In the live broadcast of Fuxi Community, where is the direction of the long short tug of war?

--

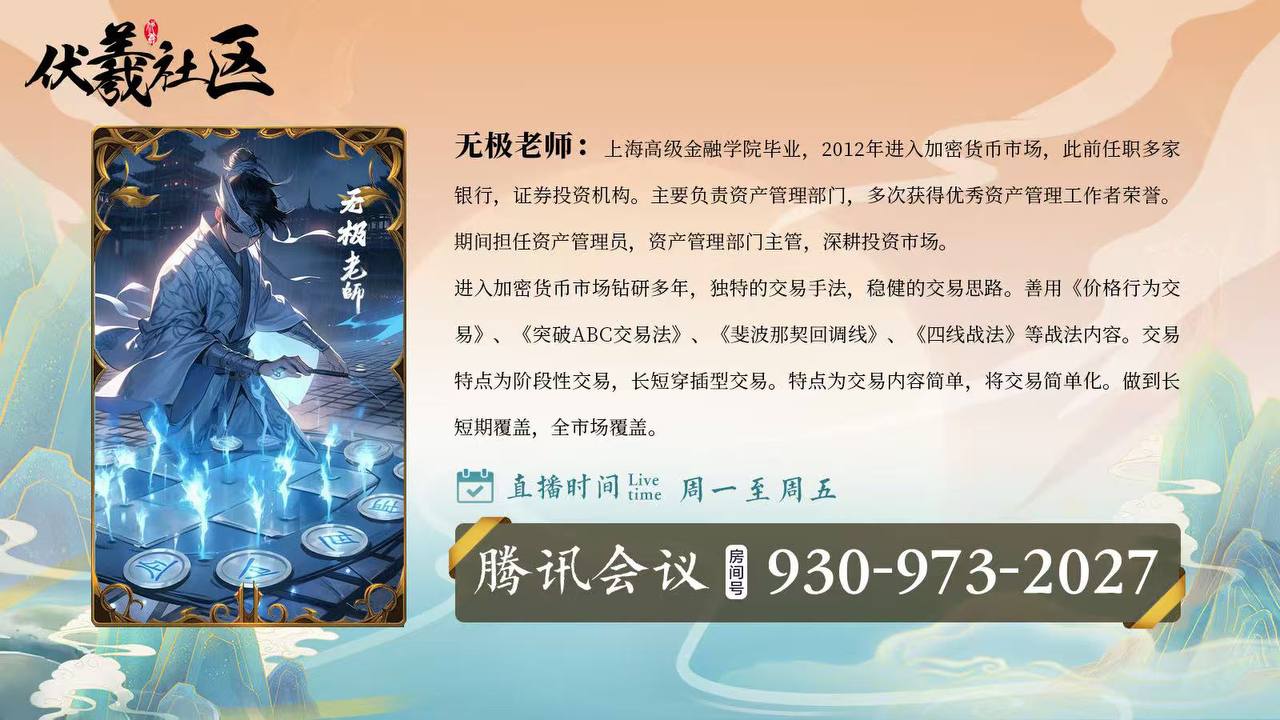

Click on the link to enter the meeting: https://meeting.tencent.com/p/9309732027 Market data shows that Bitcoin broke through the $110000 mark on October 23, 2025, with a intraday increase of 1.5%. This cryptocurrency asset has been hovering in the range of $100000 to $110000 recently, with both long and short sides fiercely competing at this critical psychological price point. Although Bitcoin has fallen about 14% from its historical high of around $126000 this month, institutional analysts remain optimistic about the future. Geoff Kendrick, Global Head of Digital Asset Research at Standard Chartered Bank, even believes that "this may be the last time Bitcoin falls below $100000". As of October 23rd, the trading price of Bitcoin fluctuated between $107721 and $110000. This fluctuation reflects the market's hesitation near historical highs, as Bitcoin failed to stabilize above the $111000 threshold. The behavior of market participants exhibits polarized characteristics. Long term holders are taking advantage of this price rebound for profit taking. According to Glassnode data, long-term Bitcoin holders have reduced their holdings by approximately 28000 BTC since October 15th, with their average daily sales increasing significantly from 12500 BTC in July to 22500 BTC in October. On the contrary, retail investors have shown a strong willingness to buy. CoinGlass statistics show that within 48 hours from October 20th, retail traders net bought Bitcoin worth approximately $435 million. From a technical analysis perspective, the range of $106000 to $107000 is the key support level, while breaking through $111000 upwards may open up further upward space. Tencent Meeting Number: 930 973 2027 Join the Fuxi Community and enjoy a variety of service offerings 1. Conduct market analysis for daily open courses and develop plans for matching orders and solving problems. 2. Join the member group to enjoy live streaming with orders in the evening; Fixed weekly technical course content. 3. Multiple market analysis and strategic trading within the day. 4. "Price Behavior Trading", "Breakthrough ABC Trading Law", "Four Line Battle Method" 5. Use tactics such as "Gann's Angle of Power", "Fei's Wave Number Example", and "MACD" to deduce the future direction. Disclaimer: The above content only represents the author's personal opinion and is intended to assist investors in understanding information related to the capital market. It does not constitute any investment advice and does not represent the position or viewpoint of AiCoin. The market is risky and investments should be made with caution.