During the live broadcast of Three Kingdoms College, the monthly chart of the stock market closed heavily negative, and the rebound continued to fall below the 85000 mark

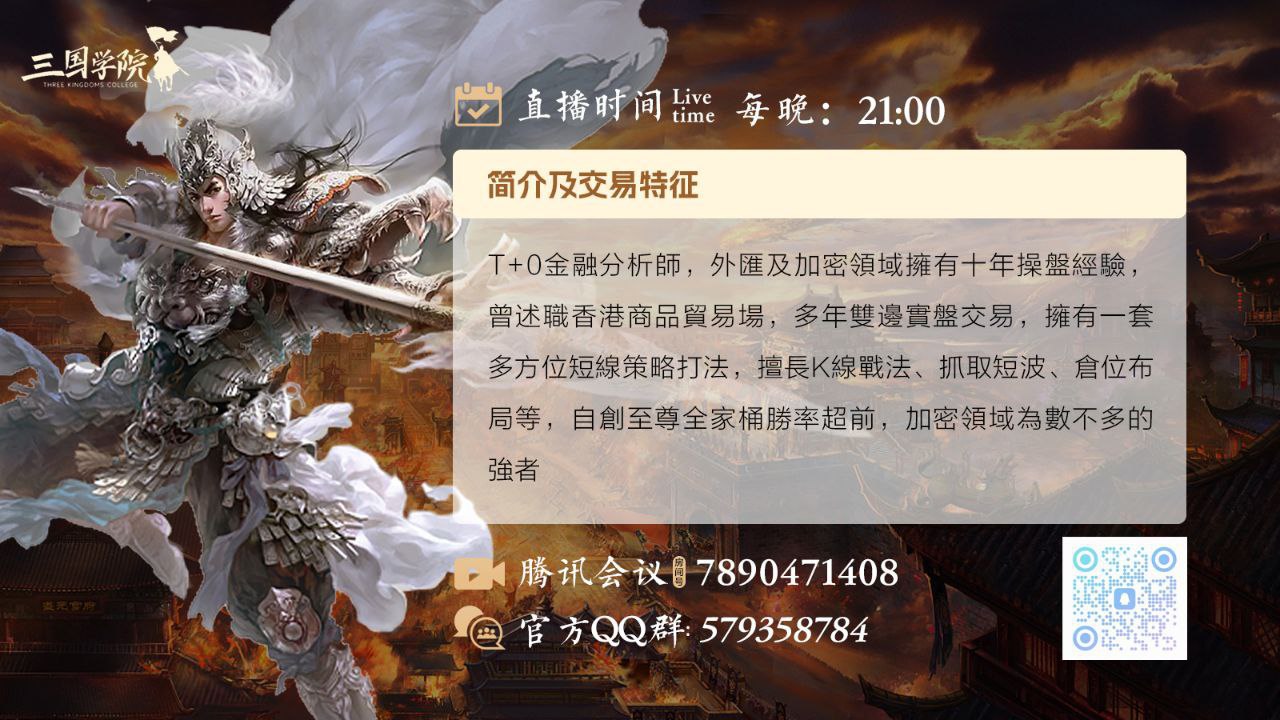

Click on the link to join the meeting directly: https://meeting.tencent.com/p/7890471408 Last week, it was predicted that Bitcoin would bottom at around 88000, but as a result, it continued to fall below the monthly line around 80000 and was about to form a head and shoulder peak; Bitcoin's monthly chart closing at a bearish candlestick indicates strong selling power within the month, which can have varying degrees of negative impact on the market in the short, medium, and long term, as follows: 1. Short term: Market panic is prone to spread, and investors who follow the trend and sell will accelerate the outflow of funds from the stock market, turning to safe assets such as bonds and money market funds; If popular sectors lead the decline and trigger a bearish candlestick, it will also cause a sharp drop in the willingness of these sectors to receive subsequent capital inflows, further lowering the short-term market. 2. Mid term: After the original market trend is broken, investors will hold onto their money and wait due to increased uncertainty, leading to a decrease in market trading volume and activity; At the same time, most investors will adjust their strategies, reduce the proportion of stock investment, and shift towards stable allocation, which will continue to suppress the rebound of the market. 3. Long term: If the bearish candlestick is caused by fundamental factors such as economic recession or negative policies, it will change the market's long-term expectations, such as shifting from bull market expectations to bear market or long-term oscillation expectations; It will also cause potential investors to postpone their entry plans into the market, reducing the long-term supply of funds in the market, which is not conducive to the long-term improvement of the market. However, there are also special circumstances. If there are positive signals such as heavy policy benefits released quickly after the bearish candlestick, it may also restore market confidence and ease the downward trend. Technical Analysis ——BTC has fallen back to the monthly mid track support of 80000, with pressure on the weekly lower track of 92000. If the weekly rebound of 92000 does not go up, it will continue to fall back to the daily level around 86000 and rise again at a double bottom. ——ETH's monthly line fell back and broke through the mid track to near the lower limit of the weekly line, falling below around 2800 to 2600. The weekly pressure was around 3050, and the daily line touched around 2800 before rising again. So, how do we proceed next? Teacher Zhao Yun, who has 9 years of practical trading experience in the cryptocurrency industry, will provide a detailed breakdown for everyone. Welcome to the live broadcast room to check in! Join the Three Kingdoms College Exchange Group to receive more services: 1. Real time troubleshooting (online one-on-one question answering and sorting) 2. Professional technical analysis and theoretical learning 3. Construction and improvement of trading system 4. Live streaming courses every day, contract termination, real-time order making, to help you successfully land! Official QQ group: 579358784 Tencent Meeting ID: 789-047-1408 Disclaimer: The above content only represents the author's personal opinion and is intended to assist investors in understanding information related to the capital market. It does not constitute any investment advice and does not represent the position or viewpoint of AiCoin. The market is risky and investments should be made with caution.