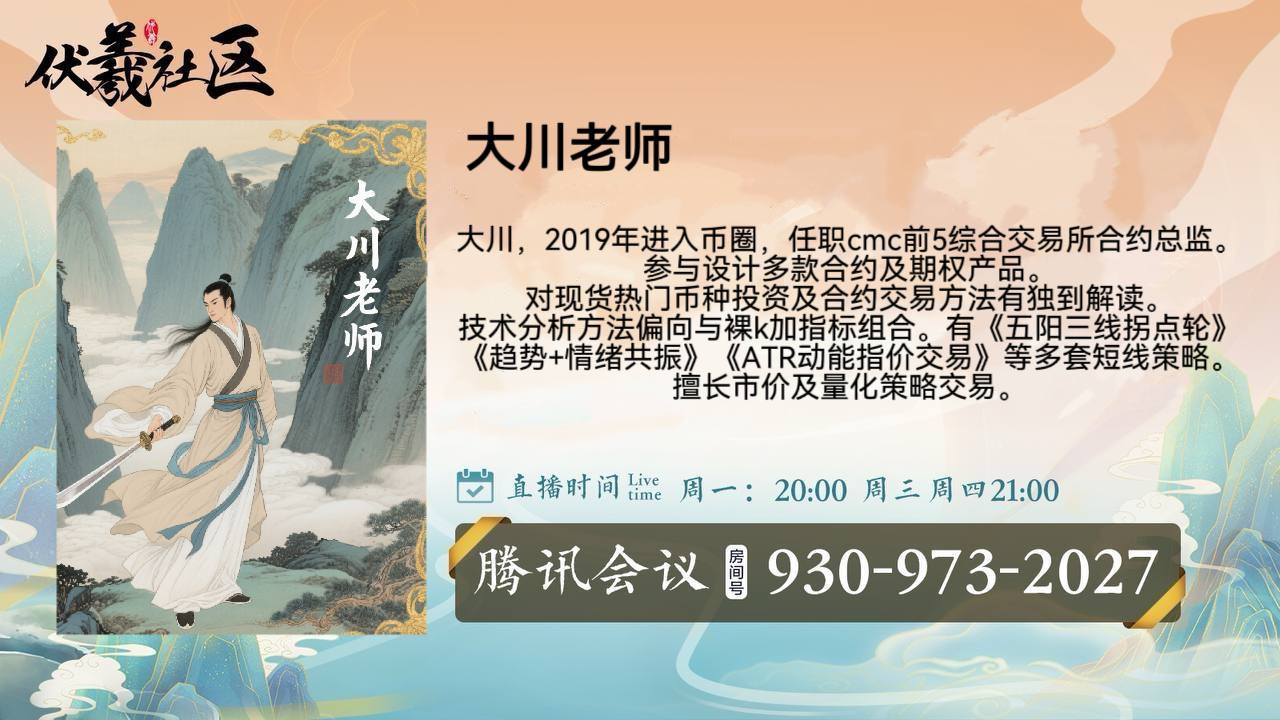

Click on the link to enter Tencent Meeting: https://meeting.tencent.com/p/9309732027 Ethereum (ETH) has recently become the focus of the cryptocurrency market, rising steadily since breaking through the psychological barrier of $4000 in early August 2025, reaching a new high of $4360 since December 2024. This breakthrough is not only a price milestone, but also marks multiple changes in market structure, institutional participation, and technological upgrading. Core driving factors: institutional funding, technological upgrading, and market structure transformation 1. Spot ETFs ignite institutional demand The US Ethereum spot ETF continues to attract huge capital inflows, with a record breaking daily net inflow of $726.6 million and total holdings exceeding 5 million ETH (approximately $20.3 billion). In recent months, institutions such as BlackRock and Ark Invest have significantly increased their holdings, with BlackRock purchasing over 65000 ETH (approximately $271 million) in a single transaction, and Sharpnink Gaming increasing their ETH holdings to $2.12 billion. Institutional buying directly led to a decrease in the exchange's ETH reserves to 18.9 million, exacerbating liquidity tightening. 2. Technological upgrades empower network value -Pectra upgrade: Optimize the Ethereum Virtual Machine (EVM) framework, significantly improve network throughput and reduce gas costs, paving the way for ecological applications; -Gas limit increase: The upper limit of block gas has been raised to 45 million, driving on chain transaction volume to 1.74 million transactions per day (7-day average), setting a new historical high. 3. Short squeeze and leverage liquidation After breaking through $4000, the market triggered a large-scale wave of short selling. On August 9th, the daily settlement amount exceeded 200 million US dollars, the second largest record in nearly six months. Historical data shows that similar liquidation events (such as May 2025) are often accompanied by subsequent increases of over 100%. 2. Key Price Levels: Panorama of Support and Resistance The short-term technical structure of ETH presents the following key intervals: -Support range: $3980- $4020 (short-term strength/weakness boundary), $4100- $4150 (retracement of defense zone after breakthrough); -Resistance range: $4450- $4550 (short-term target), with the potential to challenge the historical high of $4868 after breaking through; -Pull back risk: If there is a pullback, $3750 (Fibonacci retracement level of 38.2%) and $3600 (liquidity accumulation area) may become long positions. 3. Future Path: Short term Momentum and Medium - to Long term Goals 1. Short term trend (1-2 weeks) On the technical side, a "higher peak" upward ladder structure has been formed, and the daily RSI has broken through the 14 day moving average and issued a buy signal. If the weekly closing price remains above $4100, ETH is highly likely to break its historical peak within 1-2 weeks. If the bullish Bull Pennant is confirmed, the price will quickly surge to $5000. 2. Mid term goal (within 2025) -Conservative target: forecast to hit $6353 on October 19th; -Radical expectation: The upward channel has been opened, with a medium-term target of $20000 and a potential increase of 365%. 4. Risk Warning: High Leverage and Macro Uncertainty -Leverage foam: the average leverage ratio (ELR) of the whole exchange reached 0.68, close to the historical high. The leverage ratio of platforms other than Cai'an was higher, and the risk of partial selling accumulated; -Macro disturbances: Fluctuations in US trade policies, weak ISM service sector data (50.1), and short-term outflows of ETF funds may trigger a correction; -Volatility amplifier: If the price tests the resistance level of $4400, it may trigger a $1.24 billion short liquidation, exacerbating short-term volatility. Conclusion: Focusing on the Three Major Driving Forces and Strategic Layout The current Ethereum market is driven by a combination of technological upgrades, institutional configuration, and on chain scarcity, with a clear long-term upward trend. Trading strategies can focus on: 1. Entry timing: Build positions in batches when the support zone of $4100- $4200 is retraced and the hourly line stabilizes, or chase long positions when the retracement is confirmed after breaking through $4400; 2. Wind vane monitoring: weekly net inflow of spot ETFs, progress of Pectra upgrade implementation, and $3750 defense strength; 3. Sector rotation opportunities: After ETH leads the rise, Layer2 (Arbitrarum, Mantle) and DeFi tokens (such as LINK) may take over and explode. The market still needs to identify risks in a frenzy, but Ethereum's ecological evolution and financialization process are pushing it towards the dual value peak of "blockchain supercomputer" and "institutional asset fortress" Disclaimer: The above content only represents the author's personal opinion and is for communication and sharing purposes only. It does not represent the position or viewpoint of AiCoin and does not constitute any investment advice. Based on this investment, there may be external contacts, which have nothing to do with AiCoin, and the consequences shall be borne by oneself.