Loading...

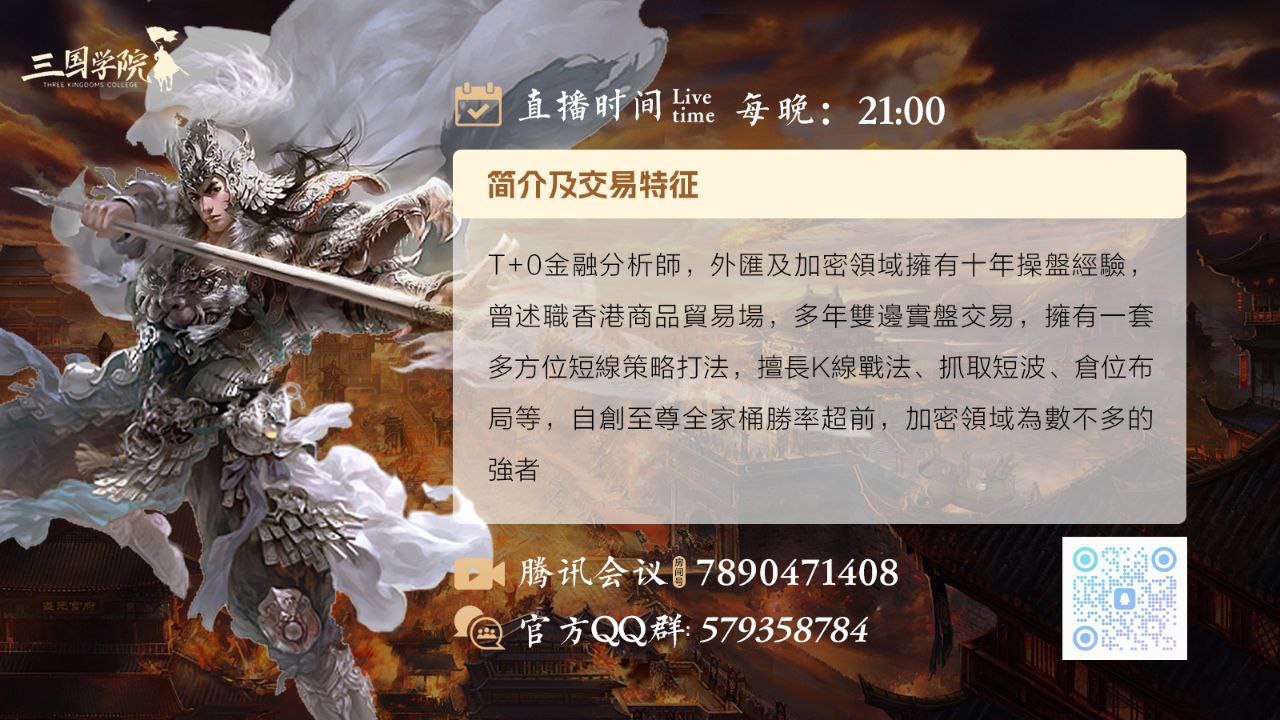

Click on the link to join the meeting directly: https://meeting.tencent.com/p/7890471408 The Federal Reserve announced a 25 basis point interest rate cut, which has both advantages and disadvantages for the cryptocurrency industry. From a positive perspective, interest rate cuts make market funds more abundant and reduce borrowing costs. According to Coinshares' report, a large amount of funds flowed into Bitcoin related products by the end of August 2025, with inflows reaching $748 million in the week ending September 1st. A large influx of funds enhances market depth and drives more active trading in the cryptocurrency industry, such as Ethereum and Dogecoin, which have seen significant increases in market expectations of interest rate cuts. At the same time, traditional financial market bond and deposit yields have declined due to interest rate cuts, and the potential high returns of the cryptocurrency market have greatly increased the attractiveness of investors, prompting them to shift their asset allocation to cryptocurrencies and bring more funds to the cryptocurrency market. But interest rate cuts also come with risks. The market is extremely sensitive to the Federal Reserve's policies. If the subsequent policies are conservative, investor panic will intensify, causing severe fluctuations in the cryptocurrency market, just like the rapid drop in prices of Bitcoin, Ethereum, and other currencies after the interest rate cut in December 2024. In addition, the market's early digestion of interest rate cut expectations can easily trigger the phenomenon of "buying expectations, selling facts". After the news lands, investors sell for profits, leading to a decline in the cryptocurrency market instead of rising. Technical analysis: Last week, it was predicted that Ethereum would reach around 5000 and around 4800, while BTC's weekly closing line broke through 114000 and reached around 118000. Currently, there are signs of a double top in the past four hours, and it is expected to fall in the short term. If it does not break through 114000, it is expected to continue breaking new highs around 120000 ETH closed with a bullish candlestick on the weekly chart and a bearish candlestick on the daily chart. The daily chart broke through the mid track and reached the upper track around 4800, suppressing the current downward demand. It has fallen below the key level of around 4400 to 4000 So, how do we proceed next? Teacher Zhao Yun, who has 9 years of practical trading experience in the cryptocurrency industry, will provide a detailed breakdown for everyone. Welcome to the live broadcast room to check in! Join the Three Kingdoms College Exchange Group to receive more services: 1. Real time troubleshooting (online one-on-one question answering and sorting) 2. Professional technical analysis and theoretical learning 3. Construction and improvement of trading system 4. Live streaming courses every day, contract termination, real-time order making, to help you successfully land! Official QQ group: 579358784 Tencent Meeting ID: 789-047-1408 The live broadcast room will be broken down in detail. Disclaimer: The above content only represents the author's personal opinion and is intended to assist investors in understanding information related to the capital market. It does not constitute any investment advice and does not represent the position or viewpoint of AiCoin. The market is risky and investments should be made with caution.