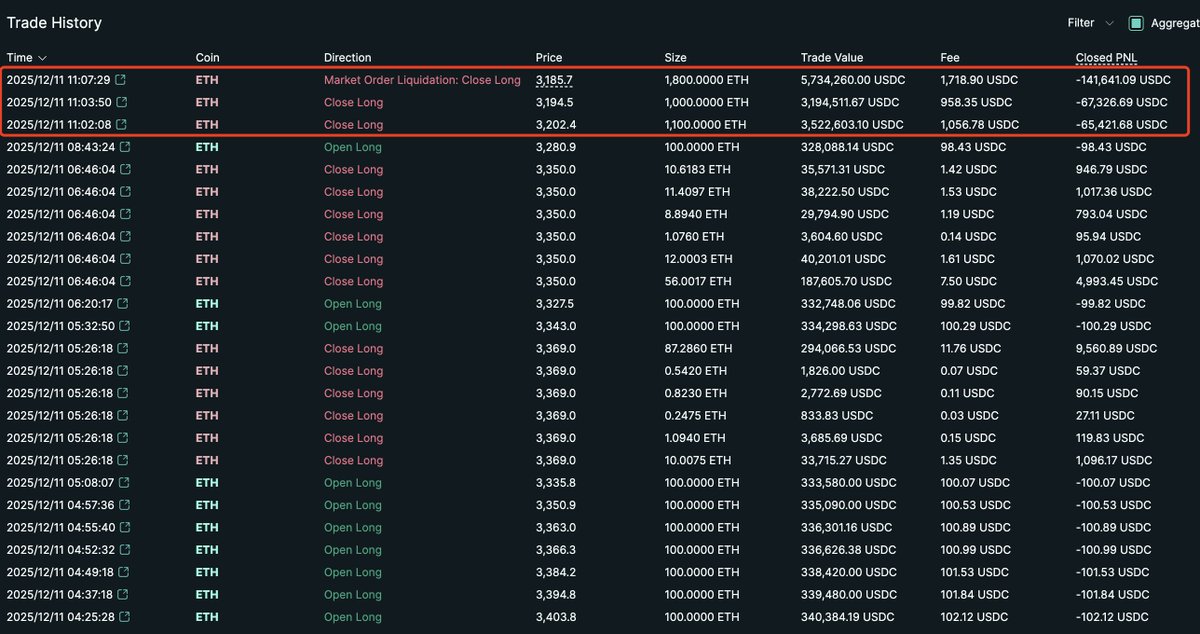

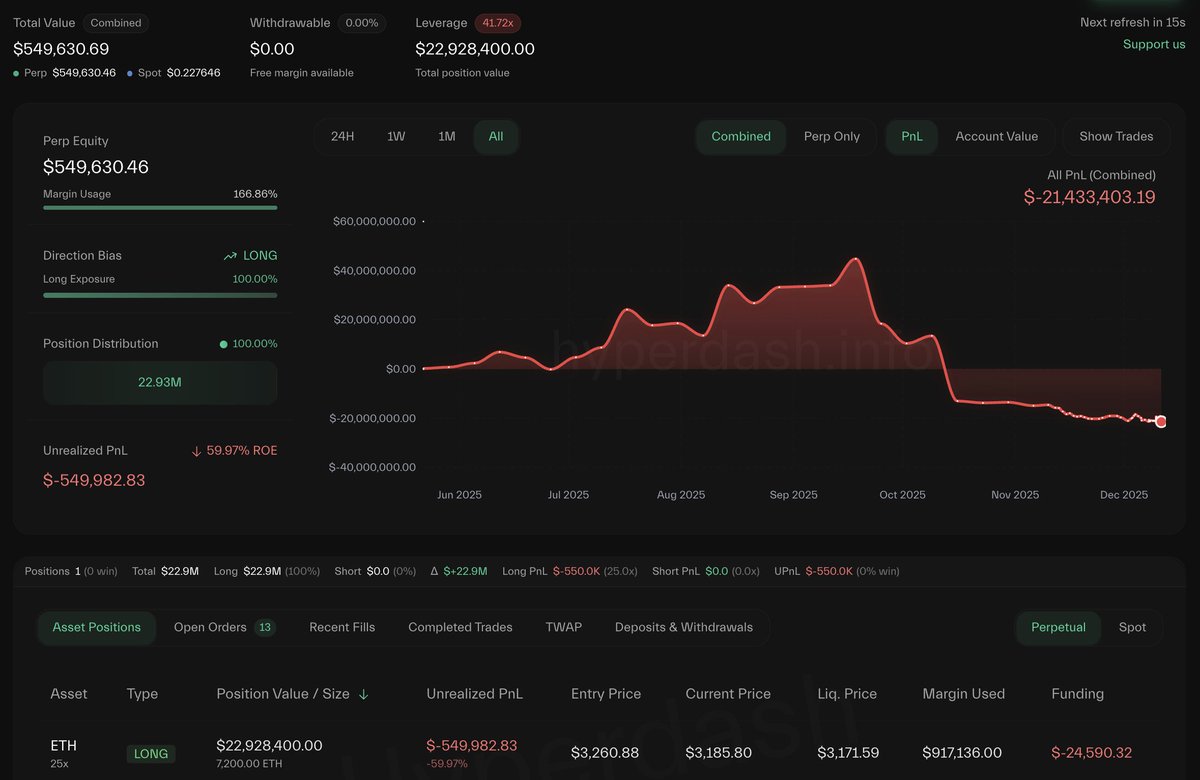

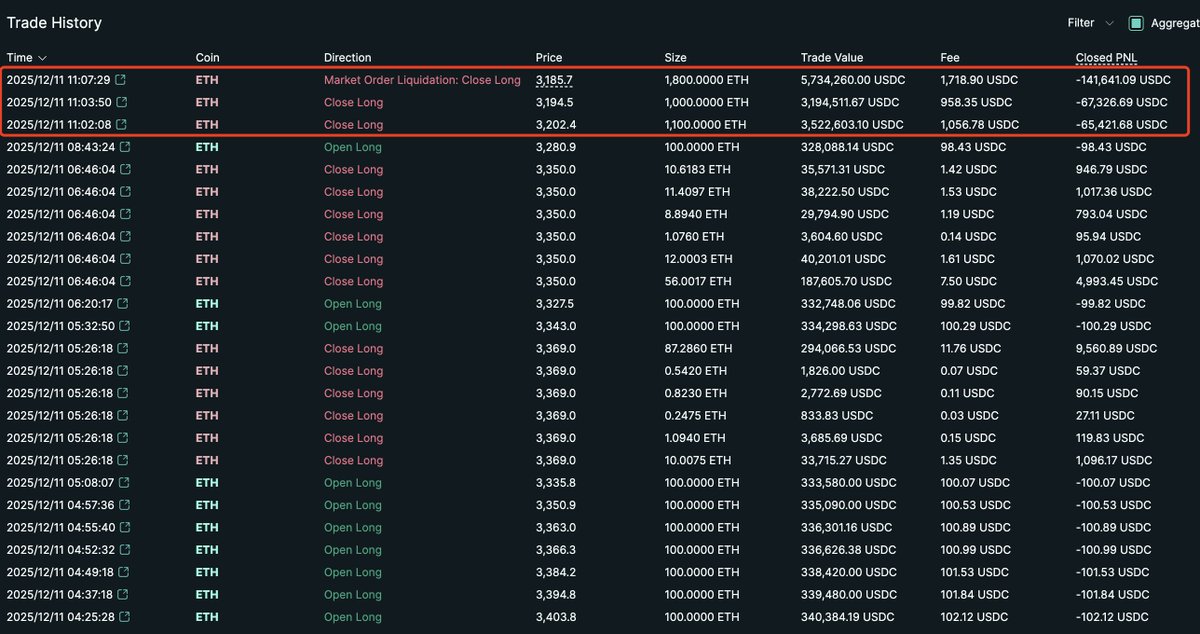

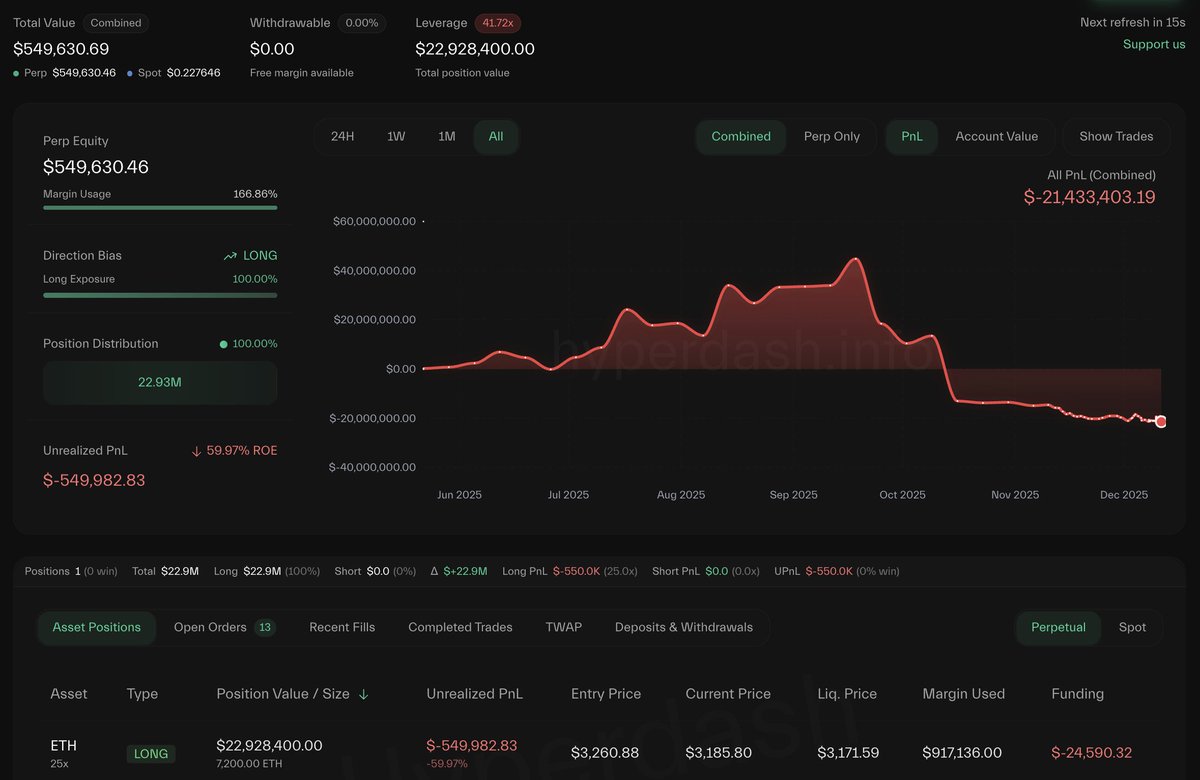

Machi Big Brother is still partially liquidated after early liquidation of 2100 ETH, with a current position of 7200 ETH

[Bitcoin Net Outflow from CEX Totals 13,350 BTC in the Past 365 Days, with Individual Investors Selling Over 520,000 BTC] In the past 365 days, the net outflow of Bitcoin from centralized exchanges (CEX) amounted to 13,350 BTC, bringing the total Bitcoin holdings on these exchanges to 3,325,265 BTC. During the same period, individual investors sold approximately 527,596 BTC, most of which flowed into Bitcoin exchange-traded funds/exchange-traded products (ETF/ETP) and corporate treasuries.

[Yesterday, U.S. Ethereum and Solana Spot ETFs had net inflows of $57.6 million and $4.9 million, respectively] Yesterday, the U.S. Ethereum Spot ETF had a net inflow of $57.6 million, and the Solana Spot ETF had a net inflow of $4.9 million.

