During the live broadcast of Three Kingdoms College, the weekly double bottom is about to stabilize, and BTC will stretch to the 100000 mark by the end of the month

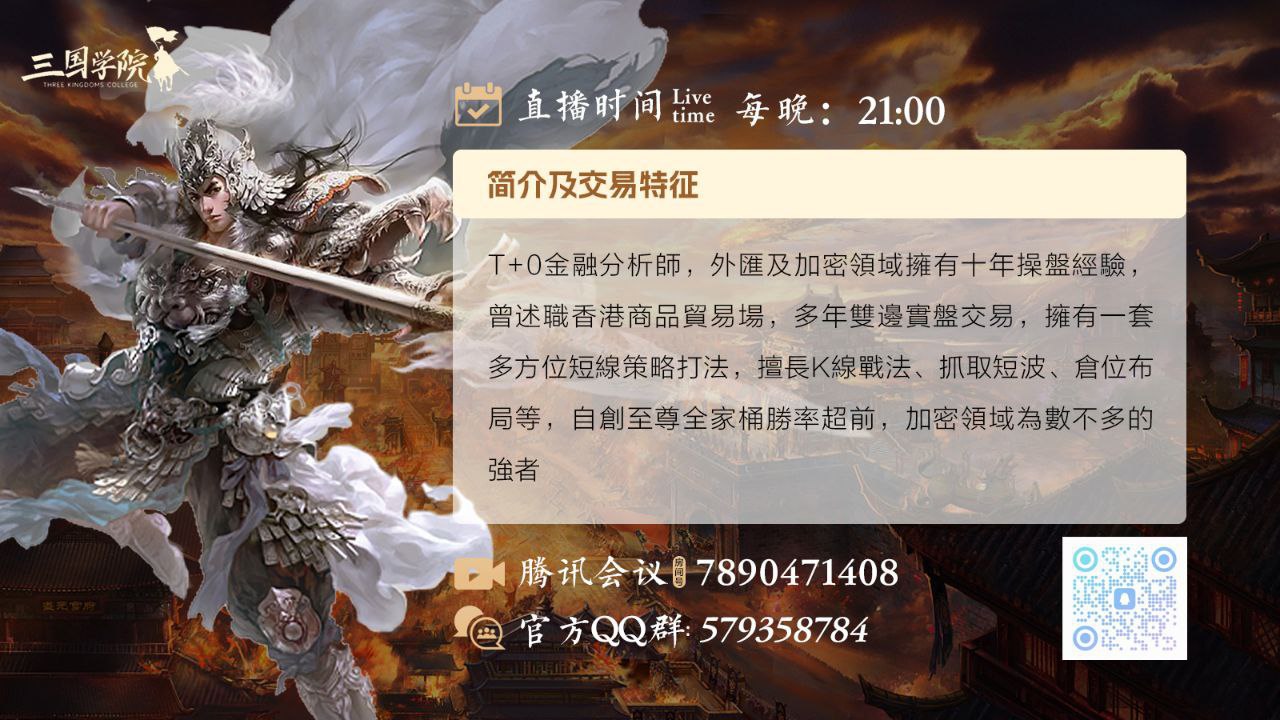

Click on the link to join the meeting directly: https://meeting.tencent.com/p/7890471408 Last week, it was predicted that we would reach the 100000 mark on the 26th. Currently, there is a trend of upward attack, and once the weekly line stabilizes, the target will definitely be reached. Below is a detailed answer: Double bottom landing on the weekly line after Christmas! Should the financial market embrace a surge in prices? Attention classmates! Just after Christmas, the financial market sent out a heavy signal - the weekly double bottom pattern has officially formed. Is this wave about to start a surge mode? Today, I will give you a chance to uncover the truth behind it in plain language! First of all, understand the key: the weekly double bottom is not a "main performance show" like the daily line, but a real bottom reversal signal! It means that the price has hit the same low twice without falling below it. The first time was when the downward trend was exhausted, and the second time was when buyers aggressively took over, which is equivalent to the market building a double safety cushion. More importantly, this double bottom is also accompanied by increased trading volume. The low point on the right side can significantly increase the volume compared to the left side, which is ironclad evidence of funds secretly entering the market. After all, weekly volume increases require continuous buying of gold and silver for 5 days, and the main force cannot falsify it! Looking at the current market environment again: after Christmas, precious metals have taken the lead in making efforts, with silver reaching a historic high and gold approaching its peak, supported by both geopolitical risks and expectations of interest rate cuts. The 'magic' of weekly double bottoms has long been validated by data - in history, varieties with 'double bottoms+volume' have a probability of rising by over 75% in the following three months, with an average increase of up to 30%. It's like building a house with a solid framework first, waiting for funds to add bricks and tiles now. Once the neck line in the middle of the double bottom is broken, the upward space is directly opened up! Of course, it is important to remember the core principle: weekly signals are based on trends, so don't be confused by daily fluctuations. As long as the 10 week and 30 week moving averages remain in a bullish position, don't easily get off the charts. Now the market sentiment has shifted from pessimism to optimism, with a triple resonance of funds, forms, and environment. Don't miss this wave of market trends! Do you want me to help you filter the current popular varieties that meet the criteria of "weekly double bottom+volume", and mark the key neck line position and target range? BTC weekly closing cross star signal, double dip near 85000, three daily dips, oscillating for almost half a month, breaking through the key level of around 90000 to 100000. ETH closed at the bearish candlestick on the weekly chart, falling back to the support level around the key level of 2800. After four hours, it did not fall below the lower limit and rose again near 3000. It did not break three times and will break through 3000 to 3300-3500 on the fourth time From the end of the year to around 3800. So, how do we proceed next? Teacher Zhao Yun, who has 10 years of practical trading experience in the cryptocurrency industry, will provide a detailed breakdown for everyone. Welcome to the live broadcast room to check in! Join the Three Kingdoms College Exchange Group to receive more services: 1. Real time troubleshooting (online one-on-one question answering and sorting) 2. Professional technical analysis and theoretical learning 3. Construction and improvement of trading system 4. Live streaming courses every day, contract termination, real-time order making, to help you successfully land! Official QQ group: 579358784 Tencent Meeting ID: 789-047-1408 Disclaimer: The above content only represents the author's personal opinion and is intended to assist investors in understanding information related to the capital market. It does not constitute any investment advice and does not represent the position or viewpoint of AiCoin. The market is risky and investments should be made with caution.