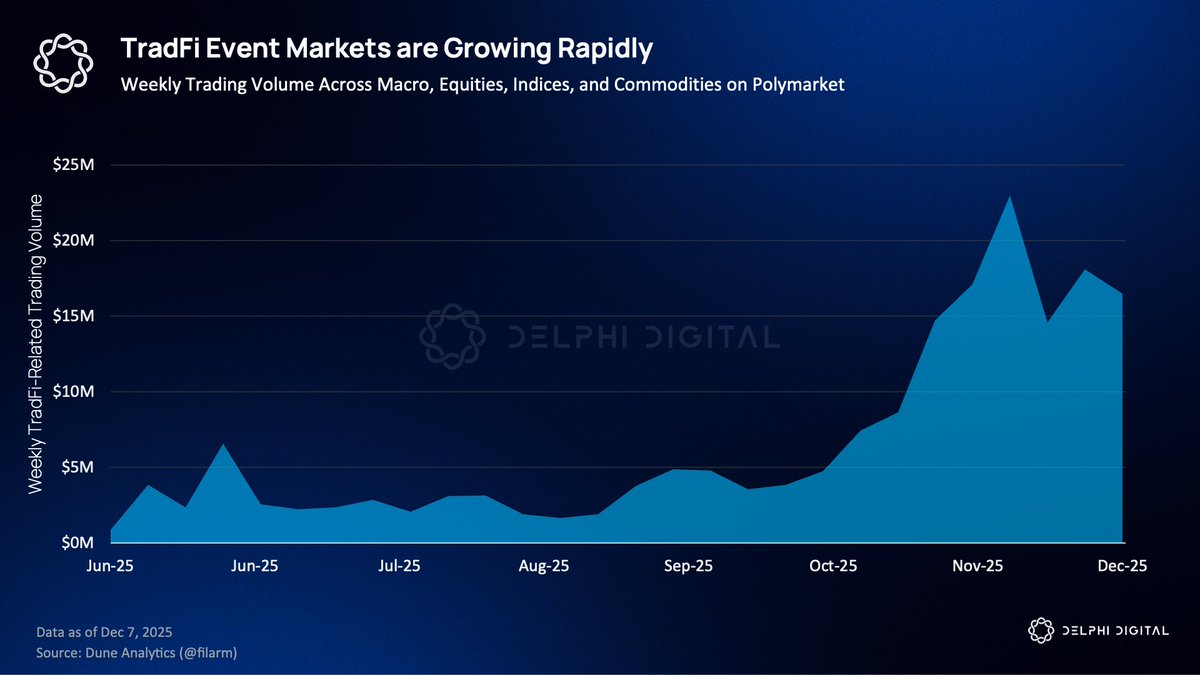

Prediction markets are becoming first class TradFi derivatives.

Earnings reports, CPI surprises, and guidance changes don't map cleanly onto existing products. You can approximate them with options, but event markets collapse all that complexity into a binary outcome with continuously updating probabilities.

As tokenized equities and RWA rails mature, this fits naturally into a unified onchain brokerage account.

A trader holding spot AAPL could borrow against that position and use a slice of collateral to hedge earnings risk, or dynamically update exposure based on a simple quote like "Will Apple beat earnings?"

Earlier this year, Intercontinental Exchange, the owner of the NYSE and one of the most systemically important exchange operators, took a multi-billion-dollar strategic stake in Polymarket.

Thomas Peterffy, founder of Interactive Brokers, framed prediction markets as a live information layer for institutional portfolios.

Early demand on IBKR is concentrated in weather related contracts for energy usage, logistics, and insurance risk, but Peterffy's vision goes further with portfolios updated by shifting probabilities from event markets rather than stale analyst estimates.