[Bhutan Launches Sovereign Gold-Backed Token TER on Solana] Bhutan has announced the issuance of the sovereign-backed gold-supported token TER on the Solana blockchain, led by Griphon Mindfulness City (GMC). Each token corresponds to physical gold reserves. DK Bank will serve as the sole distributor and custodian of TER, with digital asset platform Matrixdock providing the infrastructure. GMC previously announced the inclusion of Bitcoin, Ethereum, and BNB in its strategic reserves, and Bhutan currently holds 5,984 BTC.

[Fed Rate Cuts Push Copper Prices Near Historic Highs, Up Over 30% This Year] The Federal Reserve announced a rate cut and maintained expectations for further cuts next year, pushing copper prices near historic highs. LME copper prices briefly rose 1.5% before giving up more than half of the gains. Driven by easing policies, industrial metals have recently surged, with copper prices up over 30% this year. Concerns over mine shutdowns, supply shortages, and traders rushing to buy ahead of potential tariffs have boosted copper prices. Long-term support for copper prices will come from growing demand for renewable energy.

According to AiCoin monitoring, the net inflow of US spot BTC ETF reached $224 million yesterday, the highest daily net inflow since December 2nd. Among them, IBIT had the largest inflow of funds, reaching 193 million US dollars; Next is FBTC, with an inflow amount of 30.6 million US dollars. According to the "Spot BTC ETF Tracking" real-time trading strategy developed by AiCoin, there is a significant positive correlation between the inflow of ETF funds and BTC prices. Subscription indicators can be used to automatically place orders based on the flow of funds in the program. Data for reference